Binance P2P trading: how it works, and what it really costs

We tested Binance P2P the way a regular trader would: bought and sold USDT and BTC in local currencies, used popular payment methods, opened and cancelled ads, and checked how escrow, time limits, and disputes work in practice. We watched how spreads and fees change with order size, what happens when a counterparty delays payment or sends fake proofs, and how quickly support steps in.

Liquidity & Volume

5.0

Payment Methods

4.0

Liquidity & Volume

4.0

Payment Methods

4.0

Liquidity & Volume

4.0

Payment Methods

4.5

Liquidity & Volume

3.5

Payment Methods

4.5

Liquidity & Volume

4.5

Payment Methods

4.0

Withdrawing funds from an exchange directly to a card or bank account is not always possible or straightforward. In some jurisdictions, exchanges do not work with local banks at all. In others, withdrawals are technically available but run into bank restrictions, currency controls, or inflated fees. Some regions lack support for required payment systems, while in others transactions can be delayed for days due to compliance checks.

As a result, a simple crypto sale turns into a series of obstacles. Some users give up altogether, while others move to P2P platforms, where they can deal directly with another person and use familiar local payment methods.

That said, not every P2P platform offers sufficient liquidity in the needed currency, reliable protection against fraud, or effective support in disputed trades.

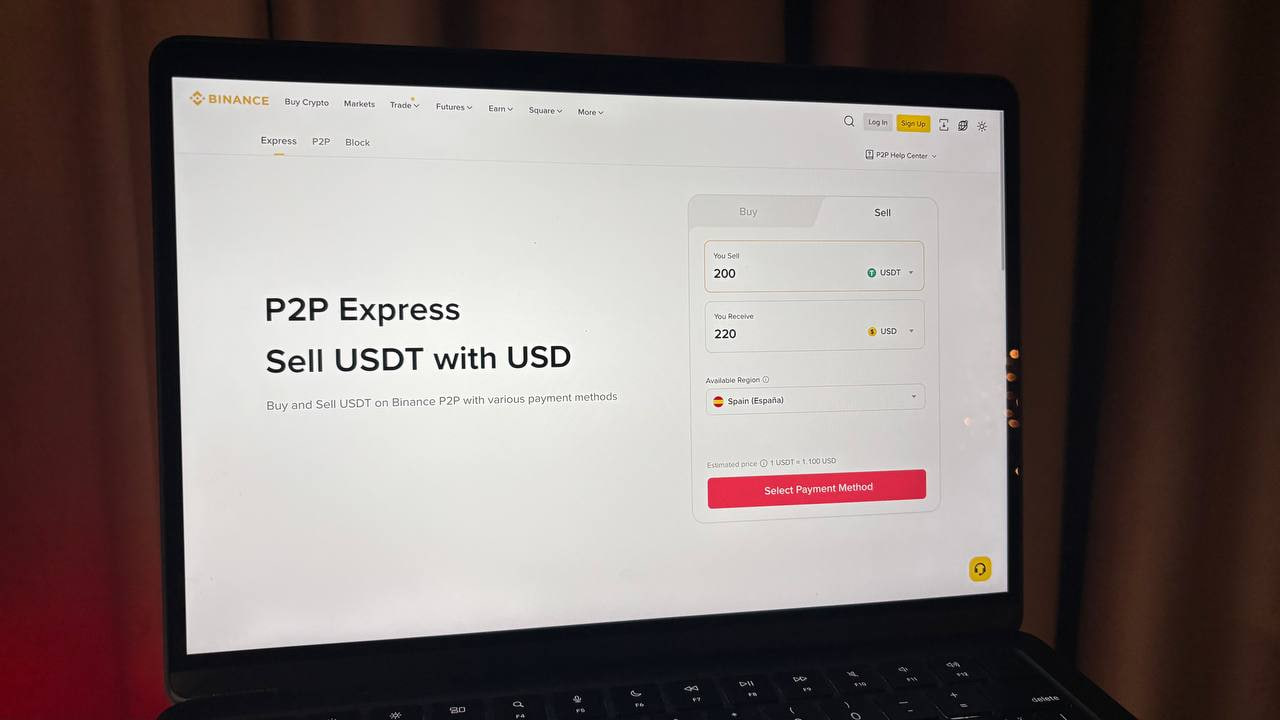

For this reason, we tested Binance P2P in this review. We completed registration and verification ourselves, posted and accepted offers, attempted to convert $200 into USDT, ETH, and USDC, and tested settlements using euro cards and popular payment methods.

GNcrypto’s overall Binance P2P rating

| Criterion | Score |

|---|---|

| Escrow & Trade Safety | 4.0 |

| Liquidity & Order Book Depth | 5.0 |

| Fees & Payment Methods | 4.0 |

| Verification & Account Limits | 3.5 |

| Platform Performance & Reliability | 4.5 |

| User Experience & Trade Flow | 4.0 |

| Customer Support & Dispute Handling | 3.5 |

| Total | 4.15 / 5.00 |

Is Binance P2P safe and worth using in 2026?

Short answer: Binance P2P is the best-in-class option for high-volume P2P trading if you’re comfortable with KYC and bank transfers.

Our verdict after testing:

Binance P2P scored 4.15/5 in our P2P methodology – the highest score among tested platforms. The platform offers zero trading fees, deep liquidity on major routes (USDT, BTC, ETH), and robust escrow protection.

Use Binance P2P if:

- You regularly move fiat in and out of crypto (not just 1-2 times per year)

- You’re already verified on Binance and comfortable with KYC

- Your local currency has active listings with familiar payment methods

- You want zero trading fees and better rates than direct exchange withdrawals

Skip Binance P2P if:

- Anonymity is a priority (full KYC required, bank details shared with counterparty)

- You want one-click, hands-off withdrawals (P2P requires manual checks and confirmations)

- You’re new to P2P and find the interface overwhelming

Key safety reminder: Binance P2P runs on escrow + SAFU fund (~$1bn). The platform has survived major incidents (2019 hack: 7,000 BTC covered; BNB Bridge exploit; $4.3bn DOJ settlement) without retail user losses. However, escrow doesn’t protect against user errors (fake payment screenshots, off-platform trades, chargebacks).

How it compares:

- vs. Remitano: Higher liquidity, zero fees (vs. 1% maker fee), stricter KYC

- vs. Paxful: Better liquidity on major routes, fewer exotic payment methods

- vs. LocalBitcoins (shut down): Binance P2P is the top remaining option for high-volume traders Full breakdown below

Overview of Binance P2P marketplace

In our view, Binance P2P Marketplace is best understood as an exchange-integrated market where users trade directly with each other, choosing the local currency, price, and payment method. Unlike spot trading, transactions run through escrow. When you place an order, the crypto is locked by Binance until the counterparty confirms payment. The platform charges no trading fees for these deals. Buying and selling are fee-free, with Binance relying on volume and turnover instead.

According to official data, Binance P2P supports over 100 fiat currencies and roughly 800-1,000 payment methods, ranging from bank transfers to local fintech services.

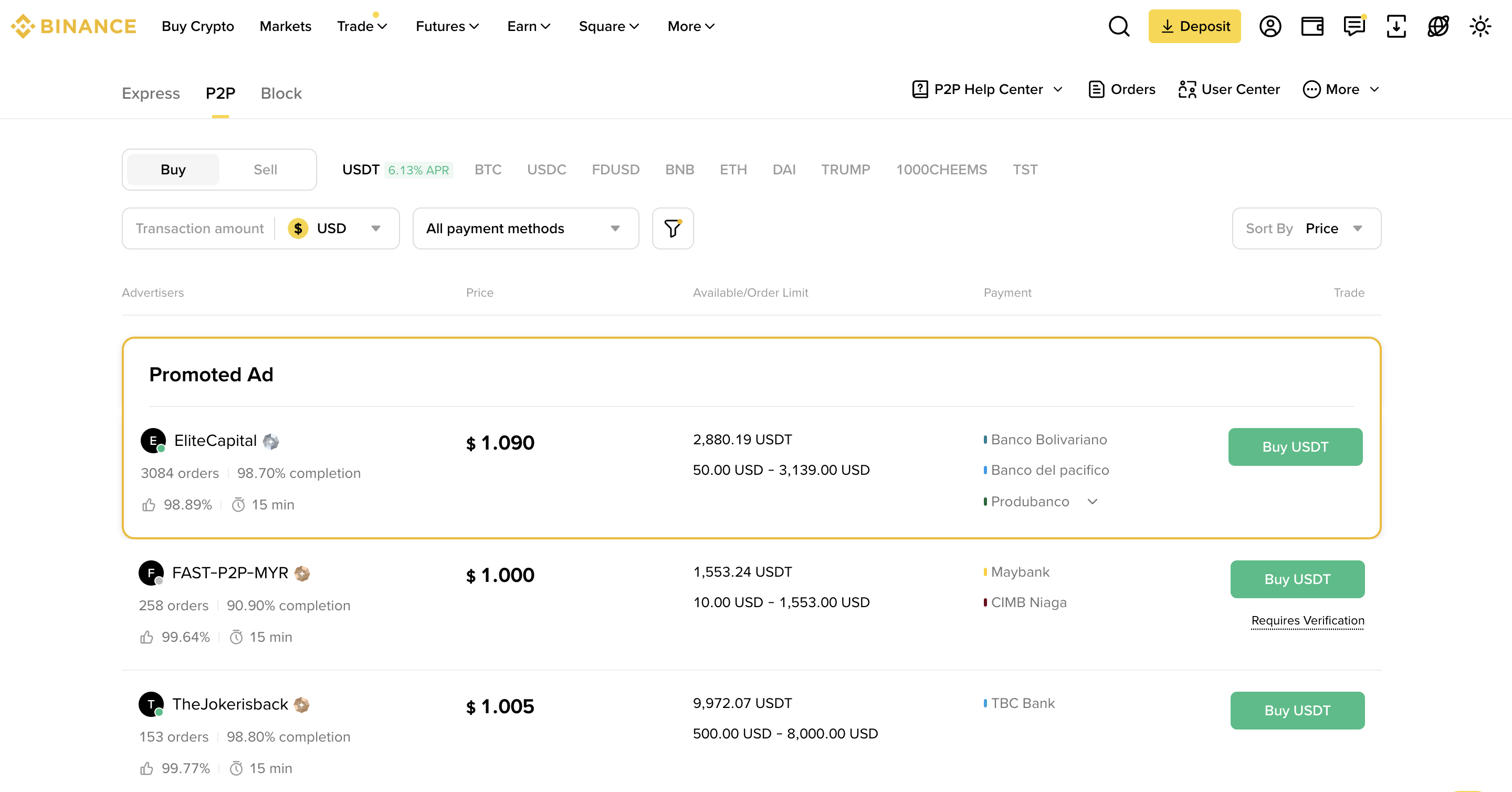

We reviewed the P2P interface, which is split into Buy and Sell tabs and immediately shows the key trade parameters.

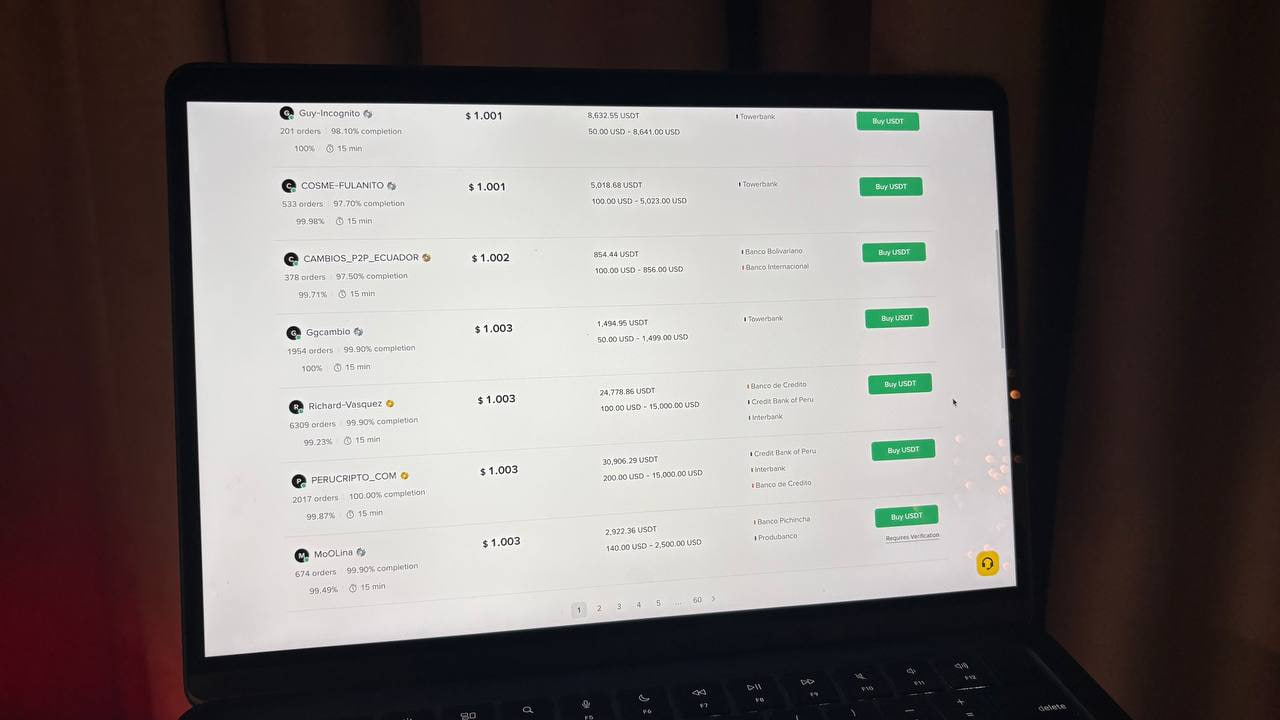

At the top, we selected the asset (USDT, BTC, USDC, ETH, and others) and the fiat currency. Below that are filters for payment methods and sorting by price or seller rating. Each listing appears as a card with the seller’s nickname, merchant badge, number of completed trades, completion rate, and amount limits, for example “$20,000-$30,000 COP”. The card also shows the payment time limit, available payment channels, and a Buy USDT or Sell button.

In our test, this set of metrics was sufficient to quickly filter out questionable counterparties and focus on sellers with high volumes and strong completion rates.

As part of this Binance P2P review, we tested two modes. Express automatically selects a counterparty at the best available price, while Classic lets you manually choose an offer from the list.

For active traders, there is a merchant program with advanced order settings and prioritized listings. Trades are protected by escrow and 24/7 support, but the real cost is driven not by exchange fees, but by the spreads set in listings and the quality of counterparties, which we will revisit in the following sections.

Assets, fiat, and payment coverage

In terms of asset coverage and fiat support, Binance P2P is one of the most flexible platforms we tested. According to official data, the marketplace supports more than 100 fiat currencies and over 800 payment methods, ranging from traditional bank transfers and cards to local fintech services and e-wallets. Our experience confirms this.

You can trade more than just USDT. The list includes BTC, ETH, BNB, USDC, and several other liquid assets. The exact selection depends on your region and chosen fiat currency. In practice, this means that usability usually depends less on Binance P2P fees and more on whether suitable listings exist for your local currency and bank.

To exchange crypto via P2P, we first selected the required bank and fiat currency. In our case, it was USDT and USD. We set USDT in the top menu, chose USD as the fiat currency, and filtered listings to match our bank cards. We then focused on three key factors: price, trade limits, and seller statistics, including the number of orders and completion rate. We ultimately chose sellers with high volume and completion rates above 98%.

We then opened an order, entered the amount (about $200 in our test), and confirmed the trade.

At that point, Binance locked the equivalent amount of USDT from the seller in escrow and displayed a countdown timer for sending or receiving payment. We completed the payment manually through our banking app using the details provided in the order. After sending the transfer, we marked the payment as completed and uploaded the receipt.

When selling crypto, we simply waited for the funds to arrive in our bank account and then confirmed receipt in the P2P order window.

In one test, we deliberately delayed payment and attempted to cancel the order. The system automatically closed the trade once the timer expired and returned the crypto to the seller. If a dispute were to arise, for example if funds were sent but the seller claimed not to see them, the next step would be to open a support ticket directly from the order. A moderator would then request evidence from both parties and decide who receives the locked crypto.

First trade safety checklist

Before you confirm any P2P order:

✅ Counterparty Stats: Aim for 98%+ completion and 500+ trades.

✅ Identity Match: The name in the bank app MUST match the name on the platform. No third-party payments.

✅ No Crypto Keywords: Leave bank transfer remarks blank or use only the provided code. Never write “crypto” or “BTC”.

✅ Verify Manually: If selling, log into your bank app to see the funds. Never trust screenshots or SMS notifications.

✅ Stay Inside: Keep all chats and payments within the platform’s official window. Ignore “let’s move to Telegram.”

✅ Evidence: Take a screenshot of the successful transfer within your banking app.

✅ Red Flags: Requests to pay a “friend’s card” or pressure to release crypto before you’ve seen the money.

If anything feels wrong, cancel the trade or open a dispute immediately.

Who Binance P2P is ideal for

We think Binance P2P works best for users who value volume and speed. This includes traders who regularly move fiat in and out through banks, are comfortable with KYC, and can work within standard banking hours. For these users, the advantage is consistent liquidity on popular routes, allowing orders of a few thousand dollars to be filled without splitting the trade across dozens of small listings.

The platform is least suitable when anonymity is a priority. If you are not willing to share bank details, identity documents, and contact information with a counterparty, the P2P model itself will feel uncomfortable.

Our verdict: Binance P2P makes sense as a tool for users already within the Binance ecosystem who trade regularly and want to reduce Binance P2P trading fees without sacrificing liquidity. For occasional transfers once or twice a year, or for users who prioritize privacy, the platform may feel overly complex and demanding.

Pros, cons & limitations

How Binance P2P behaves in daily use:

Strengths:

- high liquidity for USDT and major coins on popular routes

- zero Binance trading fees, with most costs coming from spreads and bank charges

- flexible filters by currency, bank, limits, and seller ratings, with trades protected by escrow and a countdown timer

Weaknesses:

- part of the fraud risk still rests with the user, requiring manual checks of counterparties and payment details

- trades depend on banks, so weekends, transfer limits, and reversals can easily disrupt a “quick withdrawal” scenario

- the interface can feel overwhelming for beginners, especially on first contact with P2P and a large number of payment methods

- strict KYC and compliance, meaning P2P access can be temporarily restricted along with the rest of the account if suspicious activity is flagged

Binance P2P is well suited for users who are comfortable with bank transfers, understand how escrow works, and are willing to handle extra manual steps in exchange for better rates and zero trading fees.

For those who want the simplest, one-click, hands-off withdrawal possible, the P2P format on Binance may feel overly complex and stressful.

Trustworthiness check

Binance P2P relies on the same security framework as the main exchange. All P2P trades run through escrow. Once an order is opened, the seller’s crypto is locked by Binance and cannot be released until payment is confirmed or a dispute is resolved in favor of one party.

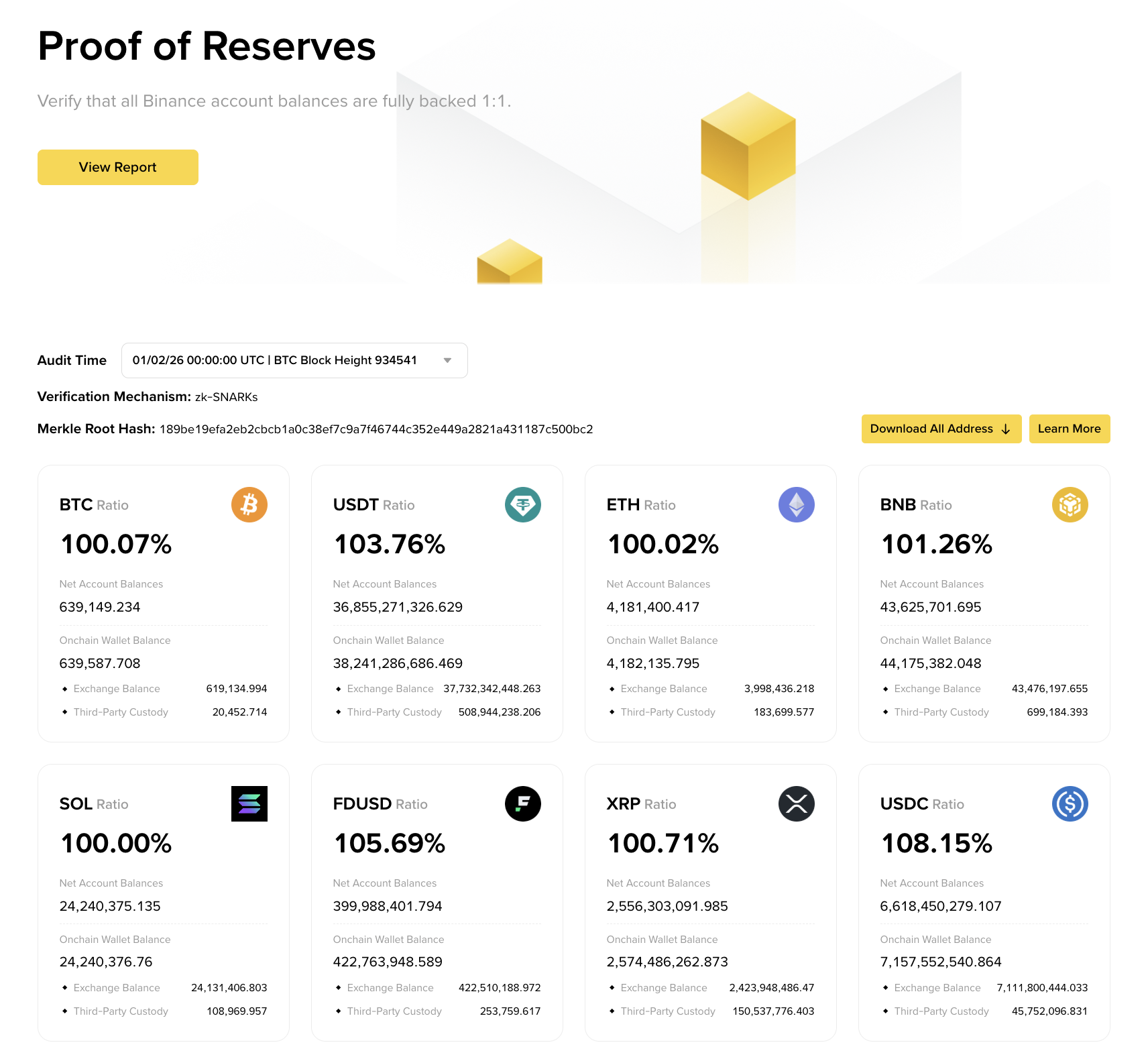

The exchange publishes Proof of Reserves and states that user assets are held 1:1 with no leverage. For extreme cases, it maintains the SAFU insurance fund, estimated at around $1bn in equivalent value.

A separate layer focuses specifically on P2P risk management. Binance regularly publishes guides and warnings about common schemes, including fake payment screenshots, requests to trade off-platform, card and PayPal chargebacks, and social engineering scams.

We decided to test what happens if an order is not paid. We created a USDT sell order from one account and accepted it as a buyer from another, but deliberately did not send the transfer. The seller marked the payment as not received, and the trade was escalated to moderators.

Binance then reviewed the chat, timestamps, and requested proof of payment from the buyer. Since no receipt was provided, moderators determined that the buyer was acting in bad faith and released the locked USDT back to the seller.

Binance’s history is not spotless. In 2019, the exchange was hacked for 7,000 BTC, but all losses were fully covered from the SAFU fund with no impact on user balances. Later incidents included the BNB Bridge exploit, with damages in the hundreds of millions, and a major settlement with the US Department of Justice over AML issues totaling $4.3bn, while the exchange remained the largest platform in the market.

These episodes highlight two things at once:

- First, even a top-tier exchange is not immune to mistakes or regulatory pressure;

- Second, Binance has sufficient resources to absorb major incidents without direct losses for retail users.

In our experience, Security on Binance P2P is a combination of platform safeguards and user discipline. Escrow and SAFU reduce the risk of systemic fund loss, but they do not protect you from trusting a fake payment screenshot, missing a chargeback, or following a malicious link to Telegram.

For this reason, Binance P2P should be viewed as a relatively reliable infrastructure with a proven financial backstop. Still, every order requires manual counterparty checks, confirmation of payment through bank statements, and careful handling of account access and 2FA.

How we test P2P crypto platforms

At GNcrypto, we put transparency above marketing. In our reviews of P2P platforms, we rely on hands-on experience rather than promotional claims. We fund accounts, complete real trades as both buyers and sellers, test escrow and limits, and observe how the platform handles disputes. Each test typically lasts 7-14 days and covers the full exchange cycle.

We are not auditors and cannot guarantee protection from every form of fraud. The scores in our tables reflect what we can directly observe and verify, such as how escrow works, the depth of listings, and support response times, rather than any theoretical “absolute security” or the company’s overall financial strength.

Categories & weights

We evaluate P2P platforms across seven criteria. Transaction security and liquidity matter most, so these factors carry greater weight in the final score.

- Escrow & Trade Safety – 25%

- Liquidity & Order Book Depth – 20%

- Fees & Payment Methods – 15%

- Verification & Account Limits – 15%

- Platform Performance & Reliability – 10%

- User Experience & Trade Flow – 10%

- Customer Support & Dispute Handling – 5%

We first assign a score from 1 to 5 for each criterion, then multiply it by the criterion’s weight and sum the results. This produces the final score we use to compare Binance P2P with other P2P platforms.

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.