Bitwise says fourth quarter 2025 activity rose as major crypto prices fell

On 21 January 2026, crypto asset manager Bitwise published a research note in which chief investment officer Matt Hougan wrote that the fourth quarter of 2025 delivered mixed signals, with major crypto prices falling while several activity and revenue measures increased.

Hougan compared the setup to early 2023, when crypto prices began recovering after the November 2022 collapse of FTX. He pointed to Bitcoin trading near $16,000 in 2023 before rising to about $98,000 by the start of 2025, and wrote that the data during the early rebound period also showed uneven moves across indicators.

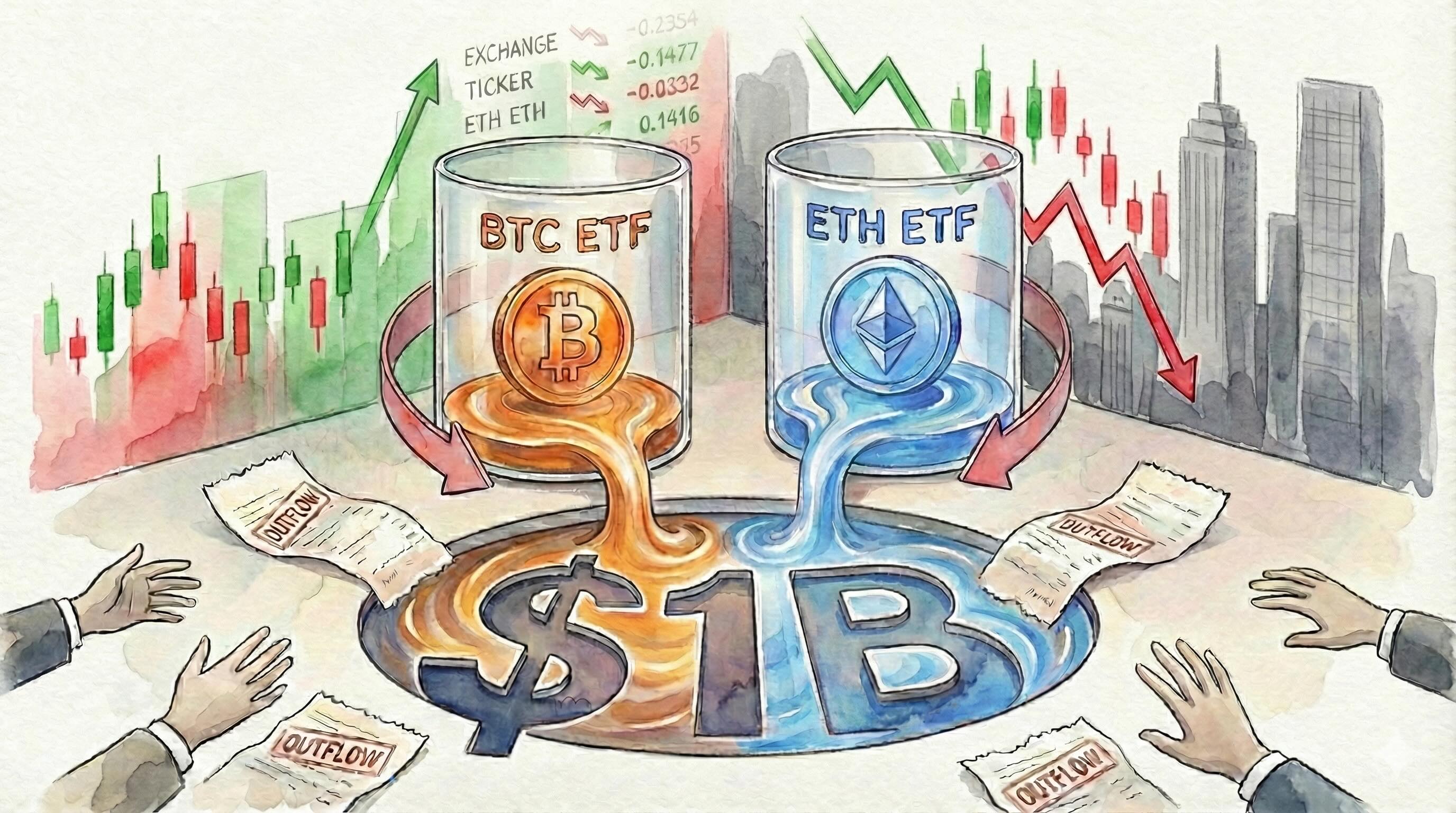

The note highlighted four areas it described as strengthening in Q4 2025. It cited Ethereum and layer 2 transaction counts reaching all-time highs, continued growth in revenues at crypto-native companies, and stablecoin activity and assets under management rising, with total stablecoin market capitalization above $300 billion during the quarter. It also pointed to decentralized finance usage, including periods in late 2025 when the decentralized exchange Uniswap processed more trading volume than Coinbase.

Hougan also listed policy and market developments Bitwise plans to track in 2026, including progress on the CLARITY Act, changes in U.S. stablecoin regulation, potential shifts in Federal Reserve leadership, and expanded access to crypto exchange-traded funds at large U.S. brokerages.

As GNcrypto wrote earlier, Bitwise’s proposed spot Chainlink exchange-traded fund appeared on the Depository Trust and Clearing Corporation registry under the ticker CLNK, after the firm filed a Form S-1 in August 2025. The DTCC entry showed the product in active and pre-launch categories, while Bitwise had not filed a Form 8-A for the fund as of 20 November 2025, and the U.S. Securities and Exchange Commission’s ETF review calendar was constrained by the federal government shutdown at the time.

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.