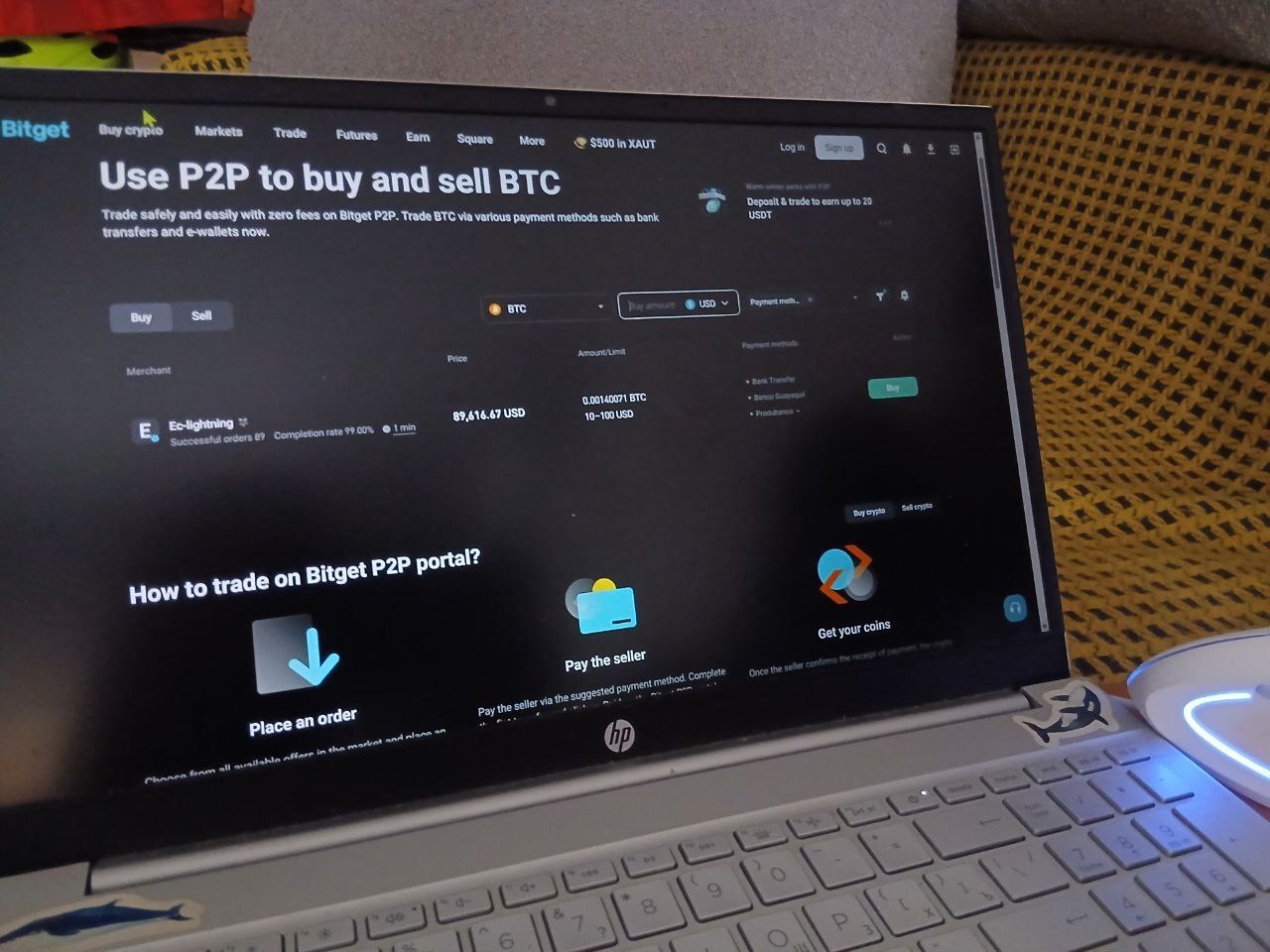

Inside Bitget P2P: a hands-on trading and funding review

Bitget has spent the last few years carving out a massive niche as the “social trading” hub of the crypto world. But before you can mirror the moves of a pro trader or dive into their high-leverage futures, you need to get your funds onto the platform.

Liquidity & Volume

5.0

Payment Methods

4.0

Liquidity & Volume

4.0

Payment Methods

4.0

Liquidity & Volume

4.0

Payment Methods

4.5

Liquidity & Volume

3.5

Payment Methods

4.5

Liquidity & Volume

3.5

Payment Methods

3.5

For many, the first point of contact is the Bitget P2P marketplace–a decentralized portal where “zero fees” and “instant speed” are the primary selling points.

We didn’t just want to take their word for it. To see if the engine under the hood actually purrs, we launched a $200 mystery shopping mission. We weren’t just looking for a smooth UI; we were hunting for the real-world friction. How long does it actually take for a seller to wake up and release the coins? Is the “zero-fee” claim a genuine gift or just a marketing lure meant to hide massive price spreads?

In this review, we’re peeling back the layers of Bitget’s peer-to-peer desk. We bought, we sold, and we sat through the KYC loops so you don’t have to. Whether you’re a privacy-conscious buyer or a high-volume merchant, this is our hands-on, subjective, and slightly obsessive breakdown of the Bitget P2P experience.

Overview of Bitget’s P2P marketplace

Think of the P2P Bitget marketplace as the primary “lobby” for one of the world’s most aggressive crypto ecosystems. Bitget has built its reputation on being the home for copy-trading and high-octane derivatives, but you can’t join the party if you don’t have the chips. That’s where the P2P desk comes in – it’s the bridge between your local bank account and the global crypto markets.

The P2P platform functions as a decentralized marketplace where users trade directly with one another, but under the watchful eye of Bitget’s escrow system. It’s a vital piece of the puzzle because it allows users to bypass traditional payment processors and their hefty credit card fees. For Bitget, this marketplace is a massive onboarding tool; once you’ve swapped your fiat for USDT on the P2P desk, the entire Bitget suite – from spot trading to strategic bot trading–is just one internal transfer away.

During our $200 mystery shopping mission, we noted that Bitget positions its P2P section as a high-security, low-cost gateway. They emphasize “zero transaction fees” for buyers, which is a powerful psychological draw. However, the real value for Bitget isn’t the P2P trade itself – it’s getting you through the door so you can start mirroring the moves of their top-tier traders in the copy-trading section.

Crypto support & fiat payment options

If you’re hunting for a vast library of exotic altcoins on the P2P side, you might be slightly disappointed. Bitget keeps its P2P lineup lean and mean, focusing on the high-liquidity assets that power the rest of its ecosystem. During our $200 mystery shopping mission, we found that Bitget P2P trading primarily centers around the heavy hitters: USDT, BTC, ETH, USDC, and BGB (Bitget’s native token).

Most traders (including us during the test) opt for USDT as it’s the most liquid entry point. Once you have your USDT, you can zip it over to the spot market for free to buy whatever obscure gem you’re actually after.

On the fiat front, Bitget is surprisingly well-traveled. They support over 70 fiat currencies, ranging from the “Big Three” (USD, EUR, GBP) to highly localized options like NGN, VND, and PHP. But a currency is only as good as its payment methods, and Bitget offers a dizzying array:

- Standard banking: SEPA, Swift, and instant local bank transfers.

- Digital wallets: Wise, Revolut, Advcash, and Skrill.

- Regional specialties: Depending on where you are, you’ll see local favorites like Zelle (US), Pix (Brazil), or various mobile money options.

The nerdy reality we discovered during our $200 test? The “best” payment method isn’t the most famous one – it’s the one with the most active merchants. We stuck to a fast digital wallet transfer to ensure our mystery shop didn’t turn into a multi-day waiting game.

Escrow system & dispute handling

In the chaotic world of peer-to-peer trading, Bitget acts as the digital “bouncer” at the door. To keep our funds safe, the platform uses a strict escrow mechanism. When a trade is initiated, the crypto assets are automatically locked from the seller’s account and held by Bitget. They don’t move until both parties have fulfilled their side of the bargain.

During our test, we noticed the process follows a precise sequence:

- The lock-up: The moment we took an offer, the seller’s USDT was yanked into escrow.

- The handshake: We sent our payment via a digital wallet and clicked “Paid.”

- The release: Once the seller confirmed the receipt, the escrow released the funds to our Bitget wallet.

But what if the seller pulls a “ghosting” act? That’s where dispute handling kicks in. If the seller doesn’t release the crypto after you’ve paid, you can file an appeal. You’ll need to provide proof of payment (like a screenshot from your banking app), and Bitget’s customer support will arbitrate. They have the power to manually release the escrowed funds to you if your evidence is solid.

As for Bitget P2P trading fees, the platform is remarkably taker-friendly. Bitget charges 0% transaction fees for buyers (takers). They essentially let you through the gates for free to encourage you to stick around for their other products. However, keep an eye on the merchant’s exchange rate; while the platform fee is zero, the “nerd tax” (the spread between the P2P price and the spot market price) was roughly 0.6% during our $200 test.

Pros, cons & limitations

How Bitget P2P compares to other peer-to-peer desks in daily use:

Strengths:

- The copy-trader’s fast lane: Since it’s baked into the Bitget ecosystem, moving your P2P funds to follow a pro trader is instant and free.

- Zero taker fees: We didn’t pay a single cent in platform commissions during our $200 mystery shopping mission.

- Massive payment variety: With support for over 70 fiat currencies and nearly every digital wallet imaginable, it’s hard to find a payment method they don’t support.

Weaknesses:

- Merchant lag: Unlike a centralized order book, you’re waiting on a human. One of our test trades took 15 minutes because the seller was likely grabbing a coffee.

- The “hidden” spread: Zero fees doesn’t mean zero cost. The spread between the P2P price and the real-time spot price can be sneaky if you aren’t paying attention.

- Limited crypto variety: You’re mostly stuck with majors like USDT, BTC, and ETH. If you want to buy a meme coin directly with cash, you’re out of luck.

- KYC is mandatory: Privacy hunters beware–you aren’t doing anything on Bitget P2P without a full ID verification.

Our P2P Bitget review shows the platform is a high-speed, low-cost entry point for anyone looking to dive into social trading, though it lacks the anonymity of more decentralized alternatives.

Trustworthiness сheck

When we talk about Bitget, we’re talking about a platform that has survived the brutal “Exchange Hunger Games” of the last few years by doubling down on security and transparency. For our test, we weren’t just looking for a pretty UI; we were looking for armor.

Bitget’s security narrative is one of the cleaner ones in the industry. They have largely avoided the catastrophic, “everyone-lose-their-life-savings” hacks that have plagued other Tier-1 exchanges.

- Bitget maintains a $300 million Protection Fund – one of the largest in the industry – designed to cover users in the event of a security breach. This acts as a massive insurance policy for your $200.

- They publish monthly PoR reports with a reserve ratio consistently above 200%. During our test, we verified their Merkle Tree data, confirming that user assets are backed 1:1 (and then some).

- While not a security feature per se, their strict vetting process for “Elite Traders” suggests a platform-wide obsession with risk management that trickles down to the P2P desk.

On the P2P Bitget desk, the “hack” is usually a social one.

- Zero major breaches: To date, there have been no documented exploits of Bitget’s P2P escrow contract. The system is battle-tested.

- The dispute barrier: In our analysis of user reports, the main “incidents” involve slow merchants or “fake payment” scams initiated by bad actors. Bitget’s response is to force mandatory KYC, which effectively nukes the anonymity that scammers crave.

While the contract has not been exploited, Bitget cautions users against social engineering scams (e.g., fraudulent traders acting as buyers/sellers) and phishing attempts. These involve user-to-user deception, not a failure of the platform’s underlying escrow technology.

GNcrypto’s overall Bitget P2P rating

| Criterion | Score |

|---|---|

| Escrow & Trade Safety | 4.5 |

| Liquidity & Order Book Depth | 4.0 |

| Fees & Payment Methods | 4.5 |

| Verification & Account Limits | 3.5 |

| Platform Performance & Reliability | 4.0 |

| User Experience & Trade Flow | 4.0 |

| Customer Support & Dispute Handling | 3.5 |

| Total | 4 / 5 |

How we test P2P platforms

At GNcrypto, we put transparency first when evaluating peer-to-peer (P2P) cryptocurrency trading platforms. Our reviews are based on hands-on testing and thorough analysis across all key dimensions that matter for safely buying and selling crypto directly with other users.

We do not audit platform solvency or guarantee user safety from all scams. Instead, our scores reflect observable escrow mechanisms, order book depth, and platform support quality. We do not accept payment for ratings or modify scores based on partnerships.

Categories & weights

We rate P2P platforms on seven criteria. Escrow and Liquidity are weighted heaviest because a platform that isn’t safe or has no one to trade with is useless, regardless of how pretty the UI is.

- Escrow & Trade Safety – 25%

- Liquidity & Order Book Depth – 20%

- Fees & Payment Methods – 15%

- Verification & Account Limits – 15%

- Platform Performance & Reliability – 10%

- User Experience & Trade Flow – 10%

- Customer Support & Dispute Handling – 5%

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.