Bybit Review 2026: Is It the Best All-Rounder for Traders?

Affiliate Disclosure:

GNCrypto editors review services independently. If you click on affiliate links, we may earn commissions, which help support our testing. The goal of our reviews is to provide our readers with the most objective and unbiased overviews of available platforms for spot crypto trading.

Bybit

We liked deep liquidity, low base spot fees and fast execution on Bybit. However, strict geo-restrictions and a complex interface keep it from being a universal choice.

GNcrypto's Verdict

Bybit functions more like a professional trading terminal than a retail-first exchange. In our tests, execution was fast and stable, with no noticeable slippage on major pairs and a Unified Account that combines spot and derivatives margin. Market depth is strong and comparable to top-tier platforms, but without an overloaded interface. The platform expects users to be technically confident, and residents of the US, UK, Canada, and France cannot access it.

- Deep liquidity and tight spreads on majors

- Low spot fees with VIP discounts

- Pro tools, bots and copy trading

- Restricted in many major countries

- Complex interface for beginners

- Limited bank on-ramps

On this page

- What Is Bybit and How Did It Become a Leading Crypto Exchange?

- A Closer Look at Bybit’s Core Features and Tools

- Bybit Pros and Cons

- Who Should (and Shouldn’t) Use Bybit?

- GNcrypto’s Overall Bybit Scorecard

- Trustworthiness Check

- Security Incidents / Major Hacks

- Methodology – Why You Should Trust Us

- How We Collect Data

- Categories & Weights

Bybit has evolved from a niche derivatives platform into a global crypto powerhouse, aggressively challenging Binance for the top spot. It offers elite liquidity and a flexible Unified Trading Account that pros love. However, with mandatory KYC now strictly enforced and regulatory exits in some jurisdictions, does it remain the best choice for active traders? We investigate its performance in 2025.

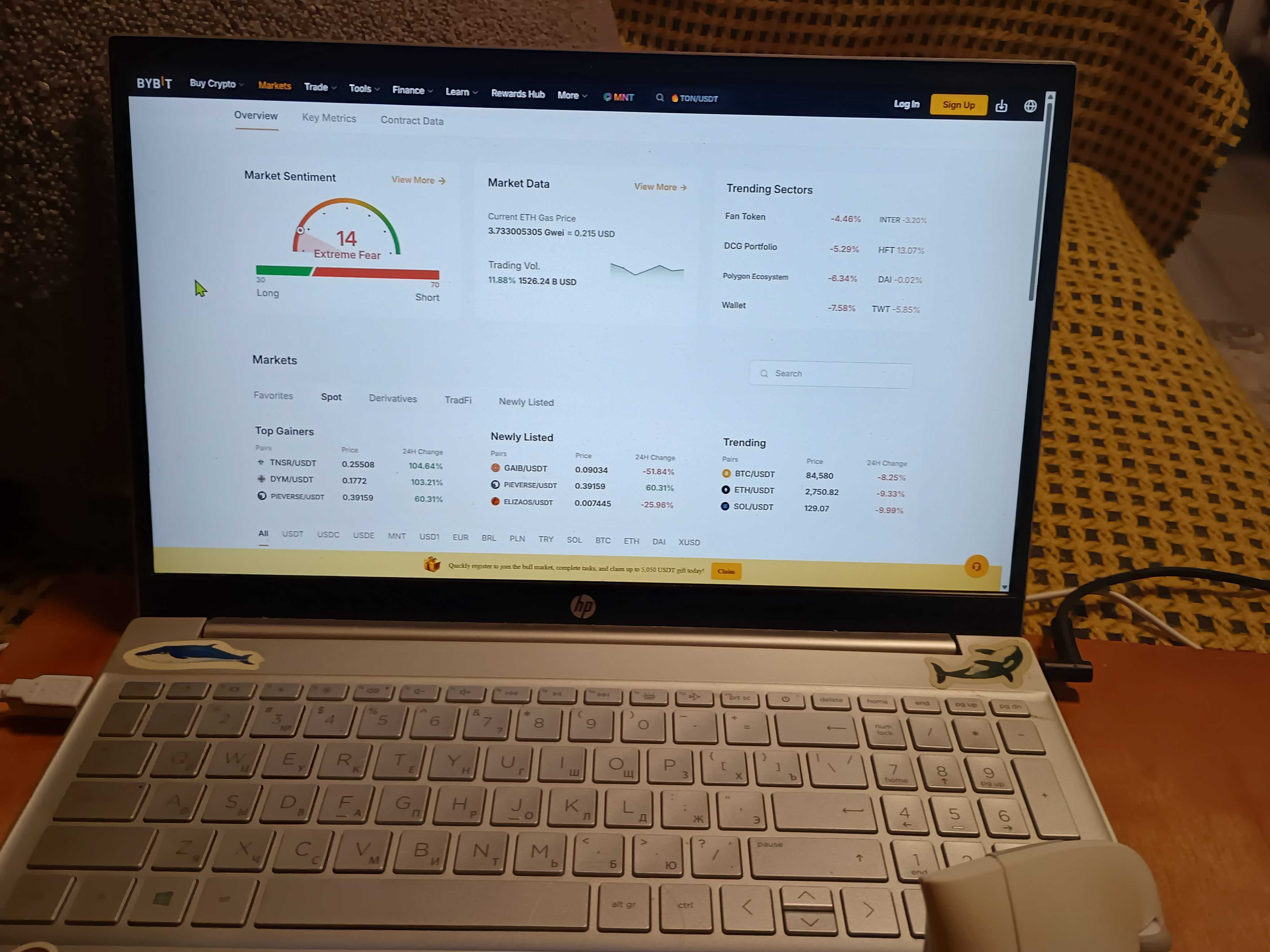

To build a comprehensive outlook, we approached the platform as mystery shoppers, running a $200 spot trade to evaluate the performance of its Unified Trading Account (UTA). Founded in 2018 as a specialized derivatives engine, Bybit has successfully pivoted from a niche leverage venue into a comprehensive global giant. Today, it stands as one of the few ecosystems with the liquidity and technical depth to legitimately challenge Binance for the top spot in the global hierarchy.

What Is Bybit and How Did It Become a Leading Crypto Exchange?

If the opener established when it started, this section explains what it has become. What is Bybit in 2025? It is widely regarded as the “technological fortress” of the crypto market. Under the leadership of CEO Ben Zhou – who brought a background in retail forex brokerage to the table – the platform prioritizes uptime and matching engine speed above all else.

This focus on infrastructure has paid off. Bybit has surged past legacy competitors to become the second-largest exchange globally by volume, boasting over 70 million registered users. While it retains its DNA as a haven for derivatives traders, it has aggressively expanded its utility. It is no longer just a place to short Bitcoin; it is a comprehensive ecosystem featuring deep Spot markets, a sophisticated “Earn” suite, and Web3 wallet integrations.

A Closer Look at Bybit’s Core Features and Tools

In our $200 spot test (BTC/USDT), execution was both fast and cost-effective. We paid the standard 0.10% base fee (approximately $0.20), and the fill matched the displayed top-of-book price with negligible slippage, confirming that the engine handles retail-sized orders with institutional efficiency.

Spot Bybit reviews are ubiquitous: Bybit has curated a focused market environment rather than flooding the zone with low-quality assets. The platform currently lists 496 coins across 664 trading pairs, prioritizing liquidity depth over infinite variety.

- Market Quality: The BTC/USDT and ETH/USDT books are exceptionally deep, often quoting USDT and USDC pairs with spreads competitive enough to rival Binance.

- New Listings: The “Launchpool” and “ByStarter” sections provide a regulated surface for early-stage tokens, though availability for these events varies heavily by region.

The terminal is designed for precision. We found the layout to be dense but logical, mirroring a professional desktop setup.

- Order Types: The ticket supports the full professional suite: Market, Limit, Stop, OCO (One-Cancels-the-Other), Reduce-Only, and Post-Only. We specifically appreciated the ability to set bracket Take Profit/Stop Loss (TP/SL) orders directly from the entry ticket.

- Visuals: We utilized the native TradingView integration to layer indicators directly on the chart. The interface simultaneously displays the Level 2 order book, depth chart, and recent trade history in a single pane.

- Unified Trading Account (UTA): This is the platform’s engine room. It allows for instant, internal transfers between Spot and Derivatives desks, letting your spot assets serve as collateral for other positions.

Fiat Gateways: Funding options depend entirely on your jurisdiction. While some regions enjoy direct bank transfers, others rely on P2P markets or third-party partners. Crucially, the system displays all network and withdrawal fees clearly before you confirm the transaction.

Bybit Pros and Cons

Based on our hands-on analysis, Bybit is a platform defined by its power. It excels for users who need professional tools and deep liquidity, but this comes with steep learning curves and regional barriers. Inquiry “is Bybit good” is out of question there 🙂

Strengths:

- High Market Quality: We experienced instant fills and tight spreads on majors (BTC/ETH) during our $200 test orders.

- Competitive Costs: Low 0.10% base fees, which can be further reduced via “Post-Only” orders and frequent promotions.

- Power User Terminal: A complete toolkit featuring native OCO orders, Grid Bots, Copy Trading, and TradingView charts.

- Asset Depth: An aggressive listing cadence (496+ coins) that provides early liquidity for altcoin hunters.

Weaknesses:

- Geo-Restrictions: The platform is strictly blocked in major markets, including the U.S., UK, Canada, and France.

- Fiat Friction: Direct bank deposits are limited; funding often relies on P2P markets or pricier third-party gateways.

- Audit Status: While Bybit publishes a self-reported Proof of Reserves, it lacks a fully independent, external financial audit.

- Learning Threshold Complexity: The feature-dense interface is often overwhelming for absolute beginners.

Who Should (and Shouldn’t) Use Bybit?

Recent Bybit reviews vary wildly depending on who’s trading. Our testing shows why: Bybit excels for active traders who need speed and professional tools. It’s built for API-driven strategies, automated grid bots, and altcoin portfolios managed through the Unified Trading Account. Need tight spreads and execution that doesn’t slip during volatile moves? Bybit delivers better than most competitors.

But that power has trade-offs. New users will struggle – the feature set overwhelms beginners who just want to buy and hold. Fiat onramps are limited, and it won’t work in the U.S., UK, or other restricted regions. If you want fully audited Proof of Reserves or treat crypto like a savings account, use a simpler regulated exchange. But for active participants running bots, trading futures, or managing multi-position portfolios, Bybit offers tools that competitors either charge premium fees for or don’t provide at all.

GNcrypto’s Overall Bybit Scorecard

| Assessment Criteria | Rating (out of 5) |

|---|---|

| Liquidity & Market Volume | 5 |

| Tools & Order Controls | 5 |

| Execution Quality / Market Quality | 5 |

| Asset Selection & Trading Pairs | 4 |

| Fees & Total Cost to Trade | 4 |

| Reliability & Transparency | 4 |

| Fiat Access & Minimum Trade Size | 3 |

Trustworthiness Check

Feb 24–Mar 31, 2021 – UK FCA warning; Bybit suspends UK services. The FCA warned Bybit for operating without authorization; Bybit then announced it would cease servicing UK customers.

May 31, 2021 – Japan FSA warning. Japan’s Financial Services Agency warned Bybit for operating without registration. Subsequent coverage notes repeat warnings in 2023 (and later) as rules tightened.

Jun 21, 2021 – Ontario (Canada) enforcement. The Ontario Securities Commission (OSC) filed a Statement of Allegations against Bybit for operating an unregistered crypto asset trading platform.

Jun 9/23, 2022 – OSC settlement. Bybit settled with the OSC, agreeing to undertakings, disgorgement (~US$2.47M) and costs, and compliance steps.

May 20, 2022 – France AMF blacklist (reiterated May 16, 2024). France’s AMF placed Bybit on its DASP blacklist in 2022 and reiterated in 2024 that the platform was operating illegally in France.

May 30–31, 2023 – Exit from Canada. Bybit announced a pause/exit from Canadian operations in response to regulatory developments.

December, 27, 2024 – Malaysia regulatory clampdown.Bybit faces regulatory scrutiny in Malaysia, highlighting ongoing international oversight and operational risks for users in multiple jurisdictions.

Oct 30–31, 2025 – Japan: new user registrations halted. Following repeated FSA warnings, Bybit stopped accepting new Japan-resident accounts while reviewing compliance options.

Security Incidents / Major Hacks

Feb 2025 – Hack (~$1.5 B). Bybit experienced one of the largest crypto exchange security incidents in history. The platform promptly responded, secured its systems, and fully restored both its own funds and all user balances.

Methodology – Why You Should Trust Us

We use a weighted, category-based model, collect standardized data from each platform (open data + hands-on testing), and convert that into a 1.0–5.0 star score in 0.1 increments.

Our focus is spot trading quality: real fees, minimum trade size, crypto availability, market quality, and the user-facing experience.

How We Collect Data

- Public data: fee schedules, supported pairs, status/help pages, network/withdrawal info.

- First-hand testing: we place test trades (here: $200), measure spreads/slippage, and check UI speed and order controls.

We do not rate solvency or make guarantees about financial stability. Ratings reflect user experience, not a balance-sheet audit.

Categories & Weights

- Liquidity & Volume – 25%

- Fees & Total Cost to Trade – 25%

- Asset Selection & Trading Pairs – 15%

- Execution Quality (Market Quality) – 10%

- Tools & Order Controls – 10%

- Fiat Access & Minimum Trade Size – 5%

- Reliability & Transparency – 10%

Latest News

MoreRecommended Articles/Reviews

MoreThe material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.