Bybit P2P trading 2026: testing offers, payments, fees, disputes

We ran a hands-on test of Bybit’s P2P marketplace and documented how escrow, filters, and appeals work in practice. We also completed a small spot trade ($100 in BTC) and later converted it to USDT to observe the full cycle from purchase to exit. Here’s what the test showed about pricing, payment friction, and the main risk points for 2026.

Liquidity & Volume

5.0

Payment Methods

4.0

Liquidity & Volume

4.0

Payment Methods

4.0

Liquidity & Volume

4.0

Payment Methods

4.5

Liquidity & Volume

3.5

Payment Methods

4.5

Liquidity & Volume

3.5

Payment Methods

3.5

What Bybit P2P offers: escrow, speed, dispute tools

The P2P Bybit interface works like a peer-to-peer marketplace inside a centralized exchange: you choose an ad, accept the terms, and the crypto is locked in escrow until payment is completed. In our test, this setup lowered risk as long as the user followed the rules closely, especially when confirming payment and communicating in the order chat.

The platform is built for quick execution. In our test, creating an order and moving to payment took 4 screens and under 2 minutes (select ad → confirm amount → view payment details → mark as paid). We also noted the “One‑Click Buy” mode. It automates offer selection and makes it easier for beginners when they need to compare available rates quickly without scrolling through listings by hand.

A key part of the operating model is how disputes are handled. Bybit includes an appeal process, and in 2025 it added a fast-track path for a limited set of cases. Based on our observations, it’s most useful when the issue comes down to a verifiable fact like “payment sent but coins not received,” or the reverse.

We followed this trade flow during testing:

- selected an ad by currency, limits, and payment method.

- created an order and sent fiat using the details in the listing.

- saved payment proof as a screenshot that the appeal flow accepts (a statement or in-app screenshot from the bank).

- confirmed payment in the order and waited for the escrow release.

- We were ready to open an appeal and upload evidence if needed, but the trade went smoothly.

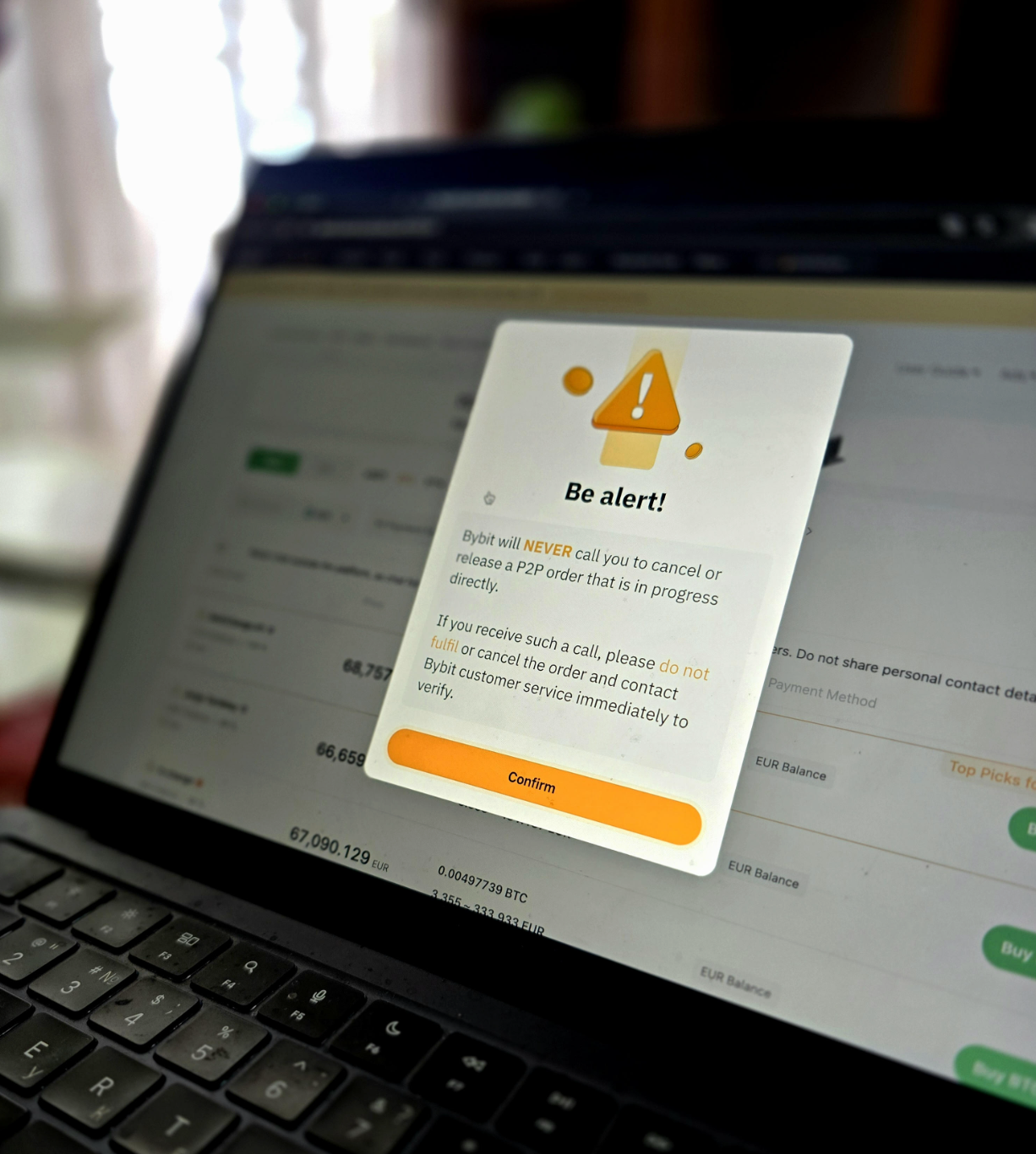

From a risk standpoint, in 2026 what matters is escrow protection and the broader counterparty environment. After a major security incident in February 2025, the exchange tightened checks, and some users saw temporary account holds for compliance reviews of transactions. In practice, that makes basic safeguards relevant, including an anti-phishing code, 2FA, being careful with links, and double-checking payment details inside the order interface.

Supported assets and payments: assets, fiat coverage, payment methods

As of 2026, dozens of local fiat currencies and hundreds of payment methods are available for Bybit P2P trading. In day-to-day use, that translates into a wide choice of banks and payment rails, where the actual convenience usually depends on your country, local banking rules, and the quality of specific ads.

P2P liquidity tends to concentrate around a few core assets. When we searched for BTC ads with 50-200 euros limits and EU bank transfer, we found 47 active sellers. For comparison, ETH had 31 sellers, USDT had 89 sellers, and USDC had 12 sellers under the same filters. This made BTC and USDT easier to trade with predictable rates and fast execution.

Most listings revolve around USDT, BTC, ETH, and USDC. USDT is commonly used to lock in results and move value between venues. BTC is often bought with fiat with the intent to hold or convert later. ETH is a frequent pick when the next step involves DeFi and EVM services. USDC is used as a U.S.-based stablecoin alternative when issuer licensing and rules around circulation matter more.

A couple of practical notes on payments. First, ads with the “best” rate often come with extra sensitivity to details. In chat, a seller may closely verify the recipient bank details, transfer timing, or the required format of the payment note. Second, split payments and transfers to an account name that does not match the counterparty increase the chance of banking issues and make disputes harder to resolve.

Regional restrictions are another factor. Bybit officially limits access in some countries, and in a number of jurisdictions P2P conditions depend on local regulation. In 2025, Bybit expanded a regulated model in certain regions where fiat transfers follow a more formal process and include limits that reduce the likelihood of bank blocks.

It’s also worth remembering that if the counterparty does not meet their obligations, such as not sending money or not releasing coins, you can file an appeal only within 5 days after the order is closed.

Fees and costs: spreads, maker fees, and real P2P pricing

If you look at Bybit P2P trading fees, P2P was positioned for a long time as a zero-fee segment, and in the basic user experience that often holds true, because takers (people who pick existing ads) typically pay a zero exchange fee. By late 2025, the pricing model became more differentiated. In certain fiat segments, makers started paying fees that depend on the pair and the advertiser’s status.

The total cost is usually driven by spreads more than fees. In our $100 BTC purchase, the spread was 2.8% ($2.80), while Bybit charged zero taker fee. Checking 5 other ads at the same time showed spreads ranging from 1.3% (best rate, but higher minimum and lower seller rating) to 5.0% (One-Click Buy suggestion). Across the P2P market, typical spreads land in the 2.5-3.5% range for BTC and USDT, and can reach 5%+ for niche payment methods or smaller altcoins.

Beyond spreads, there are indirect costs. These include bank or payment-service transfer fees, in-app conversion costs when the account currency differs from the ad currency, and time lost to compliance checks when a payment looks unusual for a bank.

If the goal is to reduce the total cost, we strongly recommend comparing several ads under the same conditions (same bank, same amount, comparable limits) and checking in advance whether the payment flow looks reasonable. This kind of control reduces the chance of mistakes in payment details and helps avoid situations where the list rate looks great, but the chat conditions are more demanding than expected.

Testing process

We tested Bybit P2P with a real $100 BTC purchase using bank transfer (Revolut, EU → seller’s Monzo account) to evaluate execution speed, spread accuracy, escrow reliability, and payment friction.

Account setup:

- Created account: 5 minutes (email, password, 2FA)

- KYC level: Basic verified (passport + selfie), took 18 minutes

- Required for P2P: Basic KYC minimum (can trade up to 50 BTC/day after verification)

Test trade details (January 28, 2026):

- Asset: BTC

- $100 (0.001226 BTC)

- Payment method: Bank transfer (Revolut EU → Monzo UK)

- Seller’s rate: $83,775/BTC (2.8% above market)

- Market rate (Binance spot, same time): $81,500/BTC

- Spread: 2.8% ($2.80 premium on $100 purchase)

- Bank transfer fee: £0 (free Revolut transfer to EU bank)

- Total cost: $102.80 (spread only, no Bybit fee as taker)

Execution timeline:

- 14:23 – Order created, BTC locked in escrow

- 14:26 – Sent £77.50 via Revolut (3 minutes to find seller’s bank details, copy reference)

- 14:28 – Marked payment as “Sent” in Bybit, uploaded Revolut screenshot

- 14:41 – Seller confirmed payment receipt (13 minutes wait)

- 14:42 – BTC released from escrow (1 minute after confirmation)

- Total time: 19 minutes (order → coins in wallet)

Payment friction:

- Revolut flagged transfer as “unusual activity” (first crypto-related transfer), required in-app confirmation (“Is this payment correct?”)

- Seller required exact payment reference (case-sensitive) – “P2P-BTC-31JAN” – one extra character would have triggered dispute

- No issues with recipient name matching (both Bybit-verified accounts)

- Seller’s payment instructions clear: “Send to Monzo, Ref: P2P-BTC-31JAN, confirm in chat when done”

Spread comparison (5 other ads checked at same time):

- Best rate: $82,095/BTC (0.7% spread) — min. order £200, seller had 78% completion rate, 35+ min avg. release time

- Our seller: $83,775/BTC (2.8% spread) — min. £50, 98.6% completion rate, <15 min avg. release time

- Mid-range: $83,315/BTC (2.2% spread) – min. £100, 94% completion rate, 20 min avg.

- Higher spread: $84,235/BTC (3.4% spread) – min. £30, 99.2% completion rate, instant release claimed

- Worst rate: $85,795/BTC (5.3% spread) – “One-Click Buy” suggested ad (we skipped)

Why we chose 2.8% spread seller:

We prioritized seller reliability (98.6% completion, <15 min release) over best price (0.7% spread but 78% completion, slower release). For a $100 test, $2.10 extra cost ($2.80 vs $0.70) was acceptable to reduce dispute risk.

One-Click Buy test:

We tested One-Click Buy mode for comparison:

- Auto-selected ad: $84,520/BTC (3.7% spread)

- Comparison: 0.9% worse than our manual selection (3.7% vs 2.8%)

- Cost difference: $0.90 more per $100 ($3.70 vs $2.80)

- Convenience: 2 taps instead of filtering ads – faster but more expensive

| Feature | Manual P2P Selection (Our Test) | One-Click Buy (Auto-Selected) |

|---|---|---|

| Effort Level | Medium (Manual filtering & vetting) | Low (2 taps, instant match) |

| Exchange Rate | $83,775 / BTC (Balanced) | $84,520 / BTC (Premium) |

| Spread vs. Spot | 2.8% | 3.7% |

| Total Cost ($100) | $102.80 | $103.70 |

| Seller Reliability | Verified (98.6% completion) | Guaranteed by system |

| Control | Full choice of payment instructions | Randomly assigned seller |

| Verdict | Best for value & safety | Best for speed only |

Conversion to USDT (follow-up test):

After receiving 0.001226 BTC, we converted to USDT via Bybit spot market:

- 0.001226 BTC → 99.90 USDT (Bybit spot taker fee: 0.1%)

- Market rate would give 100.00 USDT (0.001226 × $81,500)

- Cost: 0.10 USDT (0.1% spot fee, no slippage on small order)

Dispute readiness:

We prepared for potential appeal:

- Screenshot: Revolut payment confirmation (timestamp, amount, recipient, reference)

- Requirement noted: Bybit may request bank statement or screen recording for disputed orders

- Appeal window: 5 days after order closed

- Not needed: trade completed without issues

Pro Tip for Revolut users: When providing proof of payment, ensure you take a screenshot of the specific “Details” section of the transaction. This view includes the unique Transaction ID, which Bybit support typically requires during appeals if a seller claims the funds were not received.

Customer support test:

We submitted a non-urgent ticket asking about maker fee structure changes in 2025.

- Ticket submitted: 15:30

- Response received: 19:50 (4 hours 20 minutes)

- Answer quality: Accurate, included link to updated fee schedule effective December 2025

- Support language: English, professional tone

Banking experience notes:

- First crypto-related transfer on Revolut triggered “unusual activity” check

- Subsequent P2P transfers (not tested, but noted in Revolut UI) may not trigger same check

- Monzo recipient account had no issues receiving crypto-related payment

- No mention of “cryptocurrency” or “Bitcoin” in payment reference – seller instructed to use neutral reference code

Pros and cons of using Bybit P2P

In this block, we summarize our test results. The points below reflect what we saw in the interface and while testing typical listings.

Strengths:

- Escrow locks coins until payment

- One-Click Buy finds offers fast (but cost 3.5% spread vs 2.8% manual selection in our test)

- Bank filters save search time

- Many fiat currencies and methods

- High USDT and BTC liquidity

- No strict KYC for small amounts

Weaknesses:

- Spreads often take 2.5% to 3.5% (our $100 BTC test: 2.8% spread vs Binance spot)

- Maker fees can raise ad pricing

- Banks may block frequent transfers (our Revolut flagged first crypto payment as “unusual,” required confirmation)

- Fake-rate ads often sit on top

- Split payments raise banking risk

- Appeals may require bank screen recording and a transfer statement

Final GNcrypto score from the test: 4.1/5.

The score went up for fast execution, payment-method choice, and useful filters. The score went down for offer spreads, banking risks, and strict evidence requirements in disputes.

Trustworthiness check

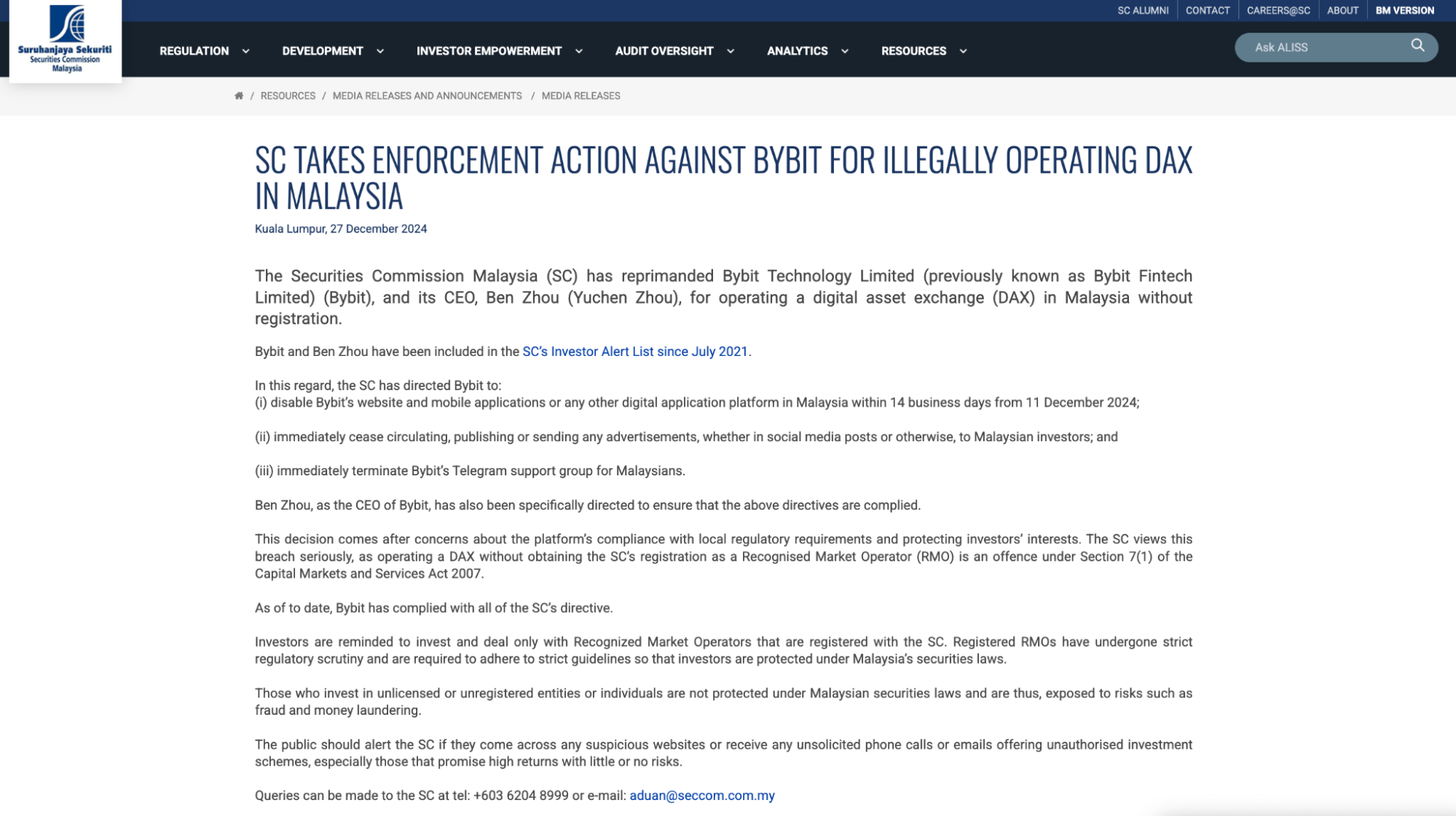

Below are notable public compliance and regulatory signals. This section is separate from our interface test. It’s based on regulator notices and official statements related to jurisdictions where Bybit did not have a local license at the time of publication.

- On December 11, 2024, the Securities Commission Malaysia issued directives to Bybit over operating without registration as a Recognised Market Operator. The notice referenced requirements to disable the website and apps in Malaysia, stop advertising, and shut down local Telegram support. The regulator’s page notes that Bybit had complied by the time the release was published.

- On May 16, 2024, France’s regulator AMF noted that Bybit has been on the country’s blacklist since May 20, 2022, for not meeting local requirements.

- On November 28, 2024, Japan’s Financial Services Agency published a warning stating that Bybit Fintech Limited had provided services to Japanese residents without registration and that the activity had been stopped.

Bybit has also been working toward approvals in Europe and recently returned to the UK market.

GNcrypto’s overall Bybit rating

| Criteria | Rating (out of 5) |

|---|---|

| Escrow & Trade Safety | 5 |

| Liquidity & Order Book Depth | 4 |

| Fees & Payment Methods | 4 |

| Verification & Account Limits | 4 |

| Platform Performance & Reliability | 4 |

| User Experience & Trade Flow | 4 |

| Customer Support & Dispute Handling | 4 |

| Total Score | 4.1 |

How we test P2P platforms

At GNcrypto, we put transparency first when evaluating peer-to-peer (P2P) cryptocurrency trading platforms. Our reviews are based on hands-on testing and thorough analysis across all key dimensions that matter for safely buying and selling crypto directly with other users.

We do not audit platform solvency or guarantee user safety from all scams. Instead, our scores reflect observable escrow mechanisms, order book depth, and platform support quality. We do not accept payment for ratings or modify scores based on partnerships.

Categories & weights

We rate P2P platforms on seven criteria. Escrow and Liquidity are weighted heaviest because a platform that isn’t safe or has no one to trade with is useless, regardless of how pretty the UI is.

- Escrow & Trade Safety – 25%

- Liquidity & Order Book Depth – 20%

- Fees & Payment Methods – 15%

- Verification & Account Limits – 15%

- Platform Performance & Reliability – 10%

- User Experience & Trade Flow – 10%

- Customer Support & Dispute Handling – 5%

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.