US spot Bitcoin ETFs record $166 million in daily outflows

The historic surge in institutional Bitcoin demand has transitioned into a steady retreat, as US spot ETFs grapple with their most persistent sell-off to date. This sustained period of capital flight signals a major shift in investor sentiment, with regulated funds now acting as a primary source of downward pressure on the market.

Institutional demand for Bitcoin has slowed, resulting in the longest streak of net outflows since the inception of spot ETFs in the United States.

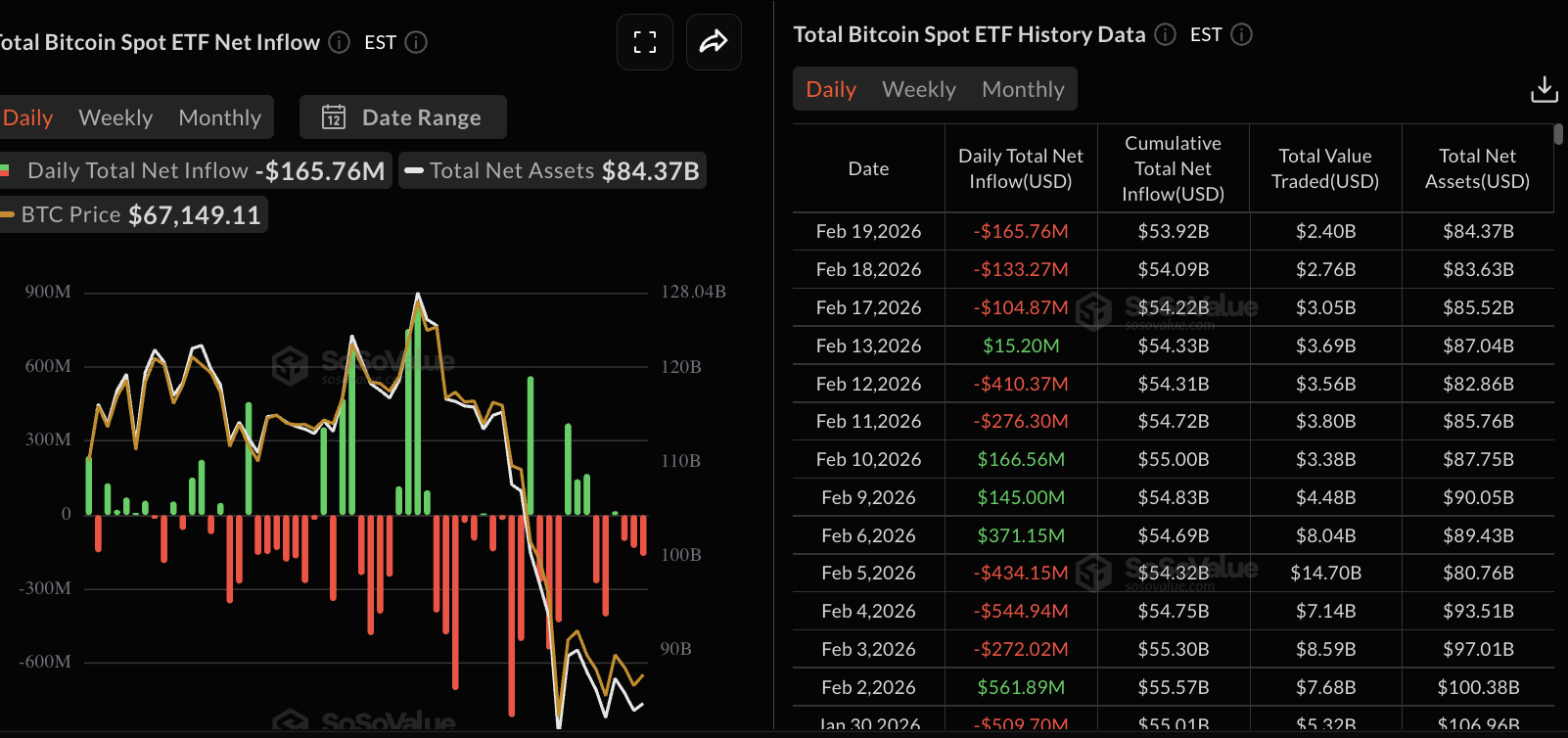

According to data from SoSovalue, the group of 11 ETFs saw a combined $166.4 million leave the funds during Thursday’s trading session. This activity contributes to a five-week trend of consistent withdrawals, with the total loss now reaching $3.9 billion. This sequence surpasses the previous record for the longest duration of net weekly outflows.

Fidelity’s Wise Origin Bitcoin Fund (FBTC) led the daily losses with $53.3 million in withdrawals. BlackRock’s iShares Bitcoin Trust (IBIT) followed with an outflow of $42.1 million. Other significant exits were recorded by the Bitwise Bitcoin ETF (BITB), which lost $10.1 million, and the Ark 21Shares Bitcoin ETF (ARKB), which saw $12.3 million in redemptions.

On the data side, Bitcoin ETF assets under management have fallen below $100 billion, marking a sharp reversal from the record inflows seen earlier in the cycle. This demand gap corresponds with Bitcoin’s current price consolidation near the $71,000 level.

The current market environment differs from early 2025, when ETFs were purchasing an average of 10,000 BTC per week. Analysts suggest that the absence of new macroeconomic catalysts is prompting institutional investors to reduce their exposure. While the funds still hold substantial assets, the aggressive accumulation phase has stalled.

For traders, the primary indicator of a recovery will be a return to positive net flows across the major providers. Until the Coinbase premium stabilizes and ETF redemptions cease, the market is likely to face persistent selling pressure from these regulated venues.

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.