ApolloX review DEX 2026: all you need to know

GNcrypto analysts tested ApolloX using live spot and perpetual futures markets on the Injective network. We analyzed real-time trading volume and orderbook depth, executed test trades on the most active spot and perp pairs, measured spread behavior and slippage during volatile periods, and reviewed fee and funding mechanics under normal market conditions.

Fees & Funding

4.5/5

Leverage & Margin

4.5/5

Fees & Funding

4.2/5

Leverage & Margin

4.2/5

Fees & Funding

4.2/5

Leverage & Margin

4.3/5

Fees & Funding

4.4/5

Leverage & Margin

4.2/5

Fees & Funding

4.5/5

Leverage & Margin

4/5

ApolloX DEX overview

Let’s kick off our ApolloX DEX review with the basics.

In our view, ApolloX doesn’t look like a decentralized exchange at all.

The interface features all the regulars: charts front and center, an order panel tucked to the side, positions and unrealized PnL running along the bottom. If you’ve spent time trading perpetual futures on large centralized exchanges, there’s very little here that feels foreign.

This approach is international as ApolloX positions itself as a decentralized futures venue that doesn’t ask traders to change their habits. It isn’t trying to teach you what leverage is or warn you about liquidation with pop-ups and tooltips since it assumes you already know. The question is whether that promise – CEX-style trading, with fewer custodial strings attached – holds up once you actually start poking around.

Where ApolloX sits in decentralized futures trading

We think that ApolloX is aimed squarely at active traders who don’t want to relearn a new mental model just because they’ve left a centralized exchange. There’s no obvious attempt to court beginners or long-term investors. This is a venue built for people who already trade derivatives and want an alternative that doesn’t involve handing full control of funds to a single company.

That positioning becomes clearer the longer you explore. There’s very little explanatory text, no onboarding walkthrough, and no attempt to soften the sharp edges of futures trading. ApolloX behaves less like an educational DeFi app and more like a professional tool that expects you to bring your own experience.

Execution, liquidity & market depth

Our Apx ApolloX DEX review showed that placing orders on ApolloX is straightforward and, importantly, quick. Market and limit orders go through without noticeable friction, and the experience avoids the familiar on-chain annoyance of repeated approvals and confirmations.

Execution quality, however, depends heavily on context. On the most active markets, fills are reasonably tight and predictable for small to moderate trade sizes. Spreads near the mid-price often look competitive at first glance, and for casual-sized orders, slippage isn’t immediately alarming.

Past the surface, limits emerge quickly. Order book depth can thin out quickly a few price levels away from the midpoint. This means that while the top of the book may look healthy, larger market orders can move price more than expected. It’s not broken, and it’s not unusual for decentralized futures platforms – but it does mean ApolloX rewards traders who use limit orders and punish those who rely on aggressive market execution.

To us, ApolloX feels usable and even smooth when traded carefully – but far less forgiving when pushed.

Test results: we opened a BTC/USDT perpetual position using 10x leverage ($100 margin). Entry via limit order filled in 1.2 seconds with no slippage. Closing with market order during moderate volatility (2.8% BTC intraday range) resulted in 0.12% slippage ($1.20 on $1,000 notional).

Funding observation: over 6 trading days, BTC/USDT funding averaged 0.0088% per 8-hour cycle, costing $0.26 daily on our position. Total funding: $1.56 over the test period – small relative to position size, but meaningful for week-long holds.

Order book depth: during US trading hours, BTC/USDT showed $400K liquidity within 0.1% of mid-price. During Asia hours (02:00-06:00 UTC), depth dropped to $180K, with spreads widening from 0.02% to 0.05%.

Trading conditions that assume attention, not autopilot

ApolloX feels built for traders who are watching their screens, adjusting orders, and thinking actively about entry and exit. Stops and position sizing matter, and the platform doesn’t step in to save you from bad decisions.

There’s also a subtle psychological effect at play. Because the interface feels so similar to centralized exchanges, it’s easy to forget that you’re operating in a decentralized environment with different risk assumptions.

Protocol architecture & risk exposure

Though the interface is familiar, in our ApolloX review DEX, we want to emphasize that ApolloX is still a decentralized protocol at its core. Trades rely on smart contracts to handle margin, settlement, and liquidation logic. For users, that shifts the nature of trust as you’re essentially trusting code to behave correctly, even during fast markets and sharp price moves. There’s no undo button and no escalation path if something goes wrong. The rules are enforced automatically.

Price oracles are another quiet dependency. Like all perpetual futures platforms, ApolloX depends on external price feeds to determine mark prices and liquidation thresholds. Most of the time, this works invisibly. During extreme volatility, oracle behavior can become decisive, and traders may find liquidations happening faster than they expect. This is not unique to ApolloX, but it is a risk that doesn’t exist in the same way on regulated futures platforms.

ApolloX occupies a middle zone of decentralization. It is more decentralized than a fully custodial exchange, but less ideologically pure than governance-heavy DeFi protocols. That trade-off delivers speed and usability, but it also means fewer formal guarantees.

Pros and cons of using ApolloX

After reviewing live markets, execution behavior, interface design, and how ApolloX behaves under normal and fast conditions, here’s what we believe ApolloX does well – and where it falls short.

Strengths:

- CEX-style futures trading with minimal friction: the interface deliberately mirrors centralized derivatives exchanges. The layout, order panel, and position display mirror what most futures traders already know. During testing, it was easy to move between markets, place limit or market orders, and manage positions without relearning a new interface. Speed and familiarity reduce cognitive friction for traders who don’t want to experiment.

- Fast, smooth execution for active trading: Order placement on ApolloX feels quick and responsive, without the repeated wallet approvals that often slow down on-chain trading. For small to moderate-sized trades on active markets, fills were generally predictable, and execution did not feel meaningfully slower than centralized venues. This makes ApolloX usable for short-term, tactical strategies rather than just occasional trades.

- Low visible friction compared to many on-chain platforms: The exchange avoids many of the pain points that push traders away from DeFi derivatives. There’s no obvious per-trade gas friction, and interacting with the platform doesn’t feel like a sequence of blockchain transactions. For active traders placing multiple orders per session, low friction beats decentralization claims.

- Perpetual futures as the core product: Perpetual futures are clearly the focus, with leverage, funding, and liquidation mechanics integrated directly into the trading flow. For traders looking specifically for leveraged long and short exposure, rather than spot trading or passive investing, ApolloX’s priorities are aligned with how they actually trade.

- Appeals to experienced, self-directed traders: There are no pop-ups warning about leverage or hand-holding explanations of futures mechanics. For experienced traders, this can be a positive: the platform gets out of the way and lets you trade.

Weaknesses:

- Liquidity quality depends heavily on the market: While major contracts can feel reasonably liquid, depth often drops off quickly outside the most active pairs. Order books may look tight at the top but thin out a few price levels away, increasing slippage for larger market orders. Traders who assume consistent depth across all markets may be caught off guard, especially during off-peak hours.

- Market orders can be unforgiving: We think ApolloX works best when traders use limit orders and manage execution actively. Market orders on thinner books can move prices more than expected, which makes the platform less forgiving for impulsive or reactive trading. This isn’t a flaw so much as a reality of decentralized liquidity – but it’s a real constraint.

- Not beginner-friendly by design: The platform assumes you already understand leverage, funding, liquidation, and orderbook dynamics. There is no simplified mode, no guided onboarding, and no safety rails. A trader unfamiliar with derivatives can make costly mistakes quickly. ApolloX feels built for people who already know what they’re doing.

- Funding costs can dominate longer holds: Low execution friction doesn’t eliminate funding. Traders holding perpetual positions for extended periods can see PnL eroded by sustained funding payments, even if price moves sideways. ApolloX doesn’t hide this, but it also doesn’t emphasize it – making funding easy to underestimate if you focus only on execution costs.

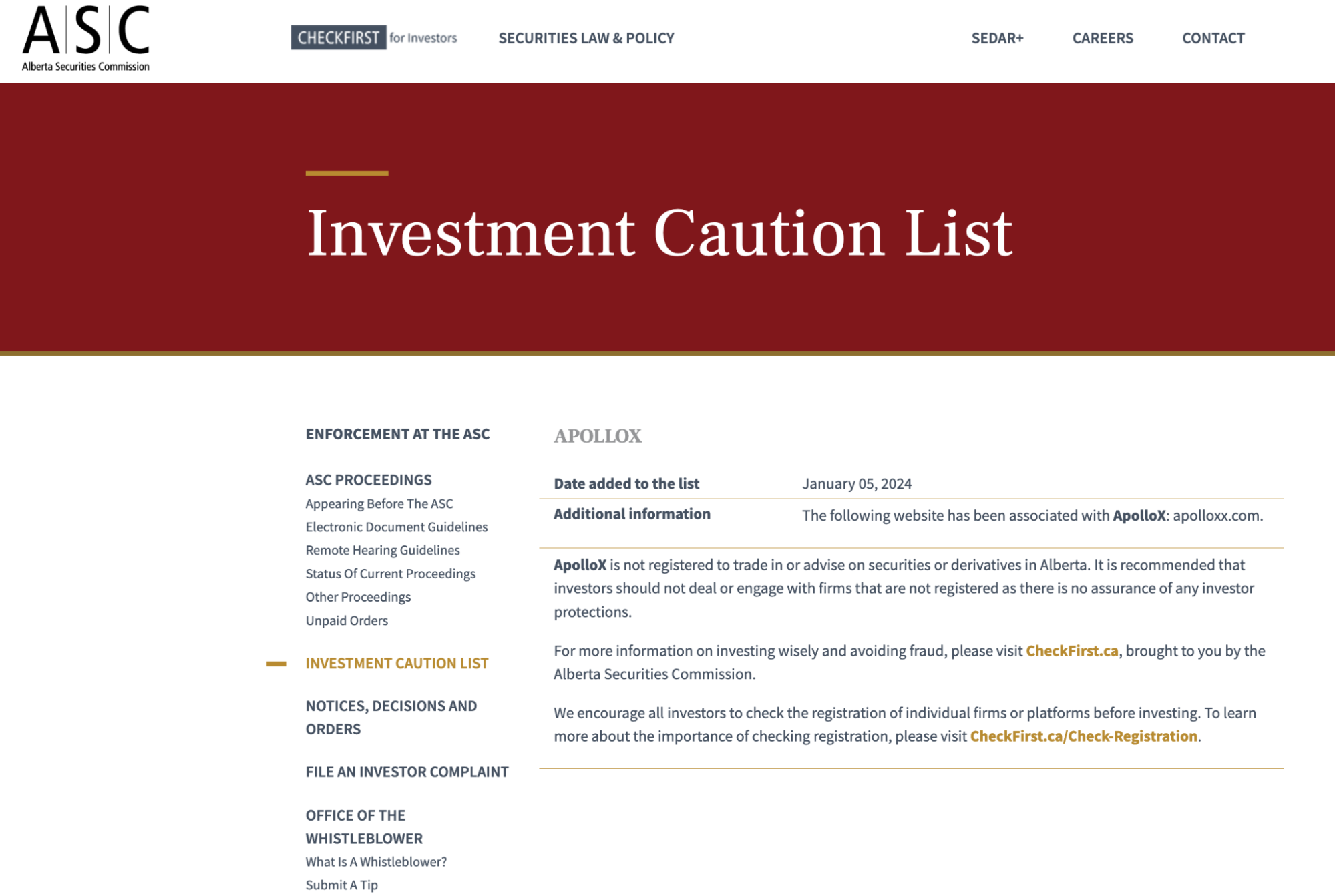

- No regulatory protection or fallback: ApolloX is not a regulated broker or exchange. There are no investor protections, no segregated clearing accounts, and no authority to appeal to if something goes wrong. Users are trusting smart contracts, oracle systems, and protocol design rather than a licensed intermediary. For some traders this is acceptable; for others, it’s a dealbreaker.

Trustworthiness check

Trust matters even more when a platform offers leveraged trading, because mistakes, outages, or design flaws can translate directly into losses. Here’s what our review found for ApolloX.

Company & regulatory status

ApolloX does not operate as a regulated brokerage or exchange in the way U.S. futures platforms do. It does not provide access to regulated venues such as the CME, and it is not subject to CFTC, NFA, or comparable financial-market oversight.

Instead, it operates as a decentralized derivatives trading platform where trading logic is handled through protocol infrastructure and smart contracts. Also, there is no central broker-dealer or clearing firm and users trade via wallets rather than traditional brokerage accounts. That means no centralized custody, reduced reliance on a single corporate counterparty. Also, there’s no formal regulatory protection, no investor recourse, no external enforcement authority.

Security & fund protection

The exchange is designed to reduce classic centralized exchange risks. Users do not hold balances in a custodial exchange account while the funds are not pooled in a single corporate balance sheet. Margin, collateral, and settlement are enforced by protocol rules rather than discretionary human intervention.

We did not find widely publicized incidents involving large-scale loss of user funds directly attributed to ApolloX itself. Risk isn’t removed – it is redistributed.

Key risk vectors include smart contract vulnerabilities, protocol upgrades or parameter changes, chain-level and infrastructure risk tied to the networks ApolloX operates on.

What’s missing: segregation through clearing firms, SIPC-style or government-backed protection, and mandated capital buffers designed to absorb losses.

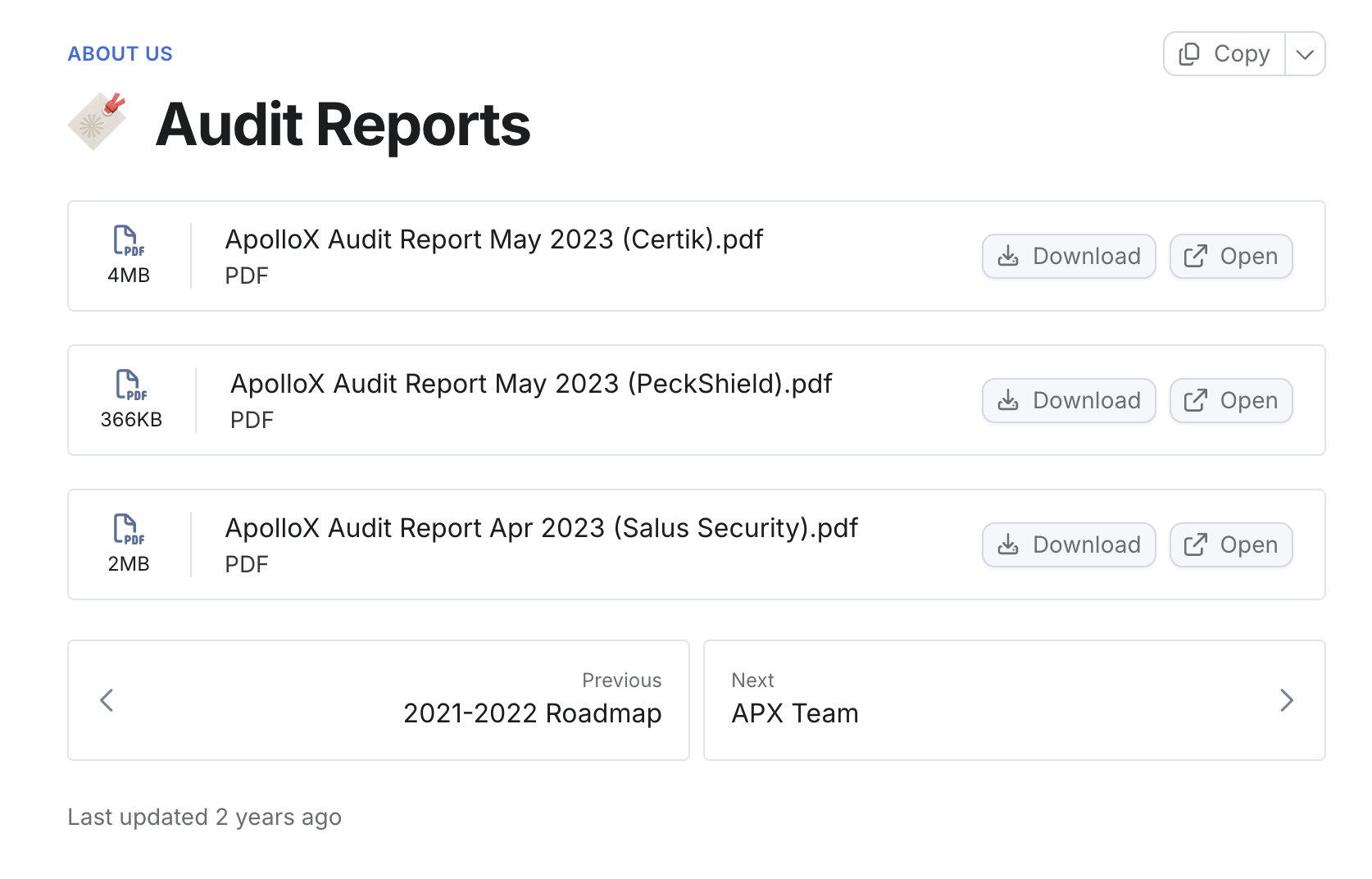

Smart contract & protocol risk

Using ApolloX means accepting risks that simply do not exist on regulated futures platforms.

These include potential bugs or edge cases in smart contracts, unexpected behavior during extreme volatility or rapid price moves, reliance on oracle pricing to determine mark prices, funding, and liquidations.

Aside from a $1.5 million exploit in 2022 – which the team resolved via token buybacks – there have been no major losses of user funds directly linked to the platform’s core infrastructure. When something breaks, outcomes are determined by code, not by customer support escalation or regulatory intervention.

Transparency & reputation

ApolloX’s transparency comes primarily from platform visibility and documentation, not from regulatory disclosures or audited financial statements. Its reputation appears strongest among active crypto derivatives traders, users already comfortable with leverage and on-chain trading, and traders seeking alternatives to fully custodial centralized exchanges.

User sentiment tends to highlight familiar CEX-like trading experience, relatively smooth execution on active markets, clear presentation of positions and PnL.

Criticism more often centers on variable liquidity across markets, limited guidance for new users, the absence of regulatory protections, rather than allegations of misconduct or fund misuse.

Overall trust assessment

We believe that ApolloX is not “trustless” in the absolute sense, but it is structurally different from regulated futures platforms.

- If your definition of trust is regulatory oversight, investor protection, and formal accountability, ApolloX will not meet that standard.

- If your definition of trust is reduced custodial risk, transparent execution rules, and direct user control, ApolloX may feel acceptable – provided you understand the trade-offs.

GNcrypto’s overall ApolloX rating

| Criteria | Weight Score (1-5) | Notes |

|---|---|---|

| Trading Fees & Funding Costs (25%) | 3.5 | ApolloX promotes low-friction trading, and in practice execution does feel inexpensive for active users. There are no obvious per-trade gas interruptions, which lowers friction for traders placing and adjusting orders frequently. Trading fees themselves are competitive relative to other on-chain futures venues, particularly for short-term strategies. That said, funding costs remain unavoidable on perpetual futures. For positions held across multiple funding intervals, funding can easily outweigh execution fees—especially in crowded markets. ApolloX does not hide funding mechanics, but it also does not emphasize their long-term impact. There are no hidden liquidation penalties or opaque deductions, but total costs depend heavily on holding period and funding awareness. |

| Leverage & Margin Requirements (20%) | 3.5 | ApolloX supports leveraged perpetual futures with margin mechanics that behave predictably under normal conditions. Leverage levels are sufficient for most retail and semi-professional traders, though not as aggressive as some offshore platforms advertising extreme leverage. Margin behavior is straightforward, but risk tooling is limited. There are no strong guardrails, presets, or automation features to help traders manage leverage responsibly. For experienced users, this is manageable; for less experienced traders, it increases the chance of over-leveraging. ApolloX prioritizes flexibility over protection, which rewards discipline but exposes mistakes quickly. |

| Contract Selection & Liquidity (15%) | 3 | ApolloX offers a focused set of perpetual futures markets, but liquidity is uneven. Core markets tend to be usable with reasonable spreads for modest trade sizes. Outside these markets, depth drops quickly and execution quality deteriorates. The platform is not designed for broad market coverage or large-size trading across many pairs. Instead, it performs best when traders concentrate on a narrow set of high-activity contracts. For traders expecting consistently deep books across a wide range of assets, ApolloX may feel limiting. |

| Platform Performance & Risk Controls (15%) | 4 | Performance is one of ApolloX’s strongest areas. Order placement feels responsive and exchange-like, with no noticeable transaction bottlenecks or UI lag during testing. The platform avoids much of the friction that plagues on-chain trading interfaces. Risk controls, however, are mostly manual. Liquidation logic and funding mechanics function as documented, but there are no native bracket orders, OCO tools, or advanced automation to help manage downside. Execution quality is solid where liquidity exists, but traders must actively manage risk themselves. |

| Security & Regulatory Compliance (10%) | 3 | ApolloX is non-custodial by design, meaning users do not deposit funds into a centralized exchange account. This reduces traditional custody risk but introduces DeFi-specific risks tied to smart contracts, oracles, and protocol infrastructure. There is no regulatory oversight, no investor protection, and no clearinghouse backstop comparable to regulated futures markets. Trust rests on protocol design, transparency, and the reliability of underlying systems rather than formal regulation or legal accountability. |

| User Experience & Trading Interface (10%) | 3.5 | ApolloX’s interface is clearly aimed at experienced futures traders. It is familiar, efficient, and uncluttered—but also unforgiving. The platform assumes users understand leverage, liquidation, and orderbook dynamics. There is no simplified mode, no onboarding flow, and minimal protection against user error. For traders comfortable with exchange-style execution, the UI works well. For newcomers, it can feel harsh and unintuitive. |

| Customer Support & Educational Resources (5%) | 2.5 | Educational resources are limited. ApolloX provides basic documentation, but there is no paper trading environment, no structured learning path, and limited direct user support. The platform assumes prior knowledge rather than helping users build it. For derivatives-experienced traders, this may be acceptable. For anyone learning futures trading for the first time, support is insufficient. |

| Final score | 3.6 | ApolloX is best understood as a tool for experienced, execution-focused traders rather than a full-service trading platform. Its strengths lie in speed, familiarity, and low friction for short-term futures trading. Its weaknesses become apparent for beginners, passive users, or traders who require deep liquidity and strong risk automation. |

Who ApolloX fits based on testing

Based on hands-on review of live markets, execution behavior, and liquidity conditions, ApolloX is optimized for a narrow segment of self-directed futures traders, not a broad retail audience.

Best for:

- Active perpetual futures traders who want a familiar, CEX-style interface;

- traders placing small to moderate-sized trades on core markets;

- users comfortable managing leverage, funding, and liquidation risk themselves;

- and traders who value reduced custodial exposure over regulatory protection.

Skip if:

- You’re a beginner;

- you trade infrequently or in very small sizes;

- you require deep, consistent liquidity across many markets;

- you want mobile-first or simplified trading;

- you expect regulatory safeguards and dispute resolution.

How we test crypto futures trading services

We tested ApolloX using GNcrypto’s weighted, category-based evaluation model with real capital deployed in live perpetual futures markets. We connected a non-custodial wallet, deposited $200 in USDC, and executed 30 live trades across the most active perpetual contracts over 6 trading days (Jan 14–20, 2026).

During testing, we measured execution responsiveness, tracked trading and funding costs, observed slippage during fast markets, and evaluated UI stability and order management behavior. Platforms are rated across 7 weighted criteria, with scores ranging from 1.0 to 5.0. All results reflect real fills under live market conditions, not demo accounts or simulated liquidity.

Note: ApolloX is a crypto-native perpetual futures platform, not a regulated brokerage offering dated futures contracts. While our methodology focuses on crypto derivatives, the same core principles apply: execution quality, fee transparency, funding and margin mechanics, and risk controls.

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.