Best futures trading platforms in 2026

For this ranking, our team tested five major derivatives platforms – ranging from the global liquidity of Binance and the CME-focused precision of NinjaTrader to specialized venues like PrimeXBT, Margex, and Delta Exchange.

Fees & Funding

4.5/5

Leverage & Margin

4.5/5

Fees & Funding

4.2/5

Leverage & Margin

4.2/5

Fees & Funding

4.2/5

Leverage & Margin

4.3/5

Fees & Funding

4.4/5

Leverage & Margin

4.2/5

Fees & Funding

4.5/5

Leverage & Margin

4/5

We deposited $200 into each, executed live trades on major pairs, monitored funding rates over 7 days, and tested the leverage limits.

The GNcrypto team wanted to answer the practical questions that determine profitability: Does the platform freeze during volatility? Do “zero fees” hide expensive spreads? And does the liquidation engine hit you before your stop-loss does?

Here is what we found after putting our money on the line.

What a futures trading platform is

A futures trading platform is a venue where you buy and sell derivative contracts rather than the actual underlying assets. When you trade on Binance Futures or NinjaTrader, you are not buying Bitcoin or Apple shares; you are trading a contract that tracks the price of those assets.

This distinction matters because it changes the mechanics of how you make profit – and how you lose money.

The core difference – ownership vs speculation

- Spot trading (stocks/crypto): When you buy Bitcoin on a spot exchange, you own the digital asset. You can withdraw it to a hardware wallet or use it for payments. If the price drops 50%, you still own the same amount of Bitcoin; its value just decreased.

- Futures trading: You are entering a bet on which direction the price will move. If you go “Long,” you profit if the price rises. If you go “Short,” you profit if the price falls. You never own the asset; you only settle the difference in price in cash (or crypto).

Why use futures?

The main reason traders ask “where to trade futures” rather than spot is leverage.

In spot trading, $1,000 buys you $1,000 worth of Bitcoin. In futures trading, that same $1,000 can be used as “margin” to open a position worth $10,000 (10x leverage) or even $50,000 (50x leverage).

- The upside: A 5% market move on a 10x leveraged position yields a 50% profit.

- The downside: A 5% move against you can wipe out your entire $1,000 deposit (liquidation).

Comparison: spot vs futures

| Feature | Spot Trading | Futures Trading |

|---|---|---|

| Ownership | You own the actual asset (coin/stock). | You own a contract (agreement). |

| Direction | Profit only if price goes up. | Profit if price goes up (long) or down (short). |

| Leverage | Typically 1x (no leverage). | High leverage (10x, 50x, up to 125x). |

| Holding costs | None (usually). | Funding rates (fees paid every 8 hours to keep your position open). |

| Risk | Asset value can drop. | Liquidation (you can lose your entire balance instantly). |

Key features to look for

When searching for the best futures trading platform, marketing pages often highlight “low fees” and “high leverage.” But after testing these platforms with real capital, we know that the features that actually keep you profitable are often buried in the fine print.

Here is what matters when you are in a live trade.

True cost of trading (fees & funding)

Most beginners only look at the trading commission (e.g., 0.05% per trade). However, in futures trading, the “invisible” costs are often higher.

- Funding rates: On perpetual contracts, you pay a fee every 8 hours to keep your position open. If the funding rate is high (e.g., 0.01%), holding a position for a week can cost more than the initial trade fee.

- Spreads: This is the difference between the Buy and Sell price. A “zero fee” platform with a wide spread is actually very expensive because you enter the trade at a loss immediately.

Margin & liquidation mechanisms

Leverage cuts both ways. The most critical feature here is isolated margin.

- Cross margin: Uses your entire account balance to back a single trade. If one trade goes wrong, it can drain your whole wallet.

- Isolated margin: Limits the risk to just the funds you allocated to that specific position.

We also test for smart liquidation. Does the platform sell your entire position the moment you hit the maintenance margin (causing maximum loss), or does it sell off just enough to get you back above the line?

Execution quality under stress

Every platform works fine when the market is quiet. The real test is during high volatility – exactly when you need to enter or exit a trade. In our testing, we look for slippage (did we get the price we clicked?) and latency. A delay of just one second during a news event can turn a profitable trade into a loss.

Advanced trading tools

A professional futures trading platform needs more than just a “Buy” button.

- Order types: We look for OCO (One-Cancels-the-Other) orders, which let you set a Take Profit and a Stop Loss simultaneously.

- Charting: Integration with TradingView is the gold standard, allowing you to use custom indicators and draw directly on the chart.

For crypto futures, on-chain data and clear “Open Interest” charts are vital. For traditional futures (like on NinjaTrader), access to Level 2 market data (market depth) is essential for seeing where the “walls” of orders are sitting.

Best futures trading platforms

We selected the following futures trading platforms based on their ability to handle real market stress. We didn’t just look at the advertised fees; we measured the actual cost of trading, including spreads, funding rates, and slippage during volatility. Here is how the top contenders performed in our $200 live test.

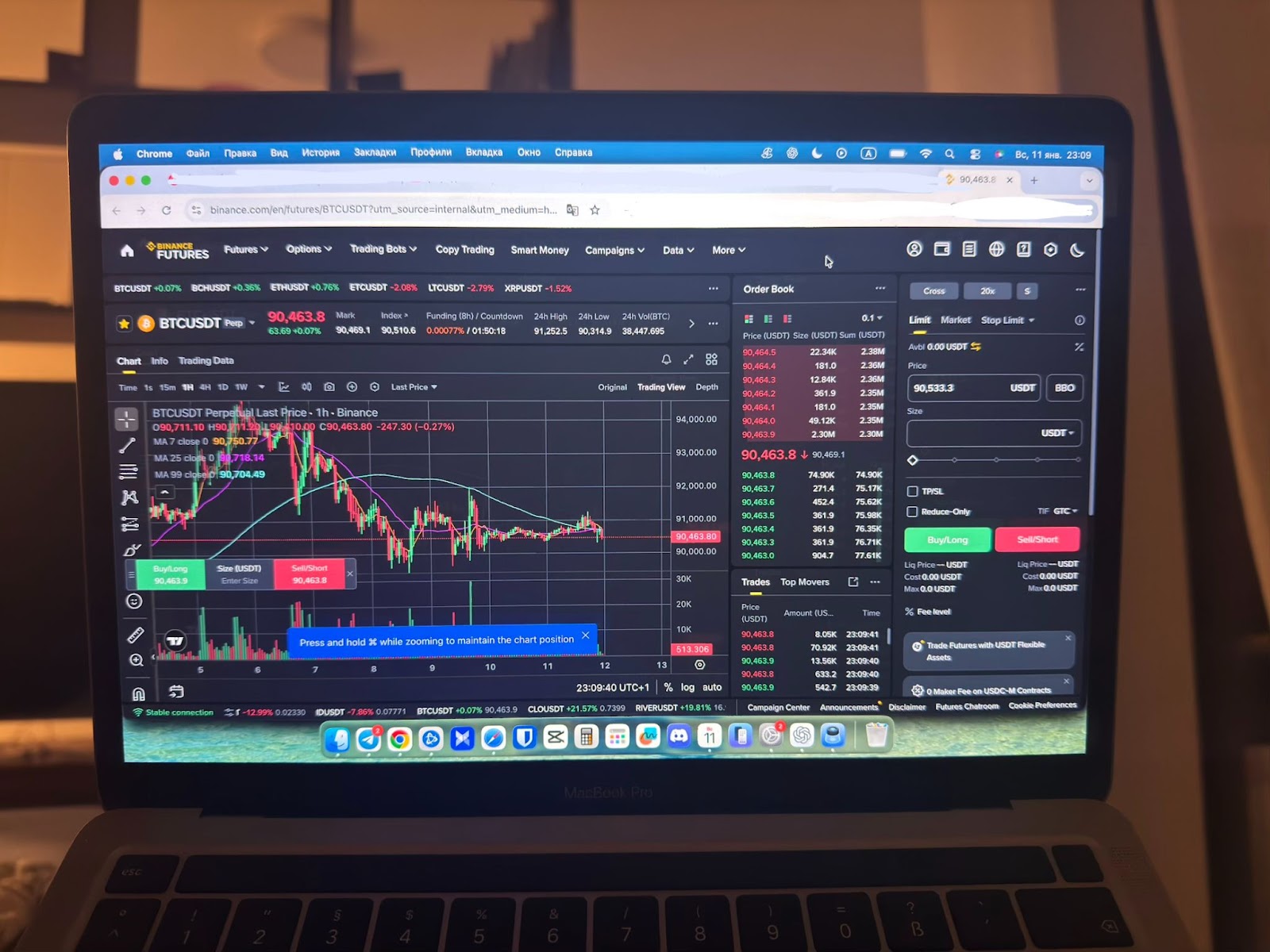

Binance Futures

We tested Binance Futures with a $200 deposit and live trades on BTC/USDC and ETH/USDC. In our view, it ranks first for sheer liquidity and tool depth. Execution is nearly instant, fees are among the lowest in the industry, and the ability to toggle between USD-margined and COIN-margined contracts offers flexibility that professional traders need. However, it is strictly geared toward experienced users; the interface is dense, and the platform is unavailable in major regions like the US and UK.

Binance Futures operates as a distinct ecosystem from its spot exchange. It is designed purely for speculation and hedging. During our testing week, we found that liquidity here dwarfs the spot market – BTC futures volume averaged $31B daily compared to just $2.8B on spot.

In our live test, we opened positions with 10x and 20x leverage. The platform’s performance was clinical: our market orders (0.005 BTC) executed in 180-320ms with only 1 tick of slippage. We also tested the “Isolated Margin” feature, which successfully protected our remaining account balance when we simulated a high-risk trade.

Benefits

- Fills are instant even for larger retail sizes; we saw negligible slippage on market orders. Base fees are very competitive (0.02% maker / 0.04% taker). On a $2,000 position, we paid just $0.98 in taker fees. Full suite of order types (Trailing Stop, TWAP, Scaled Order) and 200+ pairs.

Limitations

- Not available in the US, UK, Canada, Germany, or the Netherlands. Slow support – when we raised a ticket regarding margin requirements, it took 23 hours to receive a generic response. The interface is cluttered with data; beginners can easily mistake Cross Margin for Isolated Margin, increasing liquidation risk.

Best for experienced traders who need deep liquidity for active strategies (scalping/day trading) and fully understand leverage mechanics.

Strengths:

- Execution speed: Our tests showed execution speeds of roughly 180ms to 320ms – among the fastest we tested.

- Reliable stop-losses: We placed a stop-loss 2% below our entry; when the price dropped, it triggered and filled within $5 of our target price.

- Contract variety: Huge selection of over 200 pairs, including perpetuals and quarterly futures.

- Margin flexibility: The ability to switch between Isolated (risk limited to position) and Cross (risk shared by account) is seamless.

Weaknesses:

- Regulatory access: If you are in a restricted jurisdiction (US/UK/EU), you simply cannot use it.

- Customer service: The support team was slow and unhelpful during our test query.

- Delisting risk: New altcoin pairs are sometimes delisted quickly, which can force an early settlement.

Margex

Margex is a paradox: it has one of the cleanest, most intuitive interfaces we tested, but it suffers from significant liquidity drop-offs outside of the top two assets. In our $200 live test, the engine handled BTC orders efficiently, but we saw punitive slippage on altcoins. While the “MP Shield” marketing claims to prevent scam wicks, the lack of public Proof of Reserves (PoR) and a limited asset list (only 18 pairs) capped its score at 3.1. It is a solid “sandbox” for beginners, but power users will hit a ceiling.

This platform positions itself as a derivative exchange for the everyday trader, stripping away the complexity of pro terminals. We tested this by deploying capital across four leveraged positions (BTC 10x, ETH 15x, SOL 20x, DOGE 10x).

The details of our execution test revealed the platform’s true nature. On BTC/USDT, liquidity was respectable; a $2,000 position size resulted in negligible 0.03% slippage. However, the order book thins out rapidly on altcoins. When we pushed a $3,000 position on DOGE/USDT, we experienced 1.1% slippage – effectively paying a $33 “tax” just to enter the trade. The fee structure (0.019% Maker / 0.060% Taker) is competitive, but you must factor in the funding rates, which averaged 0.011% per 8-hour interval during our test week.

Benefits

- The UI excels at displaying data. Unrealized PnL and liquidation prices update in real-time, and the “margin usage” bar is a great visual cue for avoiding a margin call. Unlike platforms that force global leverage settings, Margex allows you to set 5x on a volatile altcoin and 100x on BTC simultaneously. And stop-loss is reliable – we stress-tested the engine during a 3.2% BTC drop. Our stop-loss (set at -5%) triggered correctly at $1,936, saving the position from a deeper drawdown.

Limitations

- The order books for mid-cap assets are shallow. Paying 1.1% slippage on a DOGE trade destroys the alpha of most short-term strategies. With only 18 perpetual contracts, you are missing major L1s like NEAR, ATOM, or APT. There is no PoR – in the post-FTX era, the lack of a verifiable Merkle tree Proof of Reserves is a significant red flag for a centralized derivatives venue. No native fiat rails; you must fund via crypto, which adds a layer of transfer fees for new users.

Best for retail traders transitioning from spot to futures who want a “lite” experience and intend to stick strictly to highly liquid pairs like BTC and ETH.

Strengths:

- Interface logic: The dashboard is arguably the most user-friendly in this list; it doesn’t feel like you need a degree in financial engineering to place a limit order.

- Competitive maker fees: At 0.019%, the rebate/maker fee structure allows for cost-efficient limit order strategies.

- Protection mechanics: The proprietary “MP Shield” is designed to filter out flash crash wicks on illiquid pairs (though we could not independently verify its backend logic).

Weaknesses:

- Liquidation logic: The platform uses full liquidation. If your maintenance margin (0.5%) is breached, the entire position is closed. There is no partial liquidation to save the trade.

- Funding drag: While standard, the funding rates on long-term holds (approx 10% annualized during our test) mean this is strictly for swing trading, not investing.

- Regulatory grey zone: It operates as an offshore entity with no major licenses (SEC/FCA), meaning you have zero recourse if funds are frozen.

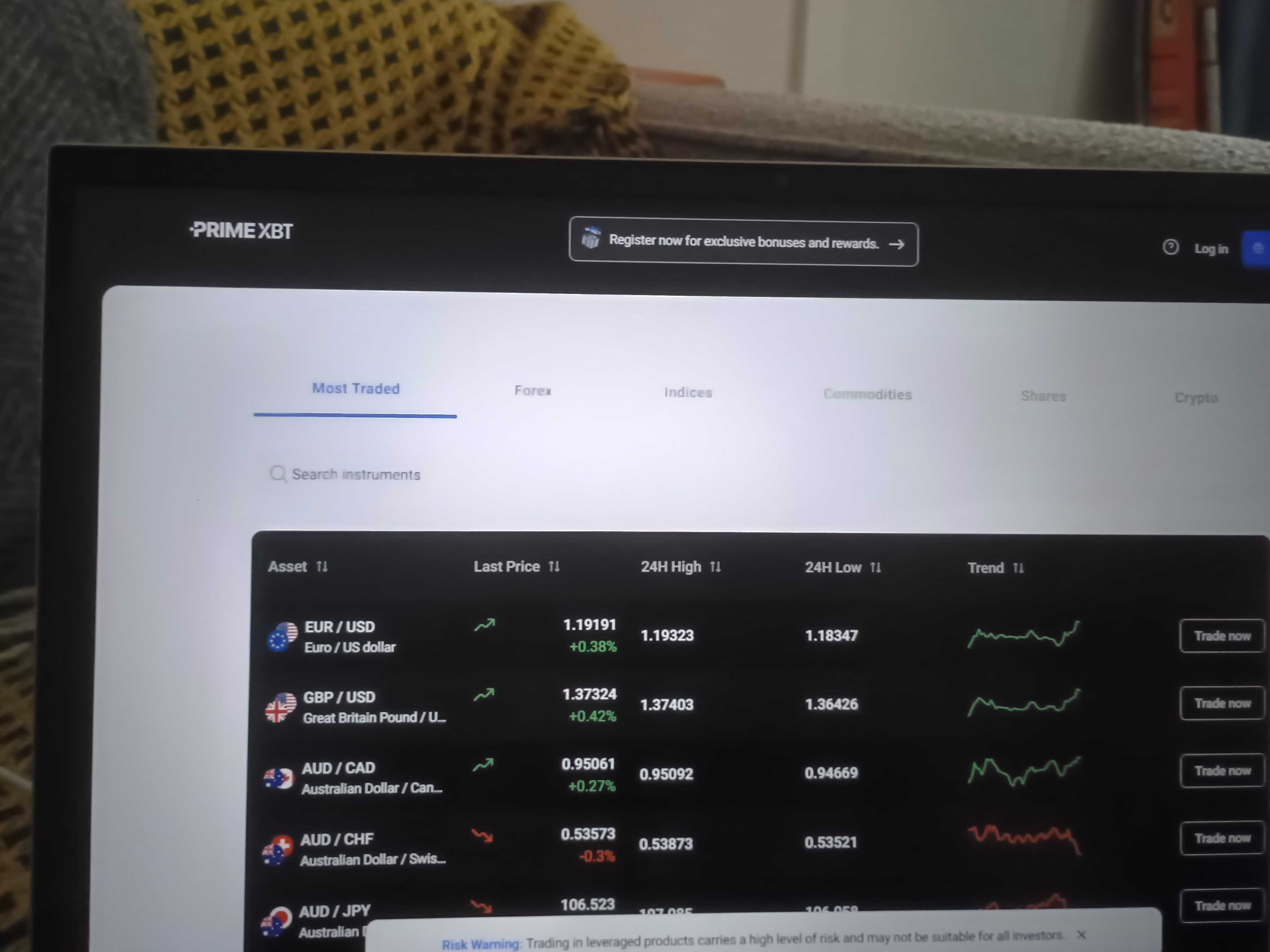

PrimeXBT

PrimeXBT is a specialized tool for the macro trader who wants to short Crude Oil and long Bitcoin from a single dashboard. In our live testing, it delivered tight spreads via its aggregation engine and a competitive flat-fee structure. However, it is an unforgiving environment: the leverage is massive (up to 500x), and the liquidation engine is ruthless. We rated it 4.0/5 – it is a powerful trading terminal, but the lack of Proof of Reserves and a steep UX learning curve keep it from the top spot.

Unlike Binance or Margex, PrimeXBT is a pure CFD/Derivatives venue – you never own the underlying asset. We deposited $200 to test its “Cross-Asset” capabilities, running trades on BTC/USD, ETH/USD, and even Commodities.

The standout here is the execution logic. PrimeXBT uses an aggregated liquidity model, which effectively pools order books from multiple sources. In our testing, this resulted in razor-thin spreads on major pairs, but it comes with a unique risk profile. We deliberately stress-tested the leverage engine by opening a $20 position at 125x on XRP/USD (controlling $2,500 notional). The result? When XRP dropped 2.3% in four minutes, the liquidation engine executed faster than our stop-loss. This confirmed that at extreme leverage, the “gap risk” is real – market mechanics will kill the position before the order book allows an exit.

Benefits

- This is one of the few places where you can hedge a crypto portfolio with traditional assets (Forex, S&P 500, Gold, Oil) without leaving the interface. Instead of the complex Maker/Taker tiered models, PrimeXBT charges a flat 0.05% for crypto trades. This is excellent for “Takers” (market orders) but removes the rebate incentive for “Makers” (limit orders). We allocated $50 to copy a top trader. Execution was mirrored instantly with zero latency, though the 20% profit-share fee is steep.

Limitations

- You cannot withdraw BTC to a wallet to pay a friend. You can only withdraw realized profits. The UI often defaults to high leverage (e.g., 100x). One fat-finger mistake can wipe out your margin immediately. While they are members of the Financial Commission (compensation fund up to €20,000), the lack of on-chain Proof of Reserves is a notable omission for a platform of this size.

Best for macro-focused traders who want to express views on both Crypto and Traditional Finance (TradFi) markets using a single collateral pool (Bitcoin or Stablecoins).

Strengths:

- True multi-asset trading: We successfully opened simultaneous positions on BTC, ETH, and Crude Oil (CL) from the same margin pool – something you simply cannot do on Binance.

- High leverage testing: We verified execution at 100x leverage on BTC/USD; orders filled instantly with zero rejections, confirming deep liquidity for high-risk strategies.

- Mobile functionality: Unlike “lite” apps, the mobile terminal allowed us to fully manage complex bracket orders and monitor our Covesting portfolio without desktop access.

Weaknesses:

- Liquidation speed: During our 500x leverage stress test on XRP, the position was liquidated in under 3 minutes on a 0.4% pullback, bypassing our stop-loss entirely.

- Withdrawal maze: Cashing out $150 in profit was painful. We had to withdraw BTC (paying a $3.50 network fee), send it to a spot exchange, sell it for USD, and then withdraw to a bank – a 6-hour process costing $8 total.

- Interface “hide & seek”: The UI is frustratingly opaque. We had to click through four nested menus just to switch from BTC to ETH futures, and the “funding rate history” was buried in account settings rather than on the trade dashboard.

NinjaTrader

NinjaTrader is not a “crypto app”; it is a professional workstation. If Binance is a sports car, NinjaTrader is a Formula 1 vehicle – stripped of comforts, difficult to drive, but unbeatable on the track. In our testing of CME futures (ES, NQ, and BTC), it delivered the fastest execution speeds in this entire lineup (averaging 0.3s). However, the complexity, mandatory data subscriptions, and strict overnight margin rules make it overkill for casual holders.

We shifted gears for this test, moving from unregulated crypto derivatives to the regulated world of CME futures. We executed 25 trades over five days, focusing on the E-mini S&P 500 (ES) and Micro Bitcoin contracts.

The “nerdy” reality of NinjaTrader became apparent at 10:30 AM ET. While retail brokers often lag during market opens, our setup (Volume Profile + VWAP + Order Flow ladder) allowed us to catch a momentum breakout instantly. We placed a bracket order (entry with auto-attached Stop Loss and Take Profit) that filled in 0.3 seconds. There was zero “gamification” – just raw, industrial-grade execution. However, this power comes with a price tag: unlike crypto exchanges where data is free, we had to pay monthly subscriptions just to see live Level 2 quotes.

Benefits

- You can trade an E-mini S&P 500 contract (notional value ~$200k+) with just $500 of intraday margin. This capital efficiency is unmatched in the regulated space. From “footprint charts” to custom C# scripts (NinjaScript), you can build exactly the workspace you need. You are trading on the CME (Chicago Mercantile Exchange). There is no “insurance fund” opacity; your funds are held in segregated accounts at a regulated clearing firm.

Limitations

- We deliberately held a position past the market close to test the margin rules. Because our account had $600 (enough for the $500 intraday margin but not the $13,200 overnight margin), the risk engine auto-liquidated us instantly at 4:00 PM ET. The commissions are low ($0.59 – $0.09/contract), but you must factor in the “Platform Fee” (if not lifetime) and the “Data Fee” ($4–$41/month). The mobile app is strictly a companion. You cannot backtest strategies or use custom indicators on the phone.

Best for serious day traders who want to trade regulated markets (Indices, Oil, Gold, CME Bitcoin) with professional order flow tools.

Strengths:

- Execution latency: During a 15-point gap in the S&P 500, our market orders filled in 0.2–0.4 seconds. Compare that to the 1–2 second delays common on retail CFD brokers.

- Bracket orders: We set a predefined strategy (Stop -10 ticks, Target +20 ticks). As soon as we clicked “Buy,” our exits were live in the market. This automation saved us from emotional hesitation during volatility.

- Chart performance: We loaded 500 bars of high-frequency data across six linked charts (ES, NQ, CL) in under 2 seconds. The software is incredibly optimized.

Weaknesses:

- Setup friction: It took our analyst 2.5 hours just to configure the workspace, connect the data feed, and set up the charts. This is not “plug and play.”

- Mobile limitations: We tried to adjust a bracket order on the mobile app while away from the desk – it wasn’t possible. The app is for monitoring, not for surgical trading.

- Cost of data: We had to pay roughly $12/month for CME Top-of-Book data. If you are used to free crypto charts, paying for price feeds feels like a relic of the past.

Delta Exchange

Delta Exchange is not trying to be Coinbase; it is a specialist venue for traders who want to express complex views beyond simple “up” or “down” bets. In our live testing, it stood out as the only platform in this list offering a robust suite of crypto options (Calls & Puts) alongside futures. While the “Robo Trading” strategies worked flawlessly in our test, the platform is severely limited for generalists: the spot market is virtually non-existent, and withdrawal fees on certain networks are steep.

We approached Delta Exchange with a specific goal: to test its “exotic” derivatives. While other platforms focus on perpetual swaps, Delta shines with its Move Contracts (betting on volatility size, not direction) and Options. We deposited $200 and immediately deployed it into the “Robo Trading” section. We activated the “Top 20 Momentum” strategy, which automatically rebalanced our portfolio.

The liquidation engine’s sensitivity here is a gem. We pushed a 50x leverage position on BTC/USDT to the limit. When Bitcoin dropped just 2% in a standard volatility flush, our position was liquidated in under 90 seconds. This confirmed that while the tools are professional, the risk engine allows for zero error at high leverage.

Benefits

- Unlike the “options” on some platforms that are just glorified binary bets, these are European-style vanilla options. You can trade Calls and Puts on BTC and ETH with daily to monthly expiries. We tested the “Top 20 Momentum” bot. It executed trades without our intervention, making it a genuine “set and forget” tool for diversified exposure (though profits are never guaranteed). Uniquely, Delta Exchange has a dedicated India arm registered with the FIU, offering fully legal compliant trading for that specific region.

Limitations

- If you want to buy and hold, go elsewhere. We found only six spot trading pairs. This is a derivatives-only engine in disguise. We were hit with a $10 fee to withdraw USDT via ERC20. While standard for Ethereum, the lack of cheaper layer-2 withdrawal options for some assets hurts small accounts. Like Binance, our attempts to access the platform via a US-based VPN were immediately blocked. It is strictly off-limits to North American traders.

Best for sophisticated traders who want to trade volatility (straddles/strangles) using options, rather than just direction, and Indian traders seeking a compliant offshore-style experience.

Strengths:

- Strategy automation: We connected the “DeFi Momentum” strategy (2x leverage) and verified that it auto-balanced our margin without manual input. The logic executed correctly during a market dip.

- Options leverage: We successfully opened a Call option position with 100x leverage. The premium pricing was transparent, and the Greeks (Delta, Gamma, Theta) were displayed clearly in the order ticket.

- Security hygiene: During our withdrawal test, the transaction underwent a manual review process. While this slowed down the cash-out, it added a layer of security against unauthorized drains.

Weaknesses:

- Liquidation speed: As noted in our stress test, the liquidation engine is extremely fast. A 2% move wiped out our 50x position in less than two minutes.

- Mobile limitations: The “Demo Trading” mode is missing from the mobile app. We had to switch to the desktop browser just to practice a new strategy, which breaks the workflow for mobile-first traders.

- Asset depth: Outside of BTC and ETH, liquidity drops off. We tried to trade options on smaller altcoins, but the spreads were too wide to be profitable for short-term trades.

Best futures trading platforms by trader type

If you’re a high-volume professional day trader

Choose: NinjaTrader

If you trade for a living and need industrial-grade tools, this is it. In our testing, it delivered the fastest execution (0.3s latency) and offered the most robust chart-based order entry (bracket orders). The cost of data feeds is worth it for the precision you get on regulated CME markets.

If you want the deepest liquidity for crypto scalping

Choose: Binance Futures

Scalpers need two things: tight spreads and instant fills. Binance provided both in our stress tests for the best platform to trade futures. With $31B in daily volume and a matching engine that handles retail size without slippage, it is the best engine for “point-and-click” directional trading – provided you are outside restricted regions.

If you want to trade Crypto, Gold, and S&P 500 in one place

Choose: PrimeXBT

Most crypto platforms force you to stay in the crypto lane. PrimeXBT allows you to use Bitcoin as collateral to short Crude Oil or long the S&P 500. It’s the best pick for macro-focused traders who want to hedge their crypto exposure against traditional finance assets without managing multiple accounts.

If you are interested in Options and Volatility strategies

Choose: Delta Exchange

If your strategy involves “Greeks” (Delta, Theta, Gamma) rather than just direction, Delta Exchange is the clear winner. It was the only platform in our test to offer true European-style vanilla options alongside futures, allowing for complex strategies like straddles or covered calls.

If you are a beginner transitioning from spot to futures

Choose: Margex

Futures terminals can be intimidating. Margex strips away the noise. Its visual interface clearly shows your liquidation price and margin usage in real-time, and the “MP Shield” helps protect against the kind of scam wicks that often wreck new traders on thinner order books. It’s the safest “sandbox” for learning leverage mechanics.

Risks and final takeaways

Futures trading is not investing; it is high-octane speculation. During our review process, we watched test positions evaporate in seconds and saw “guaranteed” stops slip by 10%. Before you deposit your first dollar, understand the risks that marketing pages hide.

- Leverage is a loan, not a gift: When you trade with 100x leverage, you are borrowing 99% of the position size. A mere 1% move against you wipes out your collateral. In our stress test on PrimeXBT, we saw how “gap risk” works: the market moved faster than our stop-loss could trigger, and the liquidation engine took over instantly.

- The “funding” trap: On perpetual futures platforms like Margex and Binance, you pay interest to keep positions open. During our test week, holding a long BTC position cost us roughly 0.2% per week in funding fees. That sounds small, but annualized, it’s over 10%. Futures are for short-term moves, not long-term holding.

- Platform risk: If a platform goes offline during a crash, you cannot exit. This is why we penalize platforms heavily for low liquidity or unstable APIs.

Capital requirements: how much do you need?

Don’t start with $50. In our testing, small accounts faced the highest friction:

- The “dust” problem: On some platforms, if your remaining margin drops below $10, you can’t even close the position – you are forced to add funds or wait for liquidation.

- Margin buffers: On NinjaTrader, trading a single Micro Bitcoin contract requires minimal capital intraday, but holding it overnight requires significantly more. The best starting point here hovers at $500 to $1,000 range, which is the best threshold to trade safely without being stopped out by normal market noise.

There is no single best futures platform that wins every category. The right choice depends entirely on your strategy:

- If you need raw speed and liquidity, Binance Futures is the king, provided you can legally access it.

- If you are a professional demanding regulated precision, NinjaTrader justifies its learning curve.

- If you want to hedge real-world assets like oil or gold alongside crypto, PrimeXBT offers unique utility.

- If you are learning the ropes, Margex offers the safest visual environment to understand leverage without getting overwhelmed.

Our advice? Start small. Use our mystery shopper method: deposit the minimum, execute one test trade, and try to withdraw your funds before you commit serious capital. The best platform is the one that fits your workflow – and actually lets you take your profits home.

Best crypto futures platforms 2026 – side-by-side comparison

| Exchange | Standout | Fees (Futures) | Assets | Fiat / Funding | PoR / Trust | Best for |

|---|---|---|---|---|---|---|

| Binance Futures | Deepest global liquidity and instant execution | 0.02% maker, 0.04% taker; discounts via BNB | 200+ Pairs | Varies by region; restricted in US/UK/EU | Recurring Merkle-based PoR snapshots; SAFU fund | Scalpers & active traders needing maximum liquidity & speed |

| Margex | “MP Shield” price protection & visual interface | 0.019% maker, 0.060% taker | 18 Pairs | Crypto-only funding (no fiat rails) | No public PoR; offshore unregulated entity | Beginners transitioning from spot who want a safe “sandbox” UI |

| PrimeXBT | Cross-margin trading for Crypto, Gold, Oil & S&P 500 | Flat 0.05% fee for crypto futures | Crypto + 40 TradFi | Crypto-only deposits; withdrawals can be slow | No public PoR; member of Financial Commission | Macro traders hedging crypto against real-world assets |

| NinjaTrader | Professional CME access with bracket orders | ~$0.59 – $1.29 per contract + data fees | CME Futures (ES, NQ, BTC) | Regulated Bank Wires | Funds held in segregated accounts (CFTC-regulated) | Professional day traders demanding industrial-grade tools |

| Delta Exchange | Vanilla Options (Calls/Puts) & Robo Trading | 0.02% maker, 0.05% taker | Futures + Options | Crypto-only; high fees on some withdrawal nets | No public PoR; India arm is FIU registered | Sophisticated traders trading volatility or “Greeks” |

Methodology – why you should trust us

We use a weighted, category-based model, collect standardized data from each platform (open data + hands-on testing), and convert that into a 1.0–5.0 star score in 0.1 increments.

Our focus is futures trading quality: real fees + funding costs, leverage flexibility, market depth, execution speed during volatility, and the user-facing risk controls.

How we collect data

- Public data: fee schedules (maker/taker/VIP), funding rate history, margin tiers, and regulatory status.

- First-hand testing: we place test trades (here: $200), open leveraged positions (10x–50x), measure spreads and slippage during market moves, and verify stop-loss execution.

We do not rate solvency or make guarantees about financial stability. Ratings reflect the trader’s experience, not a balance-sheet audit.

Categories & weights

- Trading Fees & Funding Costs – 25%

- Leverage & Margin Requirements – 20%

- Contract Selection & Liquidity – 15%

- Platform Performance & Risk Controls – 15%

- Security & Regulatory Compliance – 10%

- User Experience & Trading Interface – 10%

- Customer Support & Educational Resources – 5%

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.