Why you can’t mine Ethereum on PC after The Merge

If you’re searching how to mine ETH in 2025, you’ll discover that Ethereum mining on mainnet is gone. This guide explains what mining used to be, why it ended after The Merge, and what practical alternatives exist now for ex‑miners and ETH fans.

On this page

Ethereum mining explained

Before 2022, Ethereum relied on Proof‑of‑Work and a memory‑hard algorithm called Ethash. Many newcomers searched “how to mine Ethereum on PC” and followed a simple playbook: install a wallet, configure an Ethash miner, and join a pool that paid out shares. Miners packaged transactions into blocks and earned a subsidy plus transaction fees. Hashrate and electricity costs determined whether a rig made sense for a home setup.

Typical hardware ranged from a single mid‑range GPU to multi‑GPU frames. Tuning focused on memory clocks and power limits rather than raw core frequency because Ethash was largely memory‑bound. Pools used different payout models, and miners compared variance, fees, and minimum thresholds before committing. A frequent question from newcomers was, “Can you mine Ethereum with a CPU?” In practice, GPU performance displaced CPUs very early, and laptop cooling usually couldn’t keep up for sustained sessions.

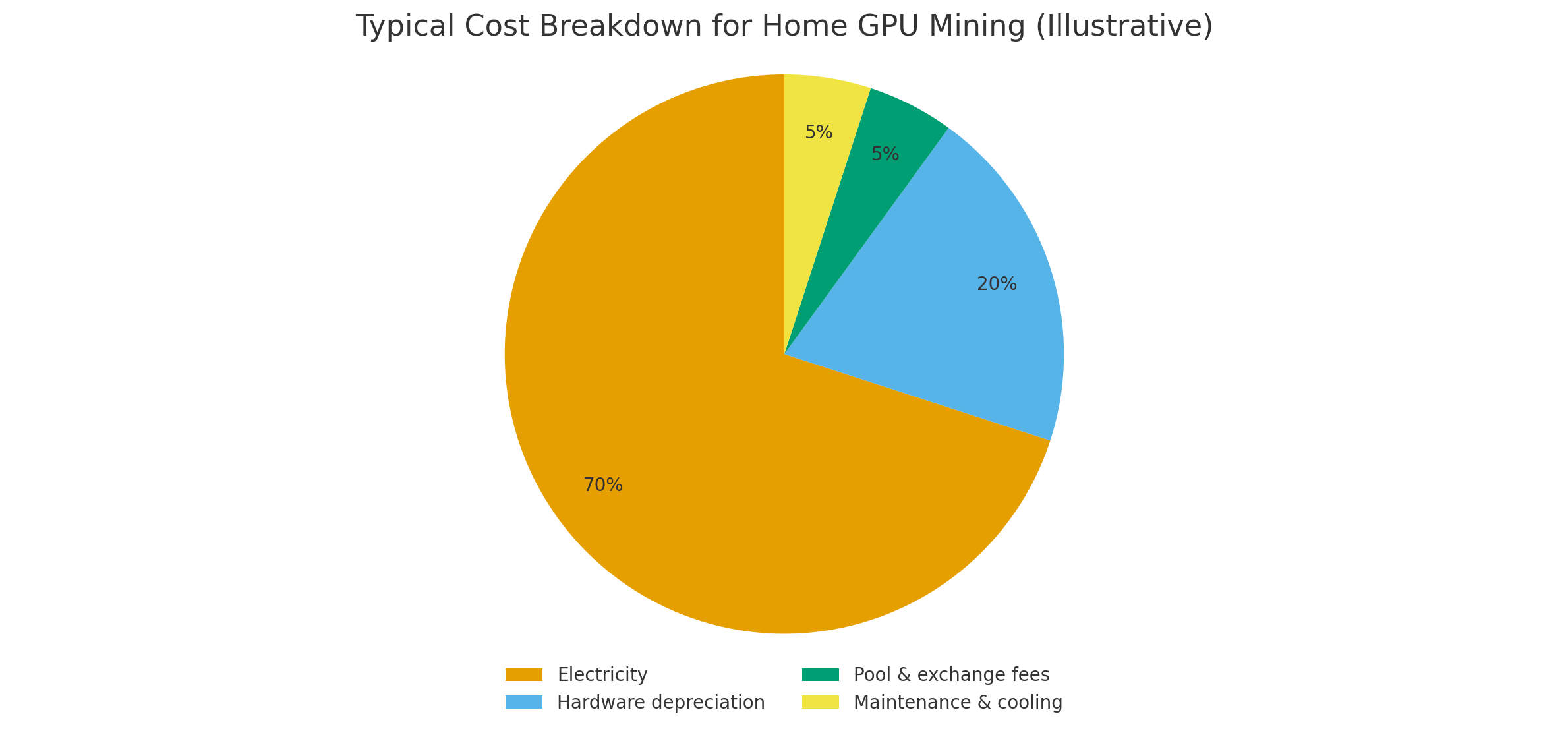

Miners also watched DAG (Directed Acyclic Graph) growth, VRAM capacity, and driver stability. As difficulty rose, solo mining became unrealistic for most people, so pools became the norm. Operational chores (dusting, cable management, airflow, and safe power delivery) often mattered as much as hashrate numbers. Profitability swung with coin prices and local kWh rates, so veterans tracked break‑even points and adjusted rigs when margins thinned.

To understand operations at the time, think in terms of three components: a wallet to receive payouts, an execution client to talk to the network, and a mining software that spoke pool protocols like Stratum. Most home setups skipped solo mining and connected straight to a pool with an address and worker name. Payout schemes differed, so fees and variance felt different across pools. A practical checklist for anyone willing to mine Ethereum on PC back then included selecting a reliable pool, setting a conservative power target, and watching stale shares.

The DAG file grew over time, so cards with low VRAM aged out. Memory stability mattered more than core clocks because Ethash was memory‑bound; miners tuned memory timings, fan curves, and PL limits to hit a sweet spot of MH/s per watt. Basic hygiene included surge‑protected power, dust control, and clear airflow. Many operators also tracked local electricity tiers and heat reuse, placing rigs in garages, attics, or ventilated enclosures. Finally, when someone asked whether they can mine Ethereum with laptops or small form‑factor PCs, the honest answer was that thermals and VRAM usually made it impractical.

What happened to Ethereum mining?

In September 2022, Ethereum completed The Merge, joining the PoS Beacon Chain with the execution layer and switching off PoW on mainnet. From that point, nodes rejected PoW blocks, and block production moved to validators who stake ETH and attest to proposed blocks. Mining software could still run, but its output had no effect on Ethereum mainnet.

The change aimed to slash energy usage, align security incentives with economic stake, and prepare the protocol for future scaling work. For miners, the outcome was immediate: block rewards for hashing disappeared, major ETH pools closed or pivoted, and GPU resale markets became crowded. Wallets and smart contracts continued functioning; only the consensus mechanism changed.

Two upgrades framed the transition: Bellatrix prepared the consensus layer, and the Paris changeover on mainnet activated at a preset Terminal Total Difficulty (TTD). Once reached, proof‑of‑work stopped decisively and the Beacon Chain fully took the reins. The result was a dramatic drop in energy use, plus a shift in issuance and security assumptions. GPU markets felt a ripple as used cards hit resale channels, while pools pivoted to other coins or wound down.

Afterwards, validator operations, not hashpower, determined block proposal rights and rewards. Withdrawals for staked ETH arrived later via a protocol upgrade, aligning incentives for long‑term participants and professional operators. For anyone still wondering, “can you still mine Ethereum” in 2025, the answer remains no on mainnet. Only separate PoW forks retained mining, and those are distinct networks with their own liquidity and economics.

Ethereum mining alternatives in 2025

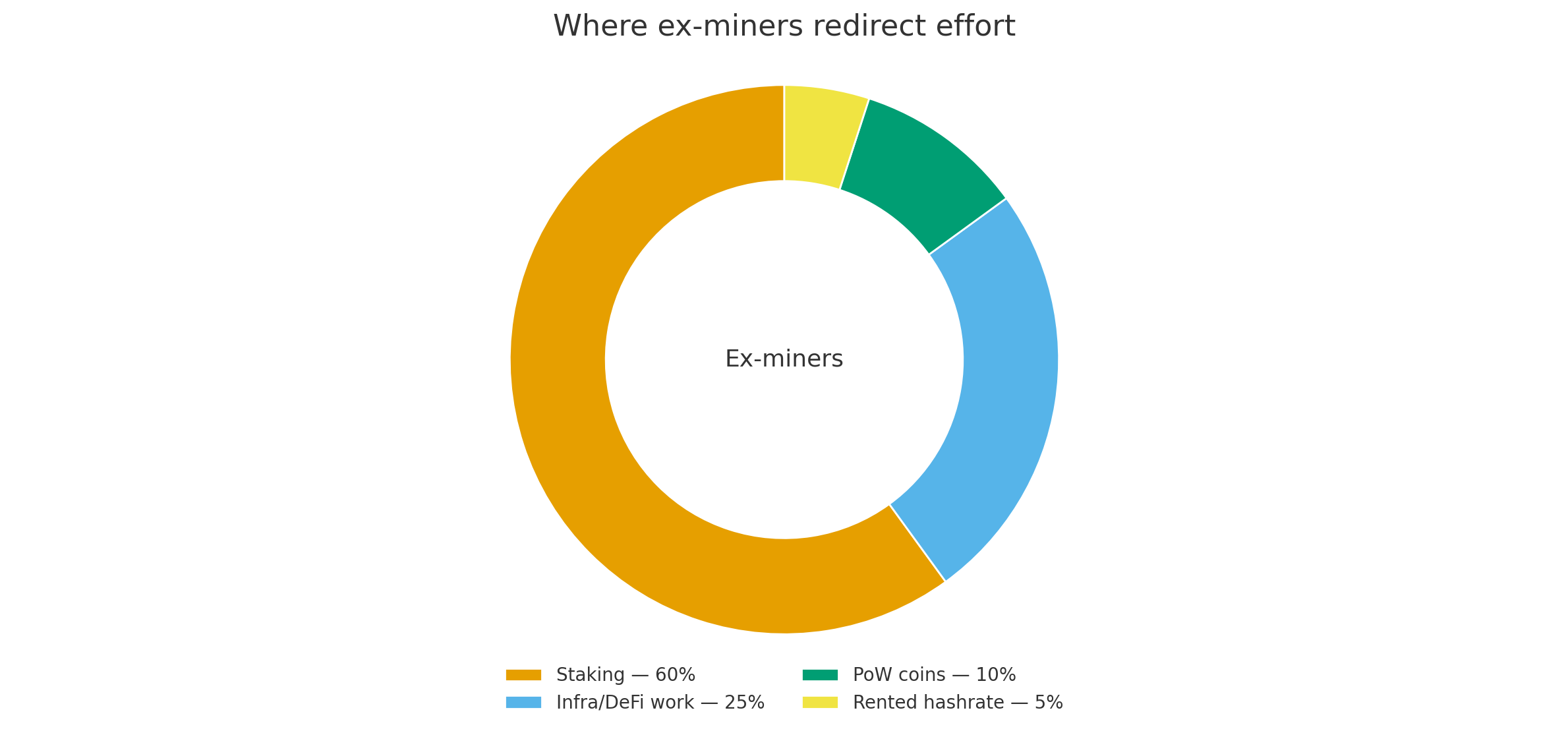

Mining ETH itself is no longer an option on mainnet, but there are practical paths for people who once mined or who still want ETH exposure. If you started by searching “how to mine ETH”, consider these alternatives and their trade‑offs.

Stake ETH (solo or via a pool)

- Solo validator (32 ETH). Operate your own validator with reliable uptime and secure key management. You earn protocol rewards and share in priority fees/MEV for proposed blocks. Operational discipline is mandatory.

- Pooled staking. If you don’t hold 32 ETH, pooled services combine deposits and distribute rewards. Options range from decentralized protocols to custodial exchanges. Compare fee structures, withdrawal mechanics, client diversity, and custody risk.

- Liquid staking tokens (LSTs): Some protocols issue a token representing a staked position, usable across DeFi. This adds smart‑contract and market‑peg risk on top of validator risk.

Mine other Proof‑of‑Work coins

You can repurpose GPUs for networks that still rely on PoW. Popular targets include Ethereum Classic (ETC), Ravencoin (RVN), Ergo (ERG), and Flux (FLUX). Profitability depends on your cost per kWh, hash rate per watt, pool fees, and coin prices. After The Merge, the migrated hashrate intensified competition, so run the current calculators before flipping the switch. Keep in mind that driver tuning, thermals, and local power rates can overshadow coin selection.

Rent or sell hashrate

Marketplaces let you rent hashing power to other networks or buyers, avoiding long‑term hardware commitments. The trade‑off is market risk: rental rates can lag coin price spikes, and fees eat into margins. Treat rentals as a short‑term tactic, not a replacement for Ethereum mining.

Contribute skills and capital in non‑mining roles

You can earn ETH without mining by providing infrastructure (indexers, relays), building applications, offering liquidity in DeFi with risk controls, or participating in bug bounties and grants. These paths convert time or capital into ETH exposure without GPUs.

Operational and security pointers

For staking, diversify clients where possible to reduce correlated risks. Safeguard keys with hardware devices or secure enclaves, and monitor for client updates.

For PoW alternatives, validate pool domains, watch for phishing using legacy ETH brands, and maintain firmware from trusted sources. Keep thermal headroom to prolong GPU life.

Rewards from staking or mining other coins are typically taxed at receipt in many jurisdictions, with later disposals potentially triggering capital gains or losses. Keep precise logs of timestamps, market values, and costs (power, hardware, pool fees) as allowed by local rules. Consult a qualified professional for your region.

Ethereum mainnet no longer rewards hashing. Staking aligns with the protocol’s current design, while PoW activity survives on other chains. Choose the route that matches your capital, risk tolerance, and operational appetite and avoid tools claiming to “re‑enable” ETH mining on mainnet.

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.