Bitcoin ETF record $145 million in inflows as outflows slow

Inflows into U.S. Bitcoin ETFs have turned positive again: after a $371 million surge on Friday, funds pulled in another $145 million on Monday despite BTC’s volatility around $70,000.

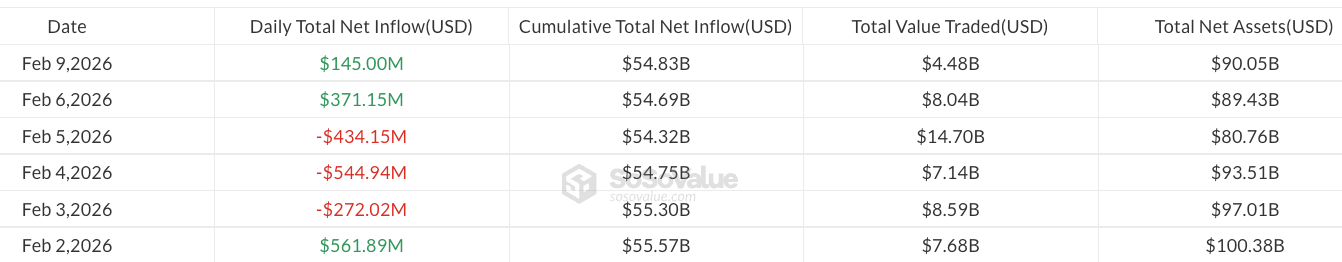

U.S. spot Bitcoin ETFs continued to rebound after a week of heavy pressure: funds attracted $371 million on Friday and another $145 million in net inflows on Monday, according to SoSoValue and CoinGecko. This marks the first clear reversal after a stretch of selling that drained $318 million over the week and nearly $1.9 billion since the start of the year.

CoinShares analysts note that the sharp slowdown in outflows may signal a potential trend shift. Head of Research James Butterfill highlighted that historically, such deceleration has often preceded stabilization in crypto investment products, even during periods of strong price pressure.

Bitcoin price traded near $70,000 during the inflows, remaining volatile after several weeks of selling. Despite the turbulence, institutional flows have begun to steady, and some investors view current levels as an entry point for a gradual reallocation back into the market.

Bitwise also stated that early bitcoin holders show no meaningful desire to exit. CIO Matt Hougan said many “first-wave” investors are only trimming small portions of their positions after substantial gains, while continuing to hold the majority of their BTC. He added that fears that institutionalization would “push out” early adopters are not reflected in actual investor behavior.

Research firm Bernstein described the current pullback as “the weakest bear scenario in bitcoin’s history,” noting the absence of systemic shocks comparable to past collapses of major players or critical infrastructure. The lack of a single dominant catalyst has intensified debate over the impact of ETFs and the degree of bitcoin’s financialization.

Notably, inflows extended beyond Bitcoin ETF products: Ethereum funds saw $57 million in inflows, while XRP products added $6.3 million – a sign that demand is gradually recovering across the broader spectrum of spot crypto funds.

Investors and analysts are now watching closely to see whether the slowdown in outflows turns into a sustained inflow cycle. If institutional allocations continue to rise, they could become a key stabilizing force for Bitcoin price after weeks of volatility and derivatives-driven pressure.

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.