Binance holds 89% of Trump family stablecoin, data shows

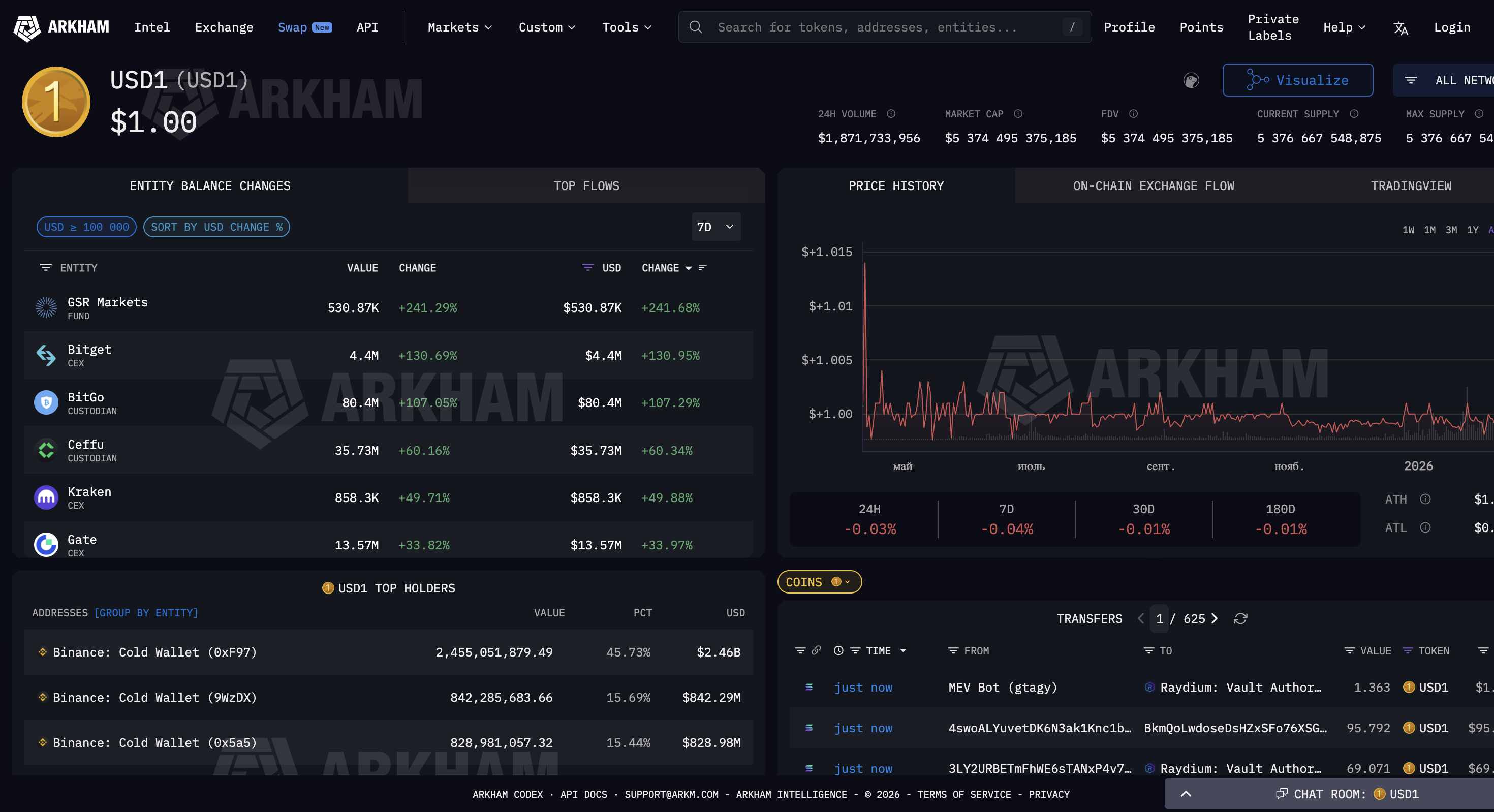

Binance has become the custodian of 89% of the USD1 stablecoin tied to the Trump family’s crypto project, raising new questions about centralization and risks for World Liberty Financial.

World Liberty Financial – the crypto project linked to the family of Donald Trump – has drawn renewed attention after on-chain data showed that Binance holds 89% of the entire USD1 stablecoin supply. That amounts to nearly $473 million in tokens sitting on exchange wallets, effectively making Binance the sole custodian of the asset.

The level of concentration has sparked concerns, especially given the scale of WLFi’s ambitions and the project’s assertive branding as an “American stablecoin.” WLFi had positioned USD1 as a more transparent alternative to USDT and USDC, claiming a superior, more resilient settlement infrastructure. But the reality of near-total liquidity centralization on a single exchange has cast doubt on those claims.

Since launch, the WLFi team has maintained that USD1 is backed by high-quality assets and designed for use by mainstream consumers rather than niche crypto markets. Yet the distribution of reserves suggests that most USD1 activity flows through Binance, and the stablecoin has yet to gain meaningful adoption among other custodians or institutional partners.

Analysts note that the situation resembles the early days of USDT, when liquidity was similarly concentrated on a single platform. But given today’s heightened regulatory scrutiny – and the political sensitivity surrounding WLFi – the risks appear more pronounced. Dependence on one exchange leaves USD1 exposed to operational outages, regulatory interventions, or technical failures.

Community discussions point to another issue: the concentration may signal weak organic demand. Blockchain data shows that a large portion of USD1 has never left Binance wallets, suggesting that most activity remains limited to WLFi’s internal operations or market-making flows rather than real user adoption.

WLFi representatives have previously said the project is in an “active scaling phase” and in talks with payment firms and financial institutions. But no concrete partnerships have been announced, and the current reserve distribution indicates that the ecosystem remains in an early, underdeveloped state.

As interest grows around politically affiliated crypto initiatives, USD1 continues to face questions about transparency, resilience, and genuine market demand. For now, the chain data is clear: nearly the entire stablecoin supply is effectively controlled through Binance infrastructure – a stark contrast to WLFi’s stated goal of building a more decentralized, distinctly “American” digital dollar.

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.