Bybit credit card review 2026: fees, rewards, and real cost breakdown

Bybit Card is one of the most searched exchange linked cards in 2026, but the real experience depends on two things: your region and what you spend from. We tested the beginner flow, then mapped auto conversion, FX and ATM costs, and reward caps to real scenarios so you can decide if it fits daily spending or works better as a travel backup.

After running the card through a beginner style live test, the takeaway is straightforward. Bybit Card works best when you keep a dedicated spend bucket in stablecoins or fiat and treat it as a spending float, not a vault. If you plan to spend volatile crypto or rely on ATMs, conversion and fee stacking can eat into any rewards fast.

GNcrypto’s overall Bybit Card rating

| Criterion | Score |

|---|---|

| Fees & Costs | 3.6 |

| Rewards & Cashback | 3.4 |

| Supported Currencies & Regions | 3.3 |

| Card Limits & Spending Controls | 3.9 |

| Security & Fraud Protection | 4.0 |

| User Experience & App Integration | 3.7 |

| Customer Support & Card Delivery | 3.4 |

| Total | 3.60 / 5 |

Is Bybit Card worth it in 2026?

Short answer: Bybit Card works best as a spending float for active Bybit traders, not as a primary payment card.

Our verdict after testing:

The card is most efficient when you fund it with stablecoins (USDT/USDC) and spend in your local currency. In that scenario, fees stay low and the experience feels smooth.

The card becomes expensive when you:

- Spend from volatile crypto (conversion spreads eat into rewards)

- Make foreign currency purchases (FX fees stack on top)

- Withdraw cash frequently (free ATM allowances are limited, then percentage fees kick in)

Use it if:

- You already keep a small balance on Bybit for trading

- You want a direct bridge from exchange funds to card payments

- You spend mainly in stablecoins and your local currency

Skip it if:

- You need a primary card with predictable global fees

- You want self-custody (this is custodial by design)

- You’re in a jurisdiction where Bybit has exited or faces regulatory pressure (France, UK, Netherlands, Malaysia)

Bottom line: Treat Bybit Card as a convenience tool for spending trading profits, not a bank replacement. Keep only a spending float on the card, and store long-term holdings elsewhere.

Full breakdown below.

Overview of the Bybit Card

In our view, the Bybit Card is easiest to understand as a spending tool that sits on top of your Bybit account. The card itself does not store crypto in a separate wallet the way a hardware wallet would. Instead, you keep a balance inside Bybit and the card lets you spend that balance at regular card merchants. That mental model matters, because it sets the right expectations: this is convenience first, not self custody.

This Bybit Card review boils down to one practical question: do you already use Bybit enough to keep a small spending float there. If yes, the card can feel like a smooth shortcut. You skip the weekly habit of moving funds to a bank or another app, and you can treat Bybit like your spending hub for subscriptions, everyday purchases, and occasional travel payments.

Bybit Card is program-based and region-based, which means your experience varies. Availability, the exact fee table, ATM rules, and even whether you can order physical plastic can differ depending on where you live and which Bybit card program you are placed under. For beginners, that means the first step is not comparing cashback headlines. It is opening the card section in the app and confirming you are eligible, what your settlement currency is, and what fees apply in your region.

One practical habit we like for first time users is starting with the virtual card and running a small test week. Make a few tiny purchases, watch the deductions in your card activity, and only then decide if you want to rely on it daily. In our opinion, the safest beginner setup is to keep your long term holdings separate and treat the card balance like a spending wallet, not your savings account.

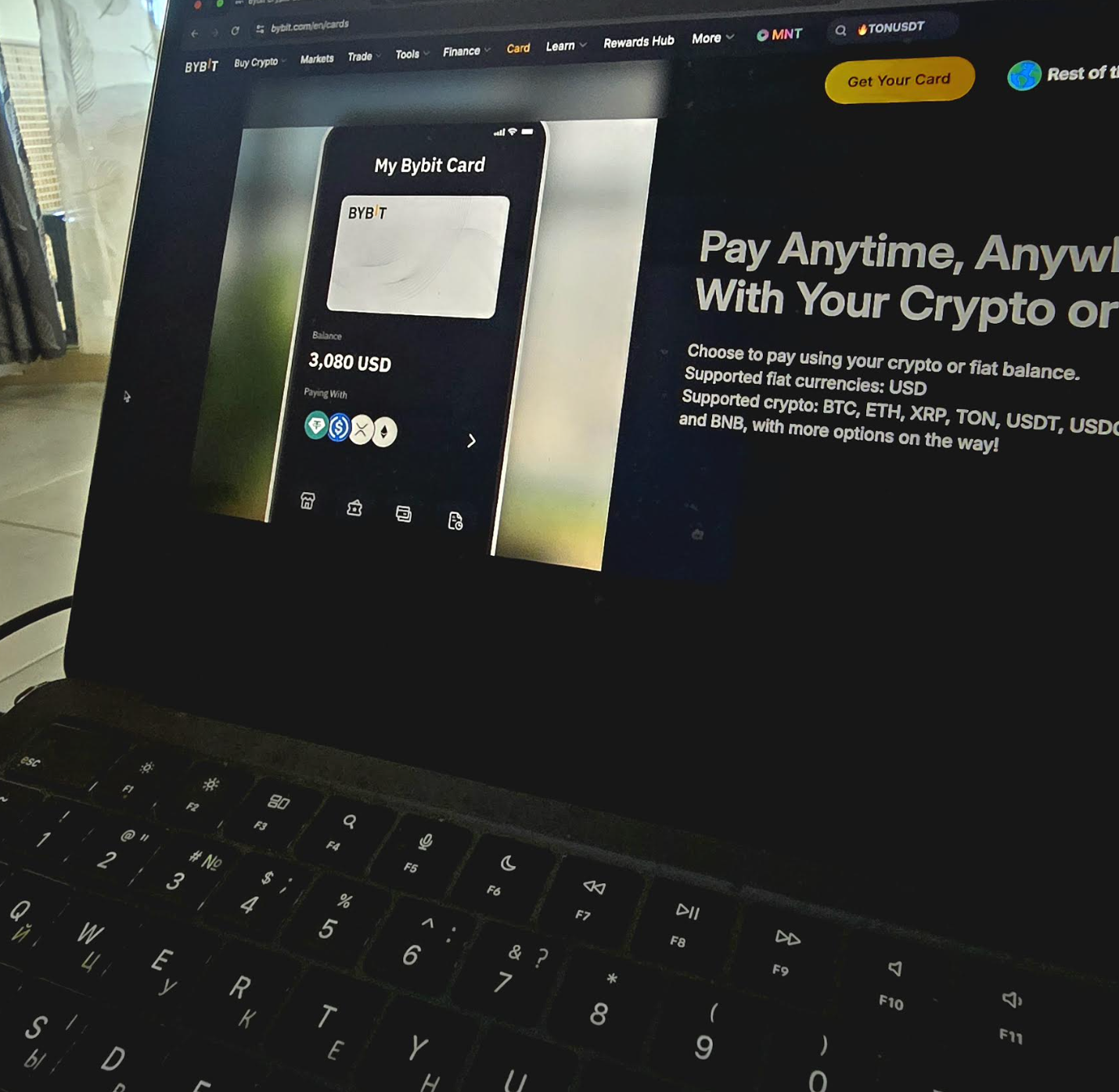

Funding sources and asset support

Once you are set up, the next question is what the card actually spends. In most real use cases, your Bybit balances are the source of funds and the card pulls from the spending balance you have available. The cleanest beginner habit is to keep a dedicated spend bucket in fiat or stablecoins so your deductions are predictable. When you spend from volatile crypto, you are effectively selling a small amount at the moment of purchase, which can make the outcome feel random if you are not expecting it.

Auto conversion is the mechanic most beginners overlook in exchange-linked cards.. If you pay with an asset that does not match the settlement logic of your card program, the platform can convert what you need at checkout. It is convenient, but it changes the real cost. You are not only paying the merchant amount. You may also be paying a conversion spread and, in some card programs, an explicit crypto conversion fee. That is why we treat this Bybit crypto card review section as a reality check: the card can feel cheap in local spending when you use stablecoins, and noticeably less cheap when you rely on automatic crypto conversions.

Asset support is also not universal. Some programs focus on a short list of assets that are practical for spending, while others emphasize one settlement currency. Don’t plan your routine around a coin you assume is supported. Check the list inside your Bybit Card page first.

Here is what this looks like in daily life. You keep 200 USDT for spending. You pay 4.50 EUR for coffee. The purchase goes through, and your card activity shows the deduction converted from your balance. If you instead spend from BTC, the same coffee becomes a tiny BTC sale at that moment, and the final BTC amount you lose depends on the conversion terms and spread.

Practical habits we would recommend for beginners:

- For predictable spending, default to fiat or stablecoins.

- If you spend from volatile crypto, assume you are locking in a sell price at checkout.

- Test small first: do two or three tiny purchases and compare the deducted amount to your expectation.

Spending, rewards and fees

In this Bybit credit card review style breakdown, we focus on real costs and beginner mistakes, rather than marketing headlines.

This is the part where most beginners either love the card or abandon it. Bybit publishes fee and limit details by program, and the exact numbers can vary by region. In practice, you will usually run into three cost buckets: conversion costs when you spend from crypto, foreign exchange costs when you spend in a different currency than your card settlement, and cash withdrawal costs if you use ATMs. Some programs show a crypto conversion fee as a percentage, some show FX fees as a percentage on top of card network rates, and many set a free ATM allowance that turns into percentage based fees after you cross the threshold. The beginner message is simple: do not assume your friend’s Bybit Card fees match your fees.

Rewards can also be real, but they are rarely as simple as the headline marketing. Bybit runs card reward campaigns and tier style structures that can include caps, category rules, limited time boosts, and changing terms. In our experience, the only safe way to evaluate rewards is to look at what your account actually shows under Card Rewards and to test with real spending. A good beginner mindset is that rewards are a bonus, not the reason to use the card.

The math that matters is the net result. If you spend in your home currency from a stablecoin balance, the card can feel efficient. If you spend from volatile crypto and you add conversion and FX on top, your effective reward rate can shrink quickly and sometimes disappear. Our first month recommendation is intentionally boring: use stablecoins for spending, avoid unnecessary foreign currency spending if your program has meaningful FX fees, and treat ATMs as an occasional tool, not your default.

Test plan you can run in one afternoon:

- Make one local currency purchase, then one foreign currency purchase.

- Make one small ATM withdrawal if your program supports it.

- Compare the deducted amount, any shown fees, and any reward credited.

- Decide if the card is a daily tool for you or a niche travel backup.

Pros and cons

In day to day use, the Bybit Card is easiest to like when you already keep a small spending balance on Bybit and you want a direct bridge from exchange funds to real world card payments.

Strengths:

- Exchange native spending: you spend from your Bybit balance instead of moving funds out first, which removes a lot of beginner friction.

- Stablecoin friendly routine: if you keep a spend bucket in USDT or another stable balance, deductions tend to feel predictable compared to spending from volatile coins.

- Virtual first onboarding: starting with the virtual card is a low commitment way to test real purchases, then decide if you need physical plastic.

- Rewards can help when your habits match the terms: promos and rewards can add value for regular users, but only if you watch caps, categories, and changing rules.

Weaknesses:

- Not one global product: eligibility, fee tables, and even the card program can vary by region, so you cannot assume the experience is identical everywhere.

- Conversion and FX can quietly tax you: spending from crypto may trigger conversion costs, and foreign currency purchases can add FX fees depending on your program.

- ATM math can disappoint: free allowances are usually limited, and percentage based fees after the threshold can make frequent cash withdrawals expensive.

- Custodial by design: your spending funds live on an exchange account, so in our opinion it is safer to keep only a spending float here, not long term holdings.

Trustworthiness check

For us, trust comes down to clear disclosures, how incidents are handled, and how stable access feels across jurisdictions. With Bybit, a few public events are worth knowing before you decide to keep a meaningful balance tied to card spending.

- May 20, 2022 France AMF blacklist notice: The French regulator blacklisted Bybit for non-compliance. Although the exchange was officially removed from the list in February 2025 after extensive remediation, services for French residents remain suspended as of early 2026 pending MiCA licensing. The practical takeaway is not drama, it is planning: even when a platform fixes its issues, the return to “normal” service can take years.

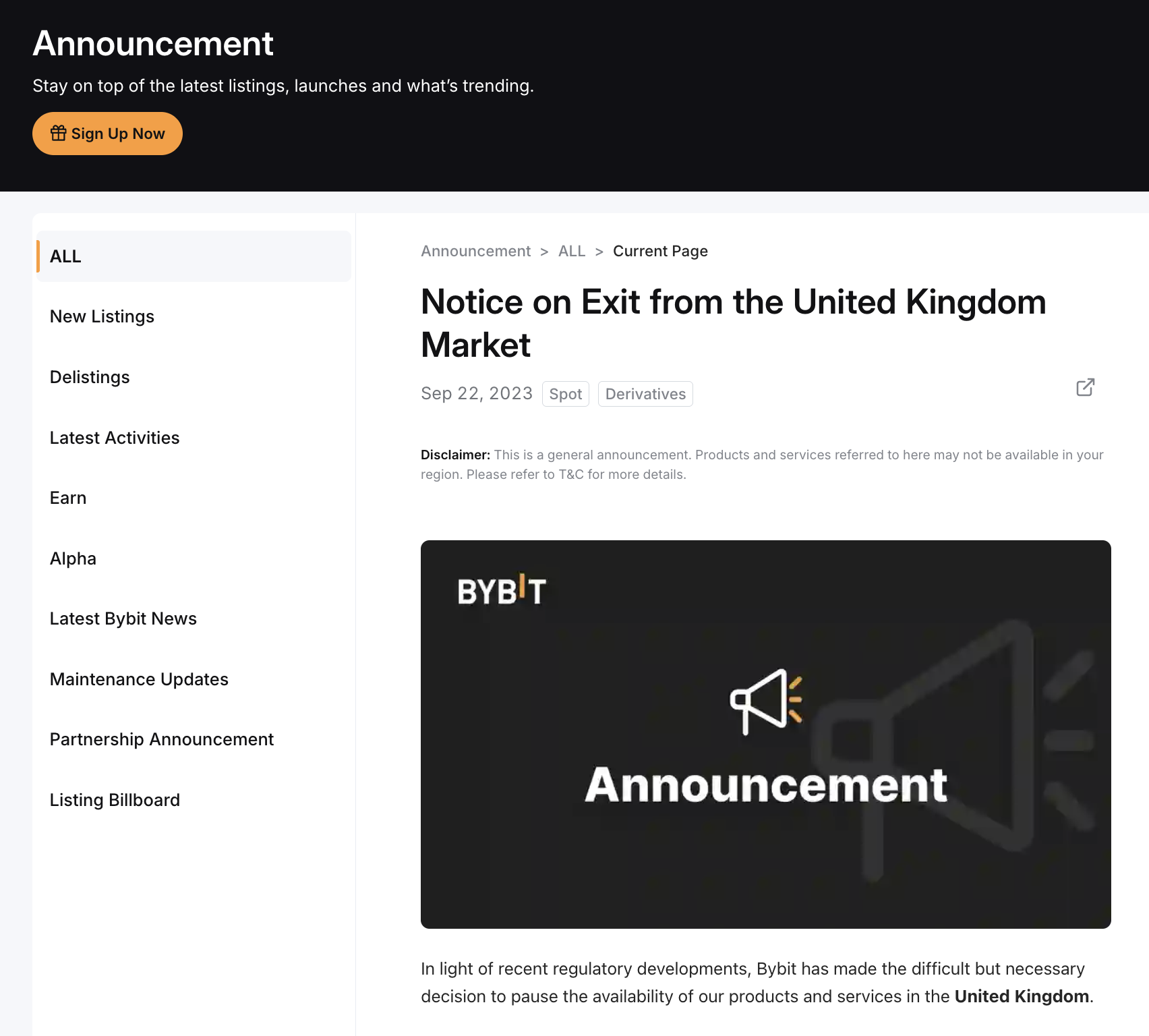

- September 22, 2023 UK market exit notice: Bybit announced it would stop accepting new UK customers and wind down services ahead of new FCA marketing rules. Even if you are not in the UK, it shows how quickly access can shift when regulation changes.

- October 22, 2024 Netherlands administrative fine: De Nederlandsche Bank imposed a fine on a Bybit entity for offering crypto services without the required registration until September 2023. The user level lesson is that compliance issues can affect onboarding, product continuity, and what a platform can offer in your region.

- December 11, 2024 Malaysia enforcement action: Securities Commission Malaysia directed Bybit to disable its platforms for Malaysian investors within a deadline and to stop advertising locally. The takeaway is simple: jurisdiction risk is real, so do not keep all your spending money in one place.

- February 21, 2025 security incident and March 3, 2025 published timeline: Bybit disclosed a major security incident affecting an Ethereum cold wallet and later published a detailed timeline and FAQs. For card users, the practical takeaway is conservative: enable strong account security, treat exchange linked cards as spending tools, and keep your long term holdings elsewhere.

One more thing we keep in mind with exchange issued cards: the same brand can switch banking partners, card program managers, or regional entities, and the user facing rules can change overnight. Our beginner habit with Bybit Card is to treat it like a spending tool, follow in app card notices, and keep your card balance smaller than your long term holdings.

Methodology – why you should trust us

We score crypto payment cards using a weighted, seven category model and convert the results into a 1.0 to 5.0 rating in 0.1 steps. Our focus is practical: real fees, rewards that actually pay out, limits that do not block normal life, and whether the card works in your country.

We collect data from public sources such as fee tables, card terms, supported regions, and support documentation. We also use hands-on testing with real funds to check how top ups, purchases, rewards, and in app controls behave in practice.

We do not audit issuer solvency or promise regulatory compliance in every jurisdiction. These scores reflect practical usability and cost efficiency today.

Categories and weights:

- Fees and Costs – 25%

- Rewards and Cashback – 20%

- Supported Currencies and Regions – 15%

- Card Limits and Spending Controls – 15%

- Security and Fraud Protection – 10%

- User Experience and App Integration – 10%

- Customer Support and Card Delivery – 5%

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.