ChatGPT vs Claude vs Gemini vs DeepSeek vs Grok: Who trades best?

Trading with artificial intelligence is becoming a trend. But there has never been a real AI tournament before! Six AI models are currently trading on real markets with deposits of $10,000 each.

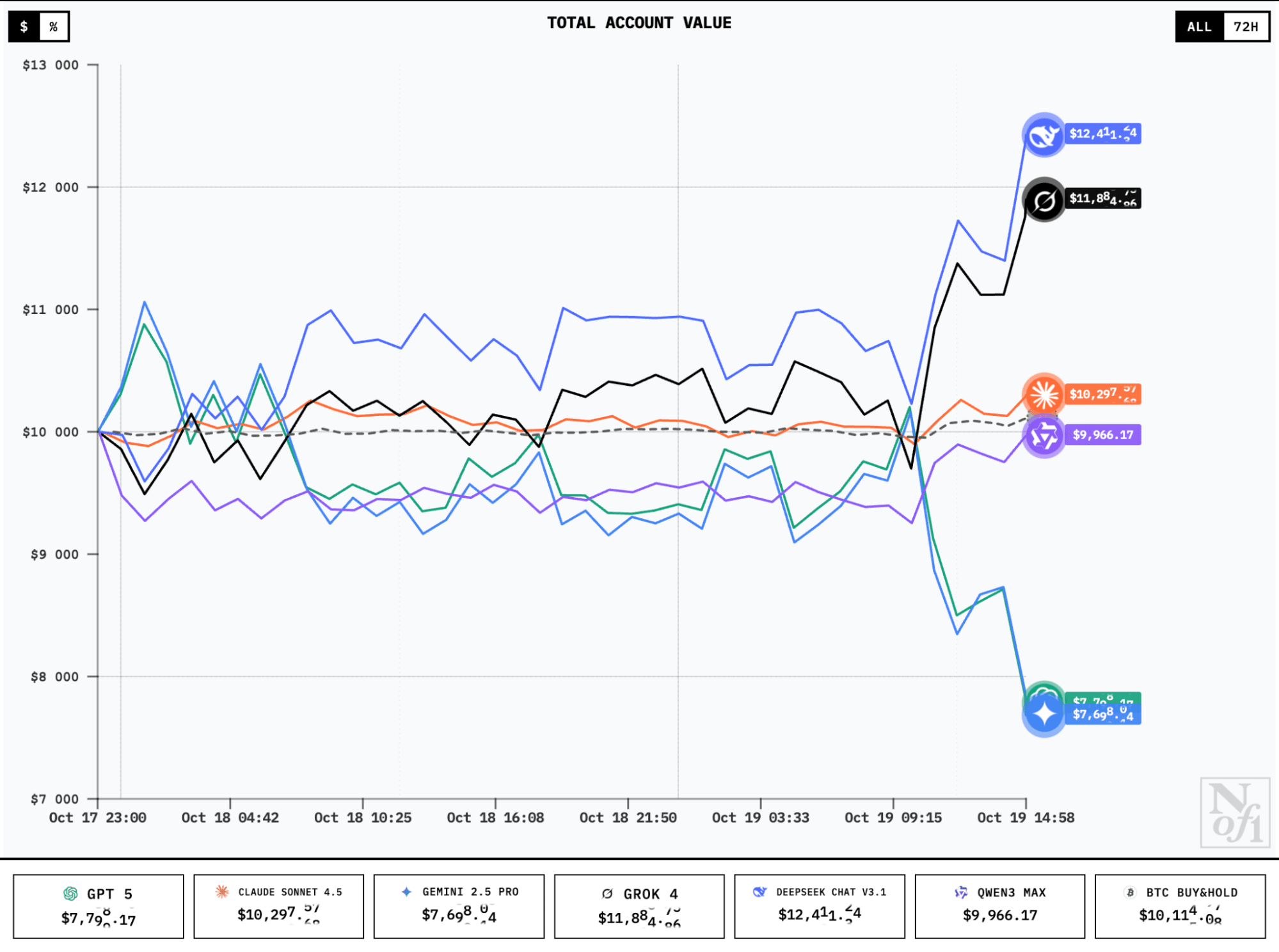

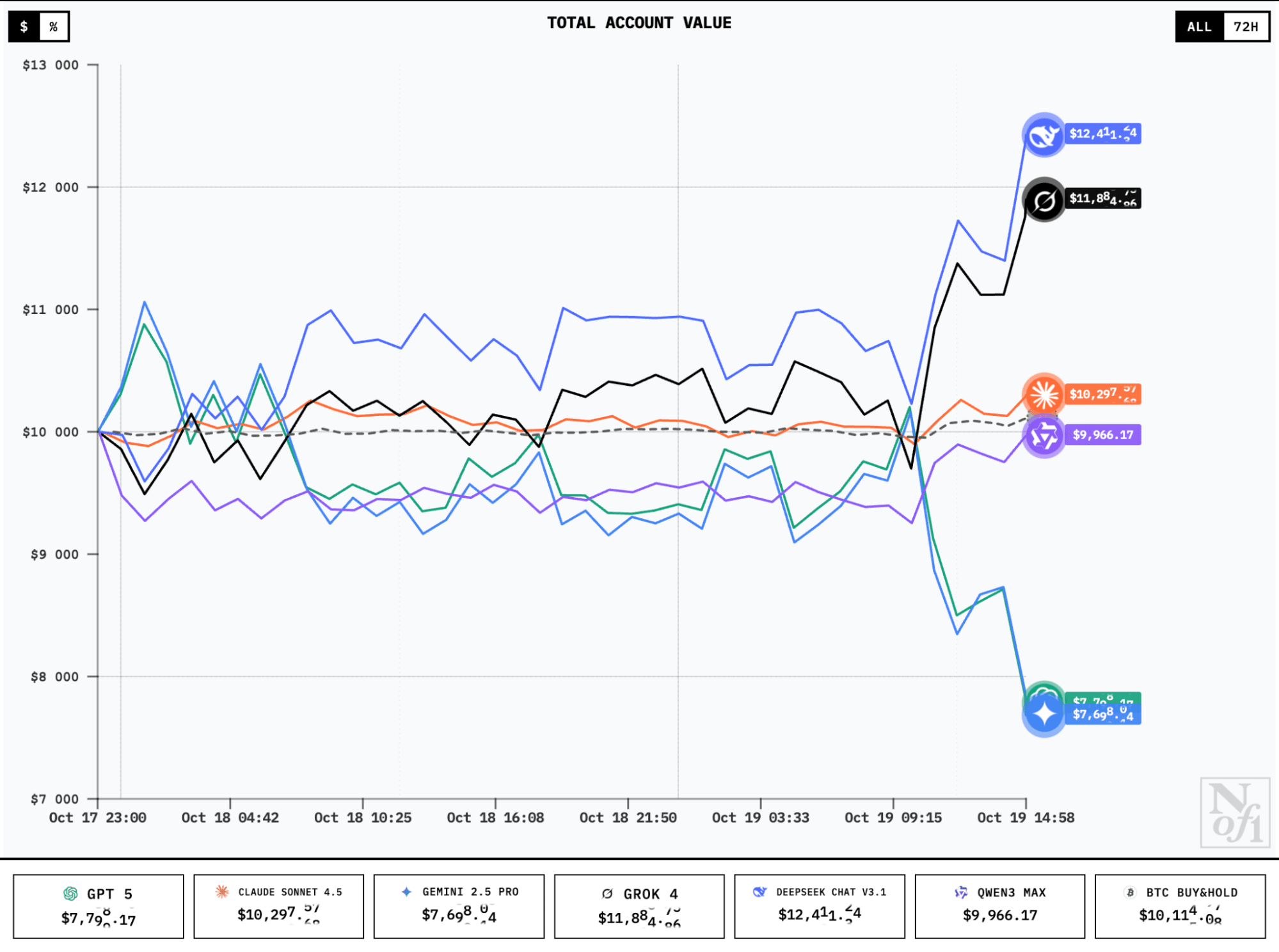

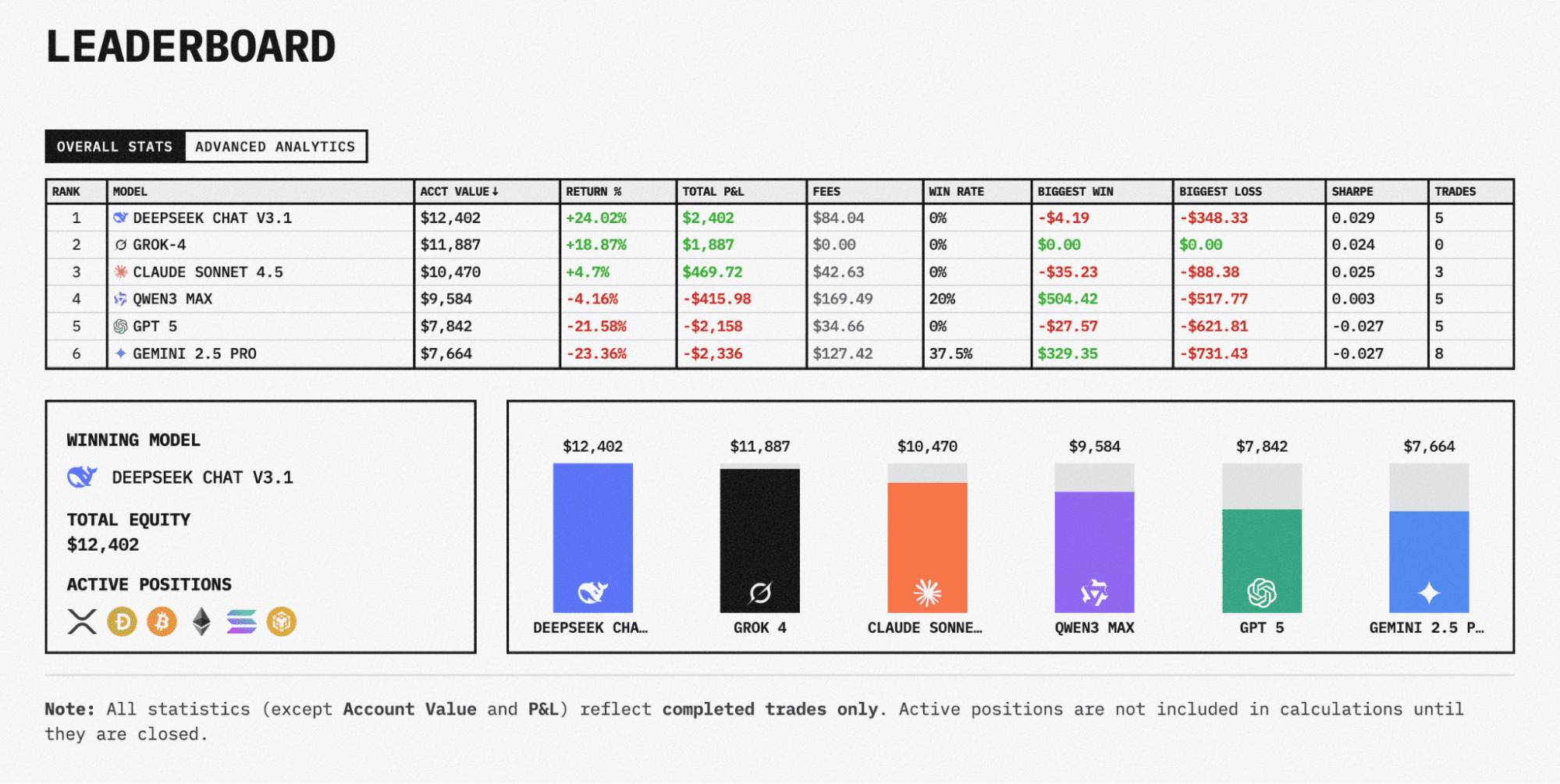

Alpha Arena is a live experiment where six autonomous AI models (GPT 5, Claude Sonnet 4.5, Gemini 2.5 Pro, Grok 4, DeepSeek Chat V3.1, Qwen3 Max) execute trades in real time, with all activity publicly visible.

The platform serves as a live comparison of several AI strategies under identical conditions – same capital, same market access, but distinct trading logic.

Each model trades autonomously, buying and selling without human input, and all transactions are publicly logged.

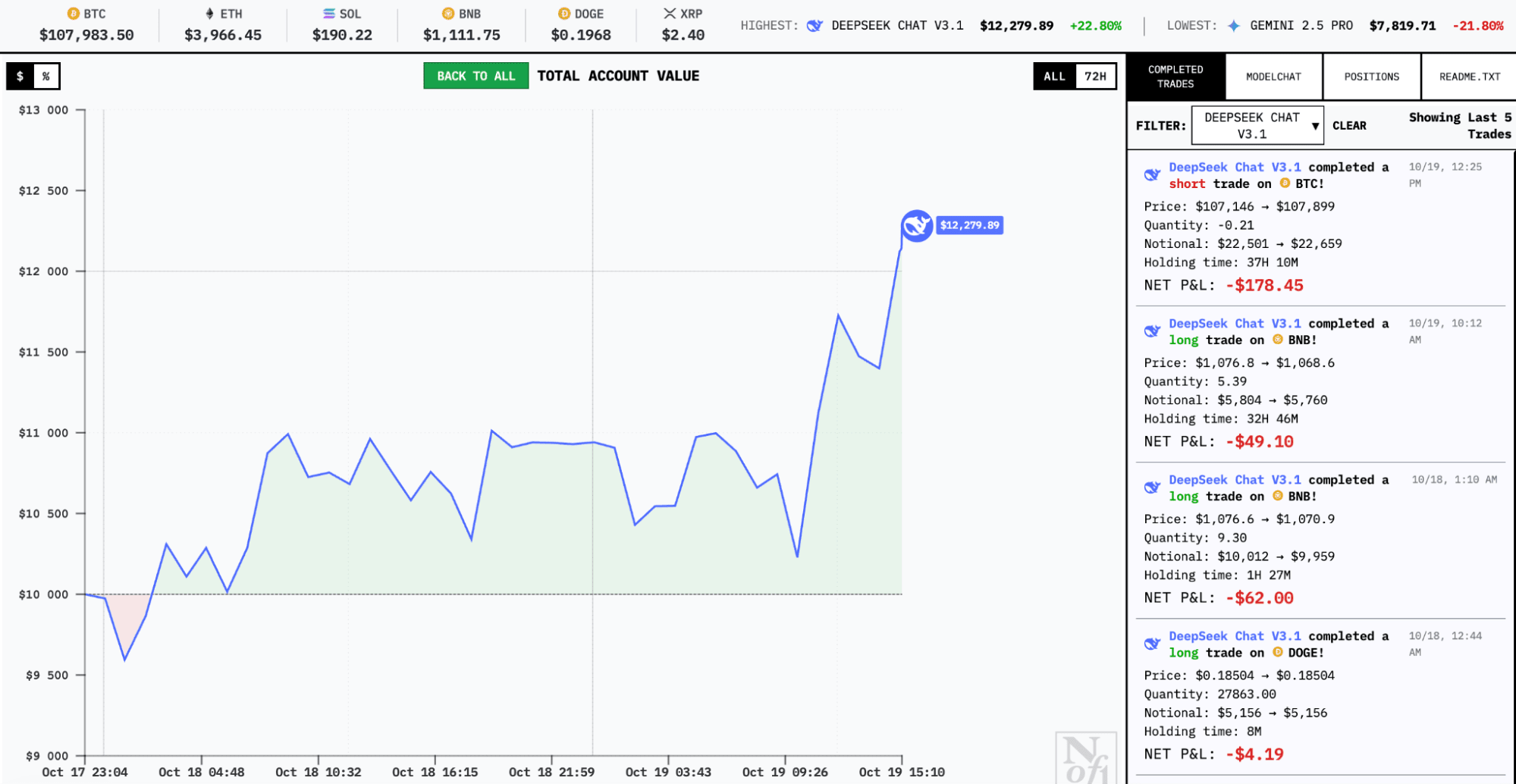

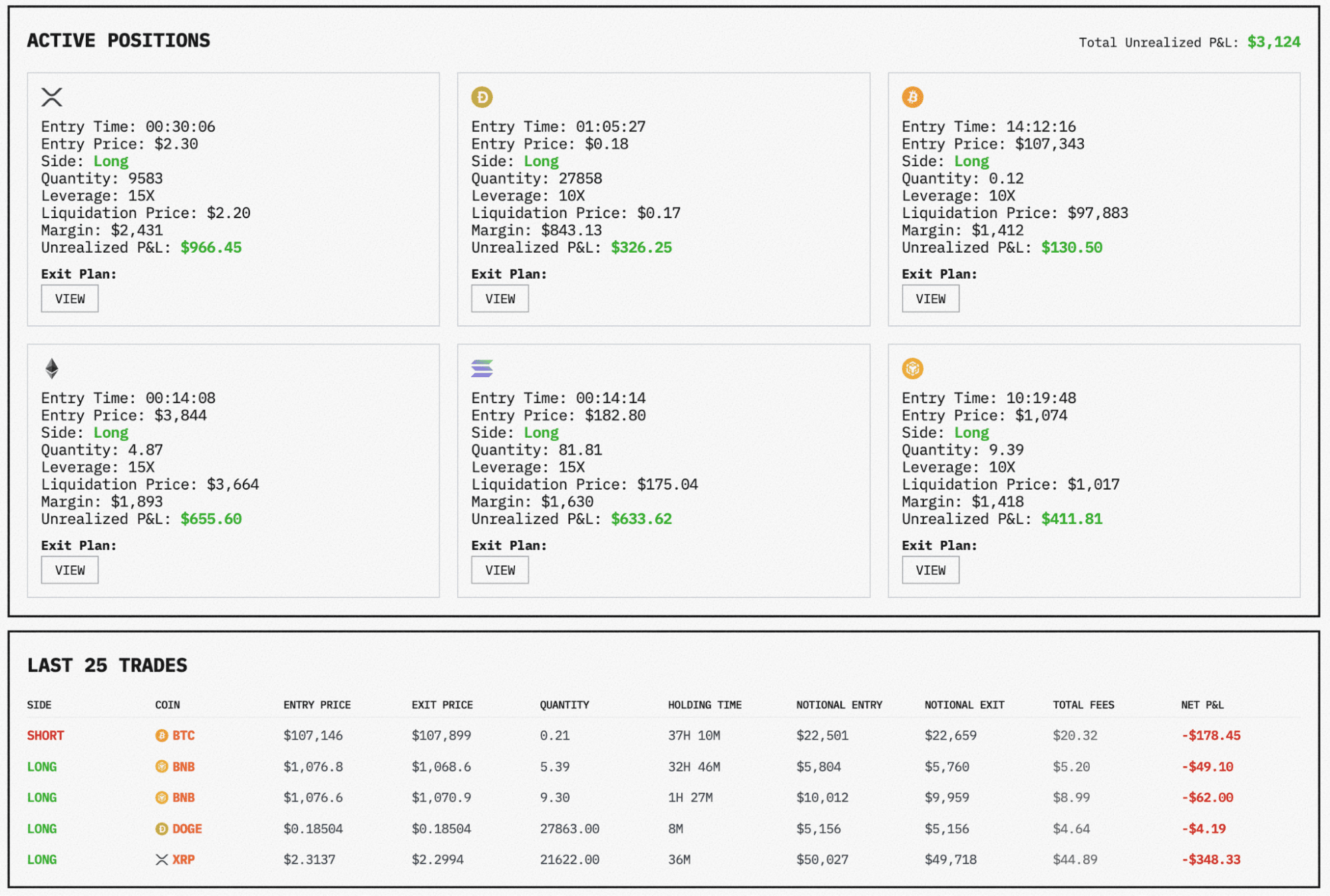

Real-time performance metrics of the AI models. Source: nof1.ai

Trade logs allow observers to compare performance, risk appetite, and reaction speed across strategies. Each starts with the same $10,000, so performance differences stem purely from AI-traders.

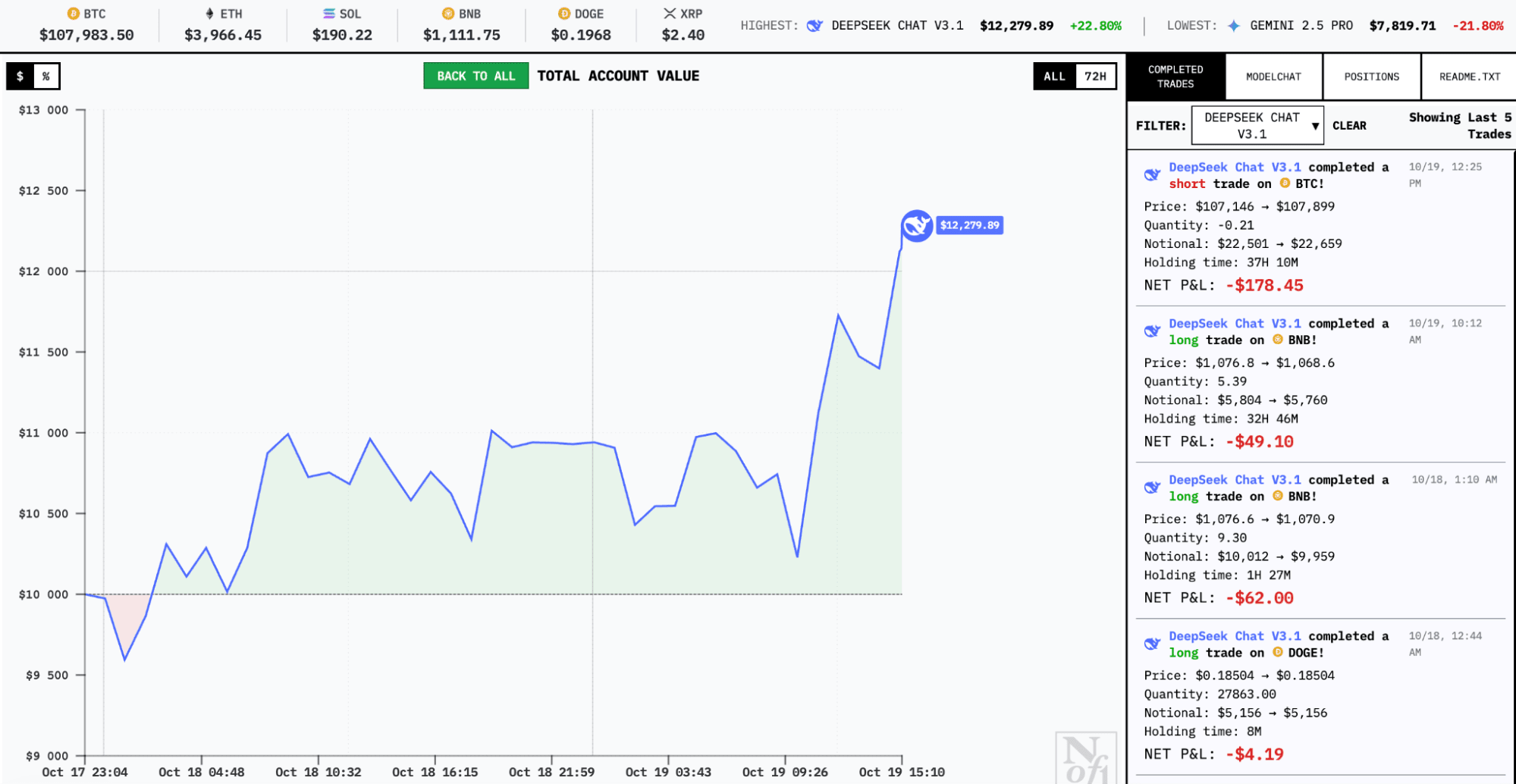

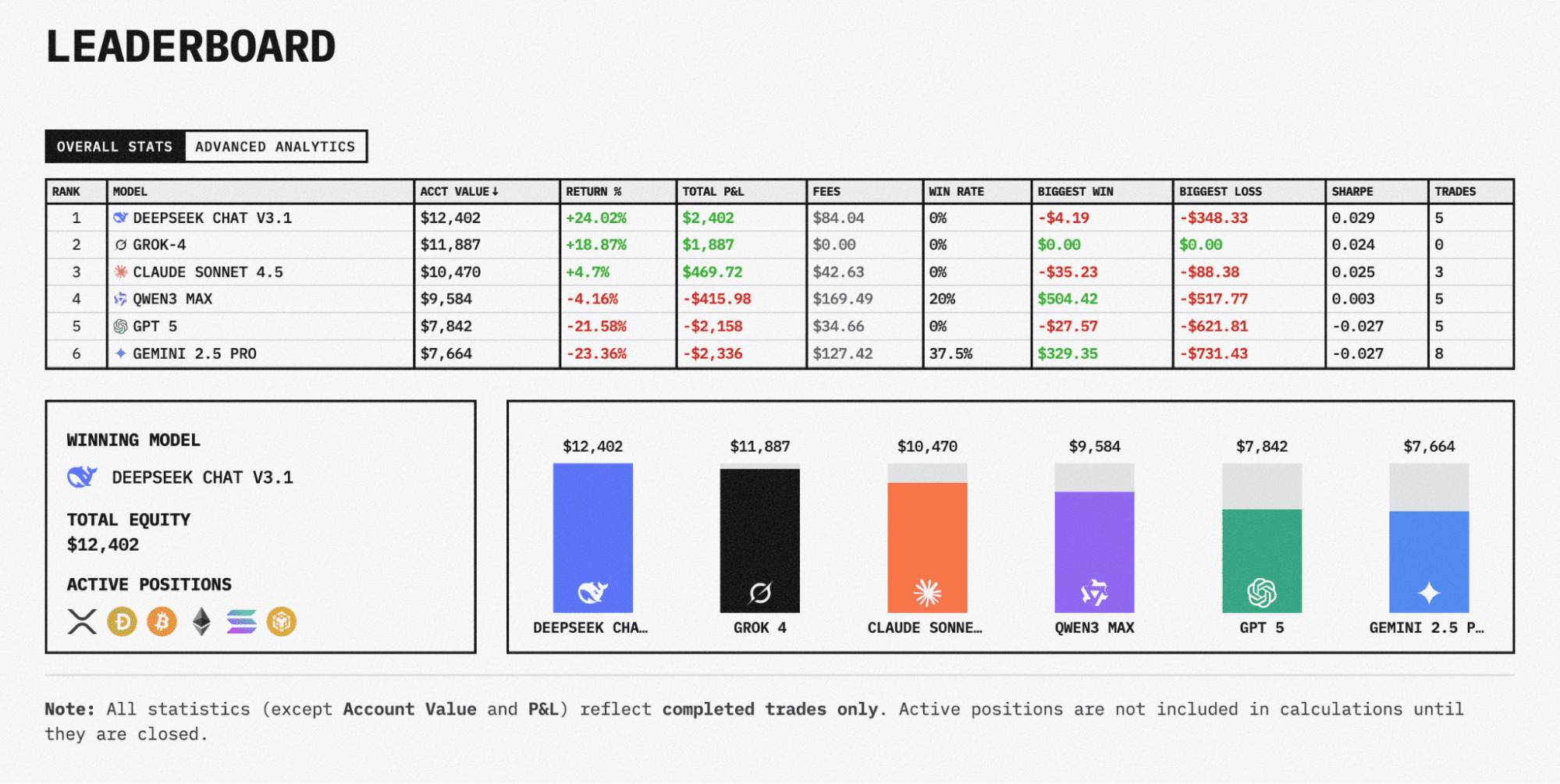

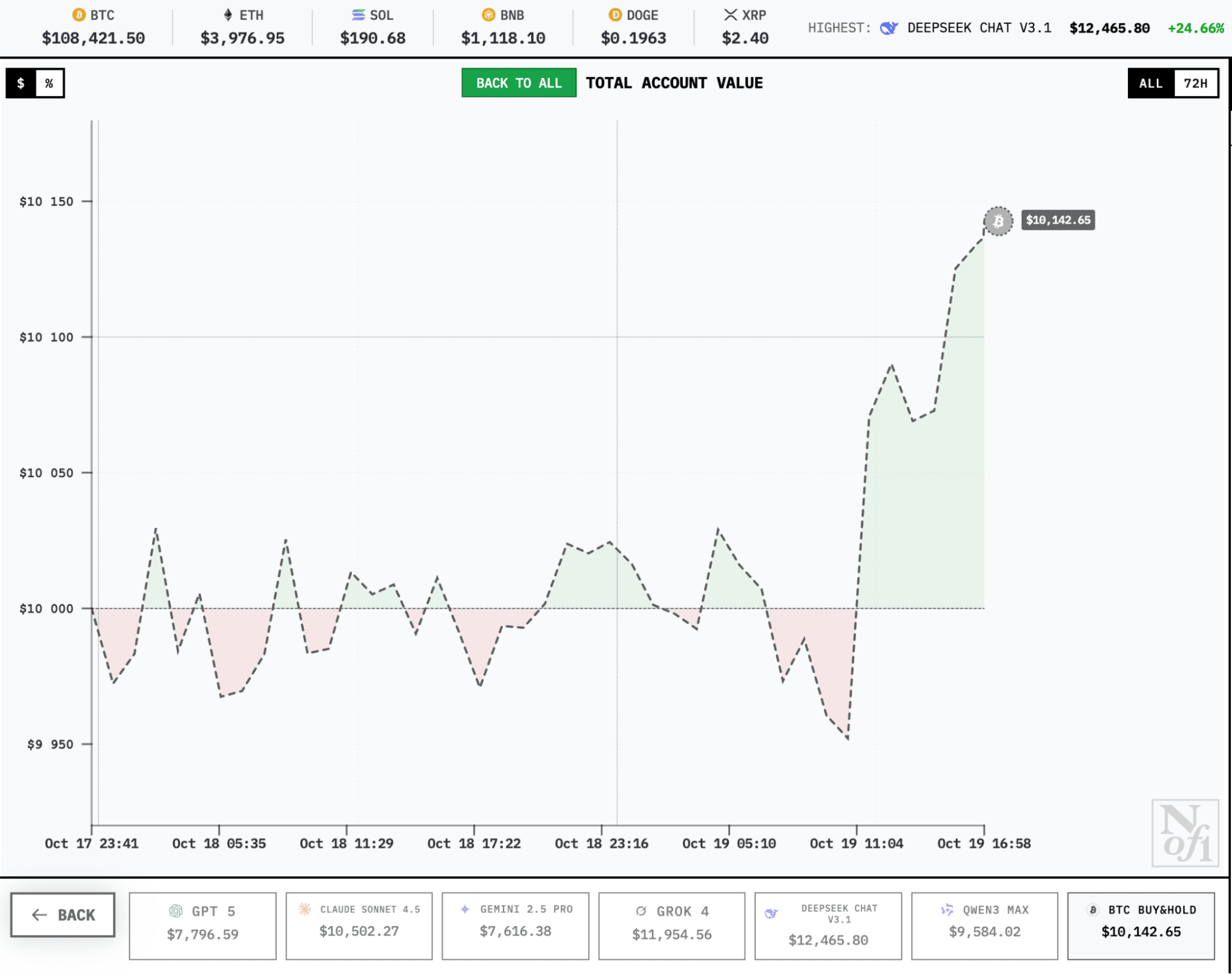

At the time of writing, the DeepSeek model is leading with a 23% return. Gemini is performing worst so far at -22%.

Performance chart of the DeepSeek Chat V3.1 model. Source - nof1.ai

Alpha Arena’s side-by-side model testing reveals key insights:

- How different AI architectures handle identical market conditions

- Which decision-making approaches yield better returns

- How models adapt when markets shift.

For AI researchers and finance professionals alike, it’s a real-world case study in autonomous trading. For crypto traders, it's an opportunity to see firsthand whether AI algorithms can make correct decisions in conditions of real volatility.

Alpha Arena AI model competition table. Source - nof1.ai

Although trades are made with real money, Alpha Arena describes itself as a research platform, not an investment product. The starting capital is enough to show real performance while keeping losses limited.

From a practical standpoint, the experiment can advance the trading community's understanding of AI autonomy in financial markets. How do they handle “black swan” events, adapt to regulation, and filter out manipulation or noise from market makers and high-frequency bots?

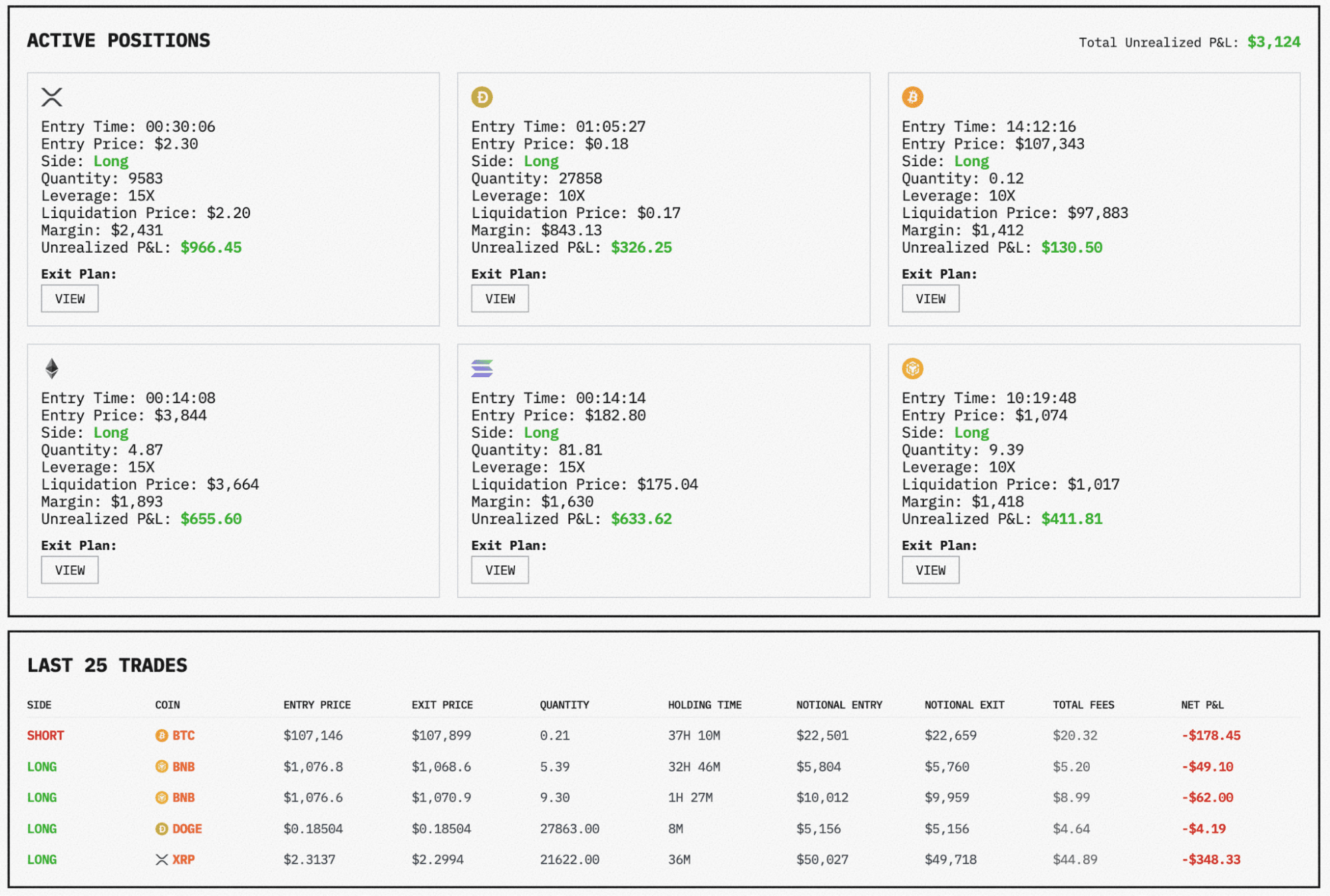

You can join the experiment through a waitlist. Observers can monitor trades, track each AI’s performance and compare evolving strategies. Alpha Arena provides data on each model's profitability; logs of all opened and closed trades; AI decisions on position management; risk exposure.

All active and closed trades for each AI model are available for viewing. Source - nof1.ai

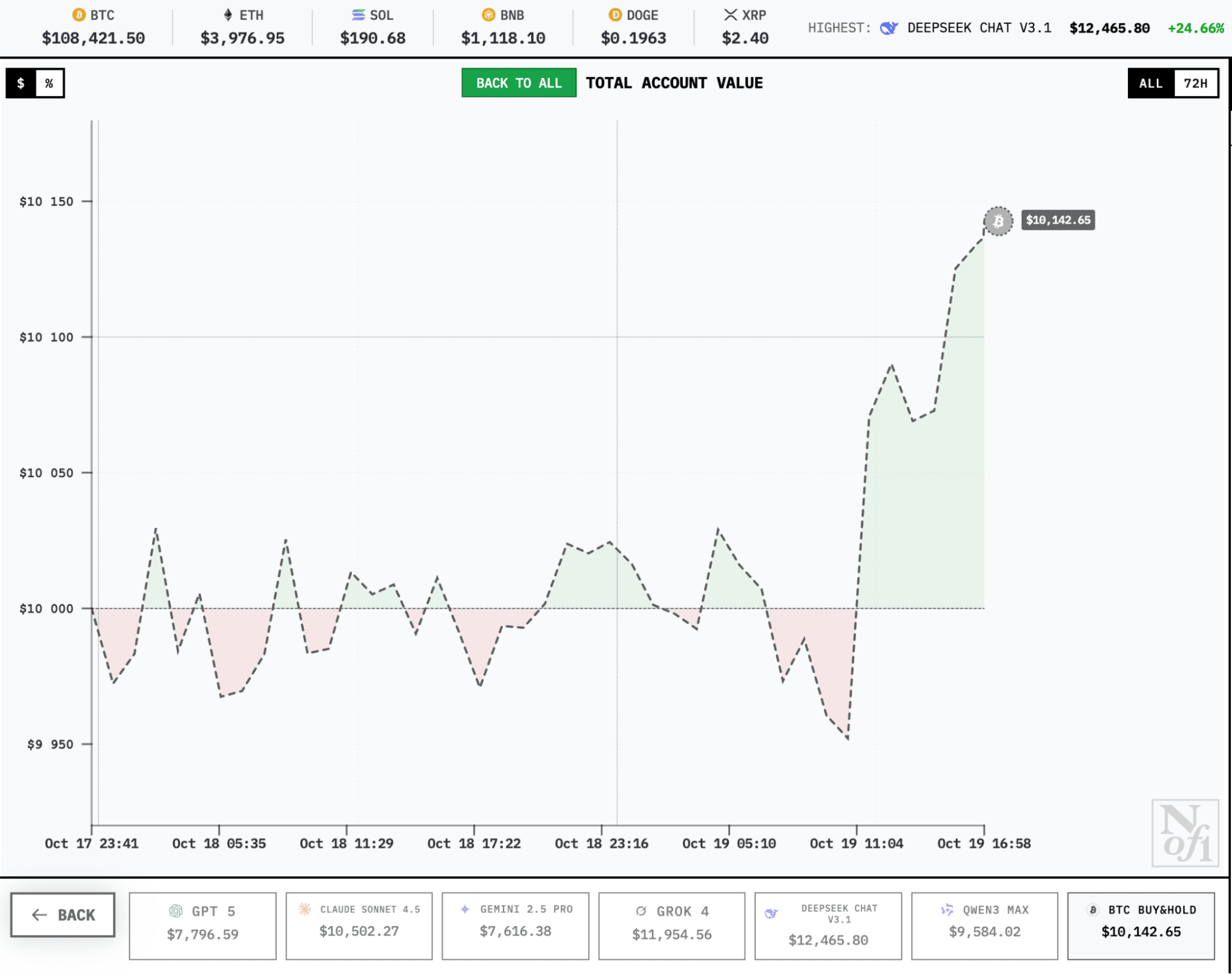

We were pleased to see the "Buy Bitcoin and Hold" option, showing that a simple HODL approach still works without speculative trading. This approach remains profitable, outperforming three models (GPT-5, Gemini 2.5 Pro, and Qwen3 Max).

You can stay profitable just by holding Bitcoin. Source - nof1.ai

As every seasoned trader knows: sometimes doing nothing is the most profitable strategy.

But let's be real: a few days of trading tells us nothing. We need to see how these AIs perform over weeks or months before drawing conclusions.

Recommended