Pump and dump scheme

From shady moonshots to sudden dumps – pump and dump scams are crypto’s dirty secret. With BALD as a cautionary tale, here’s how to recognize the playbook before it’s too late.

On this page

What does “pump-and-dump” mean in crypto?

Ever seen a random coin shoot up 500% overnight – then crash just as fast? Welcome to the world of pump-and-dump schemes. In crypto, it’s the digital version of smoke and mirrors: hype it, spike it, dump it.

Here’s how it plays out: A group (or just one savvy schemer) picks a low-cap token. They start flooding Telegram chats, Discords, and Twitter threads with buzz. “Next 100x gem,” they shout. The goal? Drive up demand. Fast.

As more people FOMO in, the price skyrockets – the “pump.” That’s when the original promoters quietly sell off their stash – the “dump.” And just like that, the floor falls out. New buyers are left holding the bag, watching the chart nosedive.

Unlike traditional finance, where regulators like the SEC crack down on these tactics, crypto’s Wild West Setup makes enforcement tricky. Most pumpers hide behind pseudonyms, offshore accounts, or simply vanish post-dump.

And yes, if you’re wondering, are pump and dumps illegal in most jurisdictions? Absolutely. But in crypto? The lines blur. Some traders even knowingly join pumps, hoping to cash out before the music stops.

Bottom line: If it looks too good to be true and has no real fundamentals – it probably is. Understanding the pump and dump meaning isn’t just trivia. It’s survival.

Key components of a pump-and-ump scheme

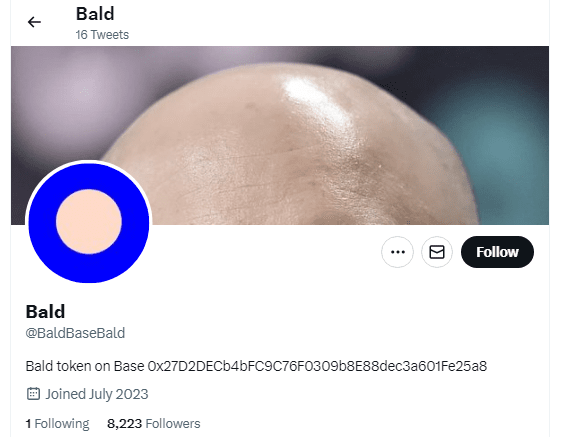

To understand what is a pump and dump scheme is, you have to look at how they actually unfold in real life. Every scam of this kind has its fingerprint: recognizable stages, same playbook. And instead of dry theory, let’s break it down through a real case – the short but explosive saga of $BALD, a memecoin that blindsided crypto Twitter roughly two years ago.

Step one: the setup.

A low-liquidity coin quietly launches on a new chain – in this case, Base, the L2 network backed by Coinbase. No website. No whitepaper. Just a weird Medium article waxing poetic about “baldness as cultural capital.” The goal? Create mystery and a whiff of legitimacy without actually delivering anything real.

Step two: the hype.

As whispers turn to noise, the pump begins. Influencer tweets. Telegram buzz. Even images of Coinbase’s own bald CEO, Brian Armstrong, started circulating – as if his dome was endorsement enough. “$BALD has 30,000x’d in 24 hours,” tweeted journalist Colin Wu, stoking the flames. Liquidity surged. So did FOMO.

Step three: the price spike.

Retail investors poured in. One pseudonymous trader claimed to hold 2% of the supply and promised not to sell until the cap hit $100 million. The token’s market cap ballooned to $85M in a matter of days. All eyes were on BALD – except those watching for exits.

Step four: the dump.

Then came the drain. In a single transaction, the masterminds withdrew 7,000 ETH and 142M BALD tokens. The price plummeted over 84% in hours. CoinMarketCap scrubbed the listing. Victims were left refreshing DeBank in disbelief.

And the kicker? The scammers didn’t vanish – they kept posting. One wrote:

“We’ll add back modest liquidity when there’s a reputable DEX.”

BALD hit every step of the scammer’s waltz – and the community danced right along.

Spotting the signs of a pump-and-dump

Here’s the hard truth: by the time a token’s in the news, it’s probably too late. But if you know what to look for, you can smell a pump and dump coming from blocks away. No crystal ball needed – just pattern recognition.

First sign? A mystery moonshot.

You’re casually checking your feed, and boom – some no-name token is up 1,200% in 24 hours. No roadmap update, no new listing, no real use case. Just green candles. That’s your cue to squint hard. Price doesn’t move like that without a push – and in this case, that push is likely artificial.

Next up: FOMO-fueled hype machines.

Twitter bots, Telegram armies, Discord cults – all singing the same tune: “Don’t miss this one,” “Next $DOGE,” “Whales are loading up.” You’ll see influencers (real or fake) dropping screen grabs of juicy gains. But ask yourself – have you ever seen them post losses?

Then comes the ghost tokenomics.

Just look at BALD – the token had no official site, no audit, and a vague Medium post trying to pass off baldness as some kind of crypto philosophy. That alone should’ve been a signal. But blinded by hype, most ignored the missing fundamentals – and paid the price.

Dig into the contract or project site – if it even exists. Do you see a team? An audit? A roadmap that isn’t just memes? If not, that’s a red flag. Many pump tokens are slapped together in hours, with full control resting in one anonymous dev’s wallet.

Watch the liquidity.

Low-volume DEXs are where these things thrive. Why? Because it only takes a few ETH to move the price. If you see a massive price jump paired with weak liquidity – it’s bait, not traction.

And finally: the forced optimism.

These groups often ban anyone raising doubts. It’s all about holding the line – until the rug is pulled. A smart trader watches not just the price, but the vibe.

Because at the end of the day, if something looks like a pump, walks like a pump, and hypes like a pump – it’s probably headed for a dump.

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.