Binance Futures 2026: a full review of the derivatives trading platform

GNcrypto’s finance team put Binance Futures to the test with live futures trades, evaluating fees, leverage, order execution, and overall usability. After analyzing liquidity, contract variety, and trust signals, we gave the platform a 4.4/5.

Fees & Funding

4.5/5

Leverage & Margin

4.5/5

Fees & Funding

4.2/5

Leverage & Margin

4.2/5

Fees & Funding

4.2/5

Leverage & Margin

4.3/5

Fees & Funding

4.4/5

Leverage & Margin

4.2/5

Fees & Funding

3.5/5

Leverage & Margin

3/5

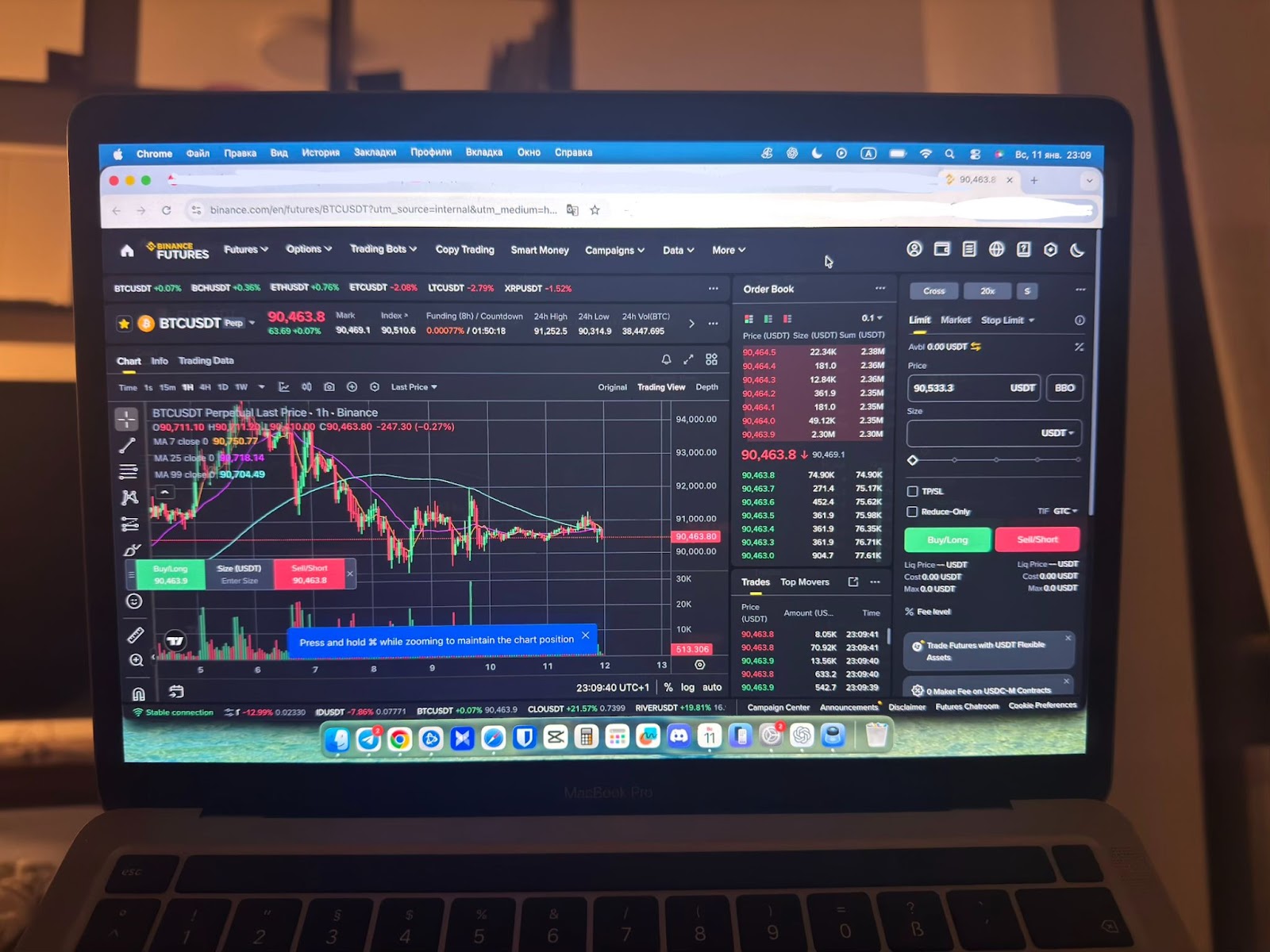

Binance Futures is a platform for trading cryptocurrency derivatives, offering a wide range of futures contracts and high leverage. We tested the platform with a $200 deposit, opening BTC/USDC and ETH/USDC perpetual positions with 10x and 20x leverage. Trading fees were in line with the published rates: we paid $0.98 in taker fees on a $2,000 position (0.049%), and $0.40 in maker fees on another $2,000 position (0.02%), order execution was stable on major pairs, and funding rates were applied every 8 hours, which increased costs for long-term positions. The platform is designed for experienced traders comfortable with leverage and is less suitable for beginners.

What Binance Futures is

Binance Futures operates as a standalone derivatives platform within Binance, rather than just an extension of its spot trading. Here, users don’t buy cryptocurrency directly; instead, they trade futures contracts, speculating on the asset’s price movement – up or down, which is central in any Binance Futures review.

Unlike spot trading, where you own the underlying asset, Binance Futures allows you to open both long and short positions without actually holding the cryptocurrency. This immediately changes the trading logic: the platform is designed for speculation, hedging, and actively capitalizing on market volatility.

Binance launched Futures in September 2019, and this product quickly became a major growth driver for the exchange. During our testing week (Jan 5-11, 2026), BTC futures averaged $31B daily volume vs. $2.8B on the BTC/USDC spot pair on Binance’s main platform. This clearly illustrates where trader interest is concentrated today.

Binance Futures supports:

- perpetual futures, which can be held indefinitely with no expiration date;

- fixed-expiry futures on BTC and ETH, settled on a quarterly basis.

The platform also offers an immediate choice between:

- USD-margined contracts, where settlement is denominated in USDC;

- COIN-margined contracts, where profits and losses are settled in cryptocurrency.

This choice affects not only settlement mechanics but also the overall risk profile of a trading strategy, and Binance allows traders to make this decision right from the start.

Key features & trading tools

A closer examination of Binance Futures highlights the sheer scale and depth of its trading environment. The platform supports over 200 futures and options pairs, including BTC, ETH, BNB, XRP, ADA, DOGE, DOT, SOL, AVAX, and dozens of other assets. New pairs are added on a regular basis and are announced in advance, making it a go-to platform for Binance futures trading.

Liquidity and trading volumes

Binance Futures posts an average daily trading volume of around $96 billion. In practical terms, this translates into minimal slippage and fast order execution – even for market orders. testing, our market orders executed in 180-320ms: a 0.005 BTC buy at 5x leverage filled at $98,451 (1 tick slippage), and a 0.05 ETH sell at 10x leverage filled at $3,419.80 (2 ticks slippage).

Leverage and margin

On major trading pairs, leverage of up to 125x is available. The platform offers two margin modes:

- Isolated Margin, where risk is limited to the capital allocated to a specific position;

- Cross Margin, where all open positions share the total futures account balance.

During testing, we used isolated margin, as at high leverage a liquidation in this mode only wipes out the margin assigned to the position, rather than the entire account balance.

Order types

Binance Futures offers a comprehensive range of order types, including:

- Limit

- Market

- Stop-Limit

- Stop-Market

- Trailing Stop

- Post Only

- TWAP

- Scaled Order

Stop orders and trailing stops are particularly useful, as they allow traders to manage risk without the need for constant position monitoring.

Fees and VIP tiers

The base trading fees (VIP 0) are as follows:

- Maker – 0.02%

- Taker – 0.04%

Beyond that, Binance applies a VIP tier system (from 0 to 9), where trading fees decrease as both trading volume and BNB balance increase. At VIP 9, the maker fee is reduced to 0%, while the taker fee drops to 0.017%.

We also noted the built-in fee calculator, which allows traders to estimate transaction costs in advance, taking into account leverage and order type.

Is Binance Futures worth using?

Binance Futures is intended for users with prior experience in futures trading, as it requires a solid understanding of how long and short positions, margin, funding rates, and liquidation mechanisms operate. Many Binance futures reviews highlight this aspect, emphasizing that the platform is not designed for beginners.

The platform is best suited for traders who trade regularly, use futures for hedging or speculation, and operate with leverage while fully understanding the associated risks.

Binance Futures delivers high liquidity, a broad selection of contracts, and flexible margin settings. At the same time, it’s important to keep in mind that high leverage can lead to a full position liquidation even with relatively small adverse price movements.

The platform is a strong fit for traders looking to trade with leverage, hedge exposure, or capitalize on market movements in both directions. We also noted that Binance Futures is seamlessly integrated into the broader Binance ecosystem, making transitions between wallets and platform sections smooth and intuitive.

Overall, Binance Futures is a tool for experienced traders who understand the risks and use futures as their primary trading instrument.

Binance Futures pros and cons

On Binance Futures, we opened several positions to test how liquidity, margin, and stop orders function in practice.

Strengths:

- High Liquidity: For example, when trading BTC/USDC with 5x leverage, our market orders of 0.005 BTC were executed instantly, with zero slippage. This is crucial for traders opening large positions or employing short-term strategies.

- Flexible Leverage and Margin System: We tested isolated margin for a single position – if liquidation occurred, only the margin allocated to that order was lost, while other positions remained unaffected. This feature genuinely helps manage risk during active trading.

- Variety of Contracts: We tested futures on gold and silver (XAUUSDT and XAGUSDT), which were launched in January 2026. The platform offers over 200 futures and options pairs, including BTC, ETH, BNB, DOGE, and new listings. New contracts are announced in advance, allowing traders to access and trade assets from the very first day of listing.

- Risk Management Tools: We placed a stop-loss 2% below entry on a long BTC position. When price hit the stop level during a sharp drop, the order executed within $5 of the target price, closing the position as intended.

Weaknesses:

- Regional Restrictions: Binance Futures are unavailable in several countries, including the United States, Canada, the United Kingdom, the Netherlands, Nigeria, Germany, Italy, Singapore, Japan, Iran, North Korea, Syria, and Cuba, limiting access for users from these regions.

- Subpar Customer Support: When we contacted support with a question about margin requirements, the first response came 23 hours later with a generic answer that didn’t address the specific question.

- Risk of Delisting: User reviews occasionally report losses on futures due to unexpected token delistings or sudden announcements halting trading of an instrument. Such events can occur rapidly and result in financial losses.

Trustworthiness Check

In May 2019, Binance suffered a major security breach: attackers gained access to users’ API keys and 2FA, withdrawing approximately 7,000 BTC (around $40 million) from the hot wallet. All user losses were fully reimbursed through the Secure Asset Fund for Users (SAFU), a fund established in 2018.

Since the breach, Binance has actively monitored and blocked fraudulent activity, freezing stolen funds. As of mid‑2024, the exchange had recovered or secured over $73 million related to external hacks and attacks.

Additionally, Binance continues to invest regularly in infrastructure and automated systems to prevent breaches, block phishing and malware, and strengthen internal security measures for APIs and user accounts.

October 2022 – Ronin Bridge Incident: While this was not a direct hack of Binance, in 2022 attackers targeted the Ronin Bridge, resulting in the theft of over $600 million. Binance was indirectly involved in the incident, assisting in the recovery of $5.8 million that had been laundered through its platform.

October 2025 – Binance Futures Liquidation Event: A sharp drop in BTC and ETH triggered mass liquidations on Binance Futures. Stop orders and the liquidation system did not always function correctly, and users reported delays and slow customer support.

Binance launched the “Together Initiative,” compensating affected users for part of their losses in USDC. However, the initiative faced criticism for its lack of transparency in calculations and relatively low payouts.

We also examined the key indicators of Binance Futures’ reliability:

- SAFU Fund: Binance allocates 10% of all trading fees to the Secure Asset Fund for Users (SAFU) to protect users in the event of a hack. These funds are stored in cold wallets and are auditable. As of January 2026, the SAFU account holds 1 billion USDC.

- KYC and Infrastructure: The platform requires strict identity verification (KYC) to open a futures account. Ongoing investments in infrastructure and the implementation of two-tier security help minimize technical and financial risks. During testing, we completed KYC verification in under 5 hours and withdrew 0.015 BTC to an external wallet – the withdrawal processed in about 20 minutes with no hidden fees beyond standard network costs.

- Regulatory Compliance: While Binance Futures is not licensed in the United States and several other countries, the exchange actively adheres to local regulations where required, such as EU standards under MiCA.

Binance Futures demonstrates a high level of security and infrastructure for derivatives trading. The SAFU fund and KYC procedures provide both legal and financial safeguards.

GNcrypto’s overall rating

| Criteria | Rating (out of 5) | Weight | Notes |

|---|---|---|---|

| Trading Fees & Funding Costs | 4.5/5 | 25% | Maker: 0.02%, Taker: 0.04–0.05%, funding applied every 8 hours |

| Leverage & Margin Requirements | 4.5/5 | 20% | Up to 125x leverage, with Isolated or Cross margin options |

| Contract Selection & Liquidity | 5/5 | 15% | Over 200 pairs, with high liquidity for BTC/ETH; altcoins have wider spreads |

| Platform Performance & Risk Controls | 4/5 | 15% | Fast order execution, with stop-losses and liquidations functioning correctly |

| Security & Regulatory Compliance | 4.5/5 | 10% | SAFU fund, KYC verification, and ongoing infrastructure investments |

| User Experience & Trading Interface | 4/5 | 10% | Clear trading logic, but challenging for beginners |

| Customer Support & Educational Resources | 4/5 | 5% | Poor customer support and a limited number of high-quality educational resources |

Final Score: 4.4/5

Our verdict: Binance Futures provides a wide selection of contracts, high liquidity, and flexible margin options for experienced traders operating with leverage. Its complex interface and the high risk of liquidation make the platform less suitable for beginners and conservative investors.

Methodology – Why You Should Trust Us

We tested Binance Futures using our weighted, category-based model, depositing $200 in BTC and opening leveraged positions (10x-50x) on BTC/USD and ETH/USD perpetuals. We monitored funding rates over 5 days, tested stop-loss execution during volatility, measured spreads during US and Asia trading hours, and withdrew funds to verify processing times. We rate platforms on 7 weighted criteria with scores from 1.0 to 5.0. Our testing uses real capital, not demo accounts.

Read our full methodology: How We Test Crypto Futures Trading Services.

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.