Is mining crypto still profitable for balcony GPU miners?

Crypto mining – the process of validating blockchain transactions through computational work – had a balcony moment: modest GPU rigs on shelves and window sills, fans humming, payouts landing daily. Then the ground shifted. Ethereum went Proof-of-Stake, home power bills climbed, and smaller GPU coins couldn’t absorb the flood of hashpower.

On this page

What crypto mining really is (and why it exists)

Crypto mining is the computational work that secures blockchain networks. Miners compete to solve cryptographic puzzles; winners validate the next block of transactions and earn rewards – newly minted coins plus transaction fees.

This Proof-of-Work mechanism replaces banks with mathematics: no central authority controls the ledger, and altering past transactions requires overpowering the majority of the network’s computing power. Mining exists to align incentives – honest participants earn, attackers burn resources – and keep decentralized networks running without trust.

How сrypto mining works in 2025

Mining in 2025 splits into two worlds: industrial ASIC farms chasing Bitcoin, and consumer GPUs mining smaller Proof-of-Work chains. Before warehouse‑scale mines, there were bedrooms, garages – and balconies. In the early 2010s people mined on CPUs, then quickly on GPUs as difficulty climbed. Purpose‑built ASICs pushed Bitcoin off consumer hardware, but Ethereum went the other way: its memory‑hard Ethash algorithm favored graphics cards. That single design choice turned retail GPUs into mini cash machines during the 2020–2021 boom: block rewards were rich, markets were liquid, and a frame full of cards could pay the power bill and then some.

Why did it work? Back then, if you asked is mining crypto worth it, the answer was often yes, because conditions lined up. Home electricity was cheap enough in many places to leave a margin; GPU‑friendly coins were easy to sell the same day; and pools smoothed the lottery – no need to “find a block,” just submit shares and get steady payouts. The rest was culture and supply: YouTube tutorials, Telegram chats, second‑hand cards on classifieds. A rig felt like LEGO for adults – frames, risers, PSUs, then a few config files and you were in.

The human angle matters. Small, modular, and (relatively) quiet, 4–8‑GPU rigs slipped into apartments and suburban closets. People tuned fan curves, ducted warm air in winter, and checked dashboards with morning coffee – a DIY hobby as much as income.

The one‑line frame: “balcony mining” = cheap home energy + liquid GPU projects + easy pool payouts. When Ethereum migrated to Proof‑of‑Stake, GPU hashrate flooded smaller networks, difficulty jumped, and residential power got pricier. Margins compressed or disappeared.

Key factors that decide mining profitability

Mining profitability boils down to four factors: electricity cost, hardware efficiency, network difficulty, and coin price. For balcony rigs, all four turned hostile at once. The hinge moment was The Merge. When Ethereum retired Proof‑of‑Work, the keystone GPU coin vanished overnight. A tidal wave of hashrate spilled into smaller GPU‑chains – ETC, Kaspa, Ravencoin, Ergo and others. Difficulty jumped as miners piled in, while prices and fee cycles didn’t rise enough to offset the crowding. Same cards, less yield. And for readers wondering is Bitcoin mining still a thing, the BTC network is very much ASIC‑only; the squeeze we’re describing here hits the GPU‑friendly chains.

Then the home‑power reality showed up. Residential tariffs were always the killer variable. After the ETH easy era ended, even a few extra cents per kWh erased most altcoin margins. Summer amplifies it: ambient heat forces fans to ramp and GPUs to throttle, so you pay more electricity for less work. Add the human layer – noise, vibration, and hot exhaust – in apartments with thin walls and you’ve got neighbor and landlord friction, not just lower PnL. Home power prices aren’t equal across the map – here’s the ballpark many apartments face in 2025.

Household electricity price ranges by region (USD/kWh)*

| Region | Typical household range ($/kWh) | Notes |

|---|---|---|

| North America | $0.12–0.30 (up to ~$0.40+ in some states/provinces) | US national ~0.17–0.18; wide state-by-state spread (e.g., Hawaii high) |

| Europe | $0.18–0.40 | Regional average around mid-$0.20s to ~$0.30; country variation is large |

| Latin America & Caribbean | $0.12–0.30 (peaks to ~$0.46) | Broad spread across countries; island grids can be pricier |

| Middle East & North Africa (MENA) | $0.05–0.20 | Many markets have subsidized tariffs |

| Sub-Saharan Africa | $0.08–0.25 | Averages around low-to-mid $0.10s; infrastructure costs can push higher |

| Asia (ex-Middle East) | $0.06–0.18 | Lowest regional averages globally in 2025 |

| Oceania | $0.20–0.35 | Australia/New Zealand typically in this band |

Hardware stopped being a magic bullet. Newer GPUs don’t map cleanly to higher mining returns. Algorithms like KHeavyHash reward specific efficiency profiles, and the best cards are pricey. Profitability calculators that once looked GPU‑bound now look power‑bound: the dominant variable is kWh price, not GPU model.

Fees and MEV? Treat them like weather, not climate. The richest fee/MEV dynamics live on PoS Ethereum and its Layers 2, not on the remaining GPU‑mineable set. Other chains see occasional bursts – token launches, congestion – but those aren’t a payroll you can plan around.

Markets got meaner as well. Altcoin prices whip around, and difficulty lags price; when a coin spikes, miners rush in, difficulty rises, and the window slams shut. Retail frictions – confirmations, withdrawal queues, KYC hurdles – can make a tasty paper spread disappear by the time funds land.

Compliance and house rules enter the chat. Leases and HOAs often restrict noise, heat, and electrical changes; some local utilities flag unusual residential loads; insurers care about fire risk. Safe wiring (no daisy‑chains), dedicated circuits, and proper ventilation aren’t optional – and they add cost.

The clear takeaway for 2025: in most homes, kWh price + elevated network difficulty crush the balcony‑mining margin. What once worked – a big, liquid GPU coin plus cheap home power – no longer exists. That’s why many hobbyists either treat mining as a near‑zero‑ROI learning project, pivot GPUs to hour‑priced AI work, or skip rigs entirely and dollar‑cost average into coins instead.

Mining methods: solo, pool, and cloud compared

Balcony miners have three paths: solo, pool, or cloud – each with different risk and control profiles.

- Solo mining means running your own node and keeping the full block reward if you find a block. For small rigs, odds are lottery-level: a single GPU facing a network like Ethereum Classic might wait months or years for a block. Solo works for large operations or very low-difficulty coins; for home setups it’s pure gambling with no guaranteed income.

- Pool mining is the balcony standard. Miners combine hashrate, and payouts are proportional to contributed shares. Pools charge 0.5–2% fees but eliminate variance – you earn daily or weekly instead of waiting for luck. Most GPU-friendly coins have established pools (2miners, F2Pool, Nanopool) with threshold or scheduled payouts. This is why the article keeps referencing “pools smoothed the lottery.”

- Cloud mining rents hashrate from a provider – no hardware, no power bills. Sounds ideal, but economics are brutal: providers price contracts to profit themselves first, leaving thin-to-negative returns for customers. Scams are common; exit scams are routine. Unless you trust the operator implicitly (rare), cloud mining is a coin-flip at best – and often just a slow way to lose money.

For balcony miners, pools became the default choice: predictable payouts, transparent dashboards, and low minimums made the hobby viable. When that stopped working, flexibility became the real hedge.

Strategies to stay profitable in a competitive market

When margins compress, flexibility beats hashrate. GNcrypto’s coverage of Kadena’s shutdown showed how chain‑locked ASIC fleets can go to zero utility in a day. Balcony rigs on GPUs aren’t immune to bad economics, but they can pivot – to AI rentals, to different algorithms, or to pure hobby mode.

The most common pivot is renting GPUs for AI. For anyone still asking is crypto mining profitable, this route reframes the question: your revenue is time‑based, not block‑based, and depends on uptime and service quality rather than pure luck. Instead of hashing, your card serves inference or training jobs from marketplaces with pay‑per‑hour rates.

The game changes from luck to service: stable uptime, correct drivers/containers, and predictable thermals become your “mining settings.”

- Pros: revenue is time‑based, payouts are quicker, and you can pause.

- Cons: platform risk, slow job flow some weeks, and stricter hygiene around data and software.

Treat it like light DevOps: power caps, auto‑restart, alerting.

A quieter move is heat reuse. In winter a 4–8 GPU rig is a space heater that offsets part of the power bill. It’s seasonal – great in cold climates, pointless in heatwaves – and safety rules still apply.

Others shift to niche coins in hobby mode. GPU‑friendly networks remain, but yields are thin and windows short. The honest pitch: learn the tooling, support decentralization, enjoy the tinkering, and expect near‑zero ROI. Pools smooth variance; calculators keep expectations honest.

And many just stack sats instead. If your local kWh price and neighbor tolerance say “no,” skip rigs and dollar‑cost average into assets you understand. You can still run a node for learning; it won’t mint coins, but it keeps you close to the tech without betting the electricity bill.

Live case: from hashrate to AI workloads

Meet the pivot in the wild. YouTuber Red Panda Mining (“Ham”) took a GPU mining pedigree and aimed it at an AI‑rental marketplace. His box: an enterprise‑style Octoserver with 6× RTX 3090, an AMD EPYC 7543 (32‑core), 256 GB RAM, U.2 NVMe storage, and 10GbE on a VLAN. He listed it on Clore.ai at about $24/day on‑demand (spot minimum ~$18/day) and it was rented within hours.

For readers who still ask is it still profitable to mine Bitcoin, Ham’s pivot shows a different way to monetize the same GPUs when coin yields compress.

Early run‑rate landed around $23–$24/day gross – roughly $600–$700/month if occupancy holds. Power during the filmed job hovered near 5 A @ 240 V (~1.2–1.4 kW), because the tenant wasn’t maxing the GPUs. For context, his separate “Salad” PCs pulled ~2.7 kW combined for ~$12/day – the AI server beat them on both revenue and watts, at least under that workload.

Two lessons defined the shift. First, network matters: his fiber‑class 1–2 Gbps upload and solid reliability earned a 5.0 rating and rentals, while rivals with weak uplinks or power limits cleared less per day. Second, the job is more DevOps than overclocking: drivers/containers, uptime targets, thermals, and fast restarts keep you billable. Quotes that stick: “It’s rented at $24 a day,” and “Upload speed is paramount.”

Costs are real. A fully built, modern GPU server can run ~$27k; a barebones (CPU/RAM/NVMe, no GPUs) around ~$7k, with used 3090s often $600–$800 each – about $13k all‑in if you already own the cards. And revenue is time‑based but occupancy‑dependent: token payouts (CL) swing with price, and competition rises as more rigs list (4090/5090 counts climbing on other platforms).

Then vs now. Mining: block/fee luck and coin liquidity. AI rental: rate × hours rented − power, with variance moving to uptime and demand. Same GPUs, different skill set, calmer PnL – when you’re online and useful.

The honest math (no spreadsheets)

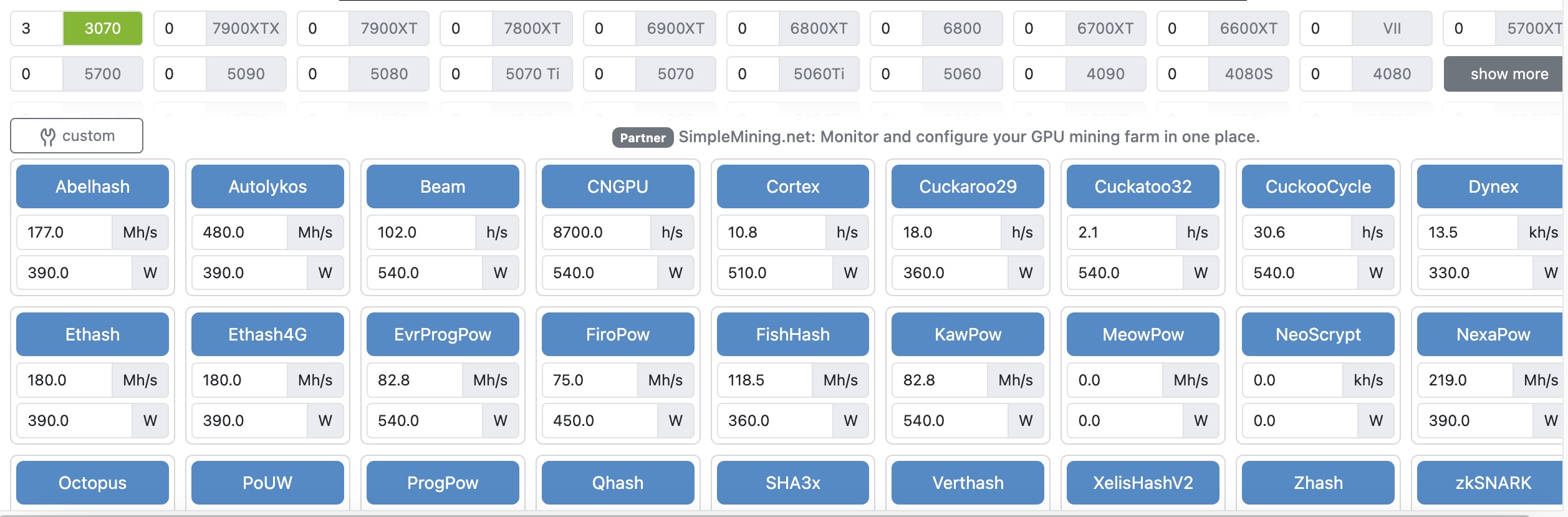

Here’s the balcony-rig napkin test you can run in 30 seconds. Start with daily revenue (from a coin or an AI rental). Subtract power: (watts × 24 ÷ 1000) × your $/kWh. Then subtract platform/pool fees and any withdrawal/gas. What’s left is your daily margin. That’s when you answer the only question that matters for a home rig – is crypto mining worth it for your setup? If the number is tiny on an average day, real life will make it smaller – because real life adds stalls, dust, and missed alerts. Quick sanity check: here’s what a typical WhatToMine input panel looks like for a small 3×RTX 3070 rig – use it as a ceiling, not a promise.

Two sensitivities decide most outcomes. Electricity: add +$0.05/kWh and watch a thin margin go negative; shave −$0.05 and a hobby can turn sustainable. Thermals/ambient: add +5°C on a summer afternoon and GPUs throttle; you burn more watts for less work. The rest is ops: uptime (Internet/power blips), stale shares or failed jobs, and the overhead of moving payouts. Tools like profitability calculators or AI‑rental dashboards are fine for a quick read, but they assume perfect conditions – use them as a ceiling, not a promise.

The anchor to remember: balcony mining is a lifestyle choice first. If your wiring, noise limits, and power price let you play safely, treat any profits as a bonus – and be ready to pivot (heat reuse, AI rentals, or simply buying coins) when the napkin turns red.

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.