Bybit report shows crypto adoption splits between utility use and investing

Bybit’s “World Crypto Rankings” study, compiled with DL Research, argues that crypto adoption is splitting into distinct tracks that do not always match wealth, regulation, or common market narratives.

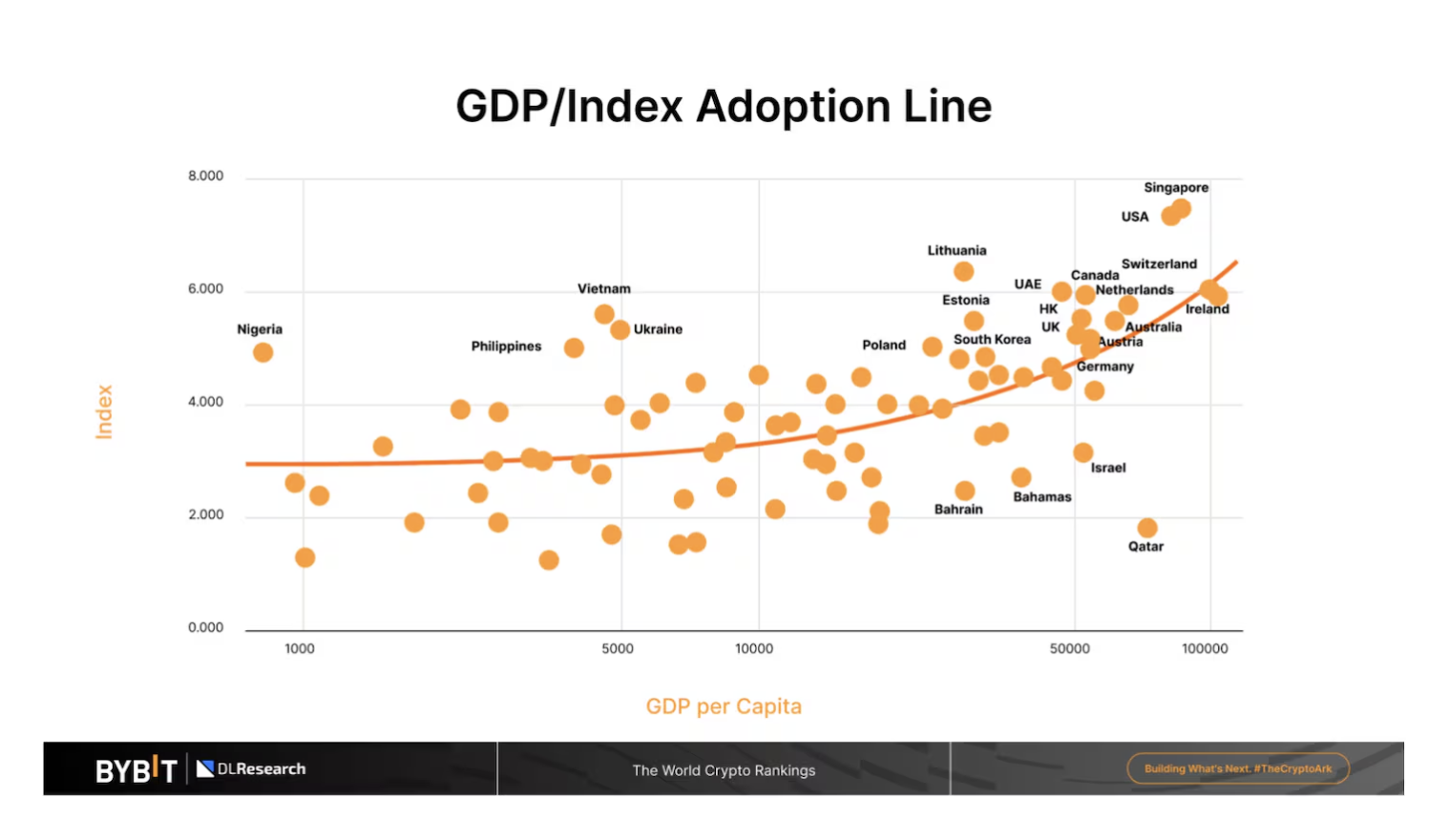

The index scores jurisdictions across pillars including user penetration, transactional use, cultural penetration and institutional readiness, and it highlights sharp mismatches between everyday usage and capital-market style participation.

On transactional use, the report found that several lower- and middle-income markets rank near the top despite relatively modest scores elsewhere. It highlighted Nigeria, Vietnam, Ukraine and the Philippines as leaders in activity tied to payments, remittances and day-to-day transfers. Nigeria’s user penetration score was listed at 0.17 while its transactional use score reached 0.83. Ukraine recorded a transactional use score of 1.00 despite lower cultural penetration, a pattern the report linked to crypto being used as a utility rather than a discretionary investment.

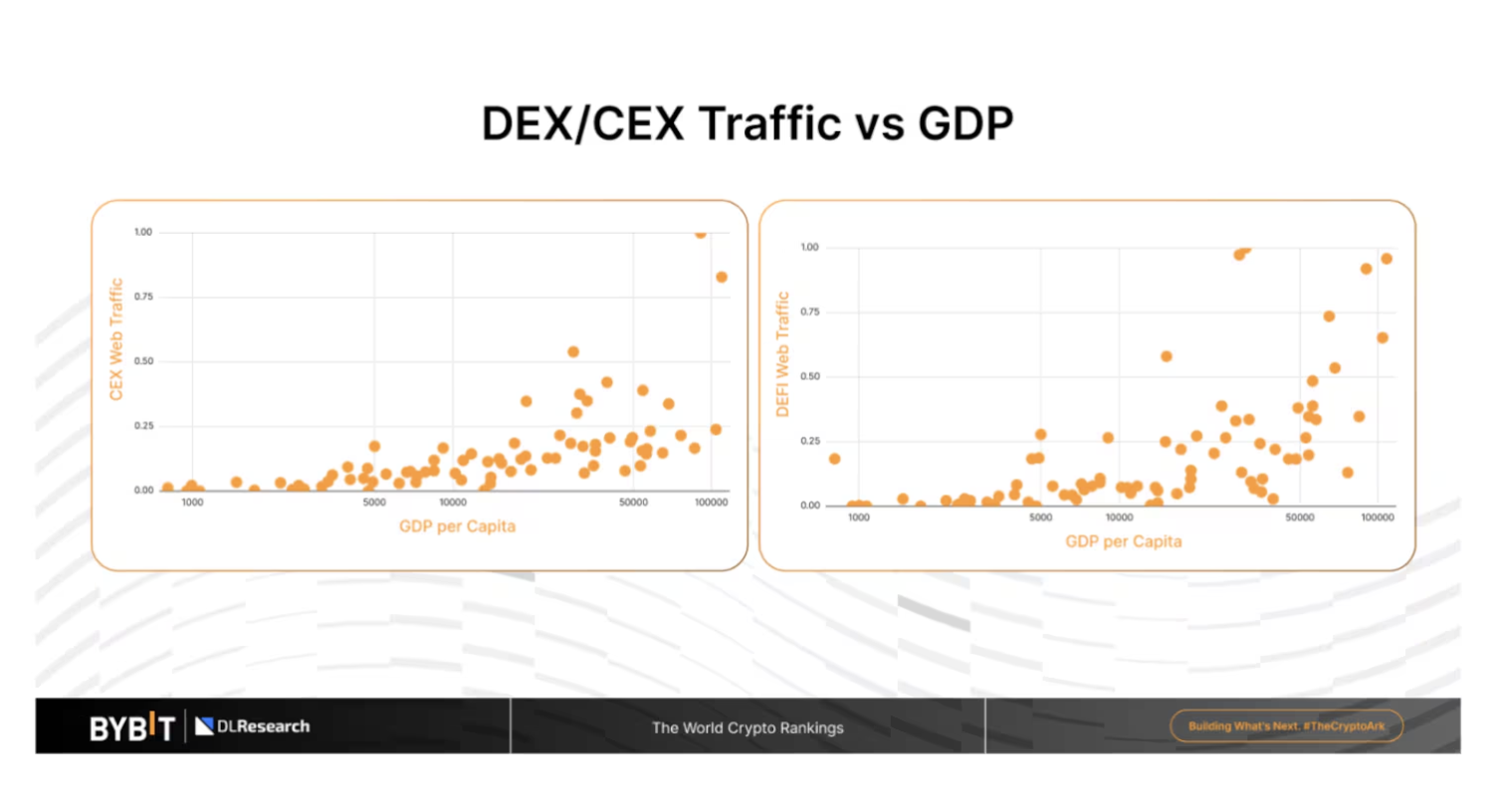

The same dataset pointed in the opposite direction on more complex market activity. Traffic and engagement tied to centralized exchanges and DeFi tools skewed toward higher-income jurisdictions, suggesting that participation in derivatives, yield strategies and browser-based DeFi remains concentrated where capital and financial infrastructure are deeper. The report added that lower-GDP markets rely more heavily on stablecoins, peer-to-peer rails and mobile-first access, and it noted that P2P activity spans income levels, shaped more by banking frictions and on-and-off ramp constraints than by poverty alone.

Regional comparisons also showed large differences inside single geographies. In Latin America, the index framed Brazil as a hybrid market combining regulatory progress with retail usage, while Argentina’s activity was described as necessity-driven amid inflation and currency controls, and Mexico’s pattern was linked to cross-border flows with the United States. The report also pointed to Georgia and Armenia as quiet outliers where mining and energy availability helped build infrastructure that can precede broader consumer adoption. In Europe, it highlighted smaller states such as Lithuania, Estonia and Ireland as gateways where regulatory clarity and licensing regimes can attract service providers despite limited population size.

Several country-level mismatches stood out in the pillar breakdown. Pakistan posted an institutional readiness score of 0.01 against a transactional use score of 0.73, while China retained a cultural penetration score of 0.76 despite restrictive policy. Turkey’s transactional use score was listed at 0.06, and El Salvador, despite bitcoin’s legal tender status, showed low cultural penetration at 0.13 and transactional use at 0.25. The report also flagged labor-market signals, saying onchain payroll nearly tripled year over year, rising from 3.2% of workers in 2023 to 9.6% in 2024.

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.