BlueWallet reviews 2026: here’s what to expect

GNcrypto analysts tested BlueWallet to see what it has to offer to regular users. Here’s what we found out.

BlueWallet at a glance

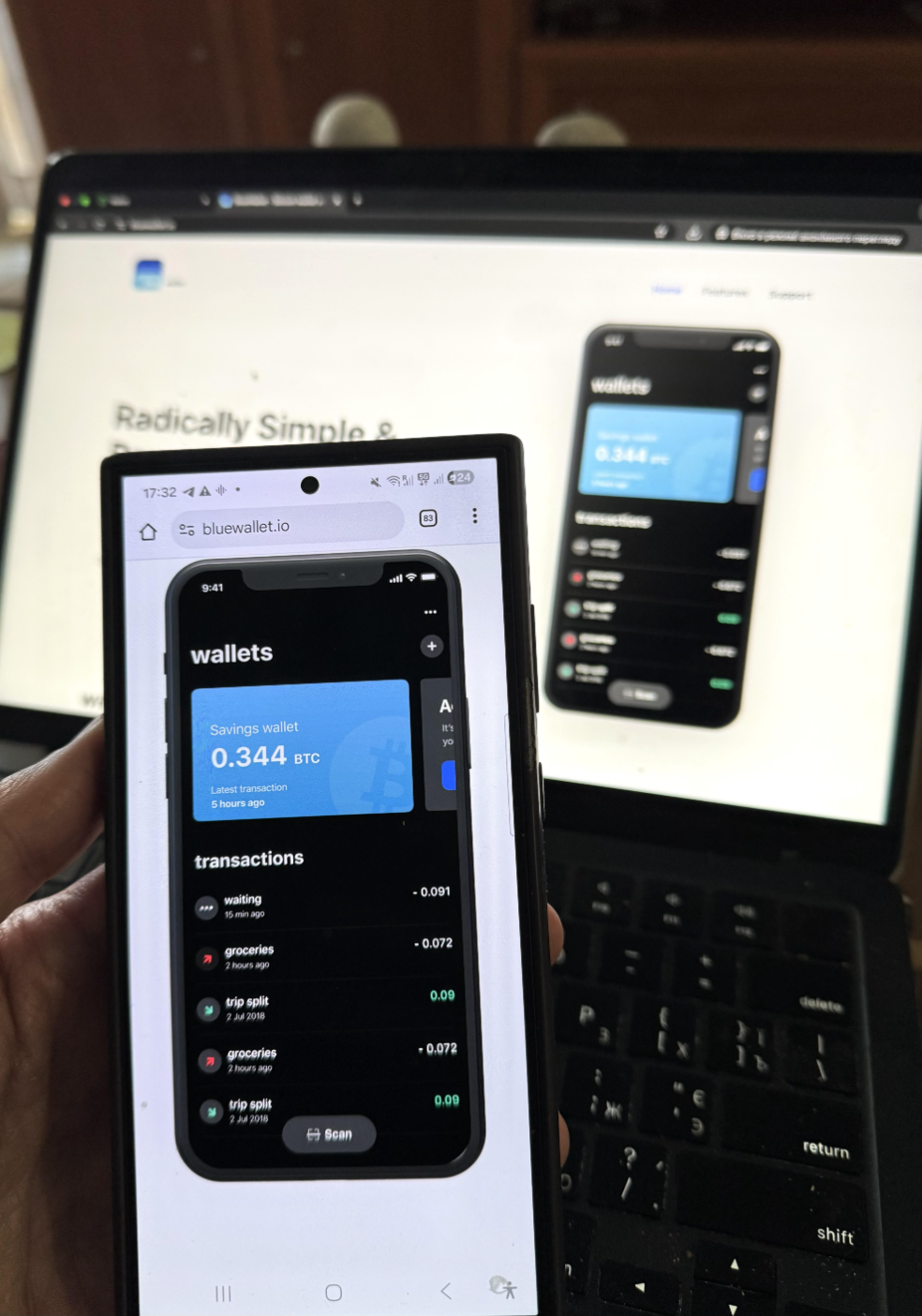

BlueWallet reviews consistently highlight its Bitcoin-only philosophy, and our hands-on testing confirms why. BlueWallet is built around a single, deliberate idea: Bitcoin deserves its own wallet. In a crypto market crowded with apps trying to be everything at once – tokens, NFTs, DeFi, staking – BlueWallet takes the opposite approach. It strips the experience back to Bitcoin and focuses on doing that one job well.

This BlueWallet Bitcoin wallet review examines how that focus translates into practice. Available on iOS and Android, BlueWallet is a non-custodial wallet that allows users to hold, send, and receive Bitcoin directly, with optional support for the Lightning Network. From the moment you open the app, it’s clear what it is. There are no token lists to scroll through, no prompts to connect to Web3 applications, and no attempt to blur Bitcoin into the wider crypto ecosystem.

That clarity is intentional. BlueWallet gives users full control over their private keys, while keeping the interface approachable enough for newcomers. Lightning support can be added for faster, cheaper payments, either through simple configurations or by connecting to a more advanced setup for users who want deeper control.

Strengths & limitations

Most BlueWallet reviews emphasize that its greatest strength is its focus, and we agree.

By committing entirely to Bitcoin, the wallet avoids the complexity that often overwhelms multi-asset apps. Sending and receiving BTC is straightforward, transaction fees are transparent, and users who want more control can manually adjust fees to prioritize speed or cost. For everyday Bitcoin use, the experience feels calm and predictable.

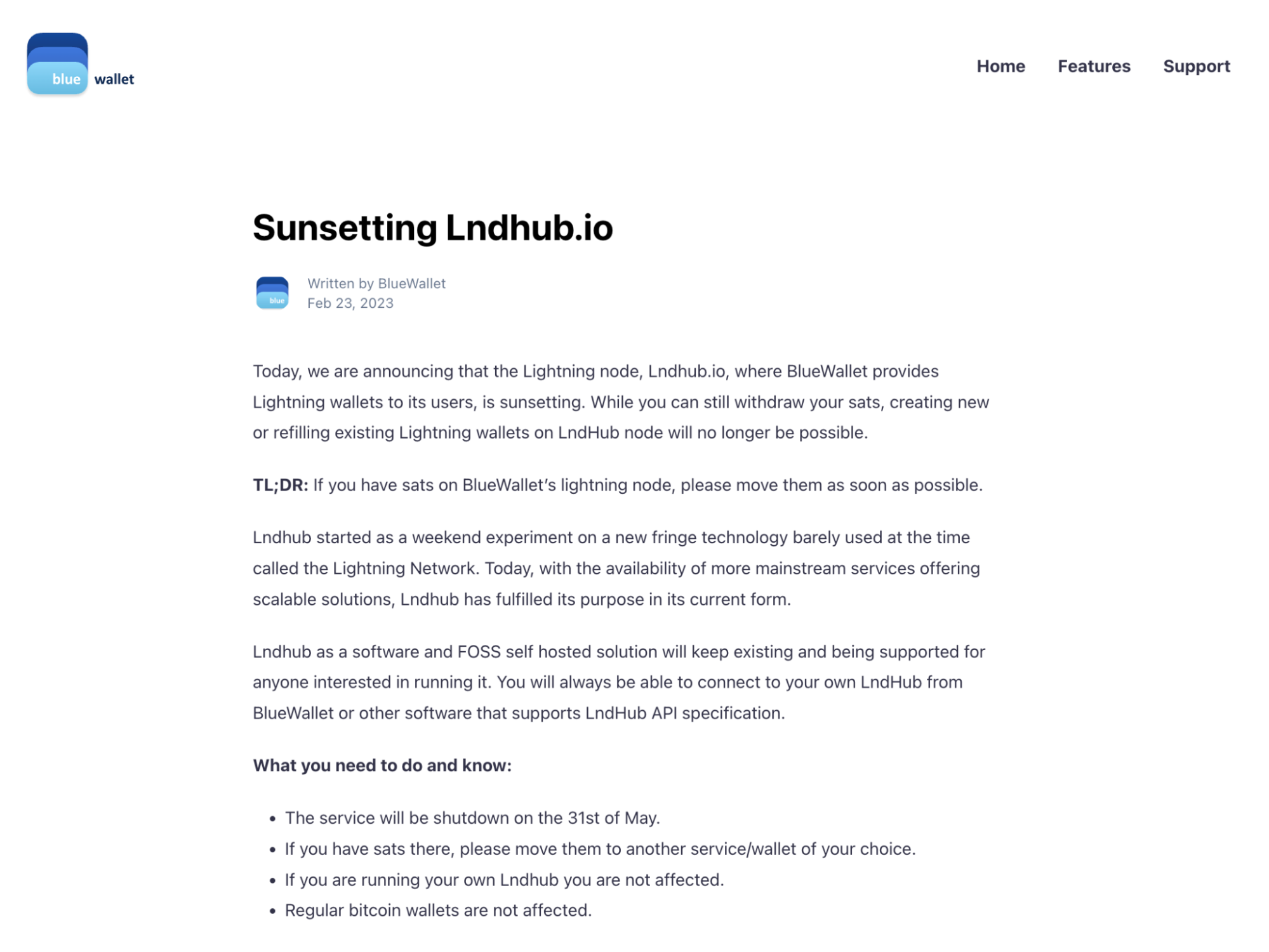

The Lightning Network integration is another standout feature. It allows BlueWallet to function not just as a storage tool, but as a spending wallet, something Bitcoin wallets have historically struggled with. Users can make fast, low-fee payments, bringing Bitcoin closer to real-world use rather than long-term holding alone. However, Lightning introduces complexity. Users who want full sovereignty may need to understand node management and liquidity, which introduces a learning curve beyond simple on-chain transactions.

The limitations – BlueWallet does not support Ethereum, altcoins, NFTs, or decentralized applications. There is no swapping, no staking, and no multi-chain management. For users whose crypto activity extends beyond Bitcoin, the wallet will quickly feel narrow. This is intentional, and it means BlueWallet works best as a dedicated Bitcoin wallet, not a universal crypto solution.

Who BlueWallet is best for

Our BlueWallet crypto wallet review is best suited for users who see Bitcoin as fundamentally different from the rest of the crypto market, not just another asset to sit alongside tokens and NFTs. Its design makes the most sense for people who want a dedicated Bitcoin wallet rather than a general-purpose crypto app.

It works particularly well for long-term Bitcoin holders who care about self-custody and private key ownership but don’t want to deal with overly complex interfaces. Someone who buys Bitcoin periodically and wants to store it securely ($15 on-chain transfer costs $1.25 in medium-priority fees), send it occasionally, or receive payments without relying on an exchange will find BlueWallet straightforward and reliable.

BlueWallet is also a good fit for users interested in actually using Bitcoin, not just holding it. The inclusion of Lightning Network support makes it practical for small, fast, low-fee transactions – whether that’s tipping, paying for digital services, or experimenting with Bitcoin as a medium of exchange. For users willing to learn a bit more, the ability to connect to custom Lightning nodes adds flexibility without forcing advanced setups on everyone.

Privacy-conscious users may also appreciate BlueWallet’s minimalism. By avoiding unnecessary features and external integrations, the wallet keeps the focus on Bitcoin transactions themselves rather than encouraging constant interaction with third-party services.

BlueWallet is not designed for users who want an all-in-one crypto solution. Traders managing multiple blockchains, users chasing altcoins, or anyone deeply involved in DeFi or NFTs will find the wallet too limited. Even beginners who want a single app to explore “all of crypto” may outgrow BlueWallet quickly unless their interest remains strictly Bitcoin-focused.

Pros and cons of using BlueWallet

After hands-on testing of wallet setup, on-chain Bitcoin transactions, Lightning payments, fee management, and backups, here’s where BlueWallet clearly excels – and where its narrow focus creates real trade-offs.

Strengths:

- Clear, uncompromising Bitcoin focus: BlueWallet’s biggest strength is that it never pretends to be more than it is. From the first screen, everything revolves around Bitcoin. There are no token lists, no prompts to explore DeFi, and no distractions. For example, a user opening the app to receive BTC is immediately shown a Bitcoin address or Lightning invoice, not a maze of asset options. This clarity reduces confusion and mistakes, especially for users who only care about Bitcoin.

- Full self-custody with private key control: unlike custodial or hybrid wallets, BlueWallet gives users direct control over their private keys. During setup, users generate and back up their wallet themselves, meaning funds are not dependent on any company’s servers or policies. If BlueWallet disappeared tomorrow, the wallet could still be restored elsewhere using the backup – something that matters deeply to sovereignty-minded Bitcoin users.

- Transparent fee control for on-chain transactions: BlueWallet makes Bitcoin fees easy to understand and adjust. When sending BTC, users can see fee estimates and manually choose how fast they want the transaction confirmed. In our test, we had three options: Slow ($0.85, 60 min), Medium ($1.25, 12 min), Fast ($2.20, 3 min). This means a user sending a time-sensitive payment can increase the fee, while someone moving funds to cold storage can save money by waiting longer. Many beginner wallets hide this choice; BlueWallet doesn’t.

- Lightning Network support for real payments: BlueWallet goes beyond “Bitcoin as savings” by supporting Lightning payments. Small, fast, low-fee transactions work well for everyday use cases like tipping, online services, or experimentation. In our test, a $0.50 Lightning payment cost $0.0001 (0.02%) and confirmed in 2 seconds – compared to $1.25 and 14 minutes for on-chain. For users curious about using Bitcoin rather than just holding it, Lightning support makes the wallet far more practical.

- Lightweight and privacy-conscious design: Because BlueWallet avoids unnecessary integrations, the app feels lean. There is no account creation, no identity verification, and no built-in tracking tied to user profiles. For privacy-conscious users, this minimalist approach is part of the appeal.

Weaknesses:

- Bitcoin-only means exactly that: BlueWallet does not support Ethereum, stablecoins, altcoins, NFTs, or Web3 applications. A user who holds even a small amount of non-Bitcoin crypto will need a second wallet. For people managing diverse portfolios, this quickly becomes inconvenient.

- Lightning can introduce complexity: While Lightning support is a strength, it can also be a source of confusion. Users who want full control – such as connecting their own node – need to understand channels, liquidity, and invoices. Beginners can use simpler setups, but Lightning still adds a learning curve that doesn’t exist with basic on-chain wallets.

- No built-in buying, swapping, or fiat on-ramps: BlueWallet does not let users buy Bitcoin with fiat or swap assets inside the app. For example, a new user who wants to buy BTC must first use an exchange, then withdraw funds into BlueWallet. This extra step reinforces self-custody discipline, but it’s less convenient than all-in-one wallets.

- Not designed for beginners who want “all of crypto”: while BlueWallet is easy to use once you understand Bitcoin basics, it doesn’t guide users through broader crypto concepts. Someone completely new to crypto who expects one app to explain everything – or to manage multiple assets – may find the experience too narrow.

Trustworthiness check

Trust is a central question for any crypto wallet – but it takes on a very specific meaning when a wallet is fully self-custodial and Bitcoin-only. With BlueWallet, trust does not live in an institution, a recovery service, or a cryptographic abstraction. It lives almost entirely with the user.

Company & custody model

BlueWallet operates as a pure non-custodial wallet. There is no account system, no broker, and no exchange custody involved. Users generate their own private keys locally and are fully responsible for backing them up. BlueWallet does not hold keys, cannot access funds, and cannot intervene in transactions.

In practice, this means users do not deposit Bitcoin into a company-controlled environment. Funds exist on the Bitcoin network, controlled solely by the private keys the user generates. If BlueWallet were to shut down or disappear, the wallet could still be restored in any compatible Bitcoin wallet using the backup.

This places BlueWallet at the far end of the self-custody spectrum: maximum independence, zero intermediary control, and no safety net.

Security & fund protection

From a structural perspective, BlueWallet’s security model is simple and robust. There is no centralized custody to hack, no pooled balances, and no platform-level withdrawal freeze risk. The attack surface is limited primarily to the user’s own device and backup practices.

At the same time, this model offers no protection against user error. If a user loses their backup, forgets their recovery information, or exposes their private keys, funds are permanently unrecoverable. There is no account recovery process, no identity verification fallback, and no support mechanism that can restore access.

We did not find reports of systemic security failures tied to BlueWallet itself. However, the dominant risk is not the software – it is the human operating it.

Recovery & control trade-offs

Recovery in BlueWallet is intentionally old-school. Access depends entirely on the user’s backup. This offers complete control and portability, but zero forgiveness.

If a phone is lost and the backup exists, recovery is straightforward. If the backup is gone, funds are gone. There is no cloud restore, no biometric fallback, and no company-side intervention. BlueWallet does not soften this reality, because doing so would require reintroducing trust in a third party.

This design strongly favors sovereignty over survivability. For disciplined users, that is the point. For casual users, it can be a serious risk.

Regulatory context

BlueWallet is not a regulated financial product, and it does not operate as a custodian. There is no FDIC or SIPC protection, no investor recourse, and no regulatory authority overseeing wallet balances.

Trust here is neither regulatory nor institutional – it is protocol-level. Users trust the Bitcoin network, open cryptographic standards, and their own ability to manage keys correctly. This is fundamentally different from fintech wallets or hybrid custody solutions.

Transparency & reputation

BlueWallet has been widely used in the Bitcoin community for years and is generally regarded as a straightforward, no-nonsense wallet. Its reputation is strongest among Bitcoin-focused users who value self-custody and simplicity over convenience features.

User feedback tends to emphasize reliability, clean design, and respect for Bitcoin principles. Criticism usually centers on the lack of recovery options, limited feature set, and absence of support for non-Bitcoin assets, not on allegations of misconduct or hidden risk.

Overall trust assessment

BlueWallet is not trustless, but it is honest about where trust lies. There is no illusion of protection beyond what Bitcoin itself provides.

If your definition of trust is institutional accountability, recoverability, and user protection against mistakes, BlueWallet will feel unforgiving. If your definition of trust is independence, private key ownership, and freedom from intermediaries, BlueWallet performs exactly as intended.

Key takeaway: BlueWallet is best suited for users who are willing to take full responsibility for their Bitcoin. It offers maximum control and transparency, but no margin for error.

Testing process

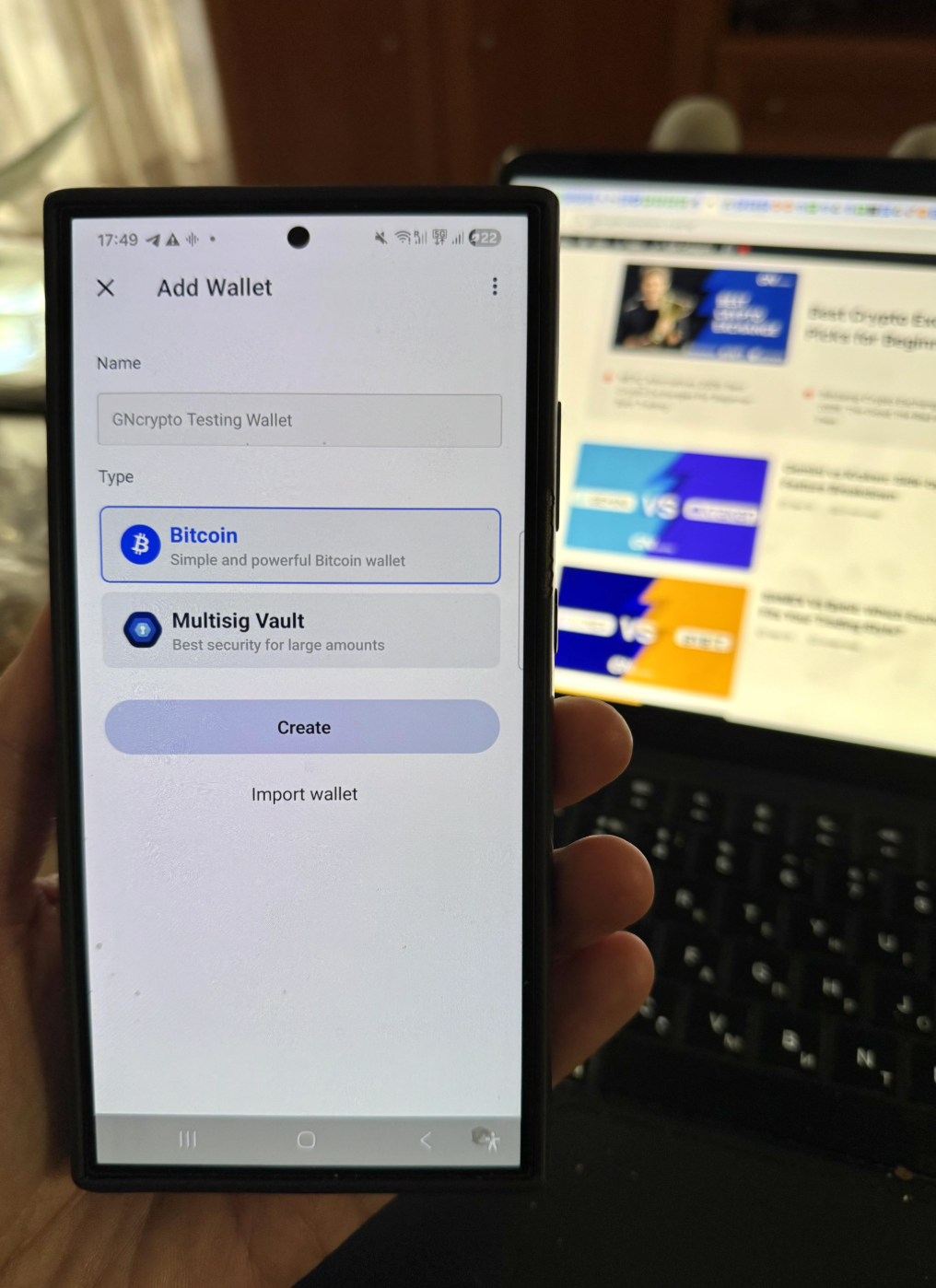

We installed BlueWallet on iOS (iPhone) and created a new Bitcoin wallet in under 90 seconds. Setup generated a 12-word BIP39 seed phrase (displayed once with manual confirmation). No account, no email, no KYC.

On-chain transaction test: we sent $15 worth of Bitcoin (0.00017 BTC) to an external wallet. Fee options:

- Slow: $0.85 (~60 min confirmation)

- Medium: $1.25 (~12 min confirmation)

- Fast: $2.20 (~3 min confirmation)

We chose Medium. Transaction confirmed in 14 minutes. Total cost: $1.25 (8.3% of $15 transfer).

Lightning Network setup: we created a Lightning wallet within BlueWallet. Setup took 30 seconds. BlueWallet offers two Lightning options:

- Custodial (LNDHub) – instant setup, managed channels

- Non-custodial (connect own node) – requires technical knowledge We tested custodial setup (simpler for beginners).

Lightning payment test: we sent $0.50 via Lightning to test the invoice. Fee: $0.0001 (0.02% of $0.50). Confirmation: instant (2 seconds). This is 12× cheaper and 420× faster than on-chain.

Fee transparency test: when preparing an on-chain transaction, BlueWallet showed:

- Estimated fee in sats/byte

- Total fee in USD

- Expected confirmation time

- Option to manually adjust fee slider

We could increase the fee for urgent payment or decrease for savings transfer.

Recovery test: we deleted the app, reinstalled on a second device (iPad). Used 12-word seed phrase to restore wallet. All balances (on-chain + Lightning custodial) restored in under 60 seconds. Lightning channel balance restored because custodial setup syncs via LNDHub.

Privacy test: no account creation, no IP tracking visible in settings, no analytics opt-in prompts. Wallet generated a new receive address for each transaction (address reuse protection).

Customer support: BlueWallet has no formal support (non-custodial = no company to contact). We checked GitHub for documentation – found detailed FAQs and community discussions. Response time: N/A (no ticket system).

GNcrypto’s overall BlueWallet rating

After testing BlueWallet with wallet creation (90 seconds, 12-word seed phrase), on-chain Bitcoin transactions ($15 sent with $1.25 medium-priority fee, 14-minute confirmation), Lightning Network payments ($0.50 sent with $0.0001 fee, 2-second instant confirmation), fee customization (Slow/Medium/Fast options with clear estimates), and recovery on second device (60-second restore via seed phrase), the wallet delivered on Bitcoin-focused self-custody (full private key control, no accounts, no KYC), transparent fee management (manual fee slider with sats/byte visibility), and practical Lightning integration (custodial setup in 30 seconds, instant payments).

We rated it 3.7/5 overall, with 4.5/5 for security (pure non-custodial, user-controlled keys), 4.0/5 for UX (clean Bitcoin-only interface but minimal onboarding guidance), but 2.5/5 for asset support (Bitcoin only, no altcoins/tokens/NFTs) and 1.0/5 for DeFi integration (none by design).

Strong for Bitcoin maximalists and Lightning users who want full custody, weaker for multi-asset holders and beginners needing guided crypto onboarding.

| Criteria | Weight Score (1-5) | Notes |

|---|---|---|

| Security & Key Management (25%) | 4.5 | BlueWallet uses a traditional, non-custodial private key model, where users generate and control their own Bitcoin keys. There is no account system, no intermediated custody, and no dependency on a company-controlled recovery flow. If BlueWallet disappeared tomorrow, users could still restore their funds using their backup in any compatible Bitcoin wallet. From a sovereignty and independence standpoint, this is a strong security model. Users are not exposed to platform-level freezes, policy changes, or infrastructure outages. Control is absolute – but so is responsibility. The trade-off is practical risk. Users must securely back up their wallet and protect their private keys themselves. There are no built-in safeguards against human error. For experienced Bitcoin users, this is expected. For beginners, it can be unforgiving. |

| Supported Assets & Networks (20%) | 2.5 | BlueWallet supports Bitcoin only, including on-chain BTC and the Lightning Network. There is no support for altcoins, tokens, NFTs, or multi-chain assets. This narrow scope is intentional and philosophically consistent, but it limits usefulness for users who hold anything beyond Bitcoin. BlueWallet performs excellently within its chosen lane, but that lane is deliberately small. For Bitcoin maximalists, this is a feature. For multi-asset users, it is a hard constraint. |

| Transaction Costs & Speed (15%) | 4.0 | Transaction performance depends on the Bitcoin network itself rather than the wallet. BlueWallet does not add hidden fees and provides transparent fee estimation before sending. One of its strengths is manual fee control. Users can choose faster confirmations or lower-cost transactions depending on urgency – something many beginner wallets abstract away. Lightning transactions, when used, are near-instant and extremely low-cost. The wallet doesn’t optimize or batch transactions automatically, but it also doesn’t interfere with user intent. |

| User Experience & Interface (15%) | 4.0 | BlueWallet’s interface is clean, calm, and purpose-built. Sending and receiving Bitcoin is straightforward, and the separation between on-chain and Lightning wallets is clearly communicated. The UI avoids clutter and unnecessary features, which reduces mistakes. However, users are still expected to understand Bitcoin basics, especially around backups and fees. There is less onboarding guidance than in beginner-focused wallets like Zengo. For users comfortable with Bitcoin fundamentals, the experience feels respectful and efficient. For absolute beginners, it may feel a little bare. |

| DeFi & dApp Integration (10%) | 1 | BlueWallet does not support DeFi, dApps, NFTs, or Web3 connectivity. There is no WalletConnect integration and no smart contract interaction. This is not an oversight – it’s a design choice. BlueWallet treats Bitcoin as a standalone system, not part of a broader Web3 stack. For users seeking DeFi or cross-chain interaction, this is a complete non-starter. |

| Recovery & Backup Systems (10%) | 3.5 | Recovery relies on traditional wallet backups. Users must back up their wallet manually and keep that backup safe. There are no account-based recovery options, biometric restores, or cloud-assisted safeguards. This offers maximum independence but minimal forgiveness. If a backup is lost, funds are irrecoverable. For disciplined users, this is acceptable. For casual users, it represents real risk. |

| Customer Support & Educational Resources (5%) | 3.0 | BlueWallet offers basic documentation and community resources, but no formal customer support in the fintech sense. There is no account recovery assistance, no live support, and no hand-holding. This aligns with the wallet’s non-custodial philosophy, but it places the burden of understanding and problem-solving squarely on the user. |

| Final score | 3.7 | BlueWallet scores highly on sovereignty, transparency, and Bitcoin-native design, but intentionally sacrifices convenience, breadth, and beginner safety nets. |

Who BlueWallet fits based on testing

Based on hands-on testing of wallet setup, private key backups, on-chain Bitcoin transactions, Lightning payments, and fee management, BlueWallet is clearly built for users who want direct, uncompromising control over Bitcoin, rather than a simplified or abstracted crypto experience.

Best for:

- Bitcoin-first users who hold BTC as a long-term asset and want full self-custody without relying on exchanges or custodians;

- users who care about private key ownership and the ability to restore their wallet independently if an app or service disappears;

- people interested in actually using Bitcoin for payments through the Lightning Network;

- privacy-conscious users who prefer a lightweight wallet without accounts, identity checks, or ecosystem lock-in.

Skip if:

- you want a single wallet to manage multiple cryptocurrencies, stablecoins, NFTs, or DeFi positions;

- you are uncomfortable managing backups and private keys yourself;

- you expect built-in buying, swapping, or fiat on-ramps;

- you are new to crypto and want a guided, all-in-one experience that explains everything step by step.

Key takeaway: BlueWallet fits users who see Bitcoin as distinct from the rest of crypto and want a wallet that reflects that philosophy. It prioritizes sovereignty, transparency, and control over convenience and feature breadth – and works best for users who are comfortable taking responsibility for their own keys.

How we test hot crypto wallets

We use a weighted, category-based model, collect standardized data from each platform (open data + hands-on testing), and convert that into a 1.0–5.0 star score in 0.1 increments.

Our focus: Can you store assets safely, transact efficiently, and access DeFi without exposing your keys to unnecessary risk?

We don’t audit wallet code or guarantee security against all attack vectors. These scores reflect usability, feature completeness, and observable security practices – not absolute protection from exploits.

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.