✨ BTC Closes September in the Green! What’s Next?

posted 30 Sept 2024

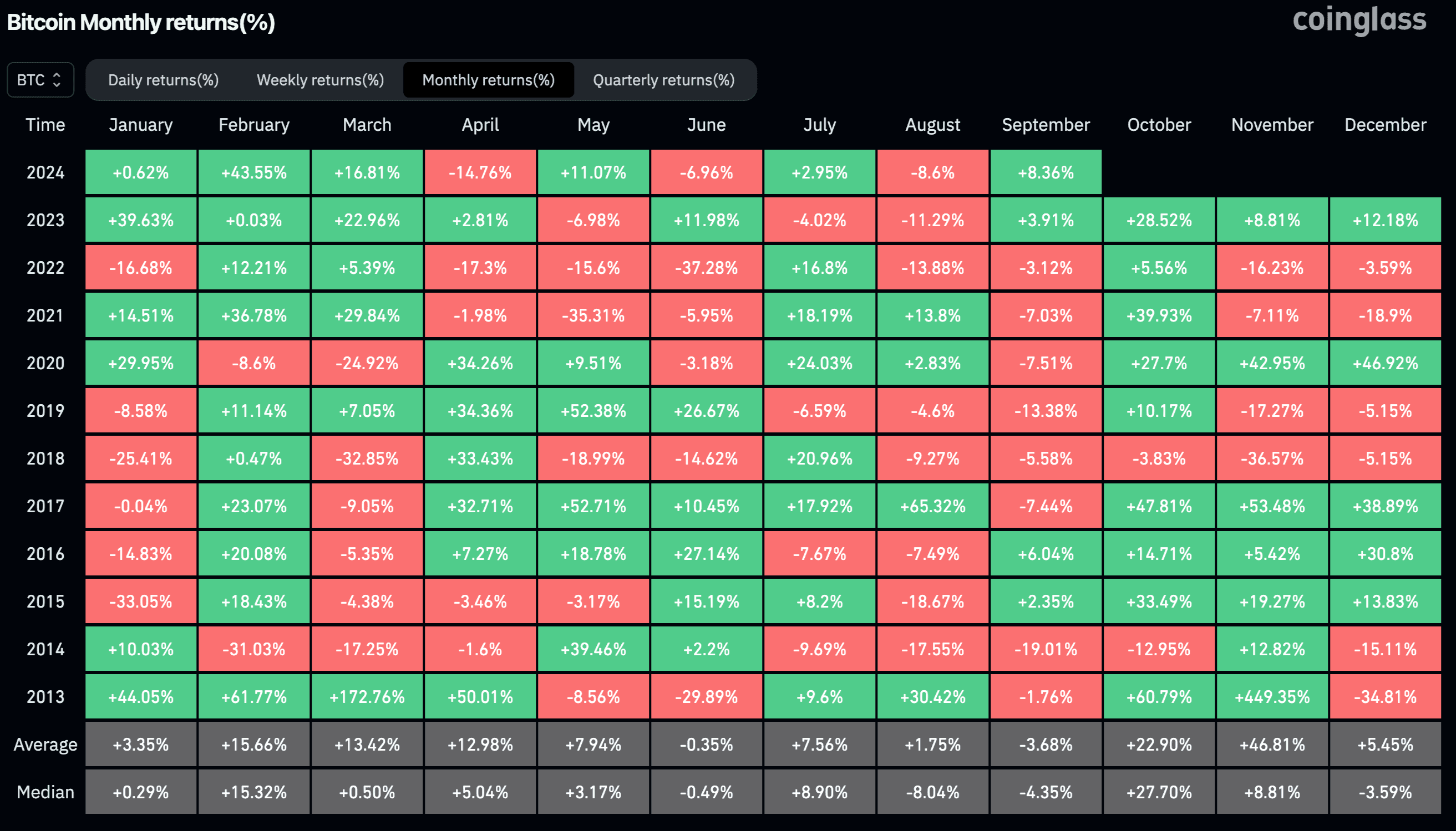

As September 2024 comes to a close, Bitcoin seems poised to end the month in the green, showing a 7% gain as of September 30. Historically, September has been a tough month for BTC, but not this time. The last time we saw a back-to-back positive September for Bitcoin was way back in 2015-2016.

As September 2024 comes to a close, Bitcoin seems poised to end the month in the green, showing a 7% gain as of September 30. Historically, September has been a tough month for BTC, but not this time. The last time we saw a back-to-back positive September for Bitcoin was way back in 2015-2016.

Monthly BTC Returns (%): A Successful September 2024. Source: CoinGlass

Why Was This September So Successful for BTC?

The main driver behind Bitcoin’s strong performance this month has been the long-awaited U.S. interest rate cut. On September 18, the Federal Reserve lowered the rate by 50 basis points, after keeping it steady at 5.5% since July 2023.

Lowering the interest rate stimulates the economy by increasing the money supply in circulation. While this effect doesn’t happen overnight, traders and investors tend to act in anticipation of the trend. The key is whether the U.S. economy can avoid a recession before the benefits of lower rates kick in.

We’ve previously discussed how macroeconomic factors influence Bitcoin’s price.

What Can We Expect from BTC for the Rest of 2024?

Historically, October has been a bullish month for BTC, earning it the nickname “Uptober” among crypto enthusiasts. Moreover, when Bitcoin ends September in the green, it often experiences strong gains in the following months through the year’s end. However, relying solely on historical data can be risky, as each year brings its own set of surprises.

It remains uncertain how the U.S. economy will fare after an extended period of high interest rates. Nick Timiraos, Chief Economics Correspondent at WSJ, notes that a rate cut doesn’t guarantee a smooth landing. Investors should keep an eye on economic updates, especially inflation data and employment statistics.

These metrics are critical for the Fed’s decision-making process on interest rates. On October 10, the U.S. inflation data for September will be released, and on November 7, the Fed will announce its next rate decision.

Additionally, the upcoming U.S. presidential election in November could have a significant impact on the crypto market. Both candidates, Donald Trump and Kamala Harris, are reportedly supportive of the crypto industry, but their public statements may still influence investor sentiment.

These metrics are critical for the Fed’s decision-making process on interest rates. On October 10, the U.S. inflation data for September will be released, and on November 7, the Fed will announce its next rate decision.

Additionally, the upcoming U.S. presidential election in November could have a significant impact on the crypto market. Both candidates, Donald Trump and Kamala Harris, are reportedly supportive of the crypto industry, but their public statements may still influence investor sentiment.