Bitcoin ETFs edge back to green as one big day does the work

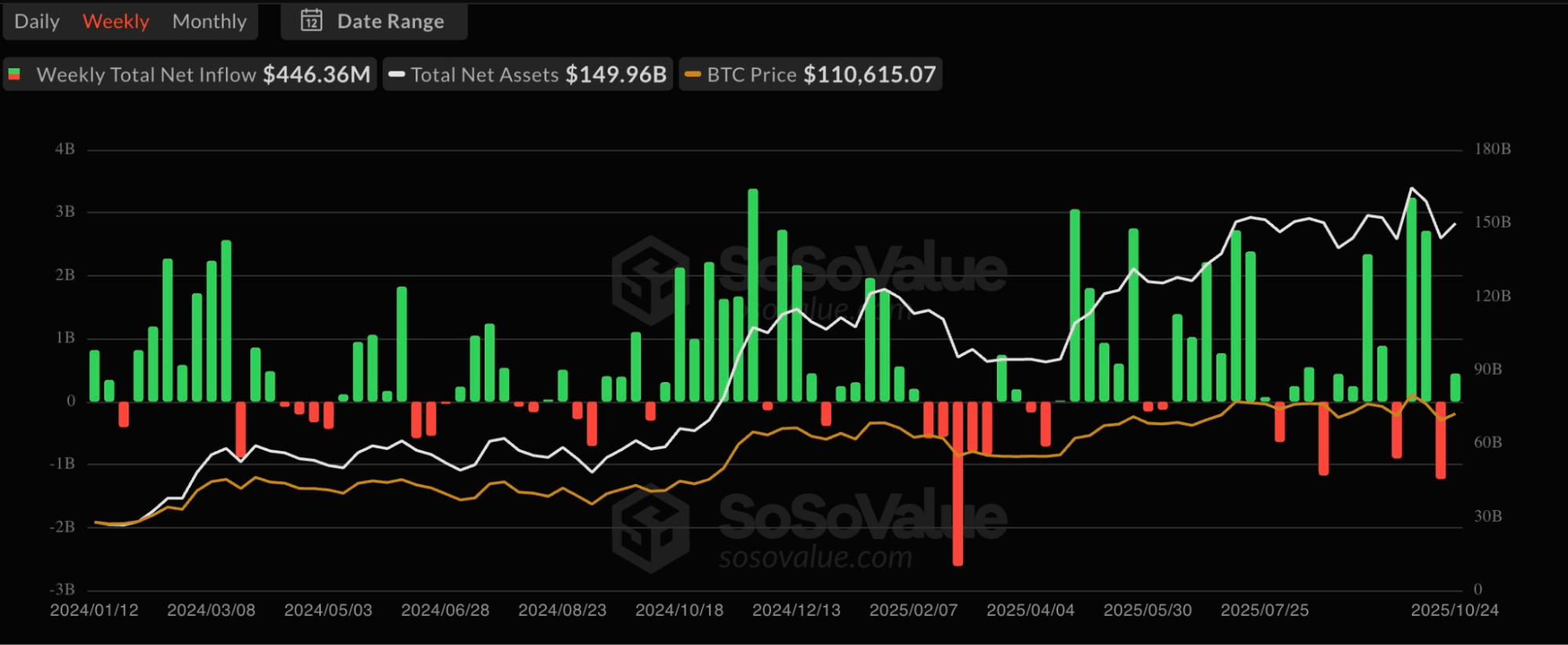

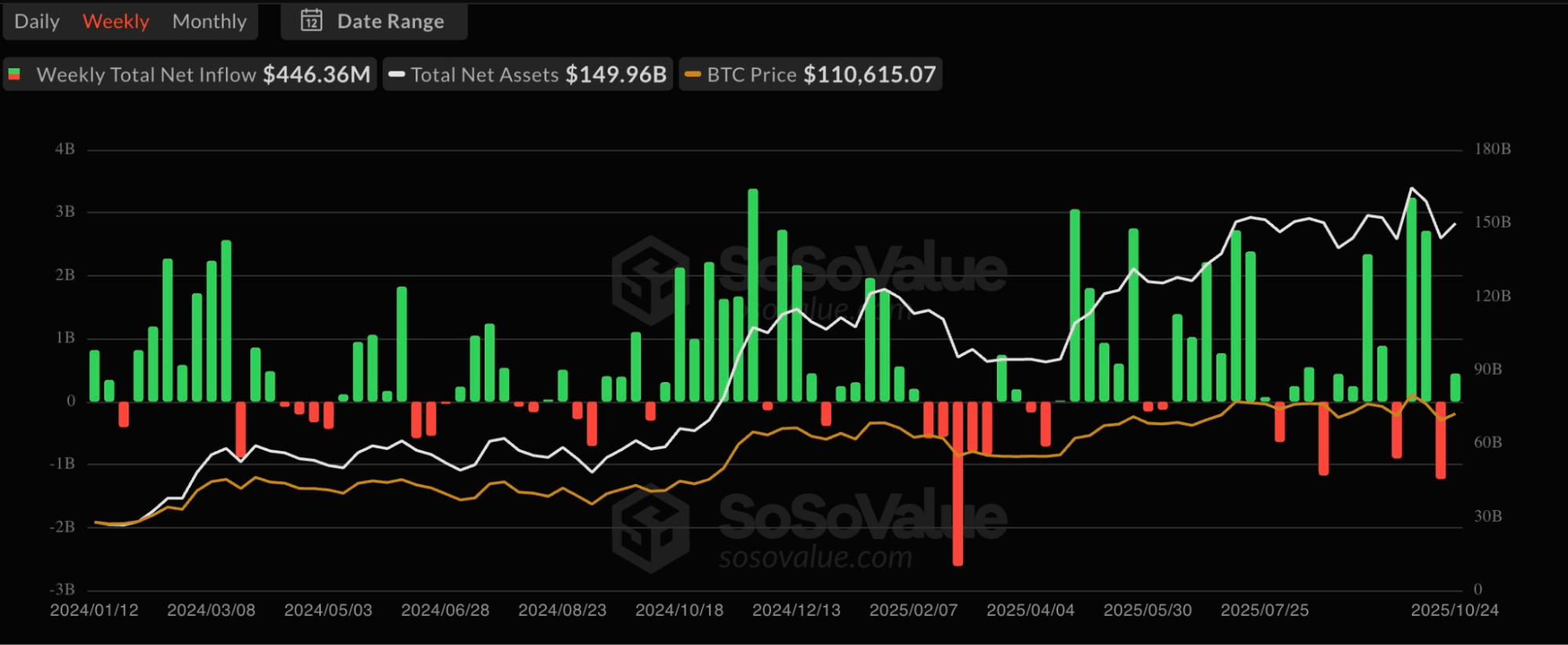

U.S. spot Bitcoin ETFs returned to the plus column for the week of Oct 20–24, but just barely. Net flows totaled about +$446M as weekly trading eased to ~$25.9B, a notable step down from the ~$34.4B seen during the prior risk‑off swing.

Assets under management (AUM) recovered to roughly $149.96B from ~$143.9B a week earlier, signaling that price stabilization in BTC did as much lifting as fresh cash.

Bitcoin ETFs edged back to green: roughly $446M flowed in during Oct 20–24 as volumes cooled and AUM rebounded toward $150B with BTC near $110.6K. Source: SoSoValue

The path through the week was uneven and mostly decided by a single session. Monday opened soft (~−$40M), Tuesday delivered the week’s inflection with about +$477M on the heaviest turnover (~$7.4B), Wednesday flipped back to red (~−$101M), and Thursday/Friday added modest greens (~+$20M and ~+$91M). Put simply: one strong print carried a patchy tape.

By product, leadership leaned back to the usual engine while laggards stayed a drag. In BTC terms (CoinGlass):

- IBIT (iShares Bitcoin Trust, BlackRock): +2.96K BTC – the clear driver; Tuesday’s +1.91K BTC set the tone and later sessions stayed positive.

- FBTC (Fidelity Wise Origin Bitcoin Fund): +0.47K BTC – finished the week strong (Friday +0.53K).

- ARKB (ARK 21Shares Bitcoin ETF): +0.46K BTC – a choppy mid‑week, but net green thanks to a solid Wednesday.

- BITB (Bitwise Bitcoin ETF): +0.36K BTC – steady second‑tier support.

- GBTC (Grayscale Bitcoin Trust): −1.09K BTC – the main headwind with back‑to‑back red prints mid‑week.

- BTCO/HODL and others: small positives that helped margin‑wise but didn’t change the story.

Two dynamics stand out. First, breadth improved versus the prior week, when leaders redeemed in sync. This time, the second tier (FBTC/ARKB/BITB) finished in the green alongside IBIT, even if their contributions were modest. Second, AUM was driven as much by price as by flows: after Tuesday’s peak, a mid‑week BTC wobble knocked AUM from ~$151.6B to ~$146.3B, before a partial rebound into the close.

Risk appetite looks tentative – the market bought the dip, but not aggressively, as volumes cooled and one strong day did most of the lifting. Leadership remains concentrated: without IBIT the aggregate would have been flat at best, while GBTC’s mid‑week redemptions capped the upside. Even so, October is still net positive: the last four weekly prints (+3.24B → +2.71B → −1.23B → +0.45B; ≈ +$5.2B in total) point to rotation rather than a wholesale exit.

Looking ahead to Oct 27–31, the base case is as follows:

If BTC holds a stable range, expect modest green or flat flows with IBIT doing the heavy lifting and FBTC/ARKB/BITB contributing intermittently. A renewed price dip likely brings mixed‑to‑red prints and caps AUM despite adequate liquidity. A broad, high‑volume melt‑up across all majors looks unlikely until breadth extends beyond one or two leaders.

Recommended