Bank of Japan lifts rate to 0.75% for first time in 30 years

The Bank of Japan raised its key short-term interest rate to 0.75% from 0.5% on Friday, taking borrowing costs to a level the country has not seen since the mid-1990s. The move broadly matched market expectations and marked another step away from the ultra-loose stance that kept rates near zero for years.

In its statement, the central bank made it clear the shift may continue. Officials said they still see a strong chance of inflation holding around the 2% target in a sustainable way, with price growth increasingly tied to wage gains. The BOJ added that if its outlook for growth and inflation plays out, it expects to keep lifting rates.

Governor Kazuo Ueda tried to strike a careful tone. He noted that real interest rates remain “significantly negative,” and that overall financial conditions are still accommodative, supporting the economy. At the same time, he avoided locking the bank into a preset path. When asked how quickly the BOJ might move again, Ueda stressed that decisions will hinge on how the economy responds to the changes already made.

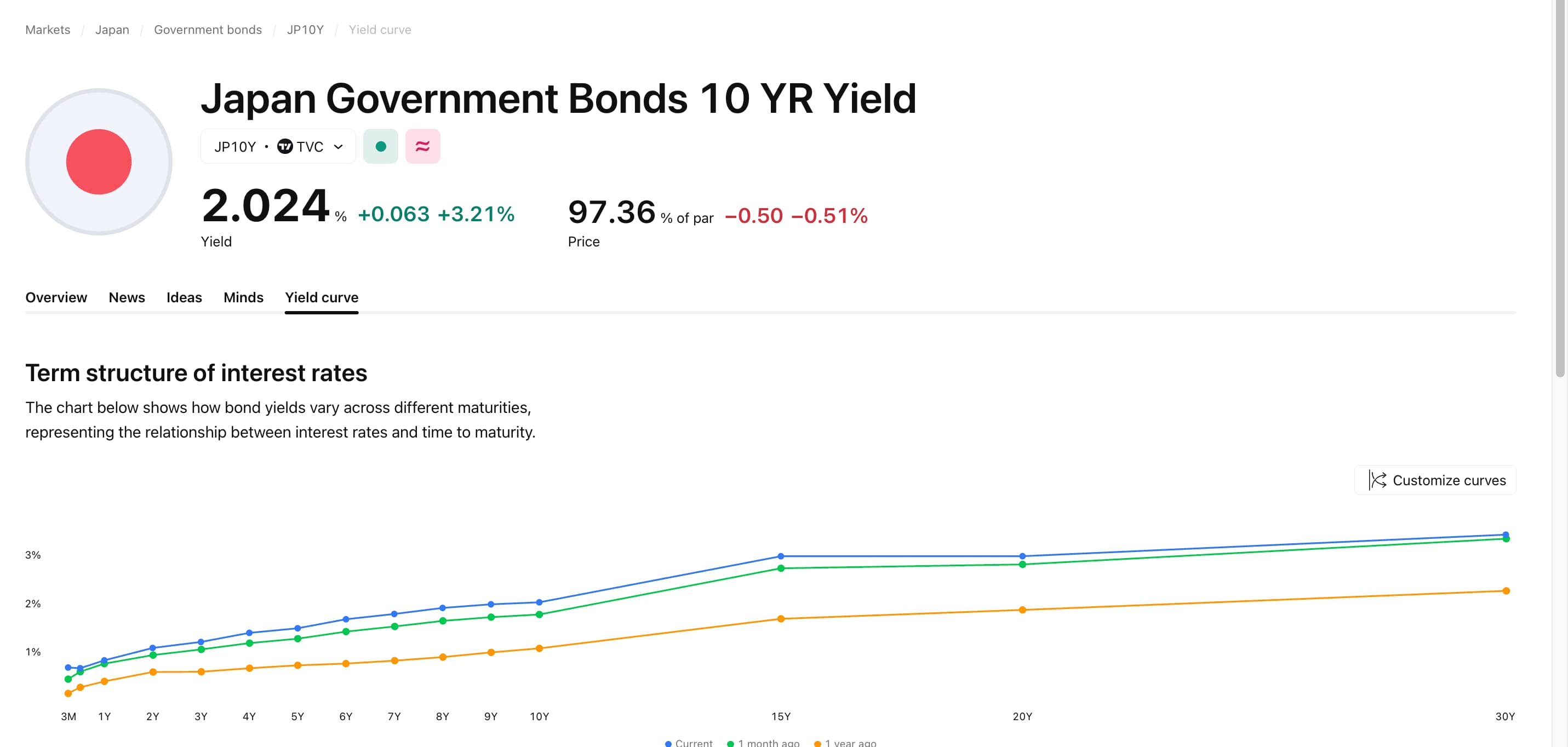

Markets reacted fast. Yields on Japan’s 10-year government bonds jumped to their highest levels in roughly 26 years. The yen moved the other way, weakening as the dollar climbed above 157 yen, the strongest level in about a month. Some analysts said the price action reflected disappointment from investors who had been hoping for a more hawkish signal about where policymakers see the peak rate in this cycle.

There are also signs of unease inside the BOJ. While the bank kept language suggesting underlying inflation is moving closer to 2% in the latter half of its forecast horizon, some board members pushed back publicly against that relatively calm view of price pressures.

Against that backdrop, State Street Investment Management noted that the gap between U.S. and Japanese interest rates could narrow faster. The argument is straightforward: if the Federal Reserve continues toward rate cuts while Japan gets a macro tailwind in 2026, the BOJ may have more room to keep normalizing policy.

For Japan’s government, higher rates come with trade-offs. Officials have warned that rising borrowing costs can increase debt-servicing expenses and deserve close monitoring for broader economic fallout. Still, the BOJ’s message suggests it intends to keep moving in the same direction, even if it does so in measured steps.

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.