Binance wallet review 2026: The goods and the bads

GNcrypto analysts tested Binance wallet to see what it has to offer to regular users like you and I. Here’s what we found out.

What Binance Wallet is

Let’s begin our Binance web3 wallet review with the basics.

Binance Wallet is a self-custody wallet embedded inside the Binance app. While assets held on the Binance exchange are fully custodial, and Binance controls the private keys, assets held in Binance Wallet are managed differently.

Instead of a traditional seed phrase, Binance Wallet relies on multi-party computation (MPC) for key management. This means we encountered three things:

- users do not manually store a 12- or 24-word recovery phrase

- private keys are split and secured using Binance’s infrastructure

- control over assets sits with the user, but within Binance’s security framework

This design lowers the risk of users losing access through misplaced seed phrases, one of the most common failure points in self-custody. At the same time, it means Binance Wallet is not fully independent of Binance. It is best understood as self-custody with training wheels, aimed at users who want on-chain access without the full responsibility of managing keys themselves.

Key features & supported assets

After testing Binance Wallet, we think that what’s distinguishable is the way multiple everyday functions are bundled into one place. Let’s analyze what this means for you.

Broad multi-chain support that caters to many

Binance Wallet supports a wide range of EVM-compatible blockchains, including Ethereum, BNB Smart Chain, Polygon, Arbitrum, and several other major Layer 2 networks. In practical terms, this means most tokens and applications that dominate everyday Web3 activity are accessible without additional setup.

For users like us, the benefit is simplicity. Assets across different chains appear in a single interface, and switching networks doesn’t require manual RPC configuration or technical know-how. This is particularly useful for users who move between Ethereum mainnet and cheaper Layer 2s, or who regularly interact with BNB Smart Chain–based applications.

While the wallet doesn’t aim to support every experimental chain, it covers the networks that account for the majority of real-world usage in DeFi, NFTs, and on-chain trading.

Supported cryptocurrencies and networks

We can confirm that the wallet supports a wide range of assets across major networks, including:

- BNB Smart Chain (BSC)

- Ethereum

- Polygon

- Arbitrum and other leading Layer 2 networks

- additional EVM-compatible chains

This allows users to hold major cryptocurrencies, stablecoins, and a wide variety of tokens used in DeFi, gaming, and on-chain trading. Because the wallet is closely integrated with Binance, moving assets between the exchange and the wallet is generally simpler than transferring funds to an external wallet.

NFT compatibility

Binance Wallet includes native NFT support, allowing users to view and manage NFTs directly alongside fungible tokens. NFTs across supported networks appear within the wallet interface, and users can connect to marketplaces or dApps without switching tools.

It’s not positioned as a creator-focused or NFT-trading platform, but it covers the essentials for users who hold NFTs as part of broader crypto activity.

Daily-use functionality

Our review shows that Binance Wallet is designed for active use, not just long-term storage. Users can:

- connect to decentralized applications

- swap tokens using built-in tools

- manage balances across multiple networks

- approve smart contract interactions

For Binance users exploring DeFi or Web3 for the first time, this significantly reduces friction compared to setting up a separate browser wallet.

Binance Wallet in practice

Using Binance crypto wallet is a solid experience. Let us give you a firsthand view.

Setup and onboarding

Setup took under 2 minutes in our test. For existing Binance users, the wallet is created directly within the Binance app through MPC-based key generation — no browser extensions, no seed phrase to write down. The process: tap “Create Wallet” → verify via existing Binance 2FA → wallet ready.

This makes onboarding dramatically smoother than traditional wallets where users must carefully record 12-24 words. For users intimidated by seed phrase management (one of the most common failure points in self-custody), this removes a major psychological barrier. However, it also means Binance Wallet is designed first and foremost for people already inside the Binance ecosystem – you need a Binance account to use it.

Sending, receiving, and managing assets

Sending and receiving crypto works like any modern wallet, but with tighter guardrails. Addresses are generated per network, QR codes are available, and network selection is handled within the interface.

From our testing: sending $10 USDT on BSC to an external address took 8 seconds to confirm with a $0.08 gas fee. The wallet clearly displayed the network, estimated fee, and arrival time before confirmation. Sending $20 ETH on Ethereum mainnet showed gas presets (Slow/Normal/Fast) with dollar estimates – our Normal-speed transaction cost $1.85 and confirmed in 2 minutes.

Binance Wallet does a reasonable job of guiding users away from common mistakes (like sending BSC tokens to Ethereum addresses), though transactions remain on-chain and irreversible once confirmed. Managing assets is where the wallet’s integration shines. Users can view balances across chains, move funds between Binance exchange accounts and the wallet instantly (tested: $15 USDT exchange→wallet transfer was instantaneous), and interact with Web3 applications without juggling multiple apps or browser extensions.

Interacting with Web3

Connecting to decentralized applications is pretty straightforward in our experience. Binance Wallet acts as a signing interface, allowing users to approve transactions and smart contract interactions directly from the app. For many users, this removes the fragmentation that often makes Web3 feel unnecessarily complex.

Pros and cons of using Binance Wallet

After reviewing setup, daily usage, asset support, and how the wallet behaves in real-world conditions, here’s an honest pros and cons take.

Strengths:

- Seamless integration with the Binance ecosystem: Binance Wallet is deeply integrated into the Binance app, and that’s its defining strength. Moving assets between the Binance exchange and the wallet is fast and straightforward compared to transferring funds to an external wallet. For users already active on Binance, this reduces friction dramatically and makes on-chain activity feel like a natural extension of existing workflows rather than a separate toolset.

- Lower barrier to self-custody: Unlike traditional self-custody wallets, Binance Wallet does not require users to manually manage a seed phrase. By using MPC-style key management, it reduces one of the most common points of failure in crypto like lost or mishandled recovery phrases. For users who want some degree of self-custody without the full operational burden, this design makes Web3 more approachable.

- Broad multi-chain and asset support: Binance Wallet supports a wide range of EVM-compatible networks and tokens, covering most assets that everyday users interact with in DeFi and NFTs. Managing balances across chains from a single interface is significantly easier than juggling multiple standalone wallets, especially for users who are not deeply technical.

- NFT and Web3 app compatibility built in: The wallet supports NFTs and connects easily to decentralized applications. Users can view NFT holdings, interact with DeFi protocols, and approve smart contract transactions without installing browser extensions or switching apps. For users exploring Web3 casually or experimentally, this convenience is a real advantage.

- Designed for regular, everyday use: Binance Wallet is clearly meant to be used frequently, not just as long-term storage. Sending and receiving crypto, swapping tokens, and interacting with dApps all happen within a familiar mobile interface. For users who want crypto to feel more like a daily financial tool than a specialized hobby, this design works well.

Weaknesses:

- Not fully independent self-custody: While Binance Wallet is marketed as self-custodial, it is still tightly coupled to Binance’s infrastructure. Users do not control a traditional seed phrase, and the wallet cannot be cleanly separated from the Binance ecosystem. For purists who want maximum independence and the ability to operate entirely outside centralized platforms, this is a meaningful limitation.

- Reliance on Binance as a platform: Because the wallet lives inside the Binance app, access depends on Binance’s availability and policies. If a user’s Binance account is restricted, or if regional or regulatory issues arise, that dependency may become relevant. This is very different from using a standalone wallet that exists entirely outside any exchange relationship.

- Limited appeal for advanced users: Experienced crypto users who already manage hardware wallets, browser wallets, and custom RPC setups may find Binance Wallet too opinionated and constrained. It prioritizes simplicity and safety over flexibility, which can feel restrictive for power users who want granular control over keys, networks, and signing behavior.

- Not a cold-storage solution: Binance Wallet is not designed for long-term, offline storage of significant funds. While it reduces some custody risks compared to exchange balances, it does not replace a hardware wallet for users focused on maximum security and minimal attack surface.

- Web3 risks still apply: Despite the smoother interface, on-chain risks do not disappear. Smart contract approvals, phishing dApps, and irreversible transactions are still part of the experience. Binance Wallet lowers the usability barrier, but it cannot eliminate the underlying risks of interacting with decentralized applications.

Fee comparison

Binance Wallet: Built-in swap on BSC: 0.25% protocol fee (PancakeSwap) + $0.08-0.12 network gas. Ethereum sends: standard network fees ($1.50-2.50 depending on congestion).

MetaMask: Swap via aggregator: 0.875% service fee + network gas. Ethereum sends: same network fees as Binance Wallet.

Trust Wallet: Swap via DEX aggregator: 0-0.5% (varies by DEX) + network gas. No additional wallet fees.

Coinbase Wallet: Swap: up to 1% fee + network gas. Higher than Binance Wallet’s 0.25% on similar swaps. For BSC transactions, Binance Wallet’s tight integration keeps swap fees competitive (0.25% vs MetaMask’s 0.875%). For Ethereum, network fees dominate and all wallets are roughly equal.

Trustworthiness check

Trust is a central question for any crypto wallet – especially one that blends self-custody with a large centralized ecosystem. Here’s how Binance Wallet stacks up from a trust and risk perspective.

Company & custodial model

Binance Wallet operates inside the Binance ecosystem, but it is structurally different from Binance’s exchange wallets. Funds held on the Binance exchange are fully custodial. Funds held in Binance Wallet are not.

Binance Wallet uses a self-custody model based on MPC (multi-party computation) rather than a traditional single private key or seed phrase. Users retain control over assets at the wallet level – Binance does not simply hold a pooled balance on the user’s behalf. Transactions require cryptographic authorization tied to the user, not a centralized ledger entry.

However, this is not absolute self-sovereignty. Key management and recovery are tightly integrated with Binance’s systems. Users are trusting Binance’s infrastructure and security model rather than holding a fully portable private key themselves.

This places Binance Wallet in a hybrid trust category: more user-controlled than a custodial exchange wallet, but less independent than a standalone browser or hardware wallet.

Security & fund protection

From a practical security standpoint, Binance Wallet is designed to reduce the most common causes of fund loss. There’s no manually stored seed phrase that can be lost or phished. Strong account-level security inherited from Binance (2FA, device checks, activity monitoring). Transaction confirmations integrated into a hardened app environment.

We did not find publicized incidents involving large-scale loss of user funds specifically attributable to Binance Wallet itself.

That said, the security model introduces different risks: reliance on Binance’s operational security, exposure to account-level compromise rather than just key compromise, and dependence on Binance’s continued operation and policies.

Unlike regulated financial custodians, there is no government-backed protection, no insurance guarantee for wallet funds, and no segregation through independent clearing entities.

Recovery & control trade-offs

Binance Wallet’s recovery system is one of its biggest strengths – and one of its biggest trade-offs.

Because recovery does not rely on a traditional seed phrase, users are far less likely to permanently lose access due to human error, and recovery is more user-friendly than most self-custody wallets.

However, recovery is tied to Binance’s account and security framework. Users cannot freely restore the wallet in any environment using a seed phrase – independence is reduced in exchange for convenience.

This model favors practical safety over ideological purity.

Regulatory context

Binance Wallet itself is not a regulated financial product, and holding assets in the wallet does not grant the protections associated with regulated brokers or banks.

Regulatory exposure instead comes indirectly through Binance as a company, which operates under varying regulatory frameworks depending on jurisdiction. There’s no universal investor protection scheme, no guaranteed recourse in the event of disputes, and outcomes may vary based on local regulation and Binance’s compliance posture.

This is fundamentally different from regulated custody solutions, but also different from fully anonymous, protocol-only wallets.

Transparency & reputation

Binance is one of the most widely used crypto platforms globally, with a long operating history and extensive public scrutiny. Binance Wallet benefits from:

- a large security team and mature infrastructure

- ongoing updates and maintenance

- integration into a platform used by millions of users

At the same time, Binance’s scale and regulatory challenges are well known. Trust in Binance Wallet is inseparable from trust in Binance as an operator.

User sentiment around Binance Wallet generally highlights ease of use, reduced risk of user-side mistakes, and convenience for interacting with Web3.

Criticism tends to focus on reliance on Binance, lack of traditional seed-phrase ownership, and concerns from users who prefer maximum independence.

Overall trust assessment

Binance Wallet is not trustless, and it does not claim to be. It is also not purely custodial. Instead, it occupies a middle ground between exchange wallets and fully independent self-custody tools.

- If your definition of trust is absolute control, portability, and independence, Binance Wallet may fall short.

- If your definition of trust is reduced user error, strong operational security, and practical safety, Binance Wallet performs well.

Bottom line: Binance Wallet is best suited for users who want a safer, simpler path into self-custody without abandoning the Binance ecosystem. It trades some independence for convenience and security, and that trade-off is explicit rather than hidden.

Testing process

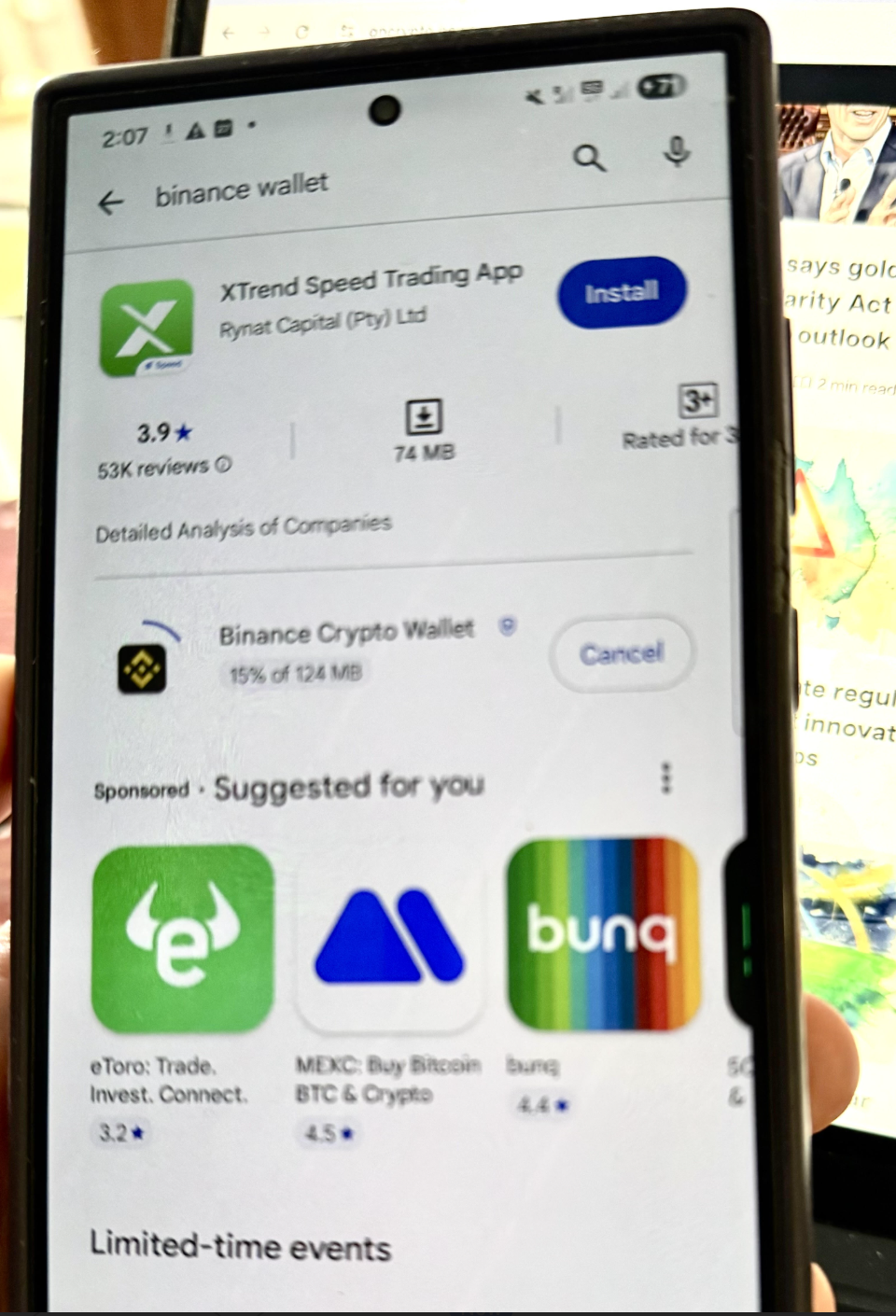

We installed Binance Wallet within the Binance mobile app and created a new wallet in under 2 minutes – no seed phrase to write down, just MPC-based setup through existing Binance account verification.

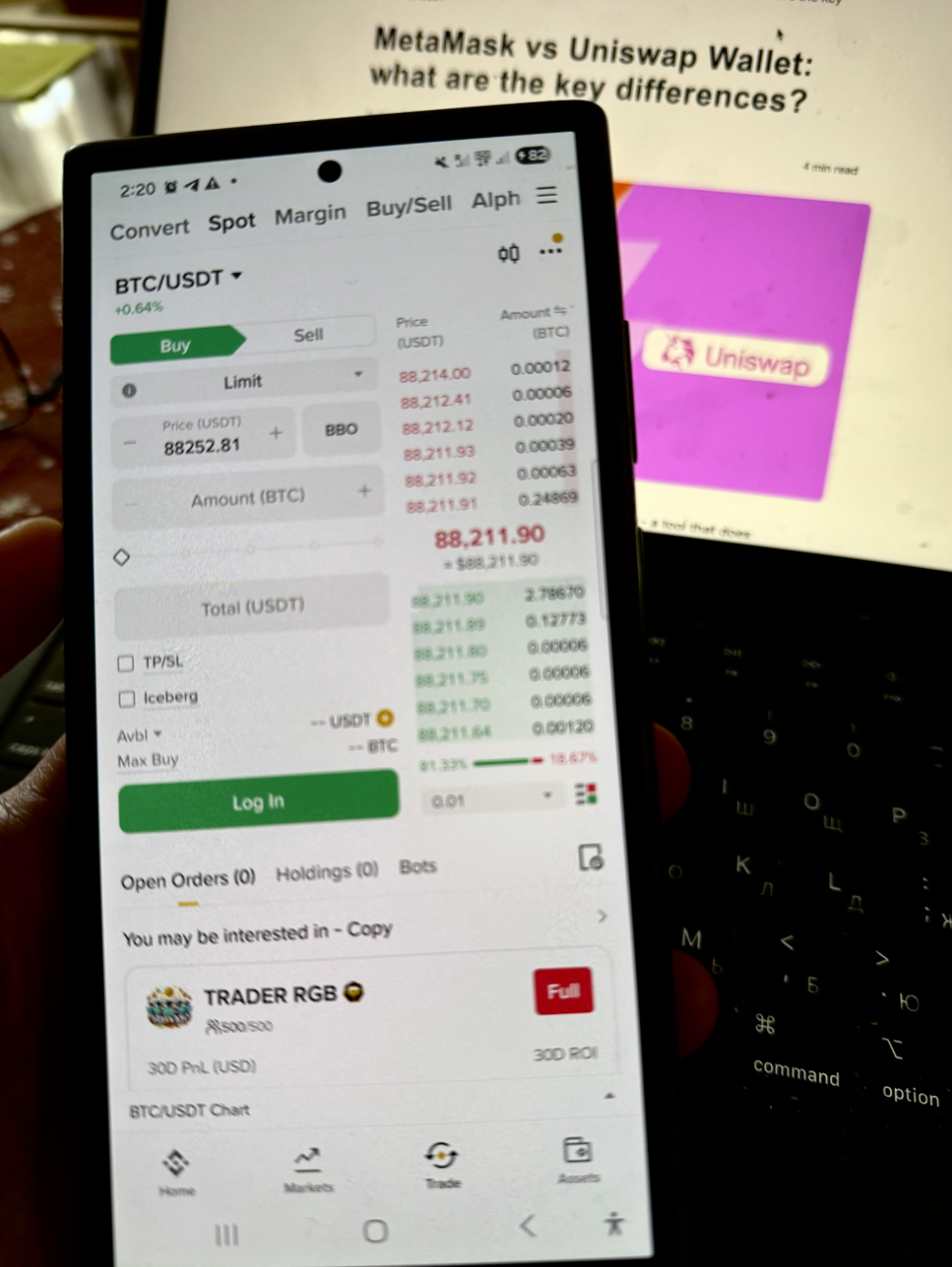

Transaction tests: we sent $15 USDT from Binance exchange to Binance Wallet on BNB Smart Chain. Transfer was instant (no network confirmation needed since both are within Binance infrastructure). We then sent $10 USDT from Binance Wallet to an external MetaMask address on BSC – network fee: $0.08, confirmation time: 8 seconds.

Cross-chain test: we sent $20 ETH from Binance Wallet to an external address on Ethereum mainnet. Gas fee quoted: $1.85 (Normal speed), actual confirmation: 2 minutes. The wallet displayed clear gas presets (Slow/Normal/Fast) with estimated times.

Swap test: we swapped $50 USDC for ETH using Binance Wallet’s built-in swap feature on BNB Smart Chain. The swap routed through PancakeSwap, showing 0.25% protocol fee + $0.12 network gas. Total cost: $0.37 (0.74%). Execution took 6 seconds.

dApp connection: we connected Binance Wallet to PancakeSwap and Uniswap (via Ethereum network switch). Connection was seamless – approve within the app, sign transactions directly. No WalletConnect setup needed. We also tested viewing NFTs: a test NFT on Polygon appeared in the wallet’s NFT gallery within 30 seconds of receiving it.

Recovery test: since Binance Wallet doesn’t use traditional seed phrases, we tested recovery by logging into the same Binance account on a second device (iPad). The wallet and all balances appeared immediately after account login and 2FA verification – total time: under 1 minute. No seed phrase entry, no manual restoration.

GNcrypto’s overall Binance Wallet rating

After testing Binance Wallet with real transactions across BNB Smart Chain, Ethereum, and Polygon, the wallet delivered on its core promise: making self-custody accessible without seed phrase management. Setup took under 2 minutes, cross-platform recovery was instant (tested on iPad), and swap fees on BSC were competitive (0.25% vs MetaMask’s 0.875%). We rated it highly for user experience and multi-chain support but noted that it trades full independence for convenience – recovery depends on Binance account access, and the wallet can’t be exported to non-Binance environments.

| Criteria | Weight Score (1-5) | Notes |

|---|---|---|

| Security & Key Management (25%) | 4 | Binance Wallet uses MPC-based key management, removing the need for users to manually store seed phrases. This significantly reduces the risk of user error—one of the most common causes of lost funds in self-custody. From a practical safety perspective, this is a strong design choice for mainstream users. However, it comes with trade-offs. Users do not have full, independent control over a traditional private key, and the wallet remains tightly coupled to Binance’s infrastructure. For purists, this is a compromise; for most users, it’s a net gain in usability and safety. |

| Supported Assets & Networks (20%) | 4.5 | Binance Wallet supports a wide range of major cryptocurrencies, tokens, and EVM-compatible networks, including Ethereum, BNB Smart Chain, Polygon, Arbitrum, and other leading Layer 2s. This covers the vast majority of assets used in DeFi, NFTs, and on-chain trading. For most users, asset and network support is more than sufficient, and the ability to manage multiple chains from a single interface is a major advantage. |

| Transaction Costs & Speed (15%) | 4.0 | Transaction speed and cost depend largely on the underlying network rather than the wallet itself. Binance Wallet does not add visible extra fees on top of standard network costs, and transactions are submitted quickly and reliably. Where it stands out is convenience—network selection, fee estimation, and confirmations are handled cleanly, reducing friction and common mistakes. It won’t make Ethereum cheap during congestion, but it won’t slow you down either. |

| User Experience & Interface (15%) | 4.5 | This is one of Binance Wallet’s strongest categories. The interface is clean, familiar, and easy to navigate—especially for existing Binance users. Managing assets, sending and receiving crypto, and interacting with Web3 apps all happen in a single, coherent flow. The wallet prioritizes clarity over customization, which works well for most users but may feel limiting to advanced users who want granular control. |

| DeFi & dApp Integration (10%) | 4.0 | Binance Wallet integrates smoothly with DeFi protocols and Web3 applications. Users can connect to dApps, approve transactions, swap tokens, and interact with NFTs without installing browser extensions or managing multiple wallets. While it may not support every niche protocol or advanced signing feature, it covers the majority of mainstream DeFi and NFT use cases effectively. |

| Recovery & Backup Systems (10%) | 4.0 | By eliminating traditional seed phrases, Binance Wallet reduces catastrophic user mistakes. Recovery relies on Binance’s security systems and account protections, which are robust for most users. The trade-off is clear: recovery is easier, but also more dependent on Binance. Users cannot simply restore the wallet anywhere with a seed phrase, as they would with a standalone wallet. |

| Customer Support & Educational Resources (5%) | 3.5 | Binance provides extensive documentation and general customer support, and Binance Wallet benefits from this ecosystem. However, wallet-specific, in-depth self-custody education is limited compared to dedicated wallet providers. Support is adequate and accessible, but not deeply specialized. |

| Final score | 4.2 | Binance Wallet scores highly because it prioritizes practical security, ease of use, and ecosystem integration over ideological purity. It is not designed for maximum independence or hardware-level security, but for real-world usability at scale. Best suited for: Users already on Binance who want a smooth, low-friction way to access Web3, DeFi, and NFTs without managing seed phrases or multiple wallets. Less suited for: Users who demand absolute self-custody, offline cold storage, or full independence from centralized platforms. Bottom line: Binance Wallet succeeds at what it aims to be – a gateway wallet that makes self-custody usable for millions, even if it stops short of full sovereignty. |

Who Binance Wallet fits based on testing

Based on hands-on use of setup, daily transactions, asset management, and Web3 interactions, Binance Wallet is clearly designed for a specific type of crypto user, rather than everyone in the market.

Best for:

- Existing Binance users who want an easy way to move from exchange-based trading into on-chain activity;

- users exploring DeFi, NFTs, and Web3 apps without wanting to manage seed phrases or multiple wallets;

- traders who value convenience and tight integration over full independence;

- users who plan to use a wallet regularly for sending, receiving, swapping, and interacting with dApps rather than as long-term cold storage.

Skip if:

- You prioritize absolute self-custody and manual key control; you rely on hardware wallets for security;

- you want a wallet that operates entirely outside any centralized platform;

- you rarely interact with Web3 and only need simple long-term storage;

- you are uncomfortable with relying on Binance’s infrastructure and policies as part of your wallet experience.

How we test hot crypto wallets

At GNcrypto, we put transparency first when evaluating hot cryptocurrency wallets. Our reviews are based on hands-on testing and thorough analysis across all key dimensions that matter for self-custody and daily crypto use.

What We Test: we rate hot wallets on seven criteria that matter when you’re actually storing, sending, and using crypto. Each wallet gets a score from 1.0 to 5.0 based on weighted performance across security, asset support, transaction costs, and user experience.

Our focus: Can you store assets safely, transact efficiently, and access DeFi without exposing your keys to unnecessary risk?

We don’t audit wallet code or guarantee security against all attack vectors. These scores reflect usability, feature completeness, and observable security practices – not absolute protection from exploits.

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.