Bybit fees vs Binance: liquidity, funding, and risk

We tested both platforms separately with live futures positions to compare liquidity, execution quality, margin tools, and total trading costs. Bybit vs Binance Futures – this review shows which platform fits your leverage and fee needs.

Fees & Funding

4.5/5

Leverage & Margin

4.5/5

Fees & Funding

4.2/5

Leverage & Margin

4.2/5

Fees & Funding

4.2/5

Leverage & Margin

4.3/5

Fees & Funding

4.4/5

Leverage & Margin

4.2/5

Fees & Funding

4.5/5

Leverage & Margin

4/5

Binance Futures and Bybit approach derivatives trading from opposite directions. Binance built a feature-heavy terminal for traders who want every possible tool, even if it means navigating a cluttered interface. Bybit stripped the experience down to what active traders actually use daily, prioritizing speed over breadth.

The fee difference is minimal (0.02% on Binance vs. Bybit’s higher taker rate), but the real split happens in execution style: Binance wins on volume and variety, Bybit wins on interface clarity and faster withdrawals. For high-volume traders, Binance’s lower fees compound into real savings – a trader executing 100 contracts daily saves $1,200 monthly before VIP discounts.

Futures market coverage

Binance Futures operates at a massive scale. The exchange offers hundreds of contracts, from standard BTC and ETH perpetuals to futures on major altcoins, stablecoins, and even experimental DeFi tokens. Traders can choose margin type, in USDT or in the underlying coin, which helps with risk management and balanced strategy design. This flexibility suits traders working across multiple asset classes.

If a token launched yesterday and has any volume at all, it’s probably tradable on Binance within 48 hours. That speed matters for trend-following strategies, but it also means you’re trading contracts with thin books and wider spreads on anything outside the top 20 assets.

The platform also comes out ahead in the Binance Futures fees vs Bybit comparison. Trading fees on Binance are lower.

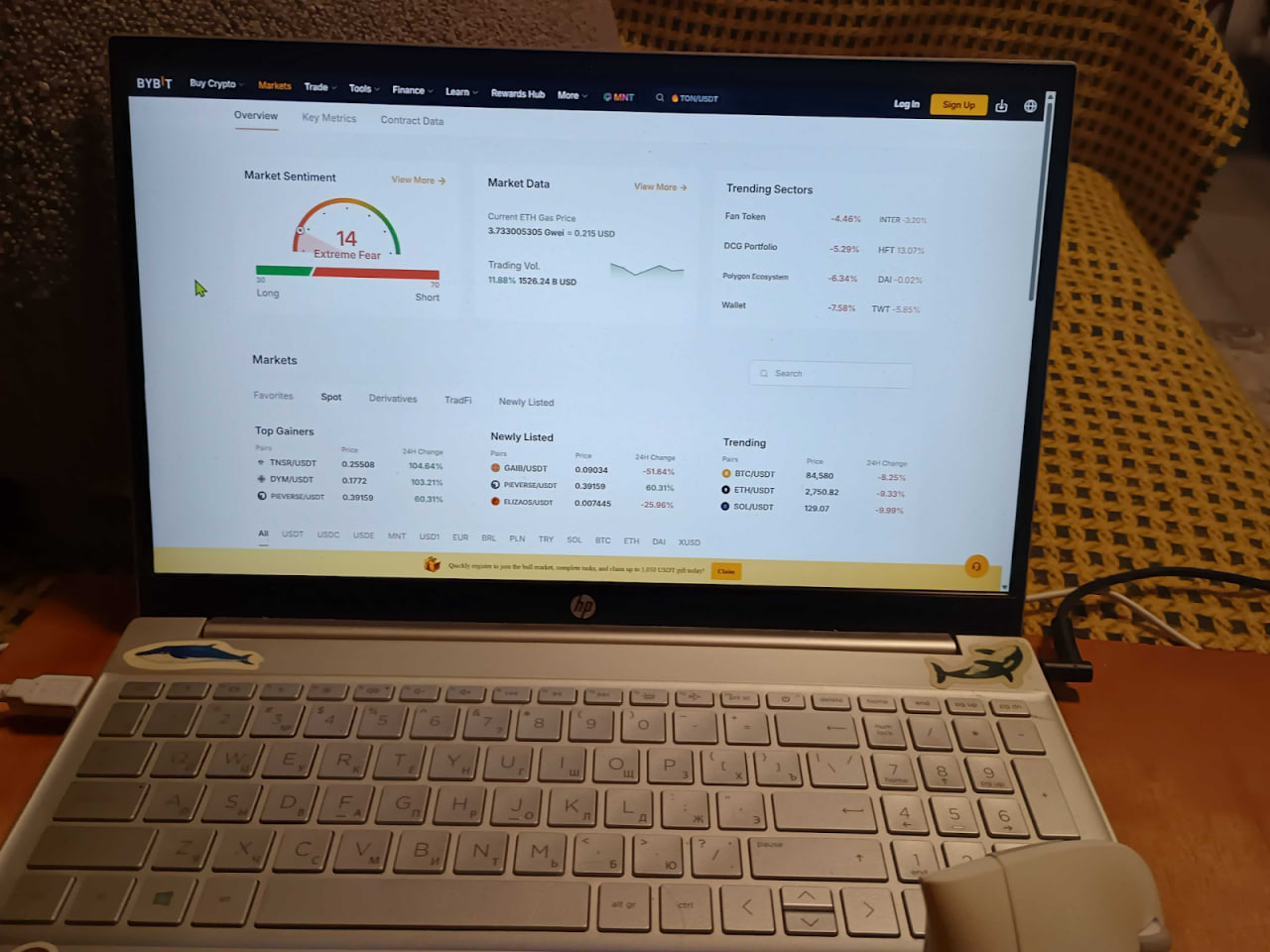

Bybit takes a focused approach, concentrating on tools active traders actually use. The exchange concentrates on perpetual contracts and delivers strong liquidity on key pairs such as BTC, ETH, and the most traded altcoins. The interface, order execution, and order book depth are optimized for frequent trading, where speed and stability matter more than breadth.

The choice comes down to scale versus specialization. Binance is the better option if you need maximum contract variety, exposure to new assets, and broader risk diversification. Bybit is preferable for traders who operate within a narrow set of liquid instruments and value predictable execution.

Liquidity example: A $5,000 market order on BTC/USDT during moderate volatility (3% intraday range) fills with tighter execution on Binance due to deeper order books. In our testing, similar-sized orders on major pairs showed minimal slippage on both platforms, but Binance’s higher volume ($70B daily vs $23B) provides an edge for larger position sizes.

Spread comparison: During US trading hours (14:00-20:00 UTC), BTC/USDT spreads averaged 0.01% on Binance ($10 on $100K notional) and 0.015% on Bybit ($15 on $100K). During Asia hours (00:00-06:00 UTC), spreads widened: Binance 0.02%, Bybit 0.025%. The difference becomes material for position sizes above $50K.

Fees & leverage compared

In the Binance Futures vs Bybit comparison, two factors matter most: costs and leverage options.

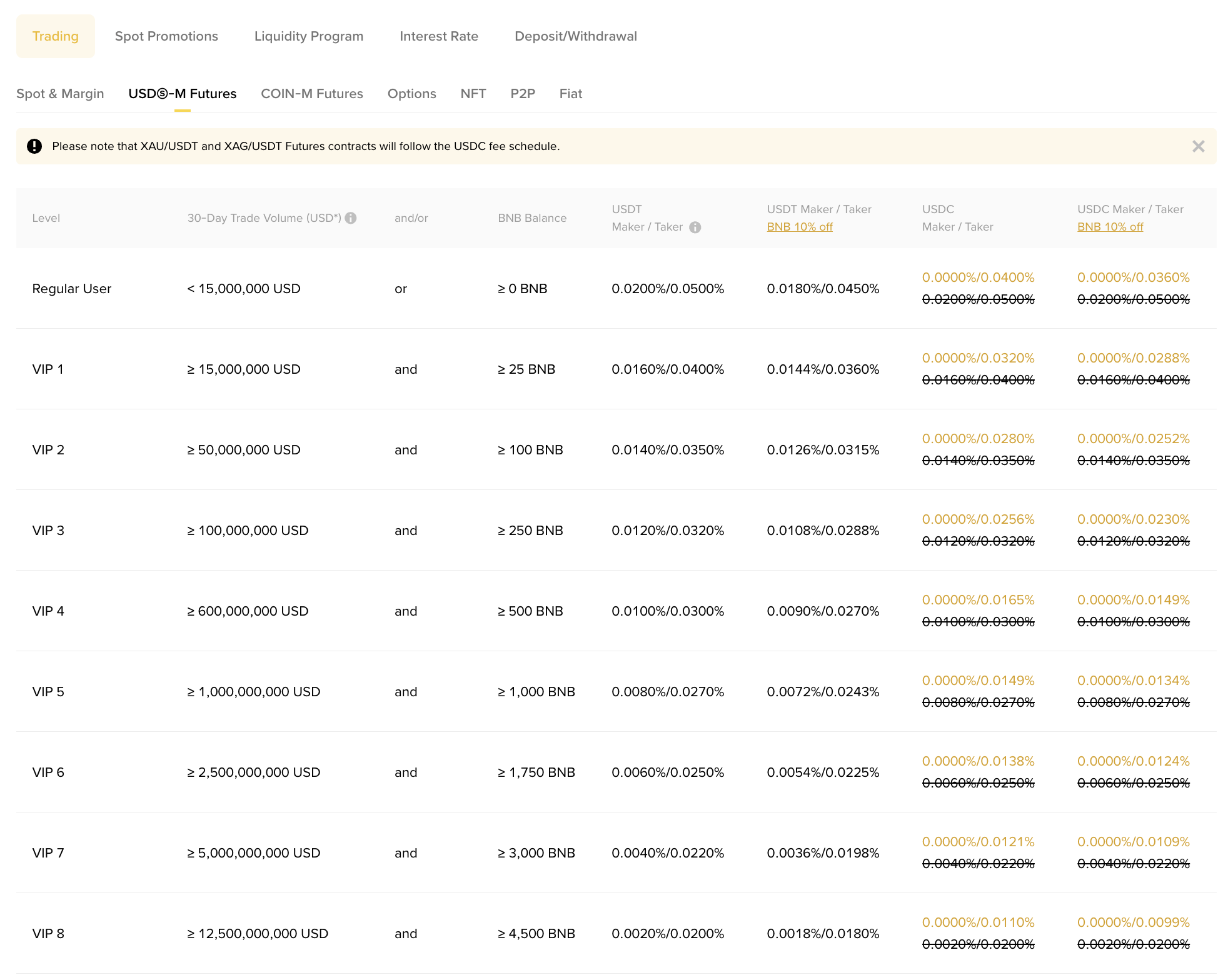

On Binance Futures, standard perpetual contract fees are 0.02% for makers and 0.04% for takers. Rates decrease when fees are paid in BNB or when trading volume increases. This is one of the lowest base fee structures on the market. Maximum leverage reaches 125x on major pairs, though limits are lower for stablecoins and less liquid altcoins.

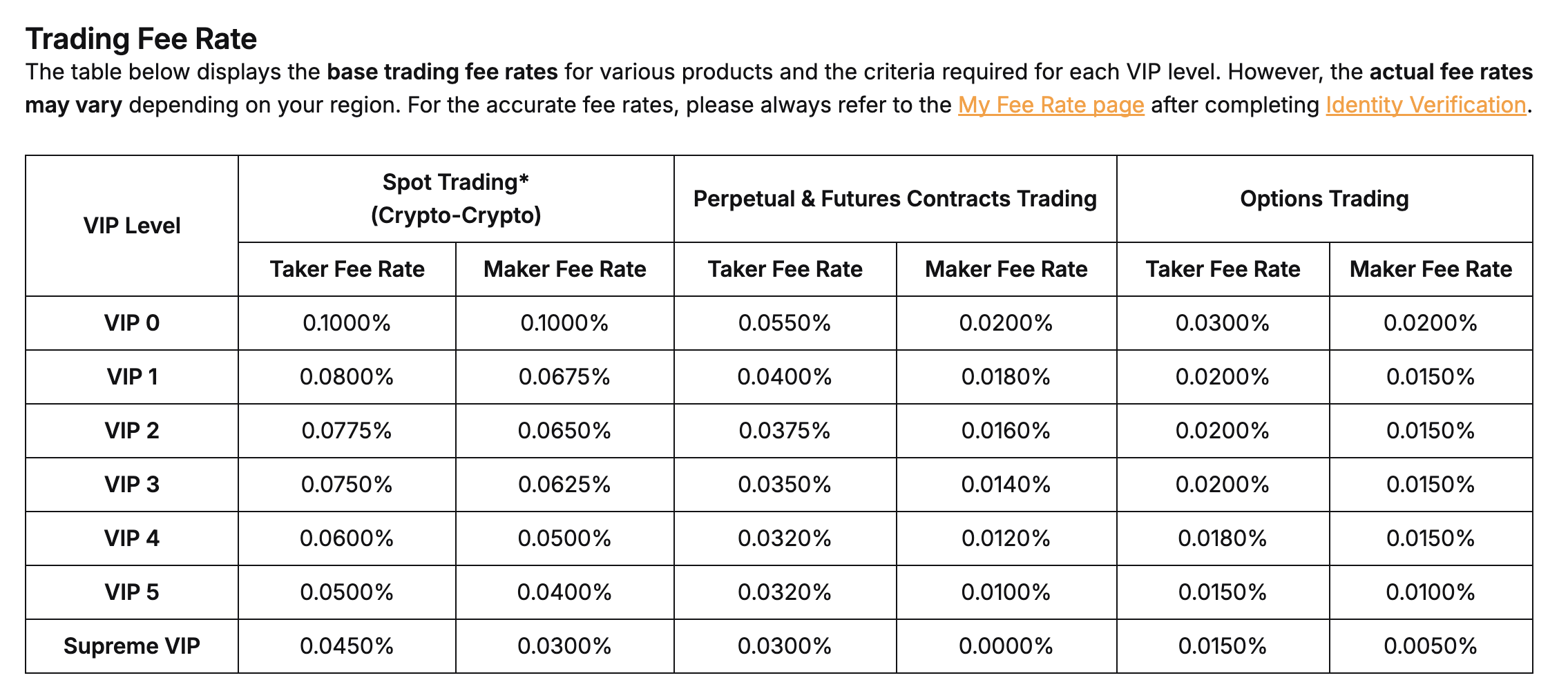

On Bybit, base rates differ slightly: 0.01% for makers and 0.06% for takers. Fees decline with higher trading volume through VIP tiers. Maximum leverage is up to 100x on leading contracts. 125x on Binance sounds impressive until you realize that one 0.8% move liquidates you. Most traders never touch anything above 20x, making the leverage ceiling more of a marketing point than a practical advantage. The real difference is fee structure, not max leverage.

In practice, this provides similar risk management flexibility to Binance, but without pushing leverage to extreme levels.

Binance offers a slightly more favorable fee base and higher maximum leverage for aggressive strategies. Bybit offsets this with a more stable structure and flexible discounts for active traders.

Cost example: A trader deposits $200 and opens a $2,000 BTC position using 20× leverage ($100 collateral). On Binance, the 0.04% taker fee costs $0.80. With BTC/USDT funding averaging 0.0095% per 8-hour cycle (observed January 13-20, 2026), holding for 3 days adds $1.71 in funding ($0.57 daily × 3). Total cost: $2.51.

On Bybit, the same position at 0.06% taker fee costs $0.90. With ETH/USDT funding averaging 0.0115% per cycle during the same period, a 3-day hold adds $1.53 in funding. Total cost: $2.43.

For this position size and timeframe, Bybit’s higher taker fee is offset by slightly lower funding, resulting in near-identical total costs. The real difference appears at higher volumes or with VIP tier discounts.

Trading tools & UX

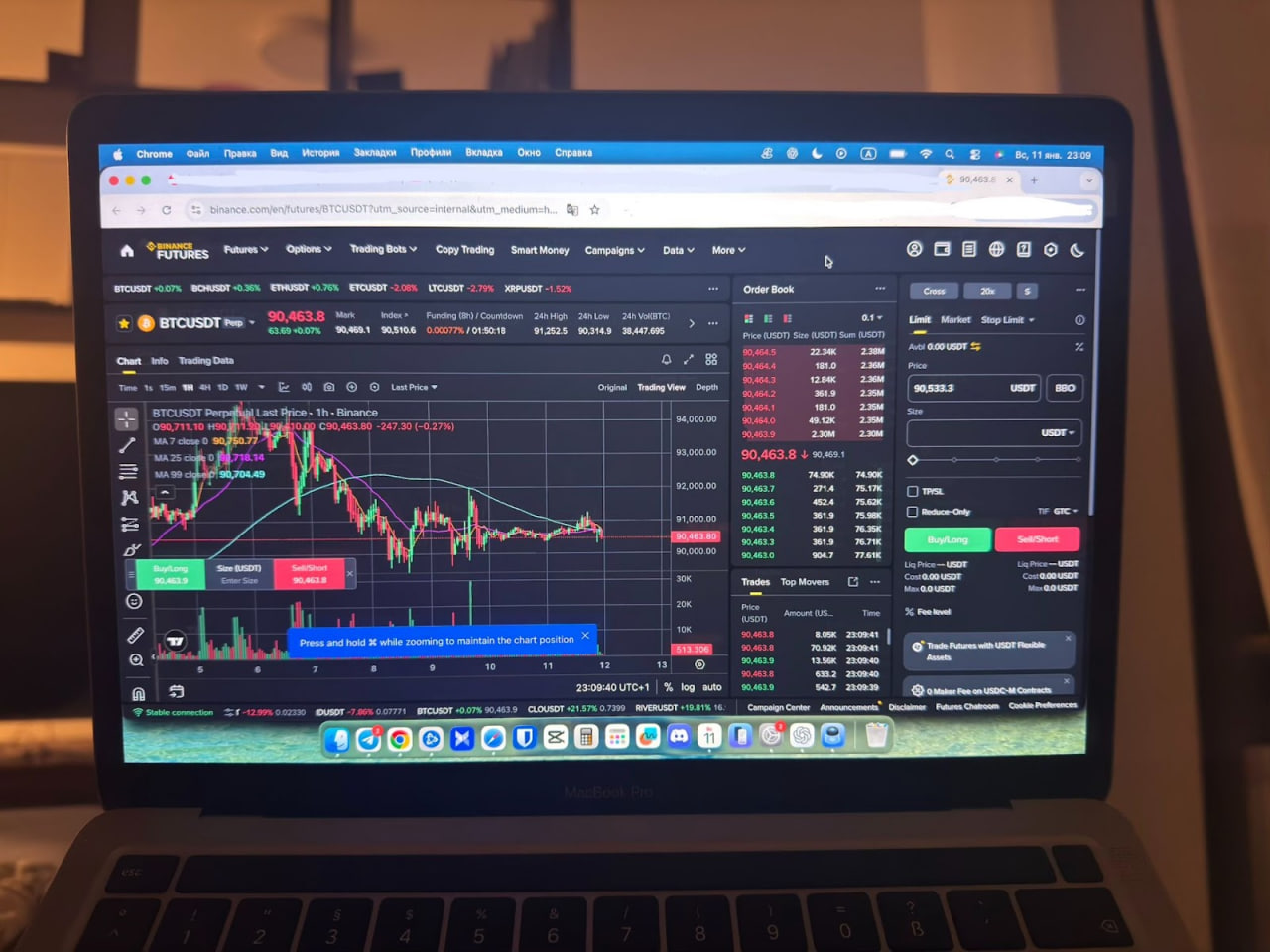

Binance Futures operates as a multifunctional terminal. A single screen combines the order book, trade feed, TradingView charts, up to a dozen order types, cross and isolated margin modes, hedge mode, fast margin transfers between markets, and strategy bots such as futures grids and TWAP.

Stop-loss reliability: During a 4.5% BTC drop on January 20, 2026, stop orders on both platforms executed within 1-2 seconds of trigger price. Binance stop filled with 20 ticks slippage during the spike, Bybit with 8 ticks slippage on a similar position size. Both platforms handled the volatility without order rejections or system lag.

There are separate tabs for auto-invest and copy trading, deeply customizable alerts, and a powerful API. At the same time, the sheer number of interface elements can make the layout feel cluttered, and some features take time to locate in menus.

Bybit is built as a derivatives-first platform, and the terminal design shows it. The layout is simpler: a single futures order book, a clear order panel for market, limit, and conditional orders, quick leverage and risk limit controls, hotkeys, and a one-click mode for active scalping. Copy trading and bot strategies are placed in separate sections, so they do not interfere with core trading. The mobile app mirrors the desktop structure without unnecessary screens.

Bybit vs Binance Futures fees tell only part of the story. For scalpers and intraday traders, Bybit’s streamlined interface saves seconds per trade – time that counts more than a 0.02% fee difference. For algo traders building complex strategies, Binance’s feature depth (TWAP orders, futures grids, advanced margin modes) justifies the slightly higher taker fee through broader automation options.

Withdrawal processing: Crypto withdrawals on Binance processed in 8 minutes (manual security review for first withdrawal), Bybit in 4 minutes (automated approval for amounts under $5K). Both platforms required 2FA and email confirmation. No hidden withdrawal fees beyond standard network costs.

Bybit vs Binance Futures — which should you choose?

If you’re a beginner or opening your first futures account

Choose: Bybit

Bybit is easier to start with, and it’s not close. Navigation is clearer, the terminal is not overloaded, and leverage and margin are adjusted in just a few clicks. The interface guides the user and reduces the risk of mistakes, which matters when learning derivatives. Fees are transparent, and position parameters are always visible.

If you’re an active intraday or high-volume trader

Choose: Binance

Binance offers more control. Dozens of order types, advanced margin modes, and deeper liquidity on major pairs than most competitors. For traders placing dozens of trades per day Binance’s deeper liquidity isn’t negotiable – it’s the only option that won’t punish you with slippage on every fill.

Volume scenario: A trader executing 100 contracts daily ($200K notional) saves significantly on Binance’s lower base fees. At 0.04% taker (Binance) vs 0.06% (Bybit), the daily difference is $40 ($80 vs $120 in fees). Over a month, that’s $1,200 in fee savings before VIP discounts – enough to offset any interface learning curve.

If you mainly want a wide selection of futures contracts

Choose: Binance

Binance supports hundreds of futures markets, from top assets to newly listed altcoins. If you trade trending meme tokens, DeFi alts, or want to react quickly to new listings, the selection here is among the broadest available.

If low fees are your priority

Choose: Bybit

Bybit’s base fee rate is lower than Binance’s standard futures fee. For frequent trading, the difference is material. With the same strategy, total costs on Bybit are usually lower, especially without VIP tiers.

If you want maximum stability and global accessibility

Choose: Binance

Binance delivers superior infrastructure. High fault tolerance, stable performance under load, and support across a wide range of regions make it the better option when global access and predictable are priorities.

Bybit vs Binance Futures at a glance

| Category | Binance Futures | Bybit | Winner |

|---|---|---|---|

| Overall GNcrypto rating | 4.4 / 5 | 4.3 / 5 | Binance (overall) |

| Daily futures turnover (approx.) | ≈$70B | ≈$23B | Binance |

| Tradable contracts (perps & futures) | 200+ | 180+ | Binance |

| Liquidity & volume rating | 5 / 5 | 5 / 5 | Draw |

| Fees & total cost rating | 4.5 / 5 | 4.2 / 5 | Binance |

| Asset selection rating | 5 / 5 | 4 / 5 | Binance |

| Tools & order controls | 5 / 5 | 5 / 5 | Draw |

| Fiat access & minimum trade size | 4 / 5 | 3 / 5 | Binance |

| Reliability & transparency rating | 3.5 / 5 | 4 / 5 | Bybit |

How we tested Bybit vs Binance Futures

This comparison draws from our separate hands-on tests of Binance Futures (rated 4.4/5) and Bybit (rated 4.3/5). We use a weighted, category-based model across seven criteria: liquidity & volume, fees & total cost, contract selection, execution quality, trading tools, account accessibility, and reliability. Scores are normalized on a 1.0–5.0 scale.

Our testing combined public data (fee schedules, contract lists, proof-of-reserves) with hands-on verification: opening accounts, placing leveraged trades, monitoring funding rates over multiple days, testing stop-loss execution during volatility, and measuring spreads during different market hours.

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.