Why are prediction markets legal: your ultimate guide

Sometimes it’s difficult to wrap your head around what’s legal or not, especially when it comes to predicting the future with money.

What counts as a prediction market?

Before answering the question of “are prediction markets legal,” let’s start with the basics.

A prediction market is a marketplace where people trade contracts tied to the outcome of future events. These events can range from elections and economic indicators to sports results or technological milestones. But this isn’t about entertainment only: it’s about people effectively buying and selling probabilities, either making or losing money as a result.

At the core of prediction markets are event contracts. Each contract represents a specific outcome. For example, will a certain candidate win an election? Will an interest rate hike occur? Will Real Madrid win another cup? Will the war in Ukraine end by a certain date?

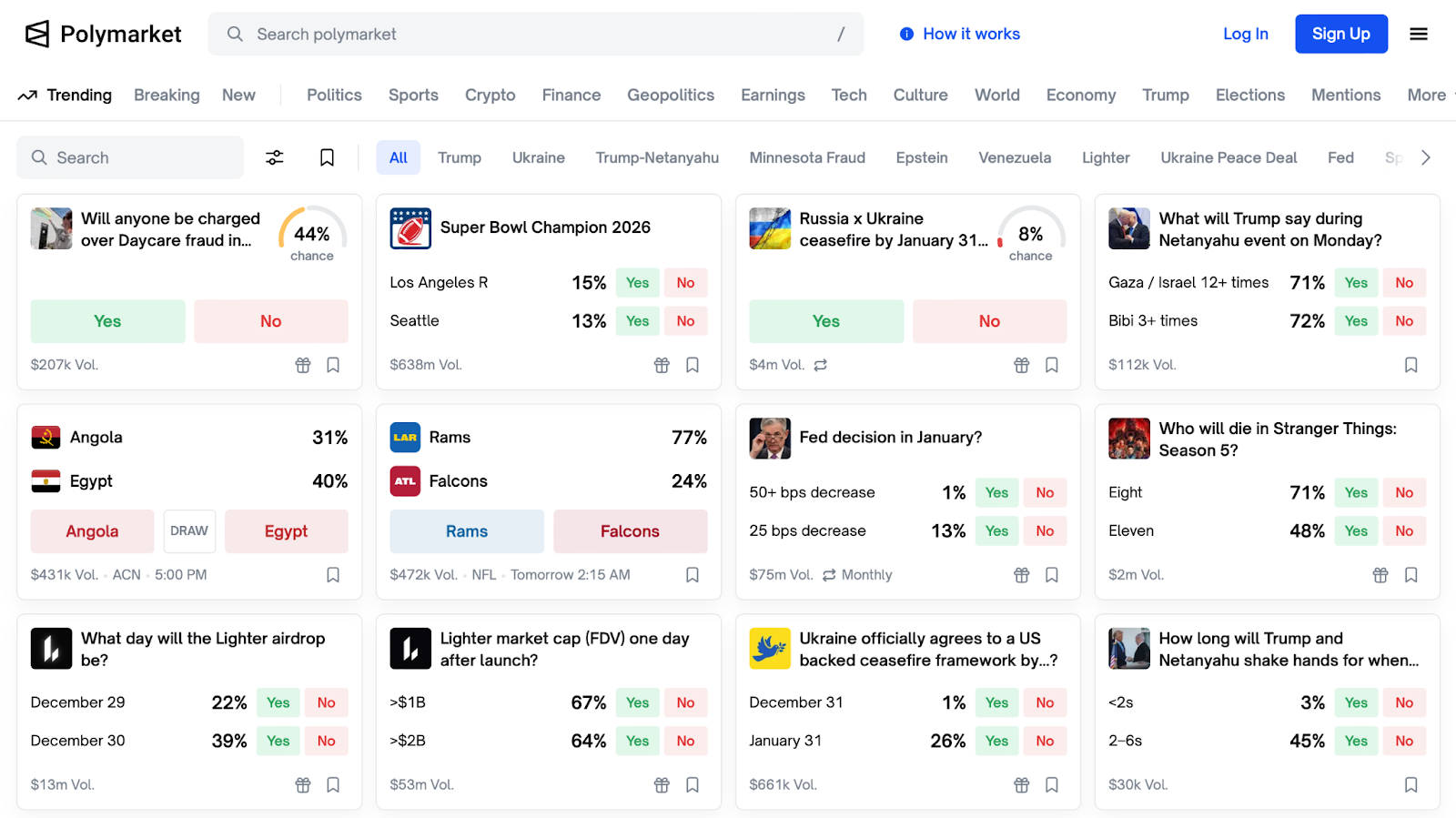

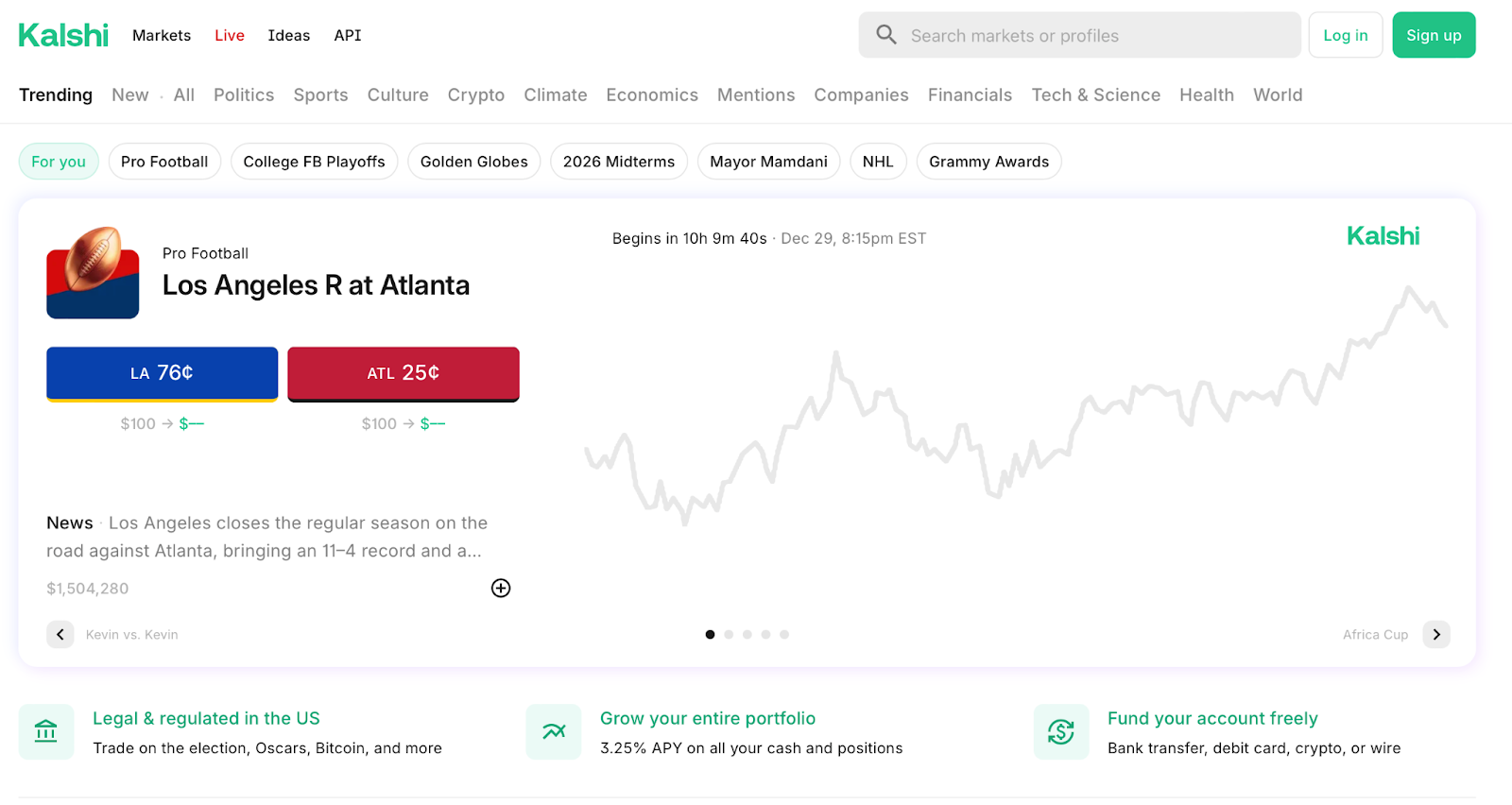

Popular prediction market platforms include Polymarket, a blockchain-based prediction market where users trade on real-world outcomes using crypto. Kalshi, U.S.-regulated prediction market approved by the Commodity Futures Trading Commission (CFTC), PredictIt, an academic-focused prediction market operated under regulatory oversight for research purposes.

Contracts are usually priced between $0 and $1 (or an equivalent unit), where the price reflects the market’s collective estimate of the likelihood that the event will happen. For example, a contract trading at $0.65 implies a roughly 65% perceived probability.

Trading mechanics resemble financial markets more than traditional betting. Participants can buy contracts if they believe the market is underestimating an outcome. Or they sell if they think the probability is overstated. As new information emerges, prices move accordingly. The final settlement occurs once the outcome is known, with winning contracts paying out at full value and losing ones expiring worthless.

People often claim that prediction markets outperform polls and expert forecasts because participants are forced to put their money where their mouth is. Accordingly, when participants risk capital, they are motivated to incorporate real data rather than opinions. But critics have their doubts, noting that liquidity, market design, and participant behavior can all influence accuracy, making prediction markets powerful but imperfect forecasting tools.

Regulated vs. unregulated platforms

The prediction-market industry is marred by one recurrent question: does it operate under formal regulatory authorization or outside of it? In other words, the question of how are prediction markets legal?

Regulated prediction markets typically function within established financial or commodities frameworks. In the United States, certain prediction-style contracts are overseen by the CFTC that, for example, fined the prediction giant Polymarket. These markets are usually subject to strict rules around contract design, position limits, reporting, and participant eligibility. The goal is to ensure transparency, prevent manipulation, and protect retail users.

By contrast, unregulated or offshore platforms operate outside these formal structures. They may be accessible globally via the internet and often rely on crypto infrastructure to facilitate participation. These platforms typically offer a wider range of markets and fewer restrictions, but they also carry higher legal and operational uncertainty for users.

For participants, the difference matters. Regulated markets tend to offer stronger consumer protections and clearer legal standing, but they may limit the types of events users can trade and impose caps on position sizes. Unregulated platforms often provide more flexibility and variety, but users may face risks related to jurisdiction, enforcement, or sudden changes in access.

It is an absolute must that you understand where a platform sits on this spectrum before using any platform. The same basic mechanics may apply, but the legal consequences and user protections can differ significantly.

Where prediction markets are allowed

The legality of prediction markets varies widely by jurisdiction and often depends on how these markets are classified – whether as financial instruments, derivatives, or forms of wagering.

Legal prediction markets US exist in a narrow and carefully regulated form. Some platforms operate under exemptions or no-action relief granted by regulators, typically for academic, research, or limited commercial use. These markets are often constrained in scope, participant eligibility, and contract size. Broad, retail-focused prediction markets tied to political or social outcomes remain heavily restricted.

In parts of Europe, prediction-market activity may fall under financial-market regulations or gambling laws, depending on the contract structure. Some jurisdictions allow limited forms of event-based contracts under existing derivatives frameworks, while others prohibit them entirely.

In offshore or lightly regulated regions, prediction markets may operate with fewer explicit legal constraints. However, permissibility in one jurisdiction does not guarantee legality for users in another. Cross-border access remains one of the most complex challenges facing the industry, particularly as platforms grow in visibility and scale.

What this typically means is that prediction markets end up existing in legal gray zones, with rules of the game changing all the time.

Industry opportunities & risks

Prediction markets are alluring for many, and we’re talking not just about people willing to make a quick buck. Institutional researchers, economists, and data analysts have begun to view them as valuable tools for forecasting and decision-making. Not least because prediction markets could support applications such as risk assessment, policy analysis, supply-chain forecasting, and macroeconomic planning.

This quality is part of the answer to the question “why are prediction markets legal?”. Financial institutions have explored whether market-based probability signals could complement traditional models. Corporations may find value in internal prediction markets to estimate project timelines or strategic outcomes. In public policy, researchers continue to study whether prediction markets can improve decision quality by surfacing dispersed information.

However, these opportunities come with significant risks.

From a legal standpoint, uncertainty remains the largest obstacle. Regulators must decide whether prediction markets should be treated as derivatives, securities, or a distinct category altogether. Each classification carries different compliance requirements, and inconsistent global approaches make large-scale deployment difficult.

Then there are the market-integrity concerns. Thin liquidity, coordinated trading, or the presence of participants with strong ideological motivations can distort prices. While markets are designed to reward accuracy, they are not immune to manipulation or herd behavior, especially during emotionally charged events.

Finally, there are ethical and reputational considerations. Markets tied to sensitive topics like elections, public health, or wars have an ethical dimension. Even when legally permissible, platforms must consider how their offerings are framed and communicated to avoid misunderstandings about intent or impact.

So if we have to predict the prediction markets future, here’s an honest take: whether they become mainstream financial instruments or remain specialized forecasting tools will largely depend on how these opportunities and risks are managed in the years ahead.

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.