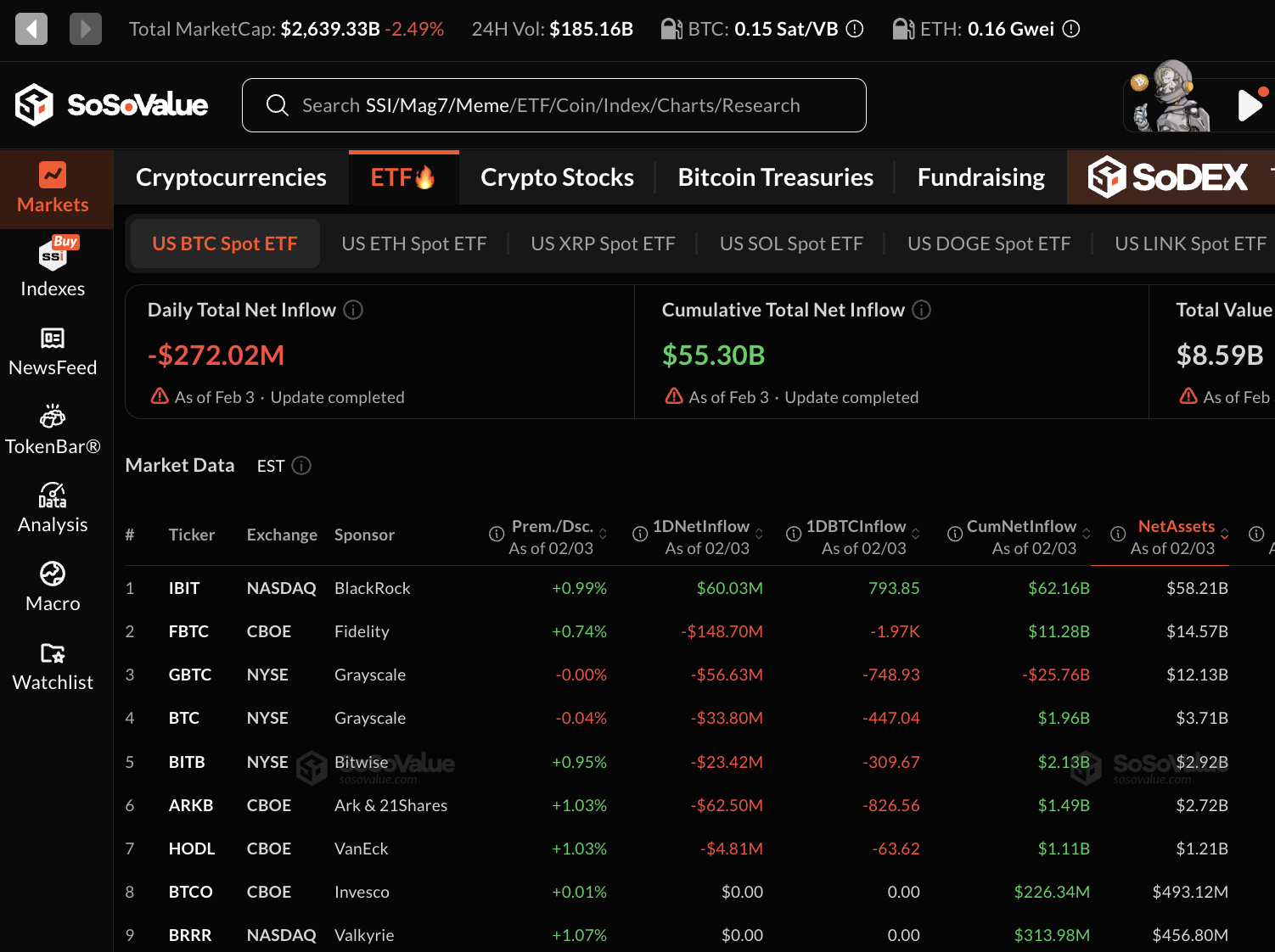

US spot Bitcoin ETF assets dip below $100B for first time since April 2025

US spot Bitcoin ETFs slipped under $100 billion in assets after $272 million in net redemptions on Feb. 3. Data shows the group last sat below that level in April 2025, and the move comes as Bitcoin trades under the ETFs implied creation cost basis near $84,000.

The $100 billion line has been a psychological marker for the spot Bitcoin ETF trade. It signals scale, liquidity, and a steady base of holders who are willing to sit through drawdowns.

That marker just broke. Aggregate assets across the US spot Bitcoin ETF group slipped under $100 billion on Tuesday after another day of withdrawals, based on the latest figures tracked on the.

The two-week story has been choppy. Monday brought a bounce, with about $562 million of net inflows. The next session reversed the mood. Net outflows totaled roughly $272 million on Feb. 3, dragging group assets below the threshold for the first time since April 2025.

The price backdrop explains why redemptions sting more right now. Bitcoin dropped below $74,000 during Tuesdays slide, and the broader crypto market has been trading defensively after a fast drawdown in January. With spot BTC under the ETFs implied creation cost basis, often cited around $84,000, new share creation becomes harder to justify for marginal buyers.

The move also highlights how much of the peak was built on momentum. Spot Bitcoin ETF assets topped out around $168 billion in October 2025. The gap between that high and the current level reflects both mark-to-market losses and a stretch of persistent outflows.

Not every crypto fund saw the same pressure. Flows into products tied to Ether, XRP, and Solana were modestly positive in the same window, suggesting some allocators are rotating rather than exiting the category entirely.

For now, the signal traders will keep watching is basic: whether ETF flows stabilize as Bitcoin tries to put in a floor, or whether continued redemptions turn every rebound into another chance for holders to cut exposure.

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.