Is Bitcoin mining still worth it? The industrial reality in 2026

Mining has grown up. What started as hobby rigs is now an energy and infrastructure business: power contracts, transformers, cooling, and uptime play the lead roles. Profit doesn’t come from “magic boxes,” it comes from unit economics – what you pay per kilowatt-hour, how efficient your ASICs are (joules per terahash), and how reliably you turn work into cash via pools and liquid markets.

On this page

- How the money’s made: profit and risk without the math

- Where it happens: a map of cheap power and why power wins

- Laws & permits: licenses, power caps, environmental rules

- Pools & hashrate distribution: how miners choose where to point

- Key players: public miners, hosters, and ASIC makers

- Infrastructure: power, cooling, networking, monitoring

- Risks & management: from volatility to regulation

- Profitability today: “yes, but…”

Prices, difficulty, and fees still swing day-to-day, but the operators who win treat mining like a data center: disciplined power, steady thermals, low latency, clean monitoring. In this guide, we map the players, the places, and the rules that decide who stays profitable.

How the money’s made: profit and risk without the math

Industrial mining isn’t “magic boxes,” it’s a predictable cash flow with familiar risks. The money flows like this: block rewards + fees → pool → miner → power and hosting bills. Pools smooth out the randomness of payouts and take a fee; miners then pay the boring line items – kilowatt‑hours, site, maintenance, people.

If you’re asking is mining crypto worth it, the industrial answer depends on three levers: your power price, ASIC efficiency, and uptime.

The north star is hashprice: in plain English, how much one unit of compute earns on an average day. It breathes with the market. When BTC rises, hashprice lifts; when difficulty climbs (more machines join), each miner’s slice shrinks; when transaction fees spike, it’s a temporary bonus. Uptime sits on top of all that: a silent farm earns nothing.

A simple rule of thumb for reading headlines about miners: the lower your $/kWh and the more efficient your ASICs (fewer joules per terahash), the better your odds of staying profitable – especially when margins are thin. That’s why farms cluster where power is cheap and stable.

Where it happens: a map of cheap power and why power wins

Follow the cheap, steady electrons and you’ll find the big mines. If you’re wondering is Bitcoin mining still a thing, look where power is cheapest and most reliable – industrial fleets follow the electrons. Power is the first and last line of the P&L, which is why industrial fleets chase not just low $/kWh, but also grids that actually deliver – firm capacity, clear rules for curtailment, and predictable interconnections.

Texas (ERCOT), USA. Miners like flexibility here. When the grid is stressed, they power down and earn demand‑response credits; when conditions are calm, they ramp back up. The catch is heat waves, price spikes, and queue backlogs for new hookups.

Canada (Québec, British Columbia). Hydro keeps costs competitive and the climate helps with cooling. The trade‑off is allocation caps and a slower, more formal permitting process – long‑term agreements and community buy‑in matter.

Iceland/Norway. Hydro and geothermal meet cool air and strong grids. Capacity is finite, though, so new megawatts often depend on fresh infrastructure and policy sign‑off.

Paraguay (Itaipú). A hydro surplus makes mining attractive, but transmission limits and shifting export rules can change the picture quickly.

UAE/Bhutan and other bespoke hubs. Think negotiated tariffs in purpose‑built data zones (UAE) or seasonal hydro abundance (Bhutan). Projects hinge on custom agreements and meticulous grid planning.

Kazakhstan and parts of LatAm. After early booms, licensing and quotas now shape access in Kazakhstan. Across Latin America, some sites work thanks to local subsidies or captive generation, but policy and currency risks loom.

Why power wins: two identical fleets can produce wildly different margins purely on the power bill – and weather. Cheap hydro plus mild air beats retail‑rate contracts under desert sun. For readers, the quick litmus test for any mining headline is simple: where’s the site, how stable is the grid, what are the curtailment terms, and who’s signing the power deal?

Industrial electricity price context by region (USD/kWh)

| Region | Typical industrial range (USD/kWh) | Notes |

|---|---|---|

| North America | $0.08–0.15 | US/Canada large-load industrials often in high-$0.08s to low-$0.10s; big spread by state/province and demand charges |

| Europe | $0.12–0.25 | Widely varies by country and contract; energy + network + levies can push above $0.20 in some markets |

| Latin America & Caribbean | $0.10–0.22 | Hydro-rich countries lower; island systems and imported fuel raise costs |

| Middle East & North Africa (MENA) | $0.04–0.12 | Many markets have subsidized or tiered industrial tariffs; gas-linked generation common |

| Sub-Saharan Africa | $0.08–0.20 | Reliability and diesel back-up often add to effective costs; utility tariffs vary widely |

| Asia (ex-Middle East) | $0.07–0.14 | Coal/gas-heavy grids and scale keep industrial rates relatively low in many countries |

| Oceania | $0.15–0.25 | Australia/NZ industrial bands typically here; network/demand charges matter a lot |

Laws & permits: licenses, power caps, environmental rules

Big mines don’t run only on electricity – they run on permission. Beyond a cheap tariff, you need the legal right to draw megawatts, plug into the grid, and make noise and heat without breaking local rules. And if you’re asking is crypto mining profitable, remember that profitability often hinges as much on permits and interconnection timelines as on cents per kWh. That patchwork looks very different across regions, which is why the same fleet can be welcome in one place and paused in another.

United States. Everything is local. Interconnection studies, transformer lead times, and load‑reporting are handled at the utility/state level. Texas’s ERCOT pairs flexible‑load programs and demand‑response credits with clear curtailment rules, while other states lean harder on siting, noise, or emissions. Some jurisdictions have imposed temporary moratoriums on new PoW sites tied to fossil generation or stressed grids.

EU/EEA. There’s no single “EU mining law,” but large power users face energy‑efficiency expectations, environmental impact assessments, and member‑state grid codes. MiCA doesn’t regulate mining directly, yet it shapes the rails around it – exchanges, stablecoins, disclosures. Timelines depend on local DSO/TSO interconnection and zoning.

Asia/Central Asia. China’s 2021 prohibition pushed hashrate abroad. Kazakhstan moved to licensing, quotas, differentiated tariffs, and tax/fee schedules after grid stress; access now depends on compliance and available caps. Elsewhere, special economic zones or bespoke approvals set the tone.

Latin America. Hydro‑rich pockets like Paraguay attract miners, but transmission limits, export rules, and political turnover matter. In other countries, outcomes hinge on local tariffs, captive generation, FX controls, and occasional government MoUs.

Pools & hashrate distribution: how miners choose where to point

If solo mining is a lottery, pools are the syndicate. By combining thousands of machines, a pool turns lumpy, once‑in‑a‑blue‑moon wins into steady, pro‑rata payouts. The trade is simple: miners ship their work to the pool, the pool finds blocks more regularly, takes a small fee, and pays contributors by a scheme that defines who carries the luck risk. In PPS the pool pays per valid share whether it found a block or not; FPPS adds an average slice of transaction fees on top; PPLNS tightens the link to recent blocks – more variance, usually lower fees.

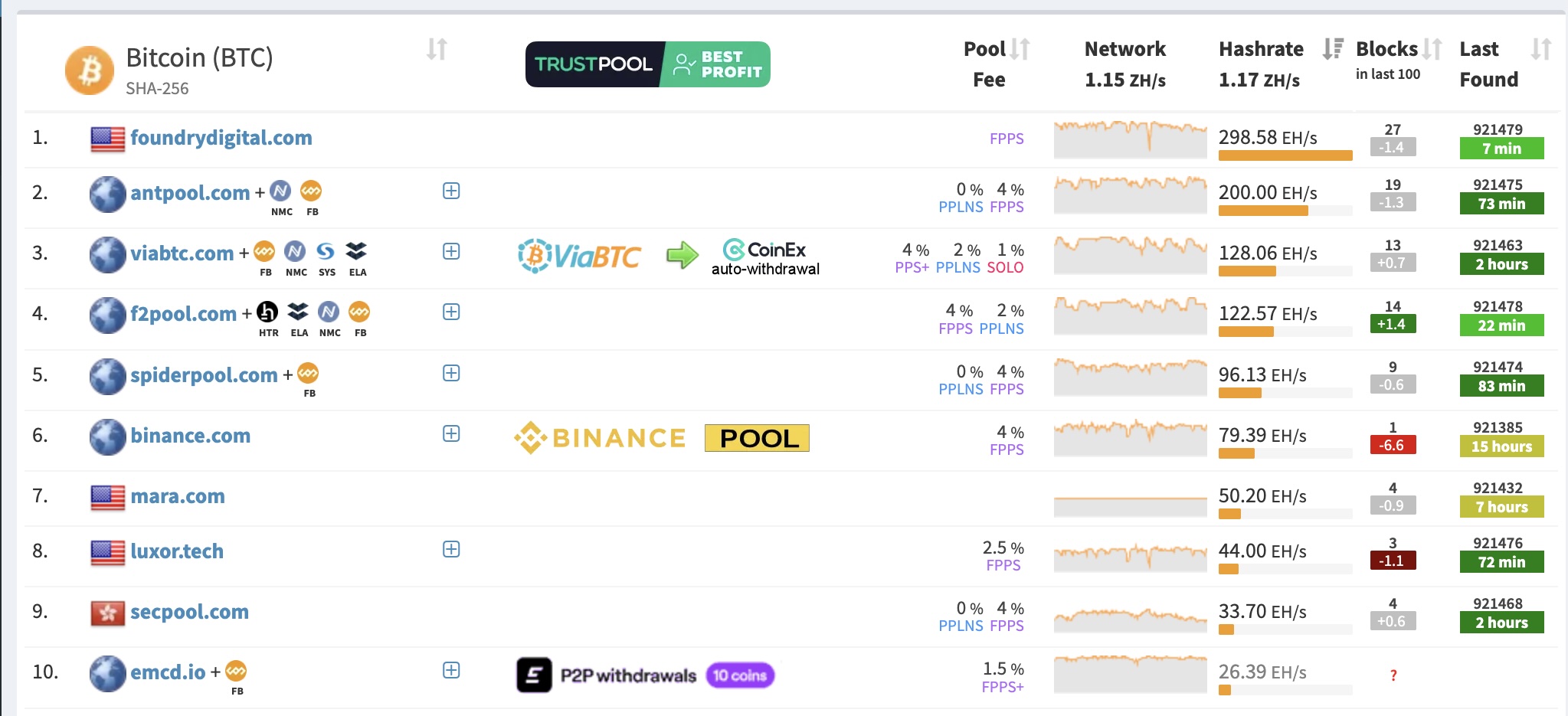

From the outside, the BTC leaderboard you’ll see on public trackers (e.g., MiningPoolStats) features familiar names – Foundry USA, AntPool, F2Pool, ViaBTC, Binance Pool, MARA Pool, Luxor, SBI Crypto, EMCD and others. They don’t differ only by logo. Pool choice and latency can shift realized revenue more than a tiny fee difference. Fees and payout options matter for margins; server geography and latency matter for stale shares; dashboards, alerts, and APIs matter for day‑to‑day ops. Even minimum payout thresholds can change the feel for a smaller site. Many pools also offer niceties like auto‑conversion of rewards or merged‑mining distributions where relevant.

Readers sometimes ask where boutique pools fit. Think of Whitepool as one more venue in that marketplace. The checklist is the same as for the giants: reputation and uptime that you can verify, a fee and payout model you actually want, server locations that sit close to your farm, clear incident reporting, and responsive support. In practice, miners will point a slice of hashrate at two or three pools for a week, compare realized revenue net of fees and stale shares, and then settle on what performs best from their coordinates.

There’s a security and governance layer too. The newer Stratum V2 protocol brings encryption and optional Job Negotiation, which reduces hijack risks and gives miners more influence over block templates – useful for censorship‑resistance. At the ecosystem level, concentration is the concern: when a handful of pools gather a very large share, fear of policy‑driven transaction filtering rises. That’s why operators keep an eye not only on their own payouts, but also on how the global pie is split – and sometimes vote with their hashrate to keep the network healthy.

Key players: public miners, hosters, and ASIC makers

If industrial mining were a sport, these are the teams, arenas, and kit. On the public stage, you’ll see Riot Platforms, Marathon Digital (MARA), CleanSpark, Core Scientific, Hut 8, Bitfarms, Cipher Mining, Bitdeer, Iris Energy and others. They look similar from afar, but models differ. Some are pure self‑miners – they own the machines, ride the price, and stomach the swings. Others blend hosting, earning steady fees by selling racks and power to clients. Power strategy is the real edge: long‑dated PPAs, demand‑response revenue in ERCOT, or behind‑the‑meter deals with hydro or gas offtake. Treasury tactics vary too: daily sell‑down vs holding BTC, hedging with derivatives, or borrowing against inventory.

Behind many megawatts sit hosting providers/data‑center operators. Their product isn’t “Bitcoin,” it’s uptime. Serious customers glance at a handful of tells: cooling design (air vs immersion), PUE and metering per rack, SLA and incident reports, transparent tariffs (including demand charges) and curtailment clauses, expansion path on the interconnect, spare‑parts/RMA handling, physical security, and clean remote telemetry. The boring stuff – change management, ticket response times – decides whether machines hum or sit dark.

Then there’s the gear. Three names set the pace: Bitmain (Antminer S21/S21 Pro), MicroBT (WhatsMiner M60/M66), and Canaan (Avalon A14/A15). The spec that matters most is efficiency (J/TH): fewer joules per terahash means lower power per unit of work and a wider safety margin when margins thin. Reliability, warranty/RMA logistics, and delivery schedules matter almost as much as headline TH/s.

Trends to watch: dense immersion sites that recycle heat or cut noise; firmware auto‑tuning and fleet orchestration to squeeze uptime and lower kWh; stronger warranties and region‑specific assembly as supply chains adapt. Same game, sharper tools.

Infrastructure: power, cooling, networking, monitoring

Behind the photos of warehouse‑sized mines is a lot of boring engineering. Start with electricity: a typical site pulls 10–50+ MW through its own step‑down transformers and switchgear, under a PPA or tariff that spells out demand charges, curtailment/demand‑response terms, and power‑factor requirements. Good power quality (minimal sags, balanced phases, controlled harmonics) means fewer trips and longer machine life; redundant feeders or fast transfer switching turn outages into short blips instead of hours offline.

Cooling is where CapEx meets OpEx. Air‑cooled halls or container rows are cheaper to build but louder and less dense; you fight dust and hot‑air recirculation with filters and containment. Immersion flips the trade: higher upfront cost, pumps and fluid management, but tighter racks, lower fan power, steadier thermals – and the option to reuse heat. Warranty/RMA terms and fluid choice matter as much as the pretty photos.

Treat the farm like a data center on the network side. Dual uplinks, segmented L2/L3, and per‑row switching limit blast radius; miners sit on isolated VLANs behind jump hosts. Telemetry flows via SNMP or agents into dashboards tracking hashrate, temperatures, reject/stale rates, PSU draw, and line current, with alerts that wake humans before revenue quietly dies. Least‑privilege access, 2FA/U2F, IP allowlists, and audited bastions keep hands honest, while runbooks – firmware rollouts, graceful curtailment shutdowns, auto‑recovery on power return – turn bad days into recoverable ones.

Risks & management: from volatility to regulation

Industrial mining looks steady from the outside, but the revenue line wiggles with three things: BTC price, network difficulty, and fee cycles. When price drops or more machines join, the same fleet earns less; when mempools clog, fees can briefly juice results. The grown‑up response is policy, not vibes: model hashprice scenarios and, if you’re a big shop, hedge part of output with futures or options collars so bad months don’t sink the ship.

Ops risk is the daily grind. Downtime vaporizes margin, so sites obsess over power quality (surge/arc‑fault protection, clean grounding), fire safety (detection, isolation, clean‑agent suppression), and environmental monitoring. Spares on hand – PSUs, fans, control boards – turn a week‑long wait into an hour’s fix. Runbooks for heat waves, storms, and grid curtailment keep humans calm when alarms blink.

Legal and compliance are the paperwork side of the same coin. Large prepayments for hosting or hardware trigger source‑of‑funds checks; permits can require energy audits; noise and environmental limits are real. Import duties, e‑waste handling, labor and land rules – all tend to be local, and all bite if ignored.

Finally, counterparties. Pools and hosters are critical partners, so miners read the fine print: payout models and minimums, incident history, SLA and uptime targets, curtailment revenue sharing, demand‑charge passthroughs, penalties, escrow milestones, and exit clauses. Diversifying endpoints (multi‑pool, split hosting) turns a single point of failure into a shrug. The TL;DR checklist: scenario P&L, a written hedge playbook, a spares list, safety audits, contract redlines, and a simple plan B for every dependency.

Profitability today: “yes, but…”

Short answer for industrial setups: yes, mining can still work – but only when the inputs line up. Three levers decide most outcomes: the all‑in power price (your tariff/PPA plus demand charges and curtailment math), the efficiency of the fleet (joules per terahash and real uptime), and operational discipline (hedging, maintenance, pool/hosting choices). Fee spikes are a bonus, not a business model.

Two quick P&L archetypes explain the split:

Low‑cost power + new‑gen ASICs. Think hydro/stranded energy or DR‑friendly contracts, machines under the newest efficiency band, steady uptime. On average hashprice, this setup leaves room for positive gross margin, with upside from DR credits, heat reuse, or smart treasury timing.

Retail‑like power + legacy ASICs. Commercial tariffs and a 25–30+ J/TH fleet in a hot climate push costs up. Margins flip thin to negative unless you add extra revenue (DR payments, heat sales), underclock aggressively, or actively hedge production. Many operators in this bucket pivot to hosting or shut off during weak epochs.

What turns a “maybe” into a “no”? Retail‑rate contracts, poor power quality or frequent outages, high stale‑share rates (latency), chunky pool/hosting fees, and unplanned downtime.

If you’re reading headlines and wondering whether industrial mining is viable, translate them into a quick checklist: contracted all‑in $/kWh and curtailment terms; fleet efficiency and delivery schedule; site infrastructure and grid stability; pool/hosting SLAs; legal/permit perimeter; and a plain‑English risk policy (hedges, spares, safety/runbooks). If those boxes are boringly solid, the math can still pencil out.

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.