Best copy trading platforms in 2026: Top picks by category, fees, and execution

Copy trading looks simple on the surface, but results depend on much more than a trader’s headline returns. Execution speed, fees, risk limits, and platform rules all shape what subscribers actually earn. This guide compares the best copy trading platforms in 2026.

Copy trading users to automatically follow professional traders, mirroring their positions in real accounts. In practice, it is a technical product: a subscriber’s results depend not only on who they copy but also on how the platform executes orders, what each trade costs, and which restrictions the broker imposes.

That’s why choosing a service shouldn’t be based solely on platform returns. More important are the platform’s conditions that can cause subscriber results to differ from the leader’s performance.

In this toplist, platforms are evaluated using the GNcrypto methodology: transparency of trader statistics, real cost, execution quality, risk control, usability, regulation, and fairness of selection. This approach filters out services where attractive returns rely on aggressive leverage and weak oversight. It highlights platforms where copying closely follows the leader’s strategy and risks are clearer.

Overall rating:

– IC Markets: 4.5/5 (best for active strategies)

– ZuluTrade: 4.3/5 (best for portfolio diversification)

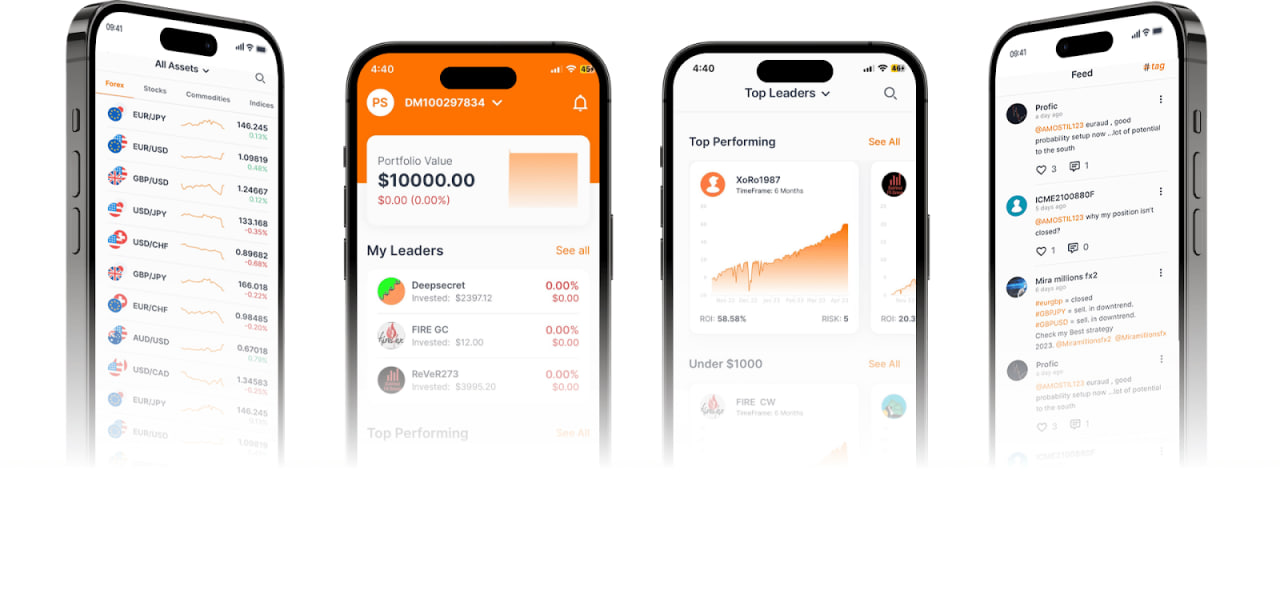

– AvaTrade: 3.8/5 (best for mobile social trading)

– FXTM: 3.7/5 (best for broker-integrated copying)

– Traders Trust: 3.5/5 (best for low minimum deposit)

Based on testing and methodology application, IC Markets is the best copy trading platform for execution quality and cost transparency.

What copy trading is

Copy trading is the automated replication of another trader’s positions in your own account. You choose a leader, allocate a fixed amount or a percentage of your balance, and the leader buys, sells, stop-losses, and takes profits on your account in proportion to the capital you’ve assigned. Funds are never transferred to the trader: positions open on your own account, and you can disable copying or close positions manually at any time.

Copying is typically offered in three formats.

- The first is direct order copying: every trade executed by the leader is mirrored for the subscriber.

- The second is portfolio copying: instead of matching each entry, the system aligns your portfolio with a target allocation.

- The third is signal subscription, where the platform can execute recommendations automatically if you choose to enable it.

Copying does not ensure identical results. A subscriber’s execution can differ due to latency, liquidity, and slippage, and their trading conditions may not match the leader’s (spreads, fees, swaps, leverage limits, margin requirements). With fast strategies, even small entry- and exit-price gaps can become a separate source of losses.

Costs also come in two layers. The first is your standard trading expenses on a broker or exchange: spread, commission, margin funding. The second is the copying fee, if one applies – a subscription, a performance fee, or a turnover-based charge. Because brokers add their own variables, the best copy trading platform is the one where trader and subscriber results align as closely as possible.

A strategy may look profitable in the leader’s stats yet still lose money for the subscriber once all costs are applied.

Copy trading delegates trade selection, not risk management. You are responsible for allocation size, drawdown limits, stopping copying, and evaluating how the leader generates returns. In the EU, many copy-trading models are treated as an investment service and require proper risk and cost disclosures, while the UK regulator warns against “copy and profit”-style promotions without adequate caveats.

Leader statistics are only meaningful when viewed as a risk profile. Check maximum drawdown, track-record length, trade frequency, and instrument concentration. Short histories and high percentages often correlate with aggressive leverage and rare but severe losses. Rankings can also be distorted because only surviving accounts stay visible, while failed ones disappear from the list.

Best platforms by category

The most practical way to choose a copy trading platform is to match it to your specific use case. Copy trading relies on different mechanics: in some setups, execution quality and fees matter most; in others, filtering tools and risk control take priority; elsewhere, the value lies in low entry requirements and simple onboarding.

To minimize divergence between leader and subscriber, brokers with strong execution and low trading costs typically perform best. IC Markets stands out as the strongest among the best copy trading platforms: competitive pricing, scalable execution, a large instrument list, and dedicated solutions for social copying (IC Social) and signals. This suits users who follow active traders and want to avoid losing strategy performance to spreads and delays.

For a portfolio of multiple leaders – when you want the freedom to switch brokers and avoid being locked into a single infrastructure – an aggregator service is more practical. ZuluTrade operates as a layer on top of your brokerage account: you choose leaders, filter them by parameters, and keep funds on your own account. Key advantages include advanced filtering (40+ filters) and the built-in ZuluGuard risk engine, which intervenes if a leader’s behavior changes sharply.

For a “social ideas + auto-copying” workflow, platforms that provide both modes within one ecosystem are easier to use. At AvaTrade, this is split between AvaSocial (social copying through a mobile app with basic risk controls) and DupliTrade (automated strategy execution on MT4/MT5). DupliTrade’s drawback is its high entry threshold: access starts at a $2,000 deposit.

For testing copy trading with small capital, a low minimum deposit and simple infrastructure matter most. Traders Trust starts at $50 and supports copying via MQL5 Signals and MAM accounts. The trade-off is a smaller market list (around 65 assets) and the fact that all logic runs through MT4.

If your priority is a strong regulatory framework and broker-integrated copy trading, FXTM with its FXTM Invest service is a viable option. It targets users who want to follow experienced traders without manual management while staying within the familiar MT4/MT5 and mobile environment.

AvaTrade

Rating: 3.8/5

AvaTrade is a forex/CFD broker, not a crypto exchange. Copy trading here is built around margin instruments and leverage-related risk. The platform does not serve clients from the United States.

Copy trading is split into two products. AvaSocial supports the “social” copy trading scenario: users choose a trader, enable trade replication, and can allocate capital across multiple leaders. DupliTrade is designed for automated copying, executing a provider’s trades on the client’s account through MetaTrader without manual involvement in each entry or exit.

DupliTrade works as a curated showcase of strategy providers. The service displays a list of traders with different styles, and copying runs in real time on your MT4 or MT5 account. The materials and analysis on the DupliTrade page are prepared by DupliTrade Limited and reproduced by AvaTrade without independent verification.

The core offering is forex and other asset classes via CFDs. The platform supports 55 currency pairs and more than 1,250 instruments, including CFDs on stocks, ETFs, commodities, indices, and cryptocurrencies. Copying is executed through derivative contracts, so results depend not only on price direction but also on margin-trading conditions and the cost of holding positions.

The entry threshold is low: the minimum deposit is $100. DupliTrade’s requirement is much higher at $2,000. This difference affects diversification directly – with a small deposit, a single losing streak can drain margin quickly and force early position closures. A demo mode is available for initial testing, but copying strategies requires real funds.

Copy-trading costs include the spread and overnight financing, plus a separate inactivity fee. After three months without activity, the platform deducts $50, and after a full year of inactivity another $100. These charges are unrelated to strategy quality, so factor them in ahead of time.

A key risk-management limitation is the absence of guaranteed stop-losses. In fast markets, stops may feel worse than expected, and subscriber results can differ from the provider’s due to execution and pricing differences. CFDs are complex instruments, and most retail accounts with this provider lose money.

Selecting a trader matters more than a smooth performance curve. Review maximum drawdown, track-record length, trade frequency, and asset class to ensure the strategy’s risk profile aligns with your own. When copying with leverage, it’s prudent to start with smaller position sizes and maintain a margin buffer; otherwise, a strategy may “break” on your account simply because there isn’t enough collateral.

AvaTrade offers multiple platforms, including its own apps and WebTrader, as well as MT4/MT5. In copy trading, this often creates a split workflow: trader selection and monitoring in one interface, while execution control and position management take place in another when MetaTrader is used.

The platform provides no public data on execution quality – such as speed or slippage – and portfolio analytics and detailed trade-analysis tools are limited. This reduces comparability across providers and makes it harder to identify why subscriber results deviate from the leader’s. Users must verify copy quality themselves by comparing trade logs, testing with small volumes, monitoring divergence, and disabling a strategy if copying errors become systematic.

AvaTrade is regulated in nine jurisdictions and applies standard safeguards, including client-fund segregation. It suits users who want copy trading in the forex/CFD segment and value having both a social option (AvaSocial) and an automated one (DupliTrade). The trade-offs include leverage risk, the lack of guaranteed stops, inactivity fees, and the high minimum deposit required for DupliTrade.

| Criterion | Score | Weight |

|---|---|---|

| Execution Quality & Fees | 3/5 | 30% |

| Risk Controls & Transparency | 4/5 | 25% |

| Leader Selection Tools | 3/5 | 20% |

| Platform Usability | 4/5 | 15% |

| Regulation & Trust | 5/5 | 10% |

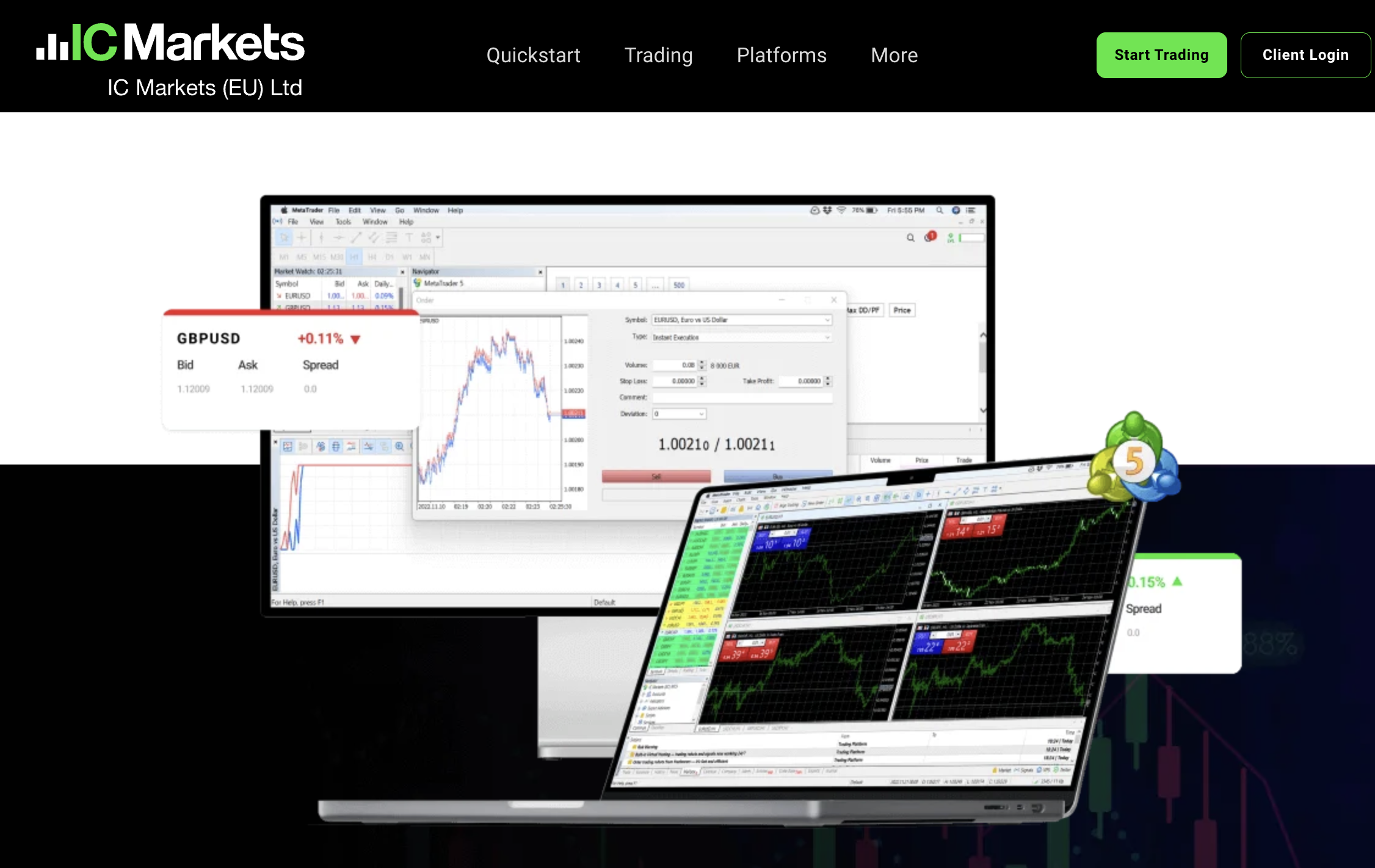

IC Markets

Rating: 4.5/5

IC Markets is a forex/CFD broker built for copying and automation on MT4/MT5 and cTrader. It doesn’t position copy trading as an internal social network; instead, it offers several integrations: cTrader Copy, MetaTrader Signals, Myfxbook AutoTrade, ZuluTrade, and the IC Social mobile app. This flexibility allows the same account to connect to different ecosystems, though availability depends on the jurisdiction and the specific IC Markets entity.

The copying system works as follows: in cTrader Copy, trades are allocated proportionally to equity using an equity-to-equity model, and investors can review a strategy’s profile and track record before subscribing. IC Social emphasizes social mechanics – rankings, feeds, messaging, trader statistics – along with basic risk indicators and the ability to set stop-losses on copied positions.

Copying is mostly limited to CFDs and forex. IC Markets operates multiple entities with different market lists, but overall it offers thousands of instruments, including cryptocurrencies via CFDs, without buying the underlying asset. For copy trading: results depend not only on market direction but also on spreads, commissions, and holding costs.

IC Markets ranks first among the best copy trading platforms for costs and execution quality. The broker uses an agency model with no requotes, allowing both positive and negative slippage. It’s a fair trade-off for true market execution, but for copy trading it implies a simple rule: the faster the strategy and the higher the turnover, the greater the potential divergence from the provider’s results. IC Markets partially compensates for this with infrastructure built for algorithmic trading.

Pricing is structured around three account types: Standard (spread-only) and two Raw Spread accounts, including cTrader Raw Spread. cTrader offers the lower commission – about $3 per side per 100,000 units ($6 round-turn). On MT4/MT5, it is roughly $3.5 per side ($7 round-turn). The minimum deposit is $200.

In cTrader Copy, providers can charge three fee types: performance, management, and volume. The performance fee is capped at 30%, the management fee at 10%, and the volume fee at up to $10 per million traded, applied on both entry and exit. These do not replace spreads or broker commissions – they are added on top. When choosing a strategy, weigh both returns and the fee model.

Risk control exists but varies across services. In cTrader Copy, users can stop copying and set an equity stop loss. In IC Social, subscribers can set stop-losses on copied trades and receive risk signals. Still, IC Markets operates in the CFD environment: stop orders do not guarantee execution price, and drawdowns depend on volatility and leverage. For the broker’s European entity, 70.53% of retail accounts lose money – a clear signal of how harshly the market punishes weak risk management.

IC Markets has operated since 2007, is privately held, and does not run a bank. ForexBrokers assigns it a Trust Score of 84 out of 99, with Tier-1 regulation (ASIC), a European structure via Cyprus, and several offshore entities. Protection levels and the set of available copy-services depend on where the account is opened.

| Criterion | Score | Weight |

|---|---|---|

| Execution Quality & Fees | 5/5 | 30% |

| Risk Controls & Transparency | 4/5 | 25% |

| Leader Selection Tools | 4/5 | 20% |

| Platform Usability | 4/5 | 15% |

| Regulation & Trust | 5/5 | 10% |

Traders Trust

Rating: 3.5/5

Traders Trust offers copy trading as an MT4 add-on. The setup is simple: you connect MQL5 Signals or use a MAM account, and trades execute in your terminal on your own account. It’s a practical option for MetaTrader users who want to copy trades without switching platforms or relying on a separate social app.

The available markets are standard for a forex broker: currencies, metals, commodities, and cryptocurrencies via CFDs. The instrument list is relatively small – about 65 assets, including roughly 40 currency pairs. If a provider’s strategy depends on broad diversification or exotic markets, the limited selection becomes a constraint.

The entry barrier is low. The minimum deposit to open an account is $50, with a separate $100 minimum for accessing successful traders’ strategies. There are no micro (cent) accounts and no MT5 support, so the entire ecosystem is built around MT4 and its surrounding services. For beginners, this simplicity is helpful; for experienced users, it means fewer instruments and a more restricted infrastructure.

The broker separates its execution models: standard accounts use STP/NDD, while professional accounts use ECN.

Execution is listed as market execution, so slippage is possible. This is critical for copy trading: the faster the provider’s style (scalping, high-frequency, news trading), the higher the likelihood of divergence between the leader’s results and the subscriber’s. Margin conditions also matter: the minimum order size is 0.01, and margin call and stop-out levels are set at 80% and 50%. These thresholds influence how quickly a strategy can pressure an account during a losing streak.

Leverage varies by account and can be aggressive. Materials mention levels up to 1:2000, while some conditions cap leverage at 1:500.

Copy-trading costs follow a two-layer structure. The first layer is your standard trading costs (spreads and any account-specific commissions). The second layer depends on the provider’s terms in MQL5 Signals or in a MAM account, if a separate fee applies. Comparing strategies by performance alone is ineffective: you must review drawdown, track-record length, trade frequency, and whether your deposit and chosen risk settings can handle the strategy’s load.

Regulatory oversight for Traders Trust includes CySEC, the FSA (Seychelles), and the BMA (Bermuda). The broker does not hold an FCA-level license, which shapes expectations around protection and dispute resolution. It has operated since 2011, offers demo accounts, and uses MT4 as its sole trading platform.

Traders Trust fits users seeking forex/CFD copy trading on MT4 with a low minimum deposit and compatibility with MQL5 Signals and MAM. Its limitations include a narrow instrument list, no MT5 or micro accounts, and elevated risk from high leverage and the unavoidable slippage inherent to market execution.

| Criterion | Score | Weight |

|---|---|---|

| Execution Quality & Fees | 3/5 | 30% |

| Risk Controls & Transparency | 3/5 | 25% |

| Leader Selection Tools | 3/5 | 20% |

| Platform Usability | 4/5 | 15% |

| Regulation & Trust | 4/5 | 10% |

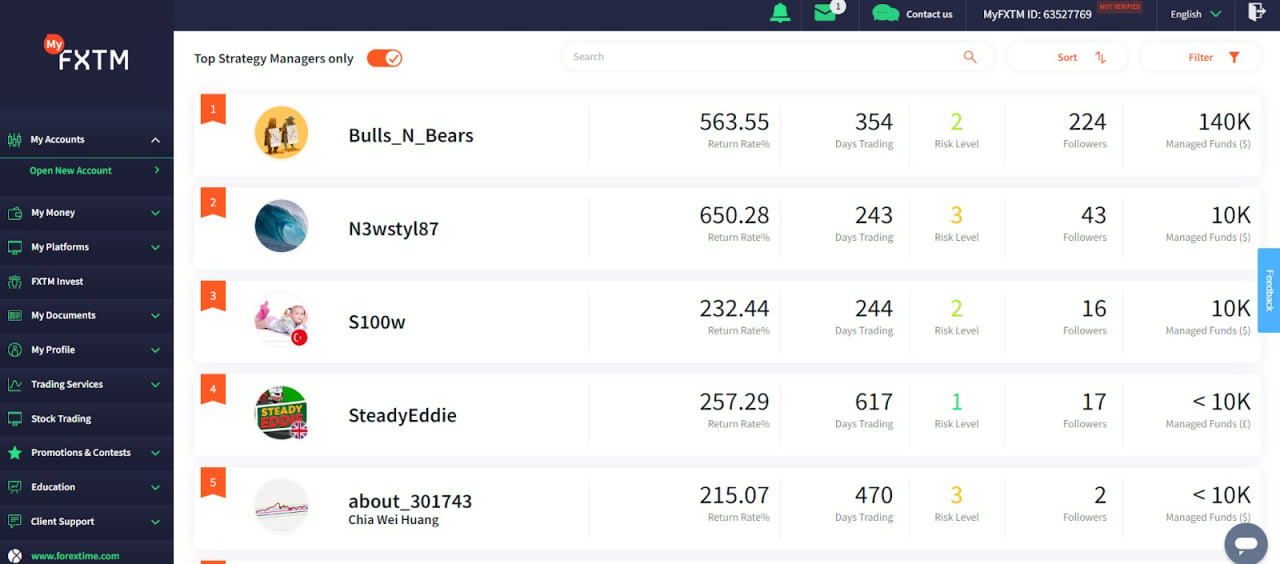

FXTM

Rating: 3.7/5

FXTM builds its copy trading around FXTM Invest. This is an investment-mode system within the broker: the subscriber selects a manager, enables trade copying, and manages subscriptions through the client portal. The model is closer to account management than to a social feed, so the focus is on metrics and rules rather than community activity.

Inside the FXTM Invest dashboard, users can view manager profiles, performance statistics, and available copy-trading subscriptions. Connecting is simply choosing a manager and setting parameters, while management comes down to monitoring results and turning off the subscription if the strategy exceeds your risk limits.

Copying follows the same markets offered for regular trading with the broker. The core lineup is forex and CFDs: currency pairs, metals, commodities, indices, stock CFDs, and crypto CFDs. Since the underlying asset is never purchased, a strategy’s performance is shaped by trading costs and the expense of holding positions. Over longer periods, swaps and commissions can meaningfully erode returns if a manager keeps trades open for weeks.

The minimum deposit varies by account type. The base minimum is $200, while Micro accounts can start from $10. Pricing comes in two modes: Advantage, which uses a commission with tighter spreads, and Advantage Plus, which removes the commission but widens the spreads. On Advantage, forex carries a $3.5-per-lot commission; spreads on major pairs can start at 0.0 pips, with typical levels up to 1.5 pips. For Micro and Advantage Plus, minimum spreads start from 1.5 pips. Crypto CFD trades use a 0.07% commission on the position’s notional value.

Copying almost never mirrors a manager’s results exactly. Spreads, commissions, and entry timing all contribute to differences. The higher the turnover and the more a strategy leans toward scalping, the larger the divergence becomes. This changes how strategies should be evaluated: returns alone mean little. Drawdown, trade frequency, and behavior during volatility matter far more.

The risk profile depends on leverage and regulatory jurisdiction. In the EU and UK, major forex pairs are capped at 30:1 and minors at 20:1; outside those zones, leverage can reach up to 1,000:1.

The minimum trade size is 0.01 lots. Negative balance protection is provided, but it does not prevent drawdowns: copying at high leverage can still drain margin quickly. Additional costs include an inactivity fee (which may apply after three months without trades if the account has a positive balance) and a fixed $3 fee for transactions under $30.

The infrastructure is standard: MT4, MT5, web terminals, and the FXTM Trader mobile app. Users have access to an economic calendar, an Acuity-powered signal center, and FXTM’s own signals updated three times daily. Educational materials are available, though live webinars have not been updated recently and some content remains archival.

The broker is regulated by the FCA and CySEC, and also operates under FSCA, FSC, and CMA in specific regions. Restricted countries include the United States, Japan, Canada, Russia, and Belarus. Deposits and withdrawals are supported in fiat currencies and select cryptocurrencies, including USDT, BTC, and ETH.

| Criterion | Score | Weight |

|---|---|---|

| Execution Quality & Fees | 4/5 | 30% |

| Risk Controls & Transparency | 3/5 | 25% |

| Leader Selection Tools | 3/5 | 20% |

| Platform Usability | 4/5 | 15% |

| Regulation & Trust | 5/5 | 10% |

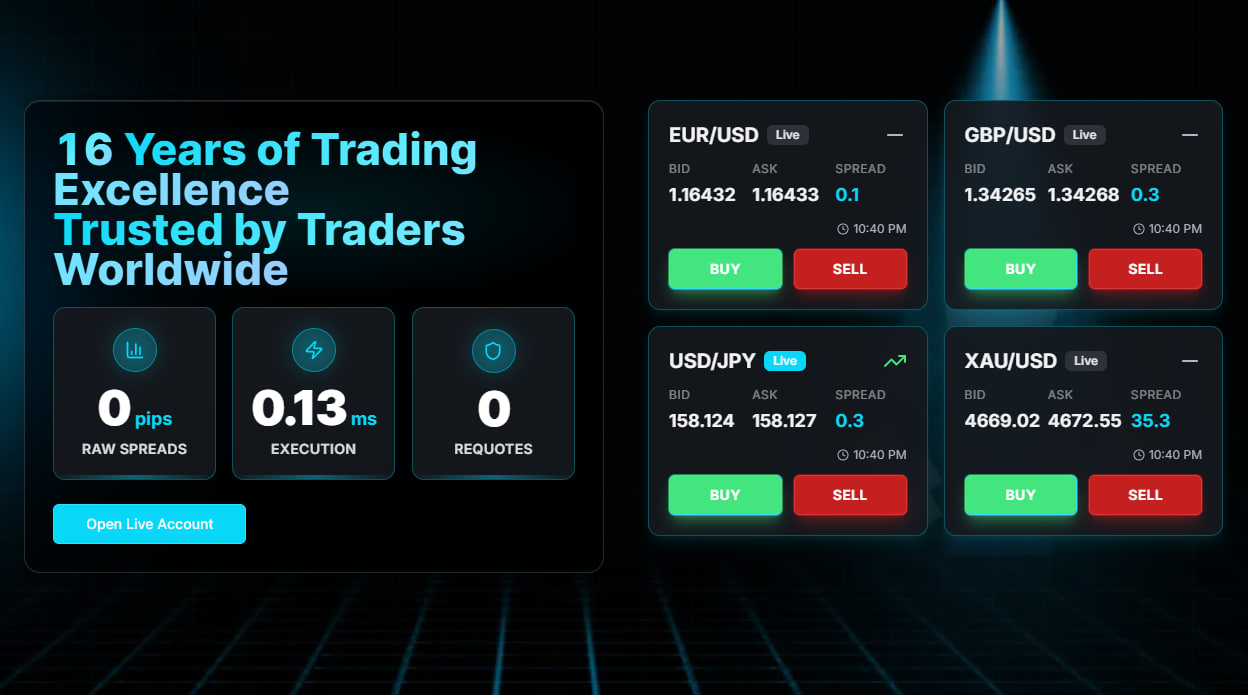

ZuluTrade

Rating: 4.3/5

ZuluTrade acts as an intermediary layer between the investor and the broker. Funds stay in the brokerage account, while the platform provides a catalog of leaders and tools for configuring how their trades are copied. You can link your account via MT4, MT5, ActTrader, or X Open Hub, or connect an existing account through a Client ID. If you haven’t chosen a broker yet, you can open an account directly through ZuluTrade with an integrated or co-branded partner.

The marketplace is multi-asset: forex, commodities, indices, stocks, and cryptocurrencies. ZuluTrade is not a counterparty and does not determine trading conditions. It simply routes trade instructions to your brokerage account, where execution depends on that broker’s environment. This creates a core implication: the same leader can generate different results across brokers because spreads, commissions, swaps, and execution quality vary.

The leader catalog is built on open performance data. The platform reports that it discloses all metrics, ranks leaders by returns, stability, and trading behavior, and offers more than 40 filters for selection. This enables proper risk assessment: filtering by maximum drawdown, track-record length, trading style (day trading, positional, high frequency), markets traded, and behavioral characteristics.

In the mobile app, users can access performance reports, the ZuluRank system, a dedicated Risk Score, and a watchlist to track potential candidates without relying on a single equity curve.

The payment model depends on how the account is connected. With integrated brokers, copying is presented as free. In subscription-based setups for some co-branded or standard connections, a fee of about $10 per strategy per month may apply, though in some cases the broker covers it. Leaders are compensated for being copied, with incentives linked to subscriber volume and activity. This creates a potential conflict of interest for high-turnover, aggressive strategies, so trade frequency and equity-curve stability need to be assessed carefully.

Execution is inherently different from the leader’s. ZuluTrade is broker-agnostic and platform-agnostic, but actual trades are executed through your broker’s infrastructure. During fast market moves, entry and exit prices may differ, and low-liquidity instruments can produce slippage. ZuluTrade partially offsets this through investor-side controls: manual trade mode, stop and limit settings, per-leader lot-size configuration, and a simulator for testing strategies before committing capital.

ZuluGuard functions as a protective mechanism that intervenes when a leader’s behavior changes, while investors set their safeguards through lot sizes, limits, and auto-deactivation rules. This is particularly useful when a leader increases leverage or shifts strategy after a losing streak.

Legally, the service is structured as a software provider: ZuluTrade International Limited is registered in Cyprus, with operational activity regulated by the Hellenic Capital Markets Commission in Greece under license No. 2/540/17.2.2010. ZuluTrade reports presence in 150+ countries, 30M+ accounts, and 2M+ leaders. Its reputation, however, is mixed: the service has a low Trustpilot rating, pointing to issues with expectations and customer experience.

ZuluTrade is the strongest among copy trading platforms for users who want flexible broker connectivity and the ability to build a portfolio of multiple leaders. A good scenario involves conservative leaders with long histories and moderate trade frequency, where costs and slippage don’t distort performance. A poor scenario is chasing short-term gains or copying scalping strategies in high-volatility markets, where execution divergence becomes a structural loss.

| Criterion | Score | Weight |

|---|---|---|

| Execution Quality & Fees | 4/5 | 30% |

| Risk Controls & Transparency | 5/5 | 25% |

| Leader Selection Tools | 5/5 | 20% |

| Platform Usability | 4/5 | 15% |

| Regulation & Trust | 3/5 | 10% |

Final recommendations

Final recommendations focus on one goal: reducing the gap between the leader’s performance and the subscriber’s. Brokers add their own variables, so the best copy trading platform is one where trades replicate closely and aren’t undermined by commissions, spreads, or execution quality.

For active strategies with high turnover and short holding periods, prioritize infrastructure and trade cost. A broker model with raw pricing and transparent commissions is the logical fit. At IC Markets, the Raw Spread account charges a $3.5 one-way lot commission on MetaTrader and $3.0 per 100,000 turnover on cTrader, with spreads starting at 0.0. This lowers the risk of a strategy being profitable only for the leader.

Building a portfolio of several leaders without committing to a single broker works better through an aggregator layer. ZuluTrade connects to existing accounts (MT4/MT5 and other platforms), offers more than 40 selection filters, and provides the ZuluGuard protection layer, which intervenes when a leader’s behavior shifts.

A “broker inside a broker” setup, where copying runs within a unified ecosystem, points to FXTM and its investment mode. Here, baseline economics matter: FXTM Advantage charges a $3.5 per-lot Forex commission, and the minimum deposit for this account is $200. This clear cost structure makes post-subscription performance easier to assess.

Mobile social layer plus auto-copying comes with AvaTrade’s dual-mode approach, but DupliTrade requires a $2,000 minimum deposit – not ideal for small-budget testing.

Cautious start with limited capital call for a low entry threshold. Traders Trust sets a $50 minimum on a standard account, with copying available through MetaTrader and signal services, though risk limits must be set manually.

To start safely, begin with a small allocation, set a drawdown limit at the account or platform level, compare your trade log to the leader’s, and disable copying if divergence becomes the norm rather than the exception.

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.