42% of Bitcoin could be illiquid by 2032: Fidelity says

Fidelity projects 42% of Bitcoin’s supply, about 8.3M BTC, could become illiquid by 2032 if current trends continue.

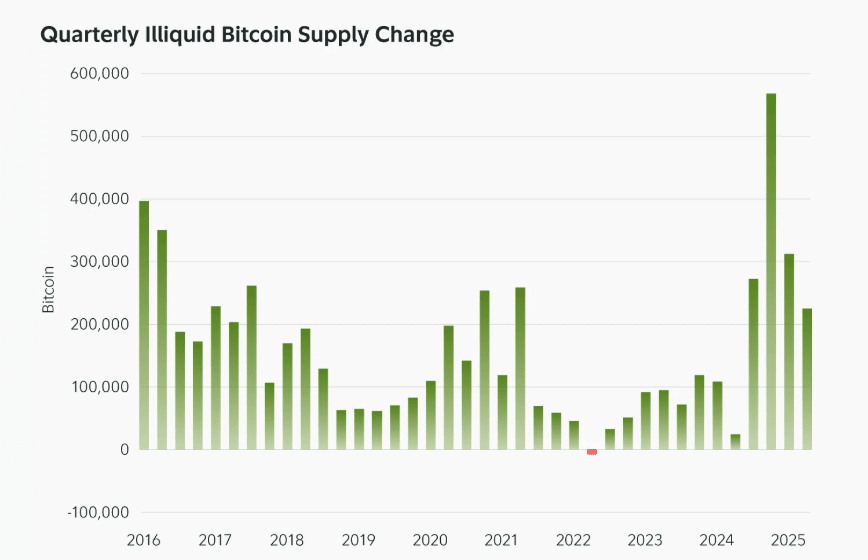

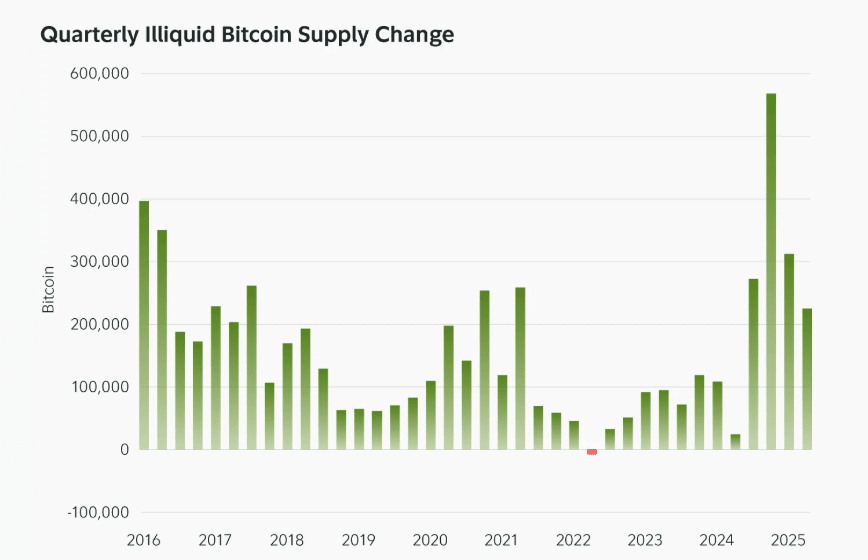

According to Fidelity Digital Assets, Bitcoin’s illiquid supply - coins held in wallets with little or no history of selling - will reach more than 6 million BTC by the end of 2025, or about 28% of the total 21 million supply. Fidelity’s analysis shows that two main groups make up much of this illiquid supply: coins unmoved for seven or more years, and holdings by public companies with at least 1,000 BTC. Together, these cohorts owned over 830,000 BTC as of mid-2025.

Long-term holders and institutions with large bitcoin treasuries tend to hold rather than trade, limiting availability on the open market. The projection to 2032 assumes the seven-year cohort continues growing at its 10-year average pace, corporate balances are added each quarter, and no new public companies join.

As of June 30, 2025, nearly all Bitcoin held by public companies - 97% of the total - is concentrated among 30 firms with balances of at least 1,000 BTC. Growing adoption by corporate treasuries has contributed to the rise in unmoved, or illiquid, supply since Q3 2024. Looking at coins unmoved for at least seven years, the illiquid supply has only declined once in history.

As of September 2025, 19.92 million BTC, or 94.86% of the maximum supply, are in circulation. With 95% of all BTC soon to be circulating, the market appears to be shifting from a period of abundance to one of scarcity. Fidelity concludes that Bitcoin’s supply and demand trends suggest this change is still in its early stages, highlighting the importance for investors to understand the shift when planning long-term portfolio strategies.

Long-term holders and institutions with large bitcoin treasuries tend to hold rather than trade, limiting availability on the open market. The projection to 2032 assumes the seven-year cohort continues growing at its 10-year average pace, corporate balances are added each quarter, and no new public companies join.

As of June 30, 2025, nearly all Bitcoin held by public companies - 97% of the total - is concentrated among 30 firms with balances of at least 1,000 BTC. Growing adoption by corporate treasuries has contributed to the rise in unmoved, or illiquid, supply since Q3 2024. Looking at coins unmoved for at least seven years, the illiquid supply has only declined once in history.

Bitcoin illiquid supply growth trends from 2016 through 2025. Source: Fidelity Digital Assets

Statistics show that more people and companies are holding onto their Bitcoin rather than selling, helping them accumulate wealth. By the end of June 2025, these holders controlled over $628 billion at a bitcoin price of $107,700 - more than double the value from the previous year. Early signs of selling appeared in July 2025, when 80,000 “ancient” BTC, unmoved for 10 years or more, were sold.

As of September 2025, 19.92 million BTC, or 94.86% of the maximum supply, are in circulation. With 95% of all BTC soon to be circulating, the market appears to be shifting from a period of abundance to one of scarcity. Fidelity concludes that Bitcoin’s supply and demand trends suggest this change is still in its early stages, highlighting the importance for investors to understand the shift when planning long-term portfolio strategies.

Recommended