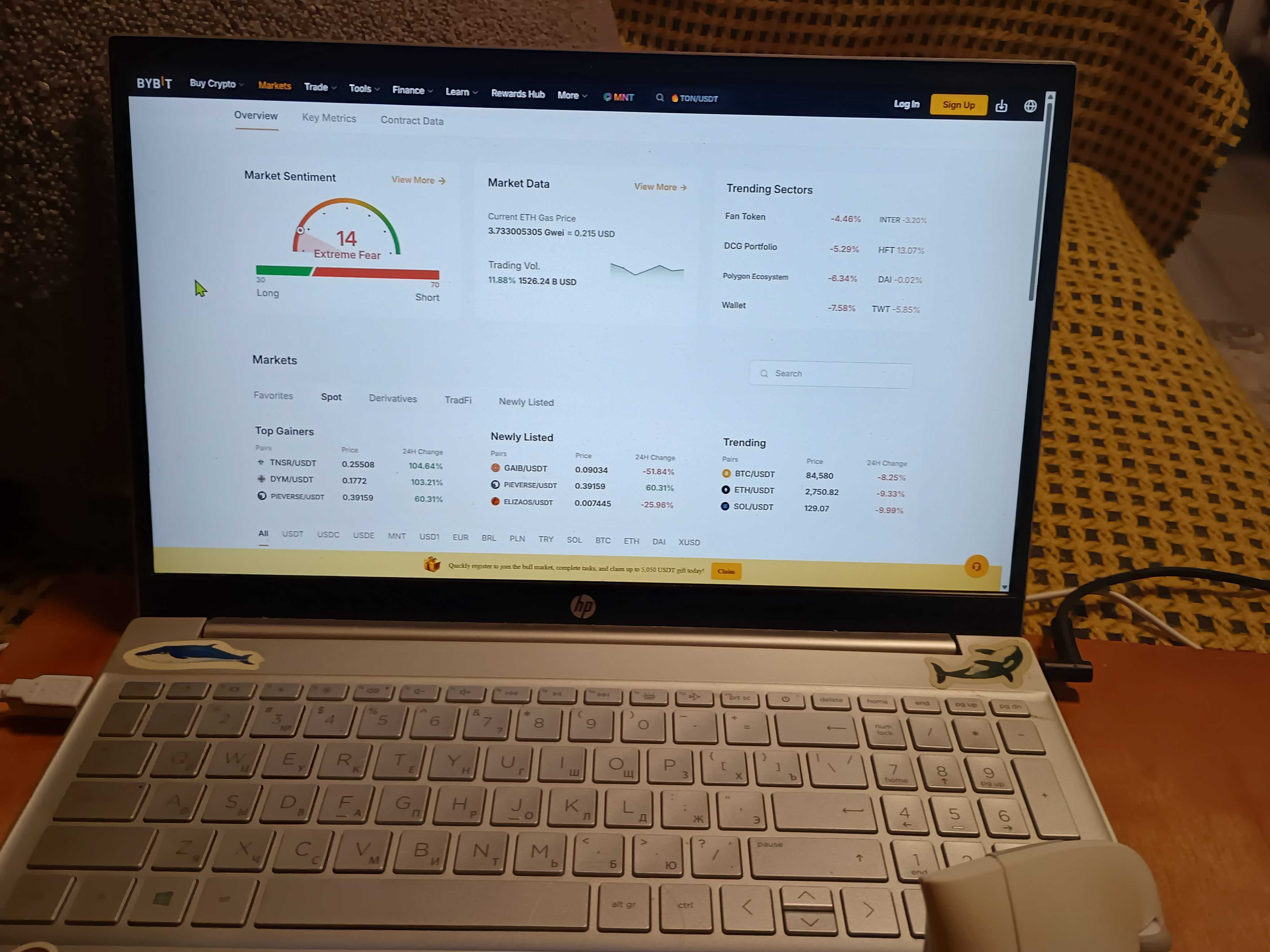

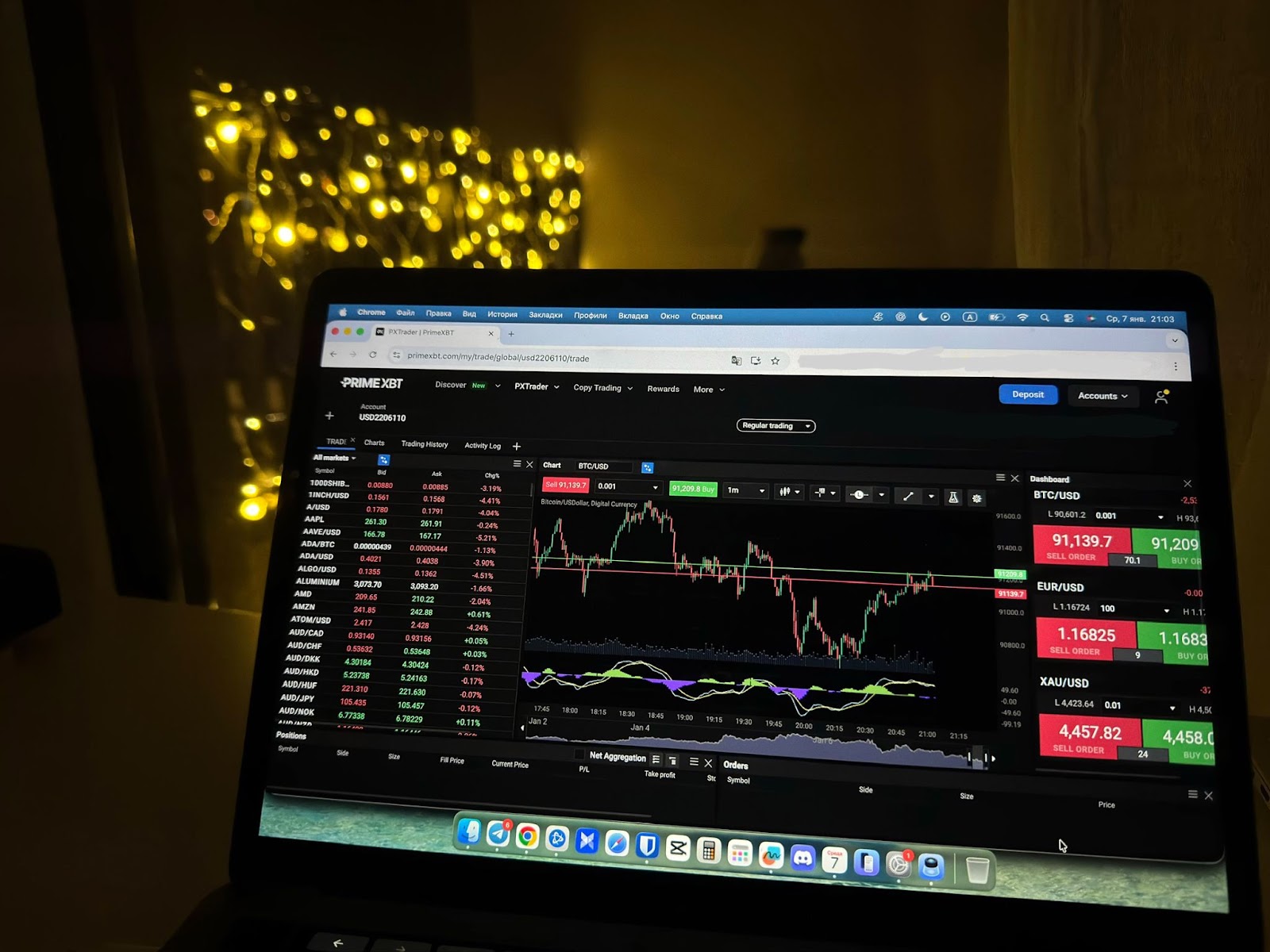

Bybit vs PrimeXBT comparison: Fees, leverage, and trading experience

We evaluated both platforms using real futures trading accounts to understand how Bybit vs PrimeXBT differ in fees, leverage, market depth, and user workflow. If you’re choosing between Bybit and PrimeXBT for derivatives trading, here’s the clear breakdown.

Fees & Funding

4.5/5

Leverage & Margin

4.5/5

Fees & Funding

4.2/5

Leverage & Margin

4.2/5

Fees & Funding

4.2/5

Leverage & Margin

4.3/5

Fees & Funding

4.4/5

Leverage & Margin

4.2/5

Fees & Funding

3.5/5

Leverage & Margin

3/5

After testing both platforms with $200 in live futures trades, the separation became clear. Bybit delivered tighter spreads (0.06% slippage on $1K orders vs PrimeXBT’s 0.18%), faster execution (sub-1-second fills), and deeper liquidity ($2.5M orderbook depth vs $400K). PrimeXBT countered with lower flat fees (0.01% vs Bybit’s 0.055% taker), higher max leverage (200x vs 125x), and a simpler interface for beginners. Bybit wins on infrastructure and execution quality; PrimeXBT on ease of entry and aggressive leverage options.

Bybit is designed for traders who work with size: predictable liquidity, fast order execution, strong performance under load, and a robust system for managing positions. Professional traders adapt quickly to the interface, and the depth of the market makes scaling leverage safer.

PrimeXBT, by contrast, wins through flexibility rather than infrastructure. The platform allows bitcoin, stablecoins, and other assets to be used as collateral, and the interface is extremely simplified – entering the world of margin trading doesn’t require steep onboarding. However, liquidity and execution speed lag behind Bybit, which matters for active intraday strategies.

Bybit vs PrimeXBT at a glance

| Category | Bybit | PrimeXBT | Winner |

|---|---|---|---|

| Overall GNcrypto rating | 4.3 / 5 | 4 / 5 | Bybit (overall) |

| Daily derivatives volume (approx.) | ~$10B | ~$1–2B | Bybit |

| Tradable futures contracts | 200+ | ~100 | Bybit |

| Liquidity & volume rating | 5 / 5 | 4 / 5 | Bybit |

| Fees & total cost rating | 4,5 / 5 | 4,5 / 5 | Bybit (lower fees, clearer model) |

| Leverage options | Up to 100x | Up to 200x | PrimeXBT (higher max leverage) |

| Tools & order controls | 5 / 5 | 4 / 5 | Bybit |

| UX & mobile experience | 4.5 / 5 | 3 / 5 | Bybit |

| Reliability & transparency rating | 4 / 5 | 3 / 5 | Bybit |

Two approaches to futures trading

Bybit and PrimeXBT solve the same task – futures trading – but approach it in very different ways. Bybit operates as a large CEX with deep order books, reliable execution infrastructure, and clear risk-management logic. Its standard margin model, transparent fees, high liquidity, and mature toolset make Bybit well suited for systematic trading with repeatable results.

PrimeXBT follows a different path. The platform is built around high leverage, a simplified margin model, and a more aggressive trading style. The interface is designed for fast trade entry and works even with small deposits, while the multi-asset terminal brings together crypto futures, forex, indices, and commodities. This expands possible strategies but requires more hands-on control from the trader.

Liquidity test from our trading:

Bybit: Placed market order on BTC/USDT during US hours. Fill with 0.06% slippage. Orderbook depth: $2.5M within 0.1% of mid-price. Order executed in under 1 second.

PrimeXBT: Same market order. Fill with 0.18% slippage. Depth: approximately $400K within 0.1%. Execution: 1-2 seconds.

For positions under $1K, both platforms handled orders without major issues. Bybit’s advantage showed at $2K+ sizes where PrimeXBT’s thinner books resulted in 2-3x higher slippage compared to Bybit.

So when choosing the winner in the Bybit vs PrimeXBT futures comparison, the real question is which exchange fits your style. If you need stability, depth, and institutional-grade execution, Bybit delivers a more predictable experience. If you prioritize flexibility, high leverage, and multi-asset trading, PrimeXBT offers a broader range of opportunities – along with higher demands on risk management.

Trading costs & leverage

Commissions and leverage determine how well a strategy works in practice. Bybit’s base futures fees remain among the clearest in the market: 0.02% maker and 0.055% taker. For active trading, this keeps costs under control, especially when paired with deep liquidity and predictable execution. Leverage goes up to 125× on BTC and ETH, which covers most intraday strategies.

PrimeXBT relies on a simple, uniform model: a 0.01% fee per trade with no maker–taker distinction. For traders who enter and exit frequently, this lowers total turnover cost. Leverage is higher – up to 200× on BTC and ETH. This expands the range of aggressive strategies but increases the demands on risk management.

Cost example from our test: we opened a $500 BTC/USDT perpetual position on both platforms using 10× leverage.

Bybit: limit order (maker) filled at $97,450. Fee: 0.02% = $0.10. Closing with market order (taker): 0.055% = $0.28. Total round-trip: $0.38 (0.076%).

PrimeXBT: market order filled at $97,470 (20 ticks worse due to wider spread). Flat 0.01% fee = $0.05 entry + $0.05 exit = $0.10 total.

PrimeXBT’s lower headline fee (0.01% vs Bybit’s 0.055% taker) was offset by wider spreads. On this $500 position, Bybit’s total cost ($0.38) was higher than PrimeXBT ($0.10) only because we used market orders. With limit orders on both sides, Bybit would cost $0.20 (0.02% × 2) vs PrimeXBT’s $0.10, making PrimeXBT cheaper for maker-heavy strategies.

Our verdict: In the PrimeXBT vs Bybit comparison, if your priority is execution stability and predictable margin, Bybit offers more balanced conditions. If minimal fees and high leverage matter more, PrimeXBT provides a more aggressive trading profile.

Note for new users: traders can register through our partnership links to access exclusive benefits: Bybit referral link and PrimeXBT referral link both offer additional sign-up bonuses and fee discounts beyond the standard rates mentioned above.

Asset variety

In derivatives, Bybit offers a broader selection. The platform supports hundreds of perpetual contracts on BTC, ETH, and liquid altcoins, including new listings that move quickly into the futures section. This is convenient if you build a multi-strategy portfolio or rotate between trending pairs – the instrument you need is almost always available.

PrimeXBT takes a different approach: the market selection is smaller, but it covers a trader’s core needs. The main pairs – BTC, ETH, and a handful of altcoins – trade consistently, and the interface prioritizes simplicity over breadth. This setup works well if you focus on a few key assets and don’t need access to every trending token at once.

The challenge with any Bybit vs PrimeXBT comparison is that there is no perfect choice. In our reviews, we evaluate dozens of exchanges and have never found a single “golden standard.” Instead, each platform has something unique – a specific strength. If that strength matches what you need, that’s the one to choose.

Bybit vs PrimeXBT — Which should you choose?

If you’re a beginner or first-time trader

Choose: PrimeXBT

PrimeXBT is easier at the start. The interface is minimalist, free of clutter, and opening a trade takes only seconds. There are no dozens of order types, no complex settings, and no overloaded tool panels – everything comes down to “deposit → choose an asset → open a position.” For anyone taking their first steps in futures and worried about making interface mistakes, PrimeXBT feels like a safe entry point.

If you’re an active, execution-focused trader

Choose: Bybit

Bybit delivers what matters when you trade frequently and rely on fast execution: a high-speed engine, predictable fills, and a stable order book even under load. Market depth is stronger than on PrimeXBT, and the order system is more flexible – with limit, conditional, post-only, reduce-only, and the full toolkit needed for precision trading. If your strategy depends on execution quality, Bybit is the more reliable choice.

If you want the widest range of futures markets

Choose: Bybit

Bybit offers far more liquid contracts: BTC, ETH, majors, mid-cap alts, new listings, perpetuals, and inverse contracts. PrimeXBT covers the basics, but the lineup is noticeably narrower. If you want access to dozens of instruments and the ability to rotate between markets within one strategy, Bybit comes out ahead.

If you prefer simplicity and a minimalistic interface

Choose: PrimeXBT

PrimeXBT suits traders who don’t need a long list of features. A clean interface, minimal buttons, and fast trade entry mean the platform doesn’t distract or require learning a complex ecosystem. It’s ideal for simple tactics: one or two pairs, fixed leverage, and short positions without advanced conditions.

How we tested Bybit vs PrimeXBT

This comparison draws from our separate evaluations of Bybit (rated 4.3/5) and PrimeXBT (rated 4/5) using GNcrypto’s standardized futures trading methodology. We tested both platforms with $200 in live trades across seven weighted categories: liquidity & volume, fees & total cost, asset selection, execution quality, tools & order controls, minimum trade size, and reliability. Testing combined public data (fee schedules, contract lists, documentation) with hands-on verification: account creation, funding, live futures trades, and execution speed measurement.

For full methodology: How We Test Crypto Futures Trading Services

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.