Bitcoin stress builds below resistance as liquidity remains the swing factor

In its Week 04 2026 report, Glassnode says Bitcoin is sitting just below a cluster of key resistance and support levels, with fragile short term holders and defensive options positioning keeping the market vulnerable. A sustained move higher likely needs clearer spot demand and improving ETF flows, while the $80.7K to $83.4K zone remains the line in the sand.

Bitcoin is still consolidating, but Glassnode is flagging that the market is doing it in an uncomfortable place, just below key on-chain resistance bands tied to investor cost basis.

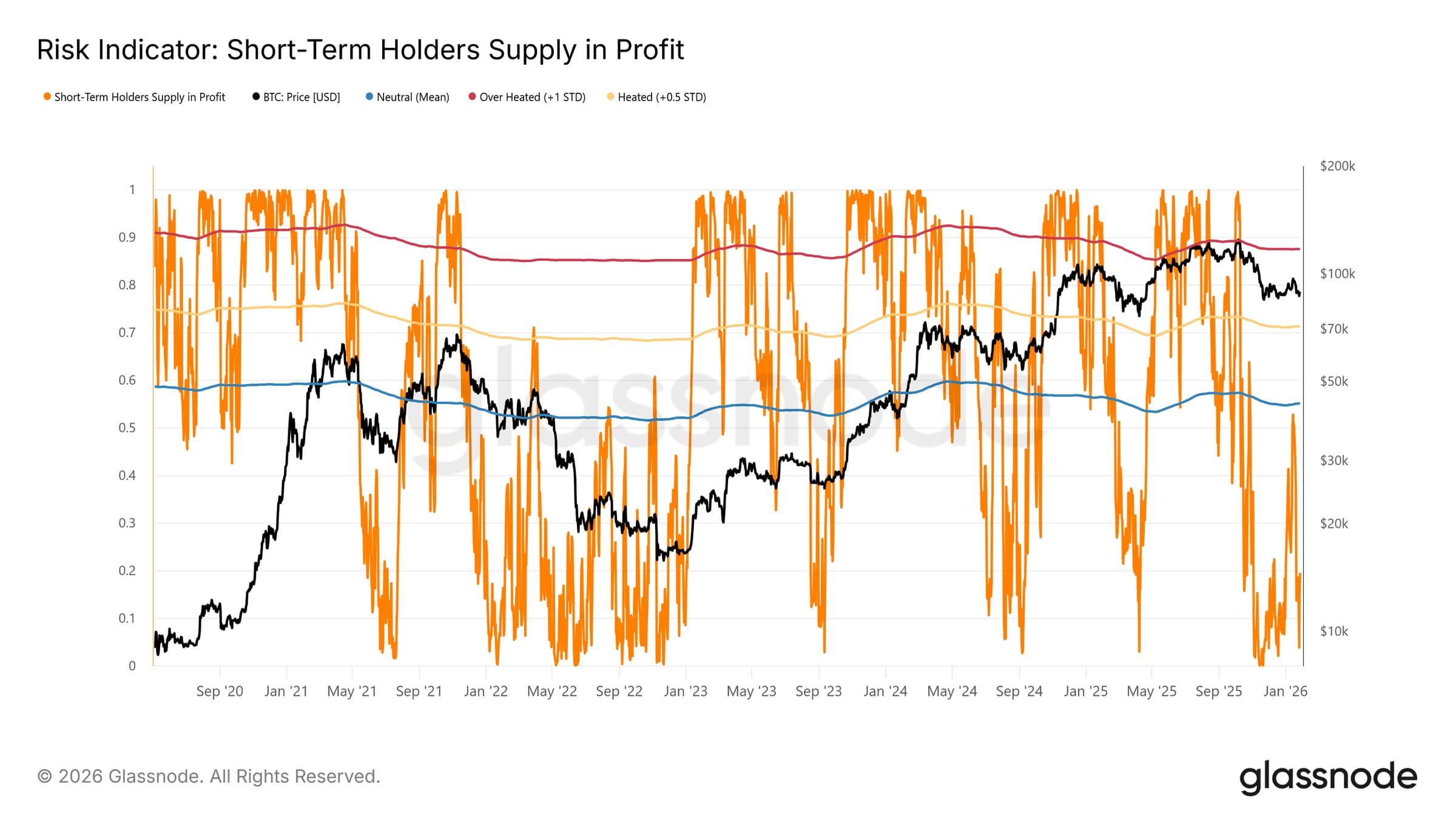

The first number to watch is the short-term holder (STH) cost basis, which Glassnode puts around $96.5K. Price trading under that level keeps recent buyers closer to breakeven, and it tends to shorten the fuse when volatility returns. On the downside, Glassnode highlights a tightening support corridor with the -1 standard deviation band near $83.4K and the True Market Mean at $80.7K. If that pocket fails, the market risks sliding into a deeper bear-like structure.

Stress is visible in positioning, even if it has not turned into full capitulation. Glassnode estimates about 19.5% of STH supply is currently held at a loss, still well below the 55% level they treat as a more neutral threshold. At the same time, more than 22% of circulating supply is underwater, a share they compare to prior late-cycle shakeouts like Q1 2022 and Q2 2018.

Liquidity is the deciding variable. Glassnode points to the 90-day realized profit to loss ratio as a tell for whether fresh capital is returning, noting that strong upside phases have historically required that metric to hold above roughly 5.

Off-chain signals are mixed but slightly better. US spot Bitcoin ETF flows have cooled from sustained outflows, with the 30-day average drifting back toward zero. Spot CVD bias is rising again, led by Binance, while Coinbase looks steadier and less aggressive.

Derivatives remain cautious. Perpetual funding is largely neutral, but options markets are leaning defensive, with bearish skew, higher front-end implied volatility, and dealer gamma dipping below zero. Glassnode notes dealers are short gamma across a wide band from about $90K into the mid-$70Ks, a setup that can mechanically amplify downside moves until sustained buying shows up.

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.