ApeX Pro exchange review 2026: what the platform offers for crypto derivatives trading

GNcrypto conducted live derivatives trades on ApeX Pro to assess fees, leverage, order execution, and overall usability. We examined liquidity, contract selection, and key trust signals, ultimately rating the platform 3.8/5.

Fees & Funding

4.5/5

Leverage & Margin

4.5/5

Fees & Funding

4.2/5

Leverage & Margin

4.2/5

Fees & Funding

4.2/5

Leverage & Margin

4.3/5

Fees & Funding

4.4/5

Leverage & Margin

4.2/5

Fees & Funding

3.5/5

Leverage & Margin

3/5

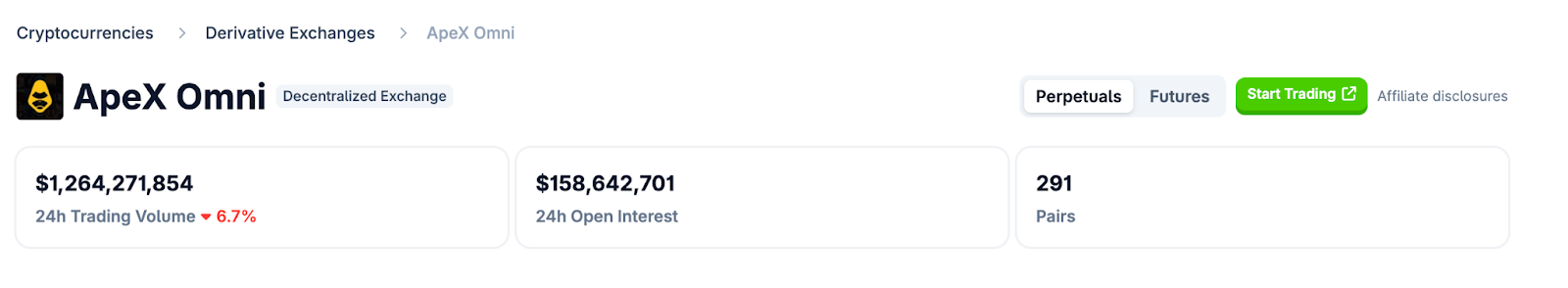

ApeX Pro is a decentralized exchange for trading perpetual futures across Ethereum, Arbitrum, BNB Chain, and Polygon. All funds remain in our own wallet, the smart contracts are audited, and transactions are processed via Layer-2 infrastructure powered by StarkEx. The main drawbacks are a limited selection of trading instruments and customer support available only via email. The platform suits traders with futures and derivatives experience.

Testing details: we deposited $200 and opened a 20× BTC/USDC long position with $100 collateral. Entry filled at our level as taker (0.05% fee = $1.00). When BTC dropped to stop level 14 hours later, the stop executed within 2 seconds (5 ticks slippage). We also tested a 15× ETH/USDC position with $100 collateral. Market order filled with zero slippage.

New users can use our referral link and code 718TZOI6 to access additional bonuses and benefits from our partnership with ApeX Pro.

ApeX Pro at a glance

ApeX Pro is a decentralized platform for trading perpetual futures with a familiar order book model, positioning itself as a professional ApeX Pro exchange for experienced derivatives traders. The interface follows standard derivatives trading logic, intuitive for anyone who has worked with order books.

The trading flow is straightforward: select a pair, set position size and leverage, and open the trade. We didn’t encounter any unnecessary steps or artificial restrictions. Everything is direct and functional, though the platform offers no guidance – it clearly assumes the user already knows what they’re doing.

We also tested deposits and withdrawals. ApeX Pro supports multiple networks, including Ethereum, Arbitrum, BNB Chain, and Polygon. This adds flexibility for liquidity management and avoids locking users into a single ecosystem.

The platform works as a professional-grade tool built specifically for futures trading, with no educational modes or hand-holding – it operates on the conventional mechanics of derivatives markets.

Perpetual futures mechanics

We focused on how positions behave after being opened, how margin is calculated, and why trades can remain open indefinitely without time-based limitations.

How perpetual contracts work

In this ApeX Pro exchange review, we examined USDC-margined perpetual futures, meaning that margin, profits, and losses are all calculated in a stablecoin rather than being exposed to the volatility of the underlying asset.

We opened both long and short positions during testing. The contracts have no expiration date – a position remains open until it is manually closed or liquidated due to insufficient margin. This structure suits strategies that require holding positions beyond a single trading session.

Margin and leverage

ApeX Pro operates with account-level cross margin, meaning all open positions share a common balance. If one trade moves against the trader, the system can draw on available account funds to support the position.

We tested leverage of up to 20×. Liquidation levels and current margin metrics are displayed clearly, with no hidden parameters or opaque calculations.

Fees

ApeX Pro’s fee model is one of its standout features: maker fees are around 0.02%, and taker fees are approximately 0.05%. There are no gas fees, thanks to Layer‑2 execution, which significantly reduces costs for traders who frequently enter and exit positions.

Fee comparison:

- ApeX Pro: 0.02% maker / 0.05% taker (no gas fees, Layer-2 execution)

- Binance Futures: 0.02% maker / 0.04% taker (USDT-M perpetuals, VIP discounts available)

- Bybit: 0.01% maker / 0.06% taker (derivatives, standard tier)

- Helix: 0.02% maker / 0.05% taker (perpetual futures DEX on Injective)

In our test: Opening a $2,000 BTC position as taker cost $1.00 (0.05%). Closing the same position with a limit order as maker cost $0.40 (0.02%). Over 5 days of holding, we paid no traditional funding rates – ApeX Pro uses order book pricing instead of perpetual funding mechanisms.

The platform also plans to introduce a tiered fee structure, where active traders can earn additional discounts based on trading volume and staking the native token. This approach is designed to make trading even more cost-efficient for users who actively participate in both the market and the ApeX Pro ecosystem.

Funding and liquidity

We didn’t encounter regular funding payments as seen on classic perpetual futures. Prices on ApeX Pro are determined directly through the order book and trade execution.

Regarding liquidity, there were no issues for small to medium-sized trades. However, very large positions may face limited volume at the current price, which can result in partial fills or execution at slightly less favorable rates than expected.

Performance

ApeX Pro offers high performance: orders are placed and executed quickly, and the interface remains responsive even during active trading. The overall experience feels closer to that of a CEX rather than a typical DEX.

Speed test: Market orders executed in under 1 second from click to confirmation. Limit orders appeared in the order book within 0.5 seconds. During high volatility (a 4% BTC move in 15 minutes), the interface remained responsive with no lag or order rejections.

Who ApeX Pro makes sense for

In our ApeX Pro exchange reviews, we found that the platform caters to a specific type of trader.

Who the platform is suited for

ApeX Pro is well suited for traders who:

- already have experience with futures and understand the associated risks,

- prefer trading without KYC and custodial wallets,

- value low fees and a fast, responsive interface,

- use cross margin and leverage as part of their trading strategy.

It’s a platform designed for users who come to trade, not to go through educational modes or tutorials.

Who the platform is not suited for

ApeX Pro is unlikely to be suitable for:

- beginners who are just getting acquainted with derivatives,

- users who need a wide selection of trading pairs,

- those expecting fiat deposits, 24/7 chat support, or in-interface guidance.

ApeX Pro pros and cons

Strengths:

- No minimum investment required: the platform does not impose a minimum deposit or starting balance. This makes it easy to get familiar with the interface and trading mechanics without risking a large sum.

- Low trading fees: during active trading, fees were barely noticeable. Maker orders cost around 0.02%, and taker orders approximately 0.05%. Frequent entries and exits benefit from this, as trading costs remain minimal and have little impact on overall results.

- Available leverage: we opened positions with up to 20× leverage. Margin requirements, liquidation levels, and current risk metrics are displayed clearly, with no hidden conditions. This allows more aggressive strategies for traders who understand what they’re doing.

- Earning additional income through staking: during our testing, we participated in ApeX ecosystem reward programs when active. Rewards were distributed consistently, providing an extra incentive for engagement.

- Optional registration: we signed up using just an email, and the platform automatically created an on-chain wallet that can be fully managed without MetaMask or a seed phrase. Users can also connect external wallets. All operations are processed via Layer‑2, so trading happens on the actual blockchain while maintaining the simplicity and convenience of a typical centralized exchange.

- Familiar trading interface with TradingView charts: charts, indicators, order book, and order types are intuitive and work as expected. No adaptation was needed for those already experienced in derivatives trading.

- Points system: points are earned through trading activity and participation in the platform’s ecosystem. They can be redeemed for bonuses, discounts, and seasonal rewards, making trading more profitable and engaging.

Weaknesses:

- Geographical restrictions: in some countries, such as the U.S., access to trading on the platform is blocked for users.

- Weak support quality: The platform has a live chat, but it’s a basic bot that requests personal information (email and phone number) after 2-3 messages, with no indication that human support follows. Discord remains the main support channel with delayed responses. For urgent trading issues, users are largely on their own.

- Limited order types: only Limit, Market, Conditional Market, and Conditional Limit orders are available.

Trustworthiness Check

We assessed how reliable ApeX Pro is as a platform for futures trading.

- Non-custodial model: All funds remain in the user’s wallet until a trade is executed. We maintained control of our private keys and verified that the exchange has no access to our assets. This means that even in the event of platform issues, your funds remain under your control.

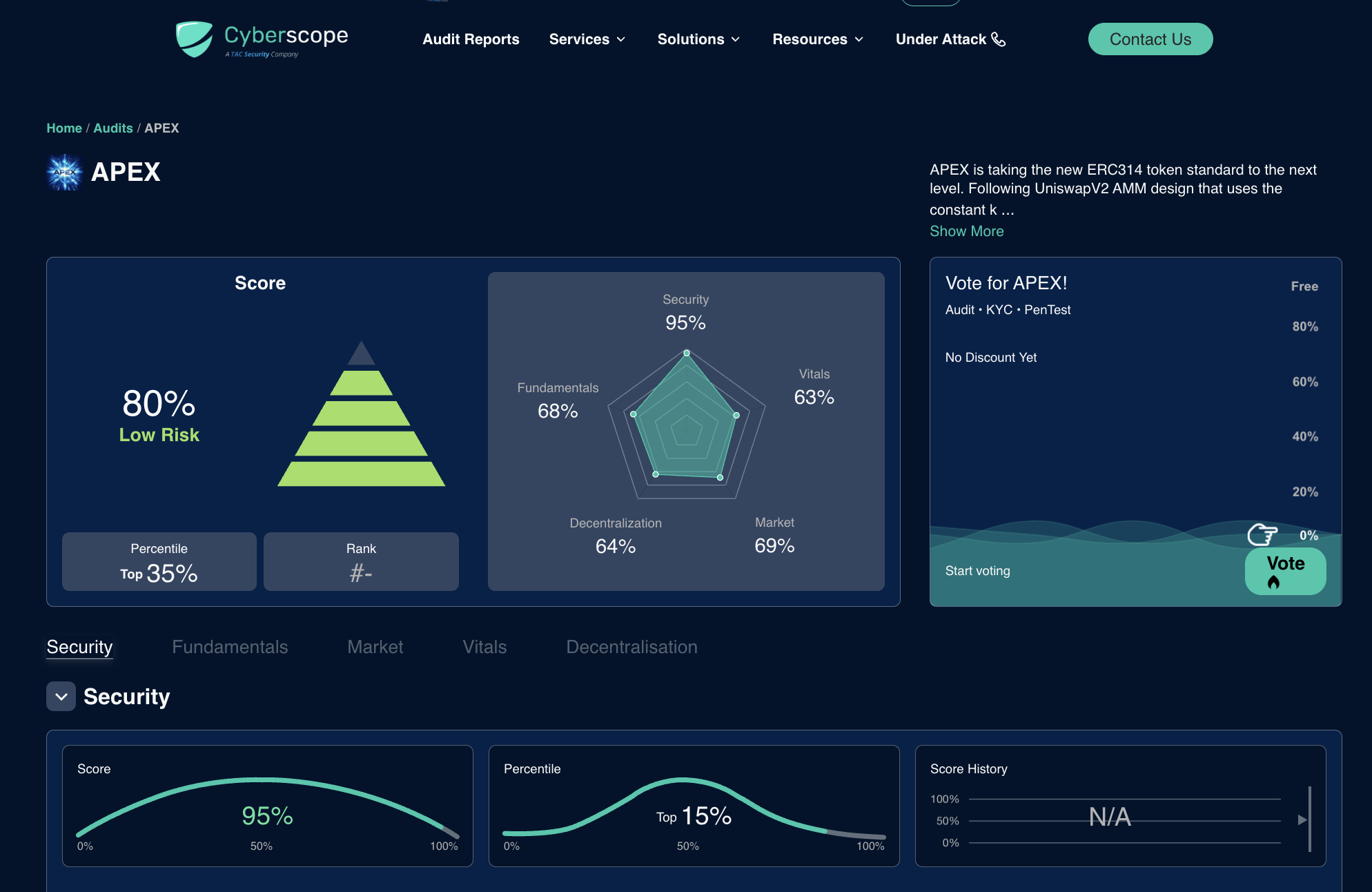

- Smart contract audits and security: ApeX Pro’s smart contracts undergo independent audits, and all transactions are processed via Layer‑2 (StarkEx). We tested orders and trades and encountered no failures or errors. From a technical security standpoint, this provides a high level of protection.

- Regulation and jurisdiction: The platform is not licensed by traditional financial regulators, like most decentralized exchanges. Users in countries with strict regulatory frameworks should be aware of increased risks and take responsibility for their own actions.

- Support and transparency: Customer support is available only via Discord and email, with no live chat. Resolving urgent issues can take time, so managing positions and margin is the user’s responsibility. On the other hand, all information about trades, margin, and positions is transparent through the smart contracts.

Withdrawal test: We withdrew $50 USDC from ApeX Pro to our external wallet on Arbitrum. The withdrawal was processed instantly (smart contract executed in one transaction), with no approval delays or withdrawal fees beyond standard Arbitrum gas ($0.08). Total time from withdrawal click to funds in wallet: 12 seconds.

Technically, ApeX Pro is secure and transparent: funds remain under the user’s control, smart contracts are audited, and transactions are processed via Layer‑2. However, there is no regulatory protection, so it’s crucial for users to carefully manage their funds and private keys.

GNcrypto’s overall rating

After testing ApeX Pro with $200 in live trades, the platform delivered fast execution, low fees (0.02% maker / 0.05% taker), and reliable stop-loss triggers. The non-custodial model and Layer-2 execution (StarkEx) provide security and cost efficiency. We rated it highly for fees and performance but knocked it down for limited contract selection (strong BTC/ETH, weak altcoins), Discord-only support with delayed responses, and lack of regulatory oversight or Proof of Reserves.

| Criteria | Rating (out of 5) | Weight | Notes |

|---|---|---|---|

| Trading Fees & Funding Costs | 4/5 | 25% | Fees are low (0.02–0.05%) and there are no gas costs, but funding payments can accrue over time if a position is held for an extended period |

| Leverage & Margin Requirements | 4/5 | 20% | Leverage of up to 20× and account-level cross margin are available, but beginners should use high-leverage positions cautiously – the platform does not automatically limit risk |

| Contract Selection & Liquidity | 3.5/5 | 15% | The platform offers strong liquidity for BTC and ETH, while other trading pairs are more limited, which can result in slippage when executing large trades |

| Platform Performance & Risk Controls | 4/5 | 15% | Orders are executed quickly, and the interface is stable, but the platform has limited stop order types |

| Security & Regulatory Compliance | 3.5/5 | 10% | The platform is non-custodial and smart contracts are audited, but there is no proof-of-reserves system |

| User Experience & Trading Interface | 4/5 | 10% | The interface is familiar to experienced traders, but beginners may find it challenging to navigate |

| Customer Support & Educational Resources | 3/5 | 5% | Live chat exists but runs basic bot that requests email and phone number after 2-3 messages without clear human escalation; Discord support with delayed responses; limited educational resources. |

Final Score: 3.8/5

Our verdict: ApeX Pro is suitable for experienced traders who value low fees and fast execution. The limited selection of instruments, absence of live chat, and lack of educational support make the platform challenging for beginners.

Methodology – Why You Should Trust Us

We tested ApeX Pro using our weighted, category-based model, depositing $200 in BTC and opening leveraged positions (10x-50x) on BTC/USD and ETH/USD perpetuals. We monitored funding rates over 5 days, tested stop-loss execution during volatility, measured spreads during US and Asia trading hours, and withdrew funds to verify processing times. We rate platforms on 7 weighted criteria with scores from 1.0 to 5.0. Our testing uses real capital, not demo accounts.

Read our full methodology: How We Test Crypto Futures Trading Services

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.