Crypto wallet vs exchange: what to use for storing and trading

Many treat wallets and exchanges as the same, yet they serve distinct purposes. This guide covers the role of a crypto exchange, the actual contents of a crypto wallet (plus the common myths), and the best ways to use both for trading, spending, or secure storage.

On this page

What is a crypto exchange?

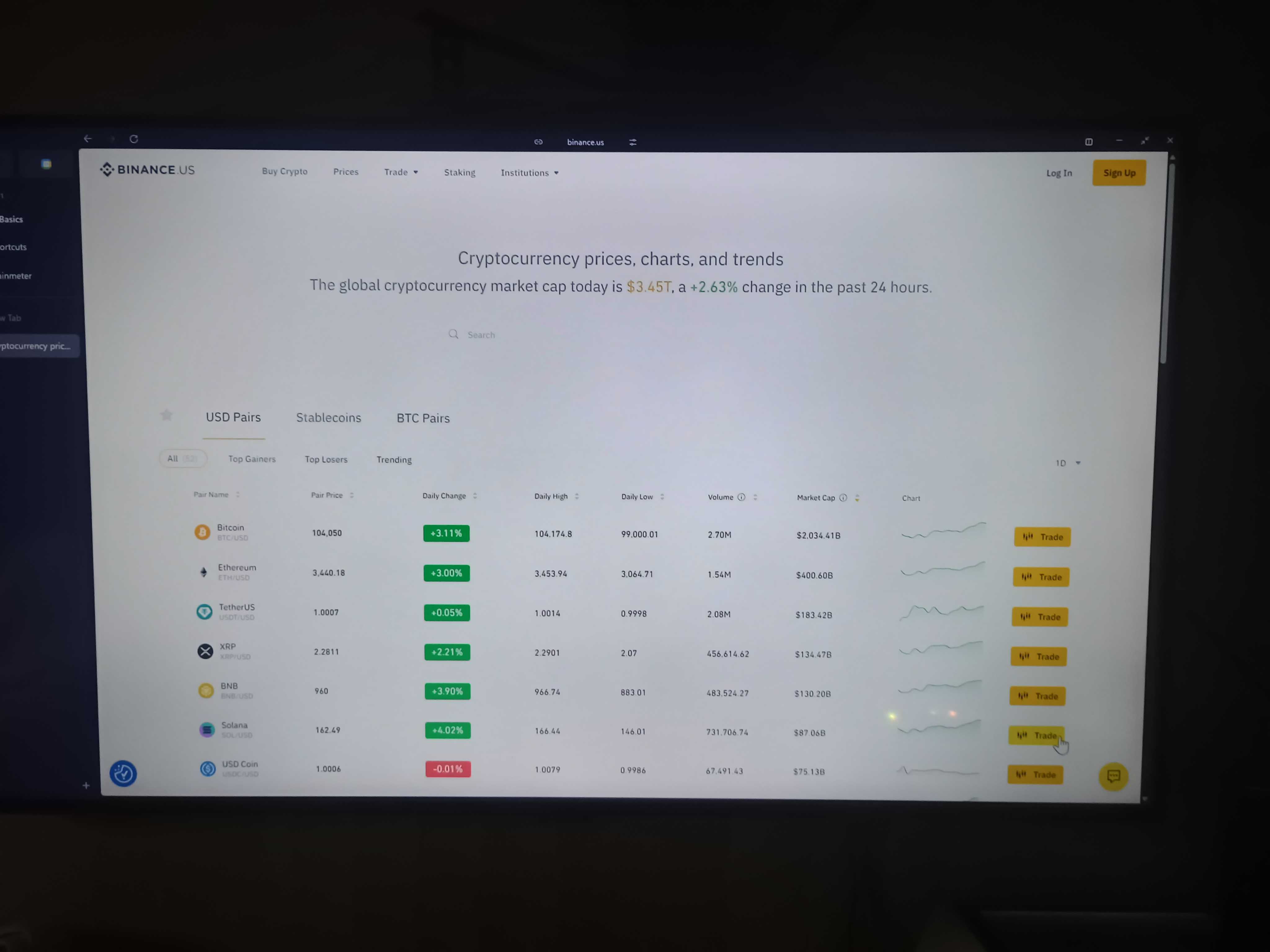

A crypto exchange is a service that helps you buy, sell, and trade digital assets by matching your order with someone else’s order (or with the exchange’s liquidity providers). In day-to-day use, it feels like a financial app: you sign in, see prices update in real time, place orders, and track your balances.

Most large U.S.-facing platforms are centralized exchanges (often shortened to CEX). “Centralized” means the company runs the infrastructure, sets the rules for account access, and usually holds your crypto on your behalf while it sits on the platform. This custody piece is the main reason cryptocurrency wallet vs exchange comparisons matter: an exchange account is convenient for trading, but it does not give you the same level of direct control as holding assets in your own wallet.

A crypto exchange typically does the following for users:

- Price discovery and liquidity. It aggregates buyers and sellers so you can trade without searching for a counterparty yourself.

- Order execution. It offers tools like market and limit orders (a limit order is a trade that triggers only at your chosen price), and handles the matching process.

- Custodial balances. It maintains internal ledgers showing who owns what on the platform, so trades can settle quickly without sending coins on-chain every time.

- On-ramps and off-ramps. It connects crypto to dollars through bank transfers, cards, or other payment methods, depending on the platform and your state.

- Extra products. Many exchanges add staking, lending, debit cards, or advanced trading interfaces, which can be useful but also add complexity.

Another defining feature of centralized exchanges is regional access. Crypto trading often falls under regulated categories like money transmission and payments. Depending on the product, it can also touch areas regulators treat like securities or derivatives. That’s why exchanges have to follow licensing rules, which vary by country and, in the U.S., even by state.

If an exchange can’t legally serve a jurisdiction, access changes quickly. The platform may block new sign-ups, restrict certain features, or route users to a local, licensed entity.

You can see this in real-world examples. Binance.US publishes a list of supported and unsupported U.S. states. Bybit lists the United States among its excluded jurisdictions. OKX operates a separate U.S. entity (OKX US) with a phased, state-by-state rollout, while its main exchange is restricted for U.S. users. Coinbase also publishes state-by-state licensing disclosures, and availability can differ by location and product.

What is a crypto wallet?

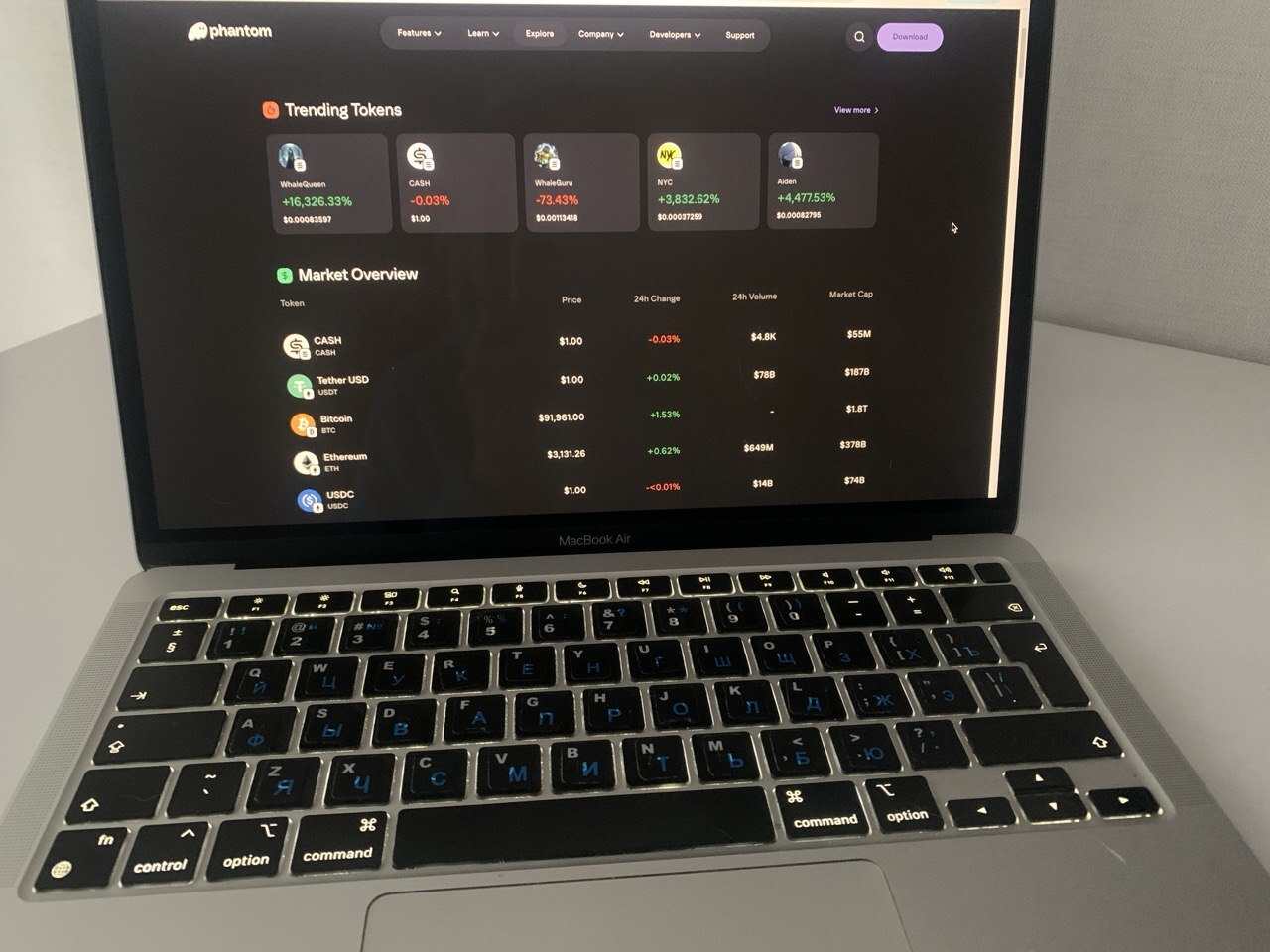

A crypto wallet is the tool you use to control crypto on a blockchain. It is not a place where coins “sit” the way dollars sit in a bank account. Instead, the wallet manages your cryptographic keys (secret codes that prove you are allowed to move funds) and helps you create transactions.

This custody difference defines the exchange vs wallet tradeoff. On a centralized exchange, the company typically controls the keys for balances held on the platform. With a self-custody wallet (also called a non-custodial wallet), you control the keys yourself. That control comes with responsibility, because there is no customer support line that can regenerate a lost secret.

Most wallets are apps. Examples include MetaMask, Rabby, Phantom, and Trust Wallet. Some are hardware devices, such as Ledger and Trezor, designed to keep keys offline. “Offline” matters because malware on a computer or phone can steal data. A hardware wallet reduces that attack surface by isolating the signing step.

When you set up a self-custody wallet, you usually receive a seed phrase (a list of 12 to 24 words that can recreate your keys). It acts as the master backup. If someone gets it, they can take your funds. If you lose it, you may lose access permanently.

Many users choose cold storage cold storage – keeping keys with no connection to the internet – at this point. Hardware wallets are a common cold-storage tool. They keep the private key isolated, and they sign transactions without exposing the secret to an online device. You still broadcast the transaction to the network, but the key itself stays offline. That is why wallets emphasize backup flows and warnings, even for beginners.

A wallet’s core functions in practice:

- Generates and stores keys: It creates your private key and derives your public addresses (the shareable identifiers people send funds to).

- Shows balances: It reads blockchain data to display what your addresses hold, including tokens and NFTs.

- Signs transactions: It uses your private key to approve a transfer or a smart contract action (a smart contract is code that runs on-chain).

- Connects to apps: It acts as a login and approval layer for DeFi, NFT markets, and other Web3 services.

- Pays network fees: It calculates and includes gas (the network fee paid to validators) so a transaction can be processed.

Wallets are powerful because they are portable. You can take the same seed phrase and restore it on another compatible wallet if your phone breaks. The tradeoff is that there is no central party to reverse a transaction or reset your access. For many people, that is the point.

Crypto exchange vs crypto wallet: the differences that matter day to day

The simplest comparison: look at what each one is optimized for. An exchange is optimized for trading and converting between dollars and crypto. A wallet is optimized for controlling assets on-chain and interacting with blockchain apps.

This is why the debate over what is a crypto exchange vs wallet isn’t about making an either-or choice. It’s more like a two-tool setup: you use each tool for the job it handles best.

These differences change outcomes in real life, especially when markets move fast or when you need access urgently:

- Control (custody): Exchanges hold the keys. Your “balance” is an entry on their ledger. Self-custody wallets flip this – you hold the keys, so you can move funds without asking permission.

- Access rules: Exchanges can freeze withdrawals, pause trading, or require extra verification. They also face regional licensing limits, so features can vary by state or country. Wallets do not gate access by jurisdiction, but the apps you connect to might.

- Privacy and identity: Most centralized exchanges require KYC (identity verification). Many wallets do not ask for personal documents, because they are software that signs transactions.

- Fees and frictions: Trading fees and spreads (the gap between buy and sell prices) come from exchanges. Wallet transactions pay network fees (gas), and some wallets add an extra swap fee if you trade inside the wallet.

- Speed and finality: Trades on an exchange settle instantly inside the platform. Wallet transfers settle on-chain, which can take seconds to minutes, and once confirmed they’re usually irreversible.

- Security model: Centralized platforms concentrate risk – many users’ assets sit behind one security perimeter. Wallet security is personal: a strong setup (hardware wallet plus cold storage habits for the seed phrase) can be very resilient, but mistakes are harder to undo.

If you want a practical way to apply this, start with your goal. Trade often or move between dollars and crypto? An exchange account fits better. Hold long-term or use DeFi? A wallet makes more sense. Many users keep a smaller “spending” balance on an exchange and move the rest to self-custody, so the convenience doesn’t come at the cost of full exposure.

Which option is right for you?

Still deciding between crypto wallet vs exchange? Start with what you need the tool to do this month. Best changes depending on whether you’re trading, holding, paying, or exploring on-chain apps.

If you trade often or move between your national currency and crypto regularly, an exchange usually fits first. You get fast execution, easy price quotes, and a direct cash on-ramp. The tradeoff is custody, because the platform typically controls the keys while your funds sit there.

If you mainly hold long term, a self-custody wallet makes more sense. It gives you direct control, and it supports cold storage setups for assets you rarely touch. The cost is responsibility, because losing the seed phrase can mean losing access.

If you use DeFi or NFT apps, you’ll need a wallet. Those apps connect through wallet approvals, not exchange logins.

If you want flexibility without over-committing, use both. Many people keep a smaller “active” balance on an exchange for trades and cashouts, then move the rest to a wallet. This approach spreads risk and makes regional exchange limits less disruptive, because your long-term holdings are not stuck behind a single platform’s rules.

Exchange-integrated wallets: a middle ground

Some major exchanges now offer their own self-custody wallet products alongside their trading platforms. Binance Wallet, Coinbase Wallet, Kraken Wallet, and WhiteBIT Wallet (Whitewallet) are examples. These sit somewhere between a pure exchange account and a standalone wallet like MetaMask or Ledger.

The setup is usually simpler than starting from scratch with a standalone wallet. The exchange handles onboarding flows, fiat on-ramps, and sometimes seedless recovery options tied to your account. You still control the keys in most cases, but the wallet is tightly integrated with the exchange’s ecosystem.

This model works well if you already use the exchange for trading and want a self-custody option without managing multiple apps. The tradeoff is portability – some exchange wallets use custom key management (like MPC or account-based recovery) that doesn’t transfer to other wallets the same way a standard seed phrase does.

When evaluating an exchange-integrated wallet, check:

– Whether it’s true self-custody (you hold the keys) or a hybrid model (account recovery, no seed phrase export)

– How recovery works if you lose your device or switch phones

– Whether the wallet supports the chains and dApps you plan to use

For detailed comparisons, see our reviews of Binance Wallet, Coinbase Wallet, Kraken Wallet, and WhiteBIT Wallet.

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.