Best Bisq alternatives for P2P trading in 2026

Bisq is the fortress of privacy, but its heavy software and thin liquidity can feel like trading in a bunker. We hunted for protocols that offer the same “no-KYC” ethos but with modern speed and deeper order books.

Liquidity & Volume

5.0

Payment Methods

4.0

Liquidity & Volume

4.0

Payment Methods

4.0

Liquidity & Volume

4.0

Payment Methods

4.5

Liquidity & Volume

3.5

Payment Methods

4.5

Liquidity & Volume

4.5

Payment Methods

4.0

If you are a Bisq user, you are likely part of a specific tribe. You value sovereignty over convenience, you trust code more than corporate promises, and you are probably used to the sound of your laptop fan spinning up as the Bisq client syncs with the DAO.

We have been there. Bisq is undeniably the gold standard for censorship-resistant Bitcoin trading. It is the “final boss” of privacy – no servers, no CEO, and absolutely no way for a regulator to freeze your funds. But let’s be honest: sometimes, freedom feels heavy. The Java-based client can be sluggish, the “chicken and egg” requirement (needing BTC to buy BTC) is a hurdle for new users, and staring at an illiquid order book while waiting for a Tor connection to stabilize is a test of patience.

Below, we’ve analyzed the best platforms that respect your privacy while respecting your time. From Lightning-native protocols to web-based multisig marketplaces, these are the tools we switch to when the Bisq client feels a little too slow.

Top Bisq alternatives compared

We know that for many Bisq purists, moving to a centralized platform (CEX) sounds like heresy. However, when you need to move volume quickly or lack the pre-existing Bitcoin required for Bisq’s security deposit, “pragmatism” beats “purity.” We selected these alternatives to Bisq not because they offer better privacy (they don’t), but because they solve the specific liquidity and onboarding friction that Bisq cannot.

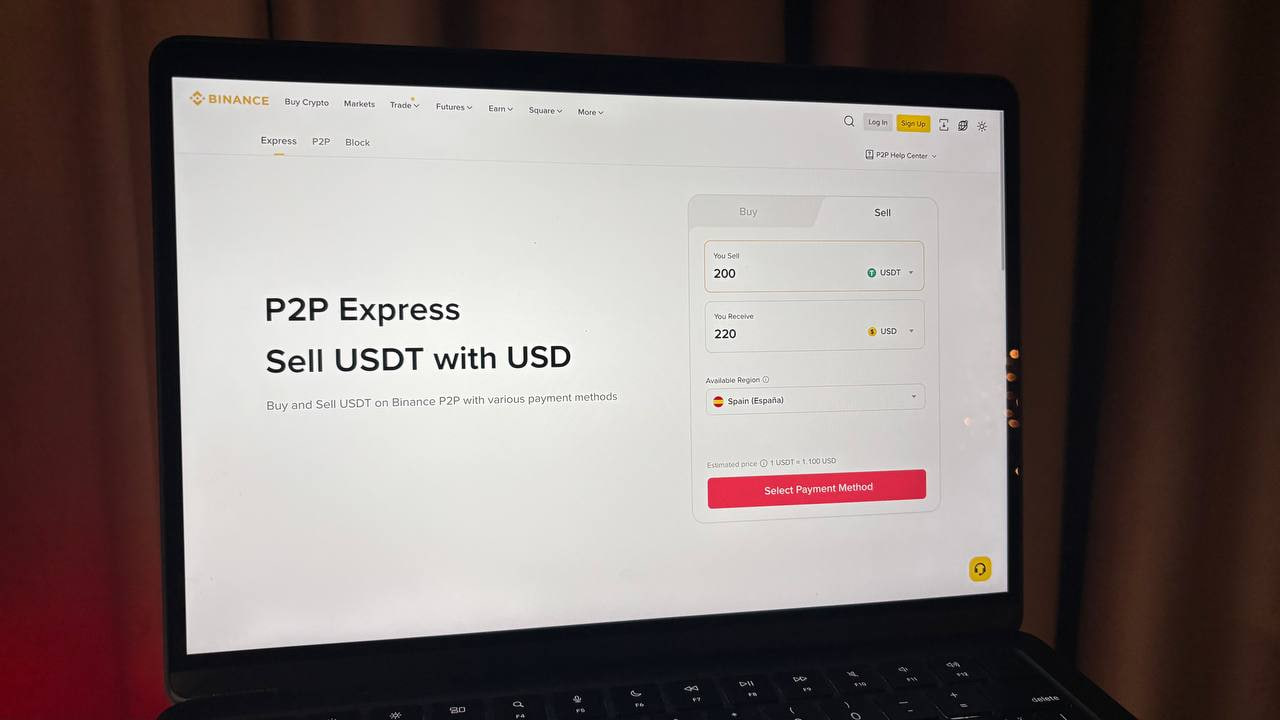

Binance P2P

Score: 4.1/5

Binance is the global crypto exchange, the best choice for volume traders who need massive liquidity and speed rather than anonymity. While it lacks the decentralized ethos, it compensates with an “always-on” marketplace where you can fill orders of any size in minutes, supported by a $1 billion insurance fund.

Benefits

The standout feature is 0% trading fees for takers, allowing you to buy or sell crypto without paying a commission to the platform. Liquidity is unmatched: with support for 100+ fiat currencies and 800+ payment methods, we found it easy to find counterparties for everything from SEPA transfers to local e-wallets. Safety is reinforced by the SAFU fund (Secure Asset Fund for Users), giving you a financial backstop that no decentralized protocol can offer.

Limitations

The trade-off is total centralization. You must complete strict KYC verification, sharing your ID and bank details, which makes it unsuitable for privacy seekers. While the platform fee is zero, the real cost lies in the spread and bank delays–weekend transfers can still get stuck in the banking system. Additionally, unlike Bisq, your account can be frozen if compliance algorithms flag your activity.

Best for

High-volume traders and “ecosystem users” who want to move large amounts of fiat quickly and cheaply without splitting orders.

Strengths:

- Zero fees: Trading on the P2P marketplace is completely fee-free for takers.

- Massive liquidity: Deep order books for USDT, BTC, and ETH across 100+ fiat currencies.

- SAFU protection: Backed by Binance’s $1B insurance fund for extreme cases.

- Merchant quality: “Verified Merchant” badges help filter for professional, reliable counterparties.

Weaknesses:

- No privacy: Mandatory KYC exposes your identity to the exchange and counterparties.

- Bank risk: Trades rely on traditional banking rails, subject to freezes and delays.

- Complex UI: The interface can be overwhelming for beginners compared to simpler apps.

- Compliance freezes: Accounts can be restricted temporarily during security reviews.

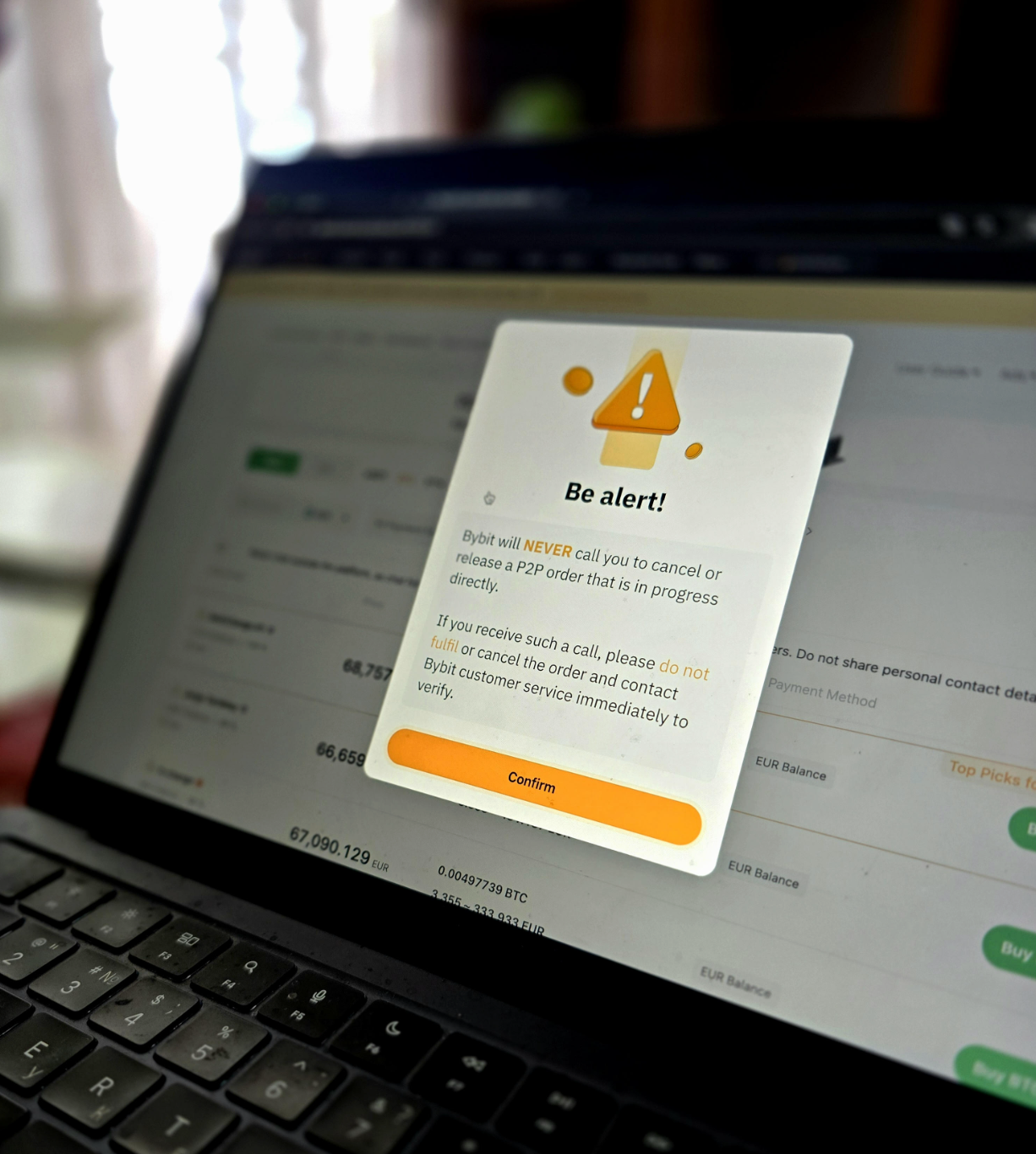

Bybit P2P

Score: 4.1/5

For beginners who find Bisq’s interface intimidating and just want to buy crypto quickly, it is the no-brainer. Bybit bridges the gap between complex P2P markets and simple “convert” tools, offering a streamlined experience that prioritizes speed over sovereignty.

Benefits

The standout feature is the “One-Click Buy” mode, which automatically matches you with a verified merchant, saving you from scrolling through hundreds of ads. In our $100 BTC test trade, the entire process from order creation to coins in wallet took just 19 minutes. Like its competitors, Bybit charges 0% fees for takers, and its escrow system is robust. Our test payment was flagged by Revolut as “unusual,” but the chat interface allowed us to coordinate with the seller to ensure the trade didn’t fail.

Limitations

Convenience costs money. While the “One-Click” mode is fast, our tests revealed it charged a 3.7% spread above market rates, compared to 2.8% for manual selection. Privacy is also compromised: Basic KYC (passport + selfie) took us 18 minutes to verify and is mandatory for all P2P trades. Furthermore, unlike the purely peer-to-peer nature of Bisq, Bybit has faced regulatory warnings in some jurisdictions like Malaysia, which could lead to sudden regional restrictions.

Best for

Beginners and “convenience traders” who want a guided, error-free experience and are willing to pay a slightly higher spread to avoid complexity.

Strengths:

- Execution speed: Our manual BTC trade settled in under 20 minutes.

- One-click mode: Automates ad selection for beginners (though at a premium).

- Zero taker fees: Buyers pay 0% platform fees on P2P orders.

- Liquidity: We found 47 active BTC sellers for a small €50-200 order.

Weaknesses:

- Higher spreads: Automated options can carry premiums of up to 3.7%.

- Banking friction: Our Revolut transfer was flagged, highlighting the risks of fiat rails.

- Regulatory risks: Compliance warnings in multiple regions (Malaysia, France, Japan).

- Mandatory KYC: Requires ID verification, removing the anonymity Bisq users value.

OKX P2P

Score: 3.8/5

If Bisq is the “bunker” for privacy, OKX is the “shopping mall” for liquidity. It is the best alternative for pragmatists who want to buy crypto from zero without the technical headaches. While it requires you to do everything Bisq hates (upload a passport and selfie), it solves Bisq’s biggest problem: you don’t need to already own Bitcoin to get started.

Benefits

The headline feature is the 0% platform fee for both makers and takers, which we verified across three separate test trades. Liquidity for major fiat routes like EUR/SEPA is massive; we found over 40 active sellers instantly, a stark contrast to Bisq’s often empty order books. It also removes the “Chicken and Egg” barrier: you can buy your first USDT or BTC directly with fiat, without needing a pre-existing security deposit.

Limitations

The cost of this convenience is your privacy. Mandatory Level 1 KYC (passport + selfie) took us 22 minutes to complete, linking every trade to your real identity. While the platform fee is zero, the “hidden” costs can be high: our tests revealed a 2.4% spread on USDT and a painful 6.2% spread on BTC compared to spot rates. Support is also sluggish, with generic template responses taking over 8 hours to arrive.

Best for

New users who need to on-ramp fiat quickly and cheaply, and are willing to trade privacy for high liquidity and zero platform fees.

Strengths:

- Zero platform fees: We paid €0 in OKX fees across all buy and sell tests.

- High liquidity: Instant access to 40+ sellers for major routes like EUR/USDT.

- No deposit needed: Allows trading from zero, solving Bisq’s “security deposit” barrier.

- Reliable escrow: Crypto is locked instantly with a clear countdown timer for safety.

Weaknesses:

- Mandatory KYC: Requires full ID verification, completely defeating Bisq’s privacy ethos.

- High BTC spreads: We observed spreads as high as 6.2% on Bitcoin trades.

- Slow support: Customer service took over 8 hours to respond with a generic template.

- Freeze risk: As a centralized platform, OKX can freeze accounts for review at any time.

Best Bisq alternative by user needs

If you want maximum liquidity and an insurance backstop

Choose: Binance

The “Heavyweight” choice. With 0% taker fees and the deepest order books in the industry, you can fill large orders instantly without moving the market. It is backed by a $1B SAFU fund, offering a level of financial protection that Bisq’s decentralized model cannot match.

If you are a beginner who finds P2P intimidating

Choose: Bybit

Its One-Click Buy mode automates the entire process, matching you with a verified merchant in seconds. While you pay a slightly higher spread (~3.7%) for the convenience, it removes the complexity of filtering ads and managing order books manually. The “User-Friendly” Bisq alternative choice.

If you need a flexible fiat gateway with zero fees

Choose: OKX

The “Pragmatist’s” choice. It excels at local currency support (especially EUR/SEPA) with 0% platform fees for both makers and takers. It solves Bisq’s “chicken and egg” problem perfectly, allowing you to buy your first crypto from scratch without needing a pre-existing security deposit.

Summary comparison

Bisq stands alone as the “sovereign” choice: it keeps you in full control of your keys and identity (Tor-routed, no KYC) but demands technical patience and pre-existing Bitcoin to trade.

Binance, OKX, and Bybit represent the “pragmatic” alternative. They solve Bisq’s biggest headaches, providing instant execution, zero-collateral onboarding, and deep liquidity, but they require you to trust a centralized company with your data (KYC) and funds (custodial escrow).

If you are leaving Bisq, you are effectively trading anonymity for accessibility.

| Exchange | Standout | Fees | Assets (P2P) | Fiat Support | PoR / Custody | Best for |

|---|---|---|---|---|---|---|

| Bisq | True DEX: No KYC, Tor-routed, Multisig escrow | ~0.15% – 1.15% (Trading Fee + Mining) | BTC, XMR | Unlimited (Peer-dependent) | N/A (Self-Custody / On-Chain) | Privacy Maximalists & Cypherpunks |

| Binance | Deepest Liquidity: 100+ currencies & SAFU insurance | 0% Taker (Spreads apply) | USDT, BTC, ETH, BNB | 800+ Methods | SAFU Fund + Merkle PoR | Volume Traders & Ecosystem Users |

| OKX | Cost Efficiency: 0% platform fees for Makers & Takers | 0% Platform (Spreads ~2.4%+) | USDT, BTC, ETH | 40+ Currencies | Merkle Tree PoR | Fiat On-rampers & Cost-Conscious |

| Bybit | Ease of Use: “One-Click Buy” & fast execution | 0% Taker (Spread ~3.7% on Auto) | USDT, BTC, ETH | Dozens of Methods | Merkle Tree PoR | Beginners & Convenience Seekers |

Why look beyond Bisq?

While Bisq remains the undisputed king of censorship resistance, its “purity” comes at a steep price: friction. For the average trader in 2026, the platform often feels like a tool from a different era – powerful, but cumbersome. The migration to Bisq alternatives like OKX, Binance, and Bybit is driven by four critical bottlenecks that the DAO has yet to solve.

1. The “chicken and egg” deposit problem

Bisq has a hard requirement: to buy Bitcoin, you must already own Bitcoin.

- The barrier: To prevent spam and fraud, the protocol requires a security deposit (usually 15%–50% of the trade amount) to be locked in a 2-of-2 multisig address.

- The reality: If you are a first-time user trying to get your first satoshis, Bisq is effectively closed to you unless you have a friend to fund your wallet.

Alternatives like Binance or Bybit allow you to start from zero, using fiat to buy your first crypto without any pre-existing collateral.

2. The liquidity drought

Bisq is a niche market. Liquidity is fragmented across hundreds of payment methods, and order books for anything other than BTC/USD or BTC/EUR can be barren.

- The Friction: Finding a counterparty for a specific bank transfer in a smaller currency (e.g., CZK, PLN, or TRY) can take days.

- The Contrast: Centralized P2P desks are “always on.” Professional merchants run automated scripts on platforms like OKX and Binance, ensuring that popular fiat pairs have depth 24/7, allowing you to fill large orders in minutes rather than waiting for a peer to come online.

3. The “heavy” software stack

Bisq isn’t a website; it’s a desktop application that runs a full Bitcoin node (or SPV) and routes all traffic through Tor.

- The performance: It is resource-intensive. Syncing the DAO state and connecting via Tor can be sluggish, often taking minutes just to launch.

- The limitation: There is no official mobile app for trading. If you want to trade on the go, you are out of luck.

Competitors offer slick, native mobile apps that let you clear P2P trades from your phone while waiting in line for coffee.

4. Account limits & “signing”

To prevent chargeback fraud, Bisq imposes strict limits on new accounts.

- The rule: Fresh fiat accounts are often capped at 0.01 BTC (or similar low amounts) until they are “signed” by completing a trade with a trusted peer.

- The bottleneck: This makes it impossible to move significant volume quickly when you are just starting out.

Centralized alternatives allow for much higher limits immediately upon completing their verification tiers.

How we test P2P platforms

At GNcrypto, we put transparency first when evaluating peer-to-peer (P2P) cryptocurrency trading platforms. Our reviews are based on hands-on testing and thorough analysis across all key dimensions that matter for safely buying and selling crypto directly with other users.

We do not audit platform solvency or guarantee user safety from all scams. Instead, our scores reflect observable escrow mechanisms, order book depth, and platform support quality. We do not accept payment for ratings or modify scores based on partnerships.

Categories & weights

We rate P2P platforms on seven criteria. Escrow and Liquidity are weighted heaviest because a platform that isn’t safe or has no one to trade with is useless, regardless of how pretty the UI is.

- Escrow & Trade Safety – 25%

- Liquidity & Order Book Depth – 20%

- Fees & Payment Methods – 15%

- Verification & Account Limits – 15%

- Platform Performance & Reliability – 10%

- User Experience & Trade Flow – 10%

- Customer Support & Dispute Handling – 5%

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.