Bitcoin ETF outflows deepen as tariff talk rattles markets

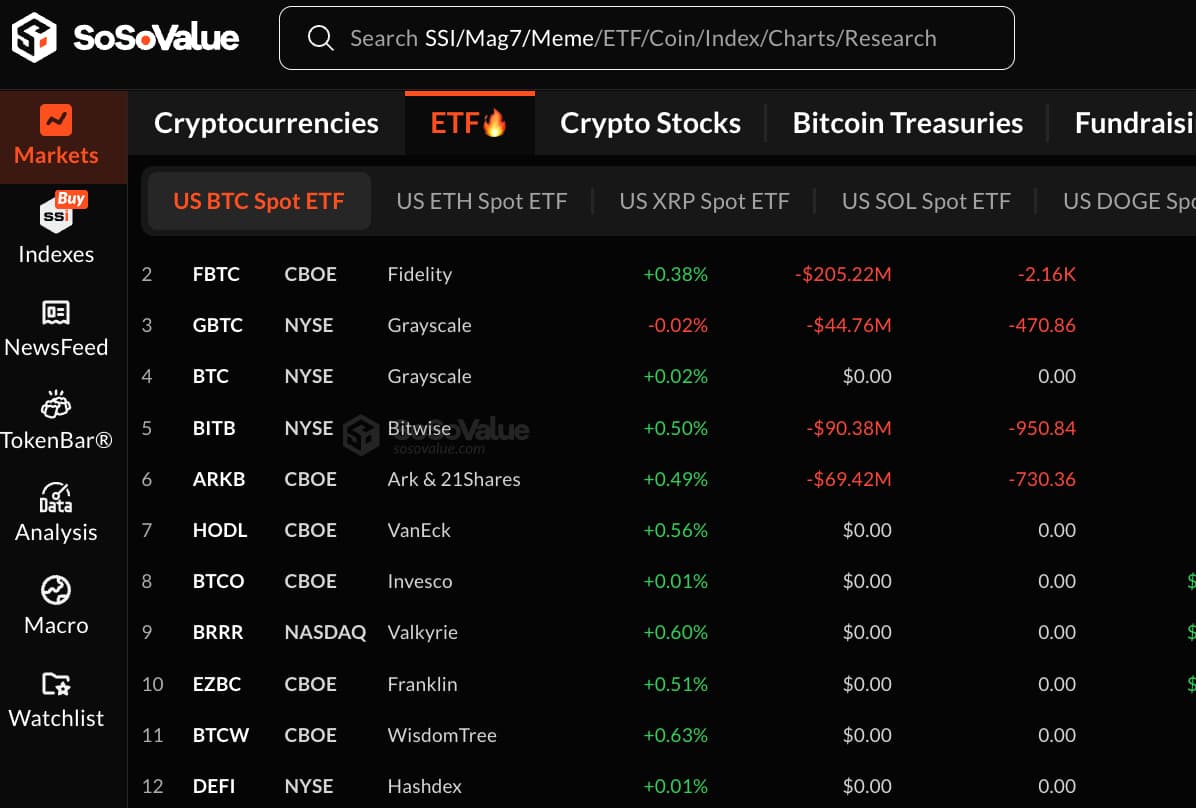

U.S. spot Bitcoin ETFs posted roughly $395 million in net outflows in a single session. After a couple of relatively calm days, it felt like someone flipped a switch and investors hurried to lock in gains and cut exposure.

The biggest outflow came from Fidelity’s FBTC (about $205 million). Next were Bitwise’s BITB (roughly $90 million), Ark & 21Shares’ ARKB (around $69 million), and Grayscale’s GBTC (about $44 million).

Against that backdrop, the only steady “plus” looked almost symbolic: BlackRock’s IBIT ended the day with roughly $15 million in net inflows.

It is also notable that ether did not see a dramatic selloff the same day. Using the same dataset, spot ETH ETFs posted a small net inflow of about $4.6 million. That does not flip the broader tone or erase the nerves, but it suggests money is not fleeing crypto altogether. It is moving within the sector, looking for pockets where the risk feels easier to manage.

The sharp one-day drop stands out even more if you remember what the backdrop looked like a week earlier. A Jan. 19 market overview noted that the prior week ended with $1.42 billion in net inflows to spot Bitcoin ETFs, with IBIT again taking the biggest share. But the week’s finish turned out to be a surprise: between Jan. 18 and Jan. 19, Bitcoin slipped from $95,099 to $92,584 in 24 hours.

It looks like a mix of profit-taking and unhelpful macro headlines kicked in. When the conversation swings back to tariffs, inflation, and questions around the Fed’s leadership, many traders prefer to wait it out with less risk.

Now Greenland is part of the mix as well. After Donald Trump’s statements about tariffs against eight European countries tied to the dispute over the island, the market got the sense that political tension may have hit a peak. In that kind of atmosphere, even neutral ETF data gets read through a risk-off lens. Some investors close positions simply to avoid extra exposure while heated rhetoric builds and Europe’s response remains hard to predict.

Regulators are adding another layer of unease. Market participants are watching delays in the Senate’s discussion of a crypto market structure bill, along with what some describe as unprecedented pressure on Fed leadership.

Still, it is too early to panic. A $395 million outflow is not a verdict on the market. It is a reminder that ETFs are a convenient on-ramp and an equally convenient exit. In January 2026, those flows can shift as fast as the headlines.

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.