BitMine buys $65M in Ethereum through Galaxy Digital

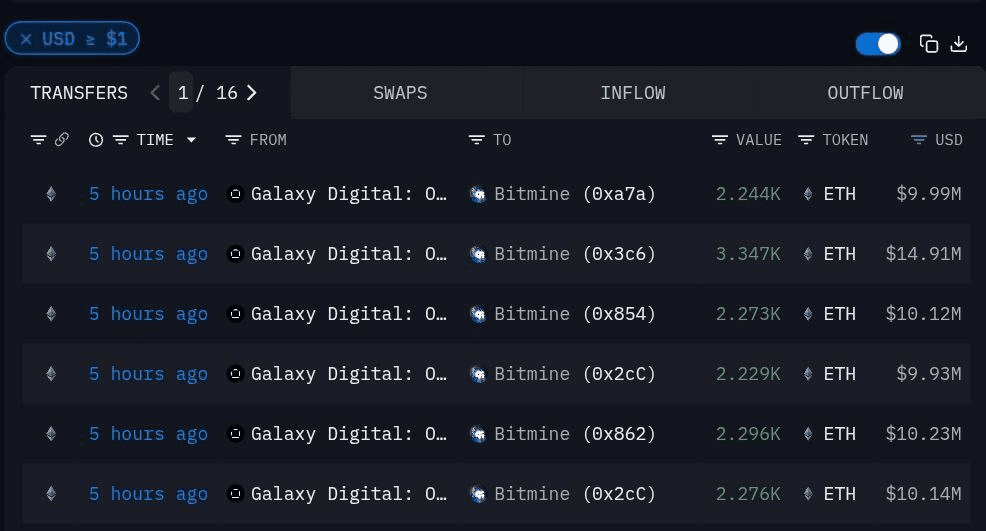

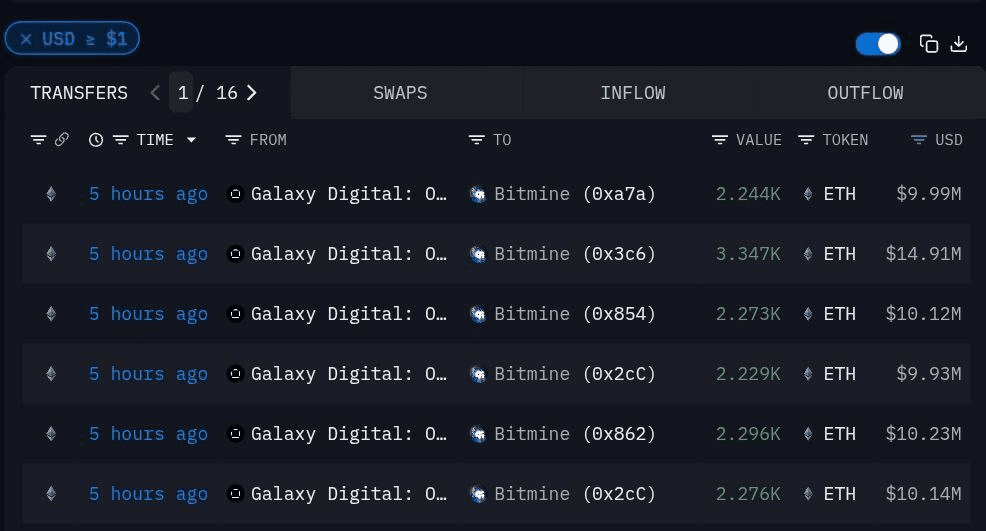

BitMine Immersion Technologies, the largest corporate holder of Ethereum, secured another 14,665 ETH worth about $65 million. The purchase was made via Galaxy Digital’s OTC service, according to Arkham Intelligence.

The company’s balance now stands at 1.75 million ETH, valued at roughly $7.7 billion at current prices. This equals about 1.5% of Ethereum’s total supply, making BitMine the largest corporate holder of the asset.

BitMine’s ETH purchase history. Source: intel.arkm.com

The company stated, all purchases are made in cash without leverage.

Public companies now hold a combined total of 2.77 million ETH. SharpLink Gaming is second with 837,000 ETH, far behind BitMine. Analysts attribute the growth in corporate reserves to inflows into Ethereum ETFs and declining supply on centralized exchanges.

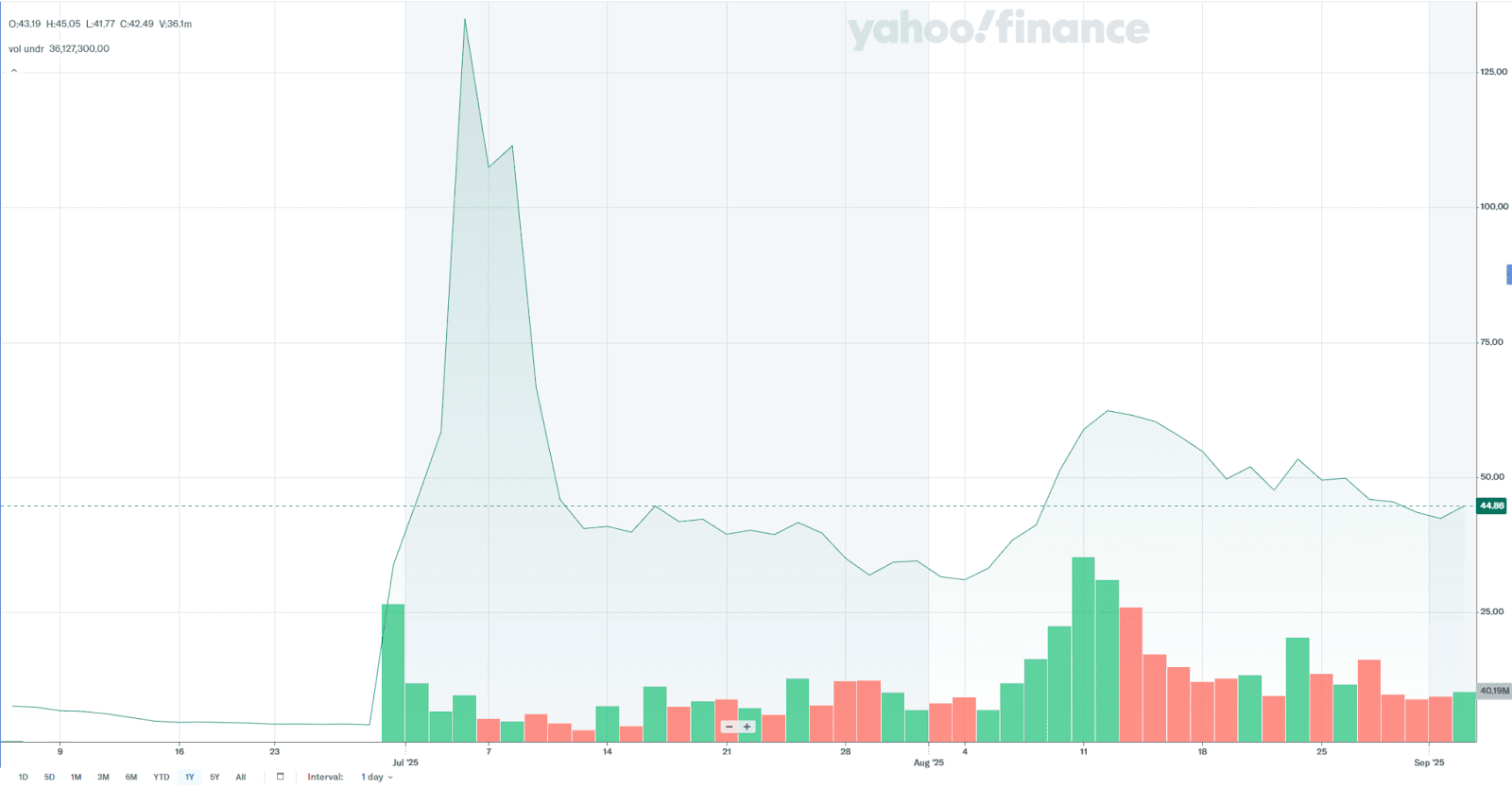

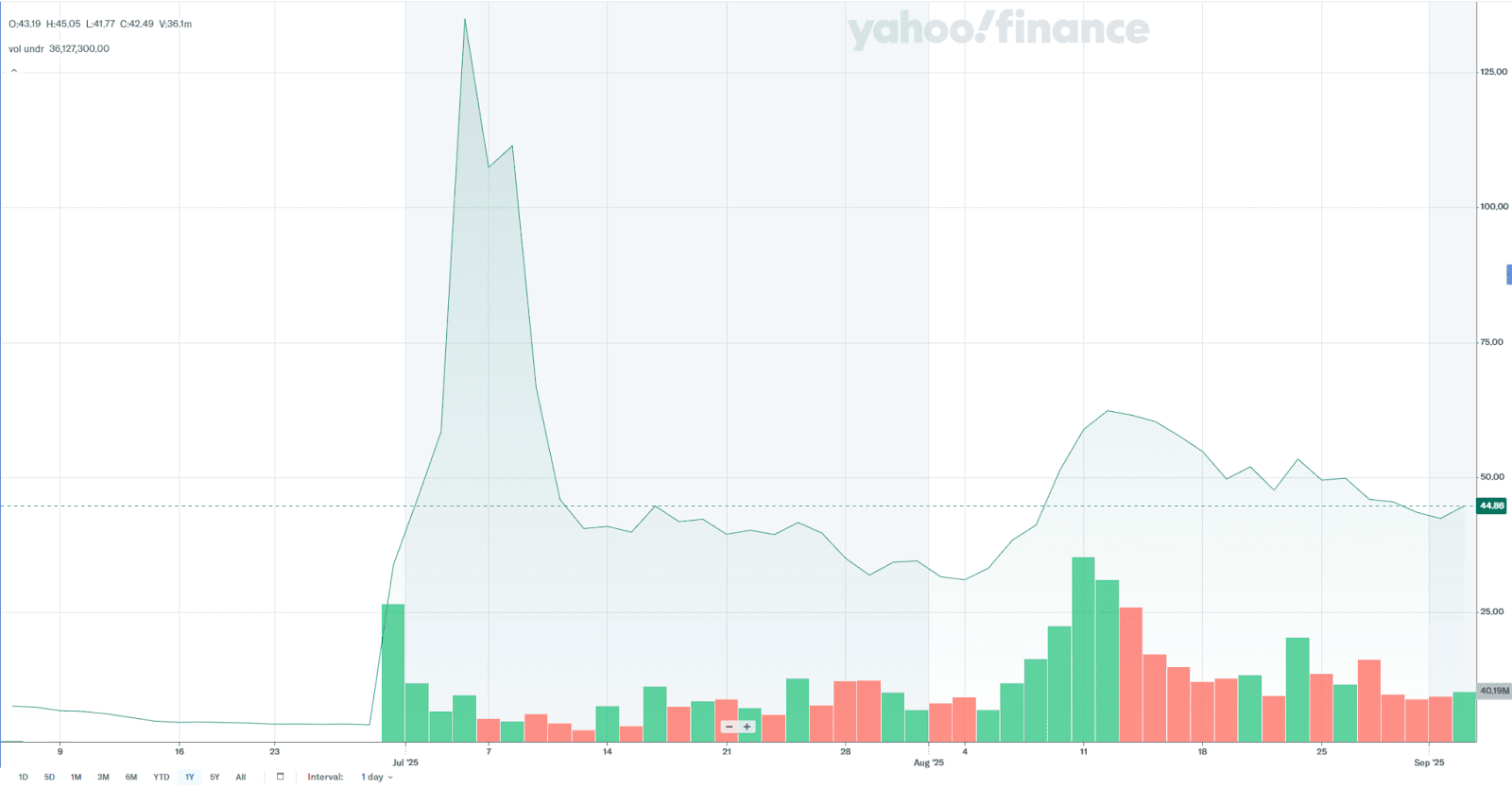

Meanwhile, BitMine shares (ticker BMNR) climbed 5.6% in the latest session, closing at $44.86. The stock remains volatile: up more than 500% since the start of the year, but down two-thirds from its July peak.

BMNR price chart. Source: finance.yahoo.com

BitMine CEO Tom Lee compared Ethereum’s outlook to 1971’s turning point in financial markets, when institutional demand triggered sharp growth. He reiterated a long-term price target of $60,000 per ETH.

The “1971 moment” refers to President Richard Nixon’s decision in August 1971 to end the dollar’s convertibility to gold, effectively dismantling the gold standard. The move transformed the global financial system, making the dollar a fully fiat currency and unleashing volatility and capital flows into new assets.

In Ethereum’s case, Lee draws a parallel to a potential tipping point where institutional adoption could redefine ETH’s role in global finance.