Best P2P crypto exchange hot list 2026: OKX, Binance, Bybit

To build this hot list, our team ran small real-money P2P trades across OKX, Binance, Bybit, Bitget, and MEXC, comparing how fast you can match with a merchant, where costs show up (fees vs spread), and how predictable escrow and disputes feel for first-time buyers and sellers.

Liquidity & Volume

5.0

Payment Methods

4.0

Liquidity & Volume

4.0

Payment Methods

4.0

Liquidity & Volume

4.0

Payment Methods

4.5

Liquidity & Volume

3.5

Payment Methods

4.5

Liquidity & Volume

4.5

Payment Methods

4.0

GNcrypto verdict: best P2P crypto exchanges 2026

We ran real P2P trades as both buyers and sellers across five platforms – OKX, Binance, Bybit, Bitget, and MEXC – deploying $100-$200 per test to measure matching speed, actual spreads, and dispute clarity. Here’s our ranking based on those tests:

Best overall: OKX P2P (4.3/5). It wins on the simplest value proposition for beginners: 0% P2P fees, broad payment rails, and a clear escrow and dispute flow.

Runner-up: Binance P2P (4.15/5). A strong pick if you want the widest merchant choice and fast matching, with the trade-off of strict real-name payment rules.

Third place: Bybit P2P (4.1/5). Best when you want a clean, beginner-friendly trade flow and you are willing to compare a few ads to control spread.

Specialized picks: Bitget P2P (4.08/5) for simple USDT top-ups if you plan to stay in-app, and MEXC P2P (3.95/5) as a budget USDT on-ramp into trading.

Quick decision framework:

- If you want the broadest rails and merchant choice, choose Binance P2P.

- If you want 0% fees plus broad rails and clear disputes, choose OKX P2P.

- If you want the cleanest beginner flow, choose Bybit P2P.

- If you mainly need a USDT top-up into an exchange ecosystem, choose Bitget P2P or MEXC P2P.

Full breakdowns below.

What is a crypto P2P Exchange and how it works

A crypto P2P exchange is a marketplace where you buy or sell crypto directly with another person, while the platform provides the trade flow, basic rules, and an escrow layer. People choose P2P when they want to use local payment methods, move from fiat to USDT without relying on a card ramp, or simply find offers that match how money moves in their country. That is why many readers start their search with the best P2P crypto exchanges and then quickly discover the key question is not the logo, but whether your specific payment rails have enough active offers.

In our hands-on tests across multiple P2P desks, we ran small real-money trades as both buyers and sellers to see what happens at each step: matching, payment confirmation, escrow release, and what the platform asks for if a trade gets stuck. The flow below is the practical version of what we saw repeated across platforms, not theory.

The roles are simple. As a buyer, you send fiat using the payment details shown inside the order. As a seller, you release the crypto after you confirm you received the money. The platform sits in the middle and locks the crypto in escrow during the deal, so you are not paying a stranger and hoping they will be honest.

A P2P trade looks like this: you pick an offer with limits and payment method you can actually use, open an order, follow the on-screen instructions, send the fiat exactly as requested, mark the order as paid, and wait for the seller to release the crypto from escrow. It is not an exchange order book where you trade against “the market” in one click. You are accepting a specific merchant offer with specific rules.

Escrow is a real safety upgrade, but it is not magic. It can help if the seller stalls after you paid, because the crypto stays locked in the order until a release or a dispute decision. But escrow cannot fix user mistakes. In our view, the three most important habits are boring but protective: always pay only to the account shown inside the order, keep all communication and proof inside the order chat, and never accept third-party payments or requests to move to Telegram.

If you treat P2P like a structured checkout flow rather than a casual chat, it can be beginner-friendly. Next, we break down the core platform features that help you choose safer offers before you hit paid.

Core features of a P2P crypto platform

A good P2P platform is not just a list of ads. On any peer-to-peer crypto exchange, you are effectively choosing a counterparty, so the platform’s job is to make that choice safer and harder to mess up.

These features matter because they are exactly what we relied on during real test trades: reading terms, filtering offers, checking merchant signals, keeping proof in chat, and understanding how disputes work when a release stalls.

- The offer page itself should be explicit about what you are agreeing to. In our experience, beginners get into trouble when they ignore the terms: price, minimum and maximum limits, the payment method, the time window to pay, and any required payment reference. If you do not follow the offer rules, you can end up in a dispute even when everyone is acting in good faith.

- Filtering tools matter more than people expect. A platform that lets you filter by fiat currency, payment method, trade size limits, and merchant quality signals makes it much easier to find a realistic offer fast. Our testing showed the safest beginner approach is to start with your payment method first, then set limits that match your budget, and only then compare prices across a few merchants.

- Reputation signals help you avoid the worst counterparts. You do not need to overthink metrics, but you should look for a merchant with a consistent history, clear terms, and normal behavior in chat. The red flags are usually human, not technical: rushing you, pushing you off-platform, or asking you to pay for a different name.

- The in-order chat and proof upload are not “nice-to-haves”. They are your paper trail. If something goes wrong, support will usually decide based on what is visible inside the order: timestamps, receipts, transaction IDs, and the chat history. That is why we would keep screenshots and confirmations in the order, even if the seller seems friendly.

- Disputes and appeals are the features you hope you never use, but you should understand the basics. If a seller does not release crypto after you paid, or a counterparty claims you did not pay, the dispute tool is what pauses the situation and routes it into a structured review. However, your funds can be time-locked while the platform checks evidence, so it pays to be organized and patient.

Our simple first-trade routine is: shortlist a few offers, read the terms, pick a merchant that looks consistent, pay exactly as instructed inside the order, and save your proof in the order chat immediately. That routine is not exciting, but it prevents most beginner P2P mistakes.

Best P2P crypto platforms right now

To shortlist the best P2P cryptocurrency exchange options right now, we compared five P2P desks we actively tested for real-world usability: how easy it is to match with a merchant, what fees really look like in practice, and how predictable the escrow and dispute flow feels for beginners. The quick table below is a fast way to see which platform fits your region and payment rails before you read the full cards.

Best p2p crypto platforms 2026 – side-by-side comparison

| Exchange | Standout | P2P fees | P2P assets | Fiat and payment rails | Escrow and disputes | Best for |

|---|---|---|---|---|---|---|

| OKX P2P (4.3/5) | Zero-fee + broad rails | 0% P2P fee | Mainly USDT, BTC, ETH | 100+ currencies, 900+ methods | Escrow + clear dispute rules | Beginners who want broad rails and fast matching |

| Binance P2P (4.15/5) | Deep liquidity | 0% taker; maker up to 0.35% | Mainly USDT, BTC, ETH | 100 fiat, 1,000+ methods | Escrow + documented appeals | Most users who want best liquidity and payment choice |

| Bybit P2P (4.1/5) | Clean P2P flow | 0% taker; maker fees apply | Mainly USDT, BTC, ETH | 80+ payment methods | Escrow + structured appeals | Bank transfer buys and quick exits back to USDT |

| Bitget P2P (4.08/5) | Easy USDT top-up | 0% service fee | Mainly USDT, BTC, ETH | 70+ fiat, broad local rails | Escrow + standard disputes | Users funding USDT then using Bitget features |

| MEXC P2P (3.95/5) | Cheap USDT on-ramp | 0% taker | Mainly USDT, BTC, ETH | 30+ fiat, mixed rails | Escrow + appeal path | Users buying USDT then trading alts or futures |

OKX P2P

If you want a zero-fee P2P desk with broad local rails and a clear dispute flow, we would put OKX P2P at the top of our hot list. In our tests, matching was fast in active markets, and the in-trade chat plus structured appeals made problem cases easier to document.

Benefits: Zero P2P trading fees plus wide local payment coverage makes it easier to find workable offers and trade at more realistic prices.

Limitations: Mandatory identity checks and real-name payment rules reduce privacy, and availability is not universal, including restrictions for US residents.

Best for: Beginners who want a big marketplace with clean escrow, fast matching, and lots of local payment rails for buying or selling USDT.

Strengths:

- 0 fee P2P trades: OKX states P2P trades have zero platform fees, so your cost is mainly offer spread plus bank or wallet charges.

- 900+ payment methods, 100+ currencies: broad rails usually mean more offers and quicker matching in mainstream regions.

- Clear escrow and dispute framework: published dispute handling rules set expectations for evidence and outcomes, which helps in stuck trades.

- Good trade flow for first timers: filters, in-trade chat, and escrow steps are straightforward enough for a first buy or sell.

Weaknesses:

- Strict real-name requirements: payment accounts must match your verified identity, which can block certain payment rails and add friction.

- Region availability risk: OKX notes P2P is not available everywhere, so you must check access before relying on it.

- Disputes can still take time: instant payment cases can move quickly, but other rails can take longer depending on region and evidence.

Binance P2P

When liquidity and payment choice matter most, Binance P2P is the desk we would reach for first. In our tests, matching in popular fiat rails felt close to instant, and the main friction came from strict real-name rules rather than the trading interface.

Benefits: Deep liquidity plus 0% taker fees and huge payment method coverage make it easy to find competitive USDT offers in most regions.

Limitations: KYC and real-name payment accounts are required, and makers may pay fees up to 0.35%, which often shows up in ad pricing.

Best for: Beginners who want the widest selection of merchants and payment rails, and who prioritize fast matching and structure over privacy.

Strengths:

- 0% taker fees with low maker costs: taking existing ads is free, while maker fees are published in a 0% to 0.35% range by market, keeping P2P costs predictable.

- Huge rails footprint: 1,000+ payment methods and 100 fiat currencies usually translate into tighter spreads and more normal prices in active regions.

- Stronger anti-scam guardrails: strict real-name payment rules and escrow reduce common P2P tricks like third-party payments and reversible-rail abuse.

- Clear appeals framework: in-order chat, evidence submission, and an escalation path make it easier to resolve stuck trades without moving off-platform.

Weaknesses:

- Strict policy enforcement can hurt beginners: using a mismatched payment account can trigger temporary restrictions, so setup mistakes have real consequences.

- Funds can be time-locked during appeals: when a dispute happens, the escrow helps, but it also means your capital may sit locked until a decision is made.

- Real cost still hides in spread: even with low platform fees, merchants often price in their risk and costs, so you still need to compare ads versus spot.

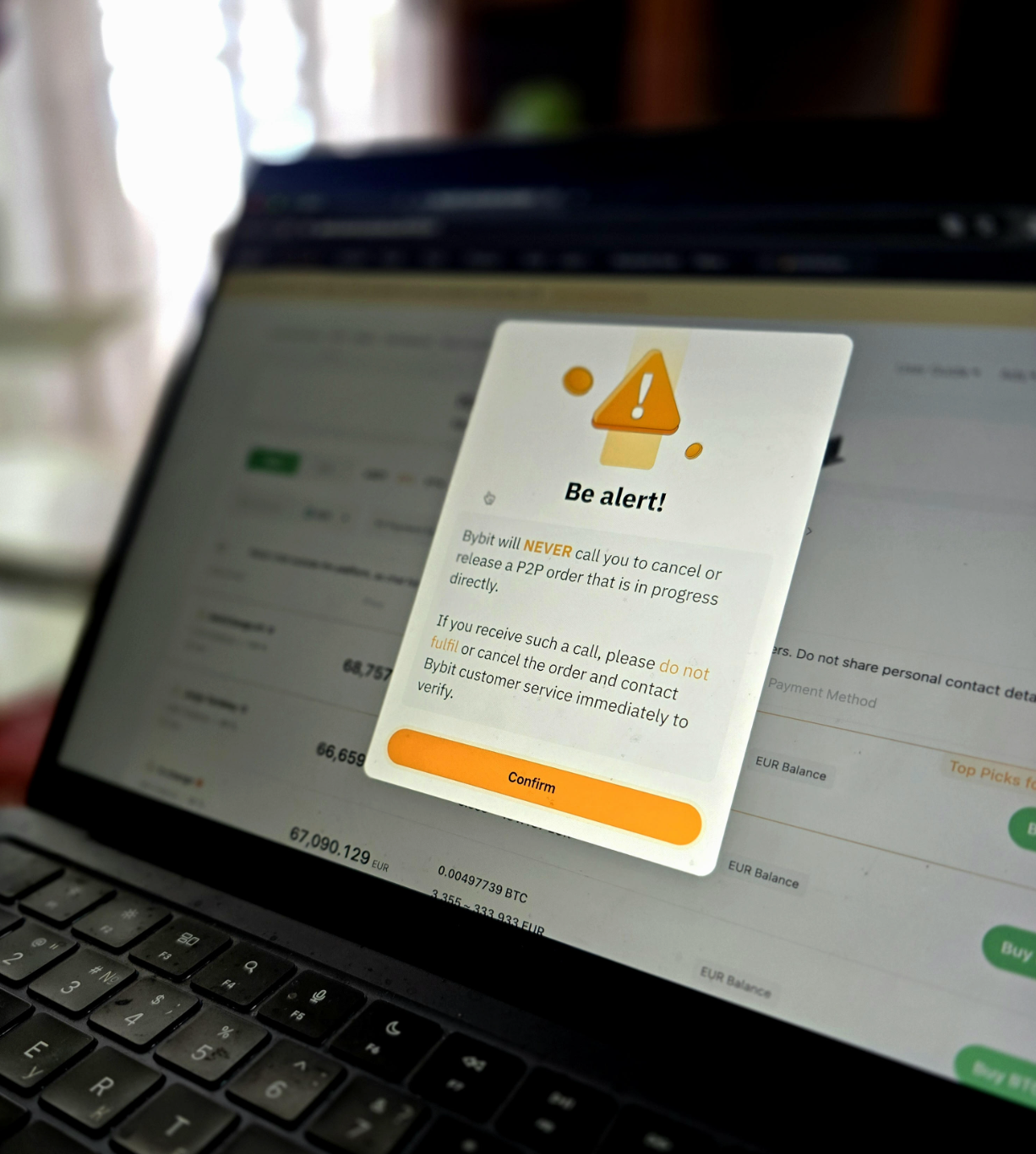

Bybit P2P

For beginners who want a clean, CEX-style P2P flow with strong escrow tooling, we think Bybit P2P is a very solid option. In our tests, a $100 BTC buy completed end to end in 19 minutes, with the real cost coming from spread rather than platform fees.

Benefits: Zero taker fees and a liquid ad market in popular rails make it easy to buy USDT fast if you compare multiple ads first.

Limitations: Basic KYC is required, and pricing can be spread-heavy, especially for small trades, niche payment methods, or One Click Buy suggestions.

Best for: New P2P users in active fiat regions who want a familiar CEX interface for bank transfer buys and quick exits back to USDT.

Strengths:

- Escrow and release speed: in our test, crypto was released about a minute after seller confirmation, reducing the risk window.

- Transparent fee logic for beginners: takers pay zero fees, while maker fees apply to advertisers by pair and level, so most users only manage spreads.

- Broad payment coverage: Bybit supports 80+ P2P payment methods, which usually improves match odds in mainstream markets.

- Structured appeals: appeals are handled inside the order flow, with published rules and typical processing windows depending on case responsiveness.

Weaknesses:

- Spread can be the real fee: our spot check showed spreads from ~1.3% to 5% depending on ad quality, limits, and seller profile.

- Payment friction is real: strict payment references and bank compliance prompts can slow the first transfer and increase human-error risk.

- Appeal evidence can be demanding: Bybit notes video proof requirements in certain appeal cases, which can feel heavy for beginners.

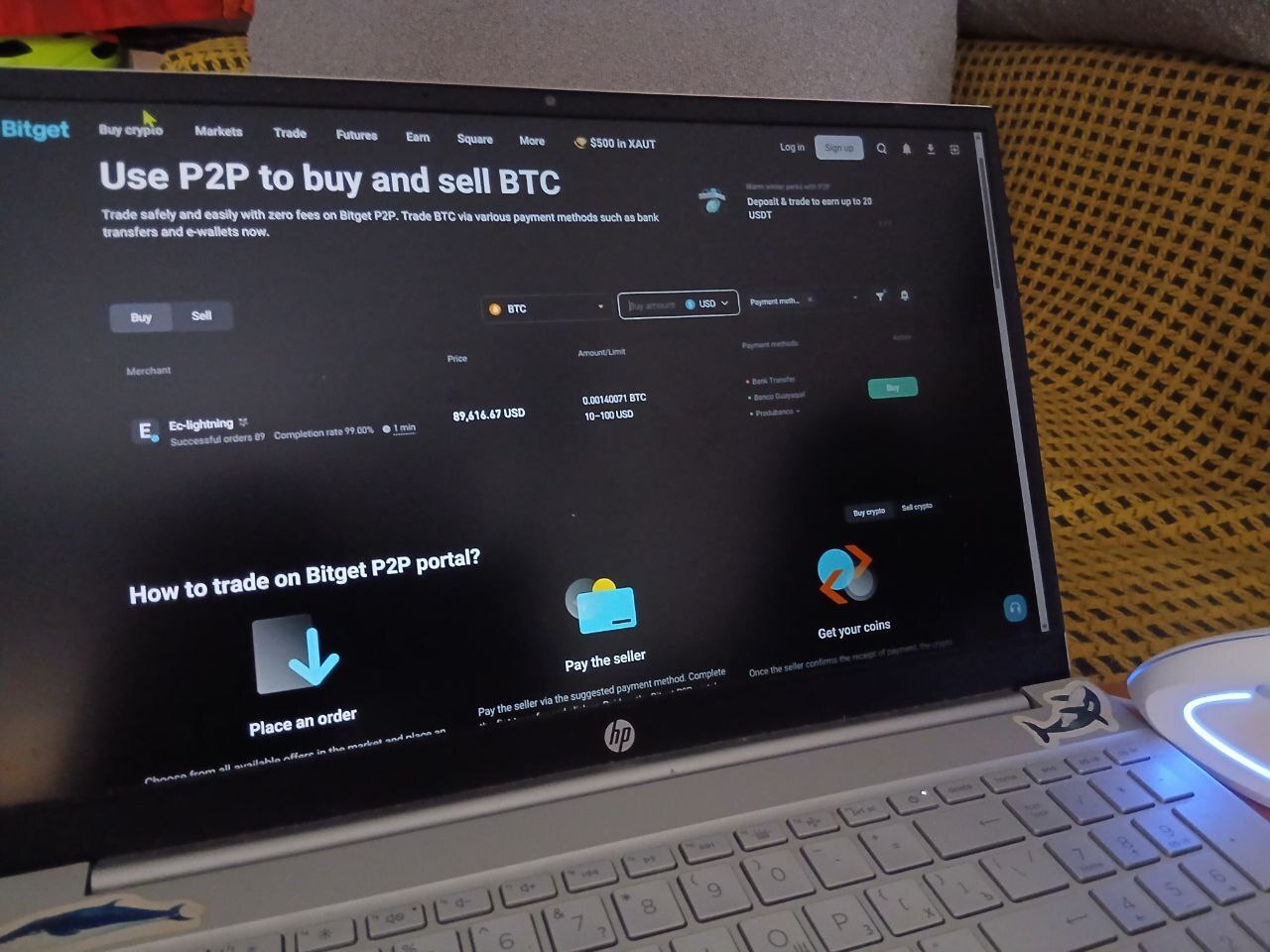

Bitget P2P

If your P2P trade is mainly a quick USDT top-up before you use in-app features, Bitget P2P is a practical pick. In our tests, we paid no platform commissions, but one trade still took 15 minutes simply because you are waiting on a human merchant.

Benefits: Zero platform fees plus wide local payment rails make Bitget a low-friction way to top up USDT, especially if you use copy trading.

Limitations: Full KYC is mandatory, and the P2P desk is mostly majors like USDT, BTC, and ETH rather than long-tail coins.

Best for: Beginners who want cheap P2P funding into USDT and plan to stay inside the Bitget app for copy trading or quick internal transfers.

Strengths:

- Zero P2P service fees: Bitget states P2P trades have no service fees, so cost is mainly spread plus any bank or wallet charges.

- Big rails footprint: the review notes 70+ fiat coverage and broad wallet support, which helps in smaller regions where banks are picky.

- Protection Fund narrative: Bitget publicly maintains a Protection Fund launched at $300M and commits to keeping its valuation above that level.

- PoR transparency: Bitget publishes Proof of Reserves updates, which is a plus for trust compared with platforms that share nothing.

Weaknesses:

- Merchant latency: execution speed depends on the counterparty, not an order book, so delays happen even when everything is legit.

- The hidden spread problem: zero fees does not mean zero cost, so beginners must compare P2P price vs spot before paying.

- Support and disputes are not top tier: the platform scores lower on support than on rails and fees, so edge-case disputes may take longer than you want.

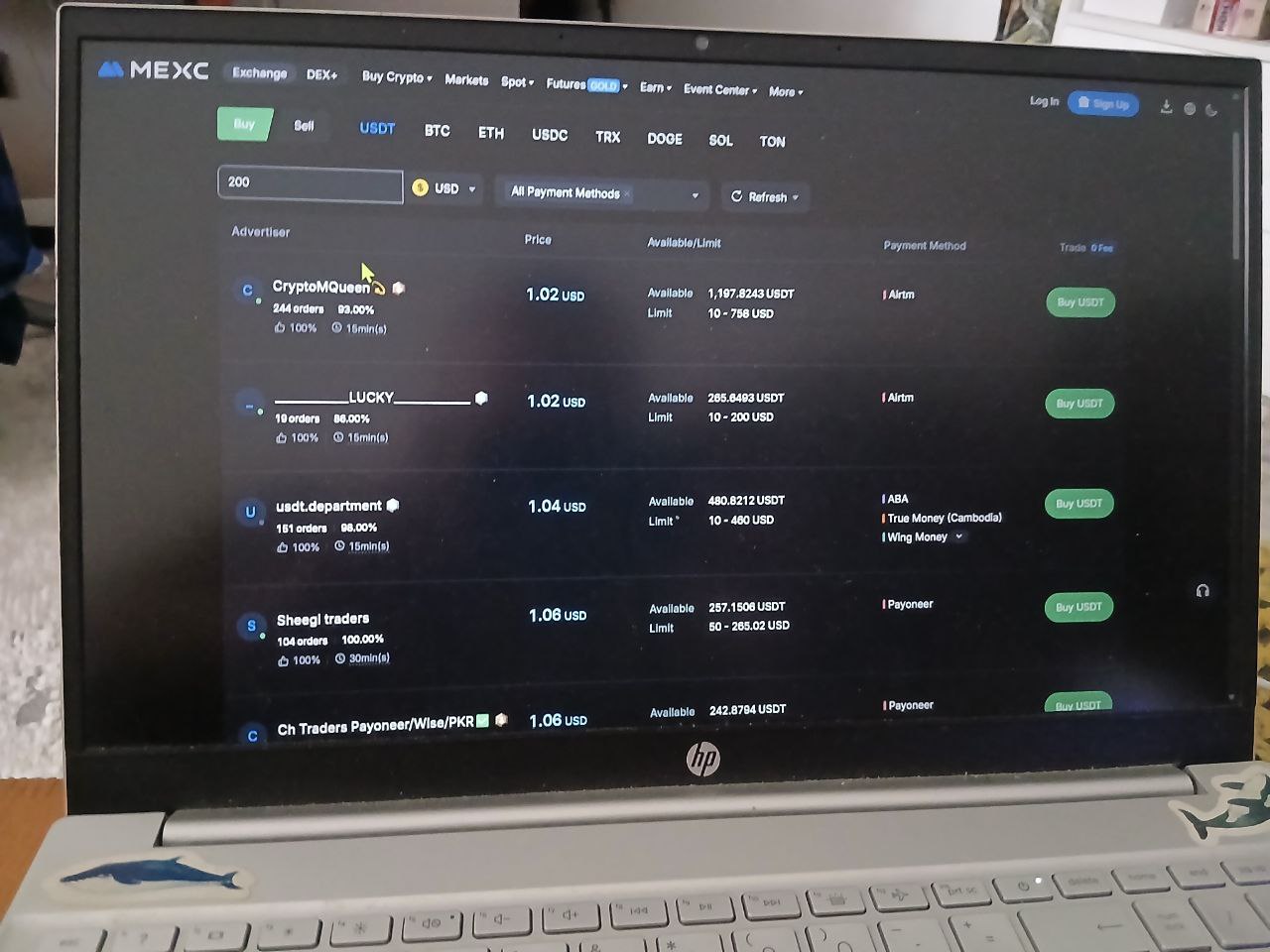

MEXC P2P

For a budget USDT on-ramp with fast internal transfers into spot and futures, we think MEXC P2P is worth a look. In our tests, we onboarded $200 into USDT quickly, then moved funds internally in seconds, but we still saw a real cost through spread versus spot.

Benefits: Zero taker fees plus fast internal transfers make it an efficient on-ramp into MEXC spot and futures when you mainly need USDT.

Limitations: P2P is mostly USDT, BTC, and ETH, liquidity can be uneven by region, and the true cost often shows up as spread.

Best for: Users who want a cheap way to buy USDT with local payments, then rotate into altcoins or futures inside the MEXC ecosystem.

Strengths:

- Zero fee for takers: taking an existing offer is 0 percent fee, so you mainly manage spread and any bank or wallet charges.

- Instant ecosystem sync: once escrow releases USDT, internal transfers to spot or futures are immediate and free, which is great for fast setups.

- 30 plus fiat currencies and diverse rails: supports major and emerging market fiat, with methods like Wise, Revolut, SEPA, SWIFT, and local e-wallets.

- Clear appeal path: escrow locks seller funds, and appeals require practical proof like receipts, transaction IDs, and in-order chat history.

Weaknesses:

- The hidden spread is real: in our test, the P2P price was about 0.8 percent above spot, which can matter on larger tickets.

- Limited asset menu on P2P: beyond USDT, BTC, and ETH, order books often feel empty, so you usually buy USDT first and swap later.

- Merchant reliability roulette: some merchants are fast, others are slow to respond, which can extend escrow lock time and add stress.

Which P2P exchange to choose

Choosing a P2P desk is mostly about fit, not hype. You need a platform that matches your local payment rails, gives you enough merchant choice to avoid bad ads, and has an escrow and appeal flow you can actually follow when something goes wrong.

In our view, if you are looking for the best P2P crypto exchange for your first deal, start with your payment method and local liquidity, not brand names.

Before you pick a platform, we would do three quick checks. First, confirm you can actually use the desk in your country and that you are fine with a KYC-first setup and real-name payment rules. Second, open the P2P market for your fiat and preferred payment method and see whether there are enough active ads at limits that match your budget. Third, remember that in P2P, a 0% platform fee does not mean 0% cost: you still need to compare a few merchants because the spread is often the real price.

A simple 60-second workflow is: choose your fiat and payment method, then use the comparison table to shortlist the platforms with the strongest rails; check the P2P fee model so you know whether costs show up as maker fees, spread, or both; and if it is your first trade, prioritize the desk where escrow and appeals feel the most predictable.

Best P2P trading platforms by trader type

If you want the deepest liquidity and the widest choice of payment methods

Choose: Binance P2P

We think Binance P2P is the easiest default when you want the most merchants to choose from and the broadest set of payment rails. With 0% taker fees and strong liquidity in active markets, you can usually find a competitive USDT offer quickly, but the catch is strict KYC and real-name payment rules.

If you want a zero-fee model with very broad rails and clear dispute rules

Choose: OKX P2P

OKX P2P is a strong pick when you want 0% P2P trading fees and wide local coverage, while still having a documented dispute flow that is easy to follow as a beginner. It feels most reliable when your region has plenty of active ads.

If you want a clean, beginner-friendly P2P flow with clear appeals

Choose: Bybit P2P

Bybit P2P is a good fit if you value a simple trade interface and structured appeal tooling that keeps everything inside the order. The main thing you manage is not the platform fee, but the offer price, so it rewards people who compare a few ads before paying.

If your main goal is to top up USDT and then stay inside the app

Choose: Bitget P2P

Bitget P2P makes sense when your P2P trade is mainly a funding step and you plan to use Bitget features after escrow releases. The flow is low-friction for USDT top-ups, but execution speed still depends on how fast the merchant responds.

If you want a cheap USDT on-ramp and then plan to trade inside the exchange

Choose: MEXC P2P

MEXC P2P works well as a fast USDT on-ramp into the broader MEXC ecosystem, especially if you plan to rotate into other markets after funding. Just keep in mind the common P2P reality: the true cost can show up as spread, and pricing can be less predictable in thinner regions.

Now scan the cards above to see the exact trade-offs per platform before you move any money.

How we test P2P platforms

At GNcrypto, we put transparency first when evaluating peer-to-peer (P2P) cryptocurrency trading platforms. Our reviews are based on hands-on testing and thorough analysis across all key dimensions that matter for safely buying and selling crypto directly with other users.

We do not audit platform solvency or guarantee user safety from all scams. Instead, our scores reflect observable escrow mechanisms, order book depth, and platform support quality. We do not accept payment for ratings or modify scores based on partnerships.

Categories & weights

We rate P2P platforms on seven criteria. Escrow and Liquidity are weighted heaviest because a platform that isn’t safe or has no one to trade with is useless, regardless of how pretty the UI is.

- Escrow & Trade Safety – 25%

- Liquidity & Order Book Depth – 20%

- Fees & Payment Methods – 15%

- Verification & Account Limits – 15%

- Platform Performance & Reliability – 10%

- User Experience & Trade Flow – 10%

- Customer Support & Dispute Handling – 5%

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.