The share of financial advisors investing in crypto reaches a record high

Financial advisors’ allocations to cryptocurrencies have reached an all-time high. According to the eighth annual Bitwise and VettaFi survey, 32% of advisors allocated client funds to digital assets in 2025 – the highest level in the survey’s history and a sharp increase from 22% in 2024.

Interest in crypto is rising not only in client portfolios. Personal ownership among advisors has also reached a record: 56% of respondents hold digital assets, the highest level since 2018.

Allocation sizes are increasing as well. Among advisors who include crypto in client portfolios, 64% now allocate more than 2% of capital – up from 51% the year before. This reflects growing confidence in crypto strategies and a greater willingness to treat digital assets as a core portfolio component.

Institutional access is also expanding: 42% of advisors said they can purchase cryptocurrencies directly in client accounts, up from 35% in 2024 and 19% in 2023.

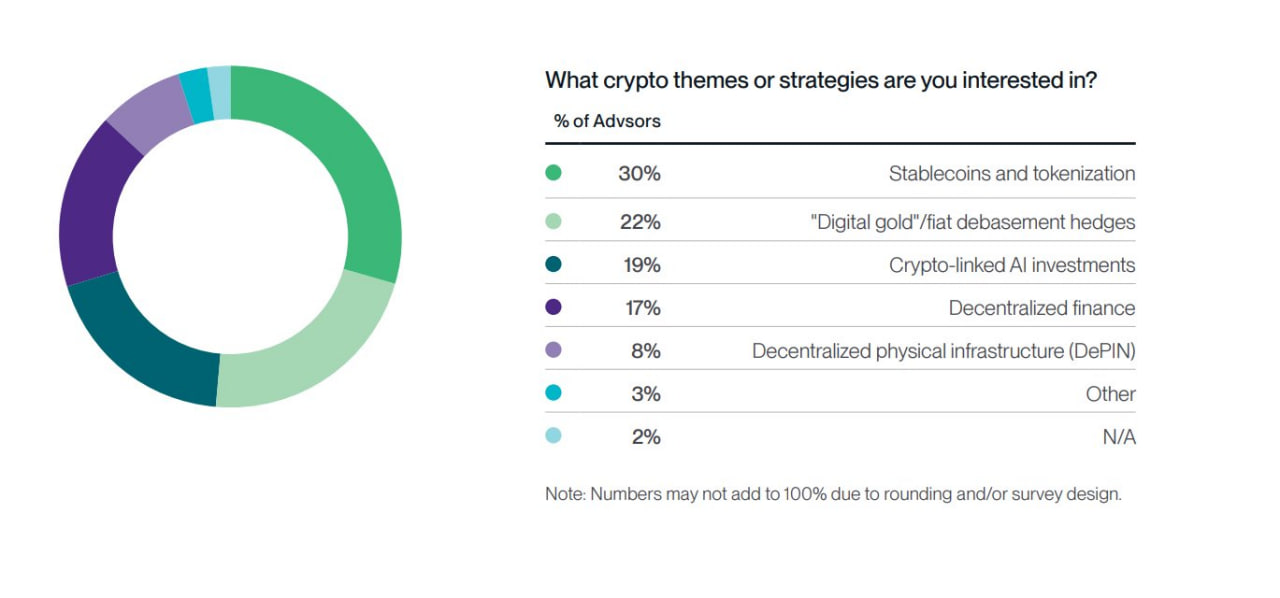

For 2026, advisors highlighted three main themes to watch: stablecoins and tokenization (30%), “digital gold” narratives and fiat-devaluation risks (22%), and investments tied to AI and crypto infrastructure (19%).

The survey also shows rising interest in index-based crypto funds. Among potential ETPs, 42% of advisors named index products as their preferred form of exposure.

Another key insight concerns where advisors are drawing capital from to increase crypto exposure. The most common sources are equities (43%) and cash (35%), underscoring a shift toward integrating crypto into traditional portfolio models and partially replacing conventional assets with digital ones.

Bitwise notes that advisors’ reaction to market volatility was surprising: 99% of those who held crypto in 2025 plan to maintain or increase their positions in 2026. This points to emerging long-term demand from the professional financial sector.

The survey included 299 advisors, ranging from independent RIAs to broker-dealer representatives and financial planners across multiple U.S. regions.

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.