Bitwise files to launch a Uniswap-based ETF

Bitwise has filed a registration statement with the SEC to launch the first U.S. ETF based on the UNI token, adding momentum to the surge in crypto fund activity following a shift in regulatory policy.

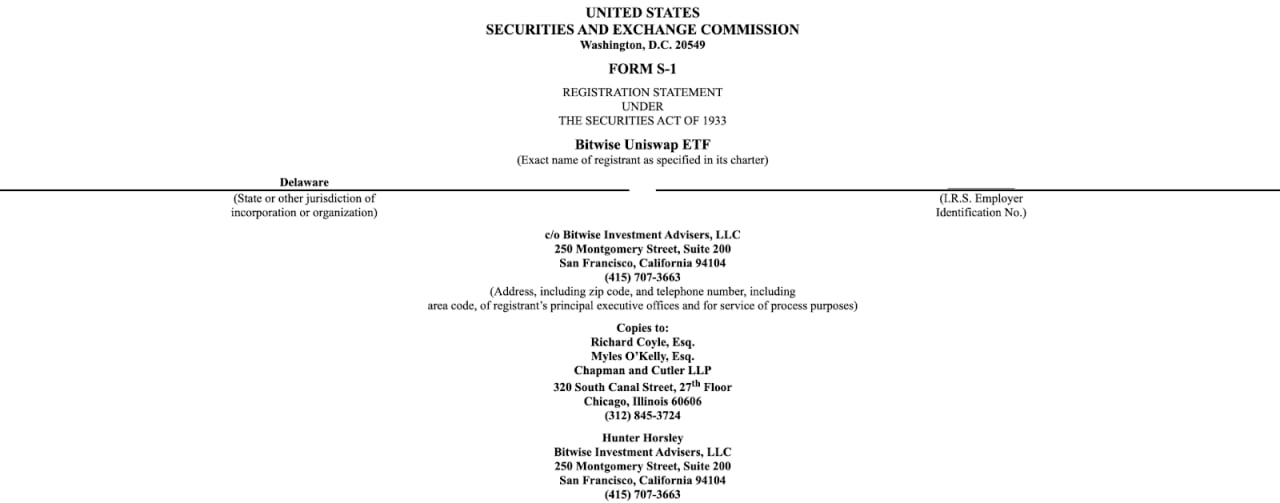

Bitwise has become the first asset manager to file an official registration statement with the SEC for an ETF that will track the price performance of UNI. According to the filing, the Bitwise Uniswap ETF will provide direct price exposure to the asset minus operating expenses. Staking is not included in the fund’s structure at launch, though the company notes it may be added later.

UNI remains one of the largest digital assets and ranks in the top 40 by market capitalization. Uniswap, the protocol behind the token, is the largest decentralized exchange on Ethereum, enabling peer-to-peer trading without intermediaries. The arrival of an ETF tied to a specific DeFi protocol has long been anticipated given the surge in crypto fund launches in 2025 and the continuation of that trend into 2026.

The filing coincides with a major shift in Washington’s stance toward digital assets. President Donald Trump has pledged to make the U.S. the “crypto capital of the world,” while new SEC Chairman Paul Atkins, together with the CFTC, has initiated Project Crypto – a regulatory overhaul aimed at modernizing digital-asset rules. These moves have created the most favorable environment in years for launching new exchange-traded products, including ETFs focused on individual blockchain projects.

If approved, Coinbase Custody Trust will serve as the fund’s custodian, underscoring institutional investors’ preference for infrastructure viewed by regulators as among the most reliable for safeguarding digital assets.

Despite the filing, market reaction was negative: UNI fell roughly 15% in 24 hours amid broad selling pressure that swept across the crypto market. Bitcoin also saw one of its sharpest intraday declines of the year.

Analysts note that in the long term, the arrival of a UNI ETF may strengthen institutional demand – especially if staking mechanisms are added later. In the near term, however, UNI’s price remains driven by overall market volatility and macro factors shaping risk appetite.

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.