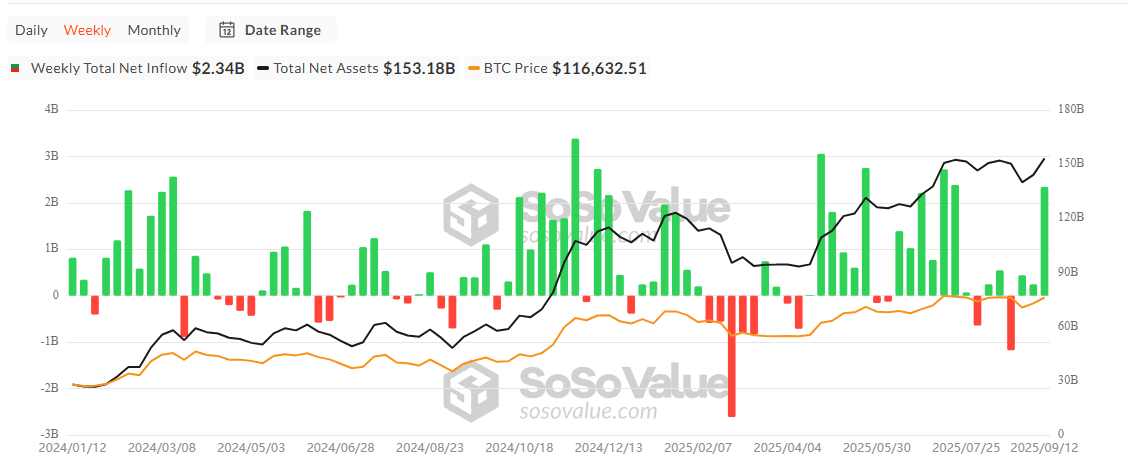

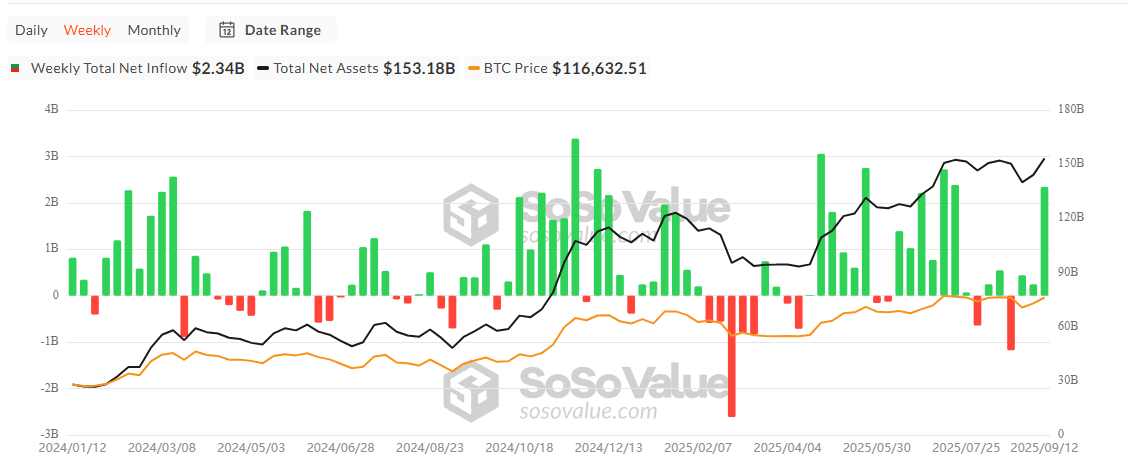

Bitcoin ETFs see $2.34B in weekly inflows from September 8 to 12

Spot Bitcoin ETFs in the U.S. recorded weekly inflows of $2.34B as of Sept. 12, 2025, according to SoSoValue. Assets under management (AUM) for these funds climbed to $153.18B, while BTC traded around $116,632.51 at the time of reporting.

For comparison, inflows two weeks ago were relatively modest — in the range of $246M–$440M — with daily flows just above the hundreds of millions, but without meaningful AUM growth.

The record week of inflows suggests investors are re-engaging after a period of relative stagnation. Consistent interest in Bitcoin ETFs is emerging against a challenging macroeconomic backdrop, as traders seek safe-haven assets and protection against inflation. BTC’s rise above $115,000 has also fueled inflows.

Looking at AUM ($153.18 billion), this accounts for about 6.6% of Bitcoin’s market capitalization, showing that ETFs continue to grow in influence while not yet dominating the overall market.

At the same time, spot Ethereum ETFs followed the bullish trend, bringing in $637 million in weekly inflows. The total trading volume in ETH ETFs for the week reached $2.55 billion.

Weekly Bitcoin ETF inflows and outflows chart. Source: sosovalue.com

The main Bitcoin ETF gainers are BlackRock (IBIT) and Fidelity (FBTC). On one day, IBIT drew about $264.71 million, while FBTC attracted around $315.18 million. Spot Bitcoin ETFs recorded more than $3.89 billion in trading volume, reflecting strong market activity and increasing institutional interest. Leading funds such as IBIT and FBTC advanced over 2% on the day.

The record week of inflows suggests investors are re-engaging after a period of relative stagnation. Consistent interest in Bitcoin ETFs is emerging against a challenging macroeconomic backdrop, as traders seek safe-haven assets and protection against inflation. BTC’s rise above $115,000 has also fueled inflows.

Looking at AUM ($153.18 billion), this accounts for about 6.6% of Bitcoin’s market capitalization, showing that ETFs continue to grow in influence while not yet dominating the overall market.

At the same time, spot Ethereum ETFs followed the bullish trend, bringing in $637 million in weekly inflows. The total trading volume in ETH ETFs for the week reached $2.55 billion.

Recommended