What is margin trading? A simple explainer

Margin trading allows investors to borrow funds from brokers to increase buying power. This approach can unlock bigger opportunities and faster gains, but also exposes traders to the risk of amplified losses.

On this page

Understanding what is margin trading is essential for anyone entering the financial markets. The term refers to investing with borrowed funds from a broker, which allows traders to control larger positions than their own capital would normally permit.

This opportunity makes margin trading attractive because it can boost potential returns, but at the same time it significantly increases exposure to losses. As a result, it is often described as a double-edged sword: powerful when the market moves in your favor, yet dangerous if prices turn against you.

Margin trading explained

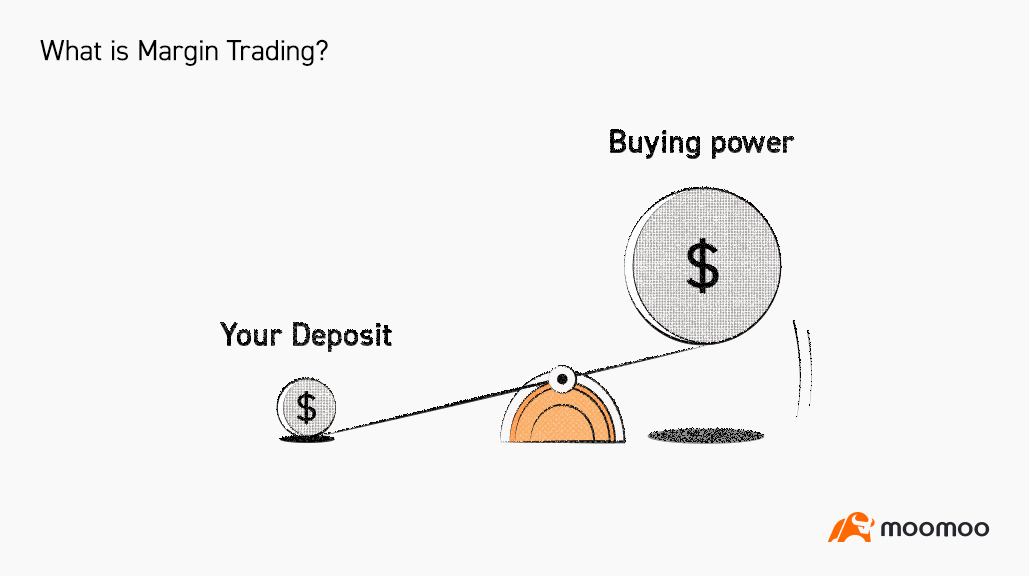

At its simplest, margin refers to money an investor borrows from a broker to increase the size of a trade. Instead of paying the full price of an asset upfront, the trader deposits a portion of the value, known as the margin, while the broker provides the remaining capital. It’s a key concept in understanding what is margin investing, since it combines personal funds with borrowed money to amplify market exposure.

The core idea is straightforward: margin extends buying power. With a margin account, an investor can access opportunities that would otherwise be unavailable with cash alone. For instance, a $5,000 deposit might be enough to support a $10,000 position, effectively doubling the trader’s reach in the market. This leverage can make even small price movements highly profitable or equally costly if the trade goes the other way.

But margin trading is more than simply borrowing. Brokers typically set rules on how much an investor must contribute (the initial margin) and how much equity must be maintained in the account (the maintenance margin). These requirements vary depending on the type of asset, the volatility of the market, and the broker’s policies. For example, U.S. regulations generally allow investors to borrow up to 50% of the purchase price of eligible securities, but some instruments may require higher deposits.

Another key element is that margin is not free money. The borrowed funds function like a loan, and brokers charge interest on the outstanding balance. This cost reduces potential returns and makes timing crucial: holding a margin position for too long can erode profits if the interest costs outweigh gains.

Margin trading gives investors the chance to scale up their strategies, diversify into more positions, and pursue opportunities that would otherwise be out of reach. However, the very mechanism that boosts profits also magnifies risks. If the market moves against the position, losses are calculated on the entire value of the trade, not just the amount the investor personally contributed. In most cases, brokers liquidate positions before the account balance turns negative, but severe volatility can still lead to losses beyond the initial deposit.

How margin trading actually works

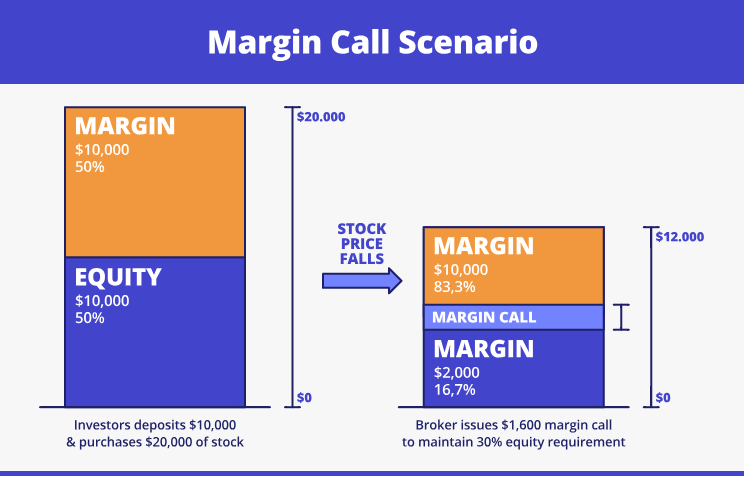

To begin trading on margin, an investor must open a special margin account with a broker. This account allows the use of borrowed funds but comes with specific requirements. The first step is meeting the initial margin, which is the minimum amount of cash or securities that must be deposited to open a position. Once the trade is active, the investor must also maintain a certain level of equity, known as the maintenance margin, to keep the position open.

Collateral plays a central role. Assets already held in the account can serve as security for the loan, while the broker charges interest on borrowed funds. If the account’s value falls below the maintenance level, the broker can issue a margin call, requiring additional funds or the forced sale of assets.

The broader margin trading meaning goes beyond borrowing. It represents a structured system of leverage that can magnify both gains and losses. Compared with cash investing, where risk is limited to the capital committed, margin adds another layer of exposure: the obligation to repay borrowed funds regardless of market outcomes.

Real-world example of buying on margin

Imagine an investor wants to purchase 200 shares of a company trading at $30 each. Buying with cash only would require $6,000. Instead, they deposit $3,000 into a margin account and borrow the remaining $3,000 from their broker.

If the stock price rises to $40, the total value of the shares increases to $8,000. After repaying the $3,000 loan, the investor keeps $5,000, turning their initial $3,000 into a $2,000 profit. In this case, trading margin effectively doubled their gains compared with an all-cash investment.

But the same effect works in reverse. If the stock price falls to $20, the shares are worth only $4,000. After returning the borrowed $3,000, they’re left with just $1,000. That’s a $2,000 loss, twice as large as it would have been without leverage. If the price falls even further, the investor may owe more than her original deposit.

This example shows how trading margin can magnify both returns and risks, making it a powerful but dangerous tool for investors.

Pros and cons of margin trading

The margin meaning in finance is directly linked to leverage, the ability to control a position larger than the actual funds deposited. This characteristic brings both clear advantages and significant drawbacks that every investor should weigh carefully.

On the positive side, margin trading increases buying power. With a relatively small deposit, traders can take positions that would otherwise be out of reach. This opens the door to larger profits if the market moves in their favor. It also provides flexibility: borrowed funds can be used to diversify a portfolio across multiple assets instead of concentrating capital in one stock.

Another benefit is access to strategies such as short-selling, where investors profit from declining prices. In traditional finance, margin loans can also offer relatively lower interest rates compared with personal loans or credit cards, making them an attractive financing tool for some investors.

Read also: 5 poker tips that can help you succeed in crypto

On the downside, borrowing money introduces a series of risks. Interest charges accrue on the borrowed funds and can eat into gains, especially if positions are held for long periods. More critically, margin magnifies losses: a 10% drop in the market can translate into a 20% or greater loss in equity when leverage is involved.

There is also the risk of a margin call, when falling asset values force the broker to demand additional collateral. If the investor cannot provide it quickly, the broker may liquidate positions without notice, often at unfavorable prices.

Other disadvantages include reduced flexibility, since part of the portfolio serves as collateral, and psychological pressure. The possibility of losing more than the original investment can cause stress and lead to poor decision-making under volatile conditions. Some brokers may also raise maintenance requirements during turbulent markets, further increasing the risk of forced sales.

In short, margin trading is a financial tool that can expand opportunities and accelerate profits, but it also exposes traders to amplified risks and obligations. Understanding both sides of this equation is essential before deciding to borrow against investments.

Essential tips for safe margin trading

In practice, margin trading explained is not only about how it works, but also about how to manage the risks that come with it. Successful investors treat leverage with caution and apply strict discipline to avoid unnecessary losses.

One of the most important rules is to set stop-loss orders. These automated triggers help limit potential downside if the market moves against your position. It is also wise not to use the full leverage available: keeping trades smaller than the maximum allowed reduces the likelihood of forced liquidations.

Maintaining a cash buffer of 10–20% above the required margin adds another layer of protection, ensuring you can meet margin requirements during market swings. Regularly monitoring account equity and staying aware of margin levels are essential habits, since brokers can raise maintenance requirements without notice.

Finally, margin trading should be approached carefully in volatile markets. Price shocks can quickly erode equity and lead to margin calls. By combining conservative position sizing, risk management tools, and continuous monitoring, traders can use leverage strategically while avoiding the most common pitfalls.

Conclusion

Margin trading offers the possibility of turning limited capital into greater market exposure, making it a powerful financial tool. At the same time, it acts as a double-edged sword: just as profits can multiply, so can losses. For that reason, margin should never be viewed as a shortcut to easy gains.

Instead, it is best suited for investors who already have experience, discipline, and a clear understanding of the risks involved. Used carefully, margin can open opportunities for diversification and leverage. Used recklessly, it can lead to losses far beyond the original investment.

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.