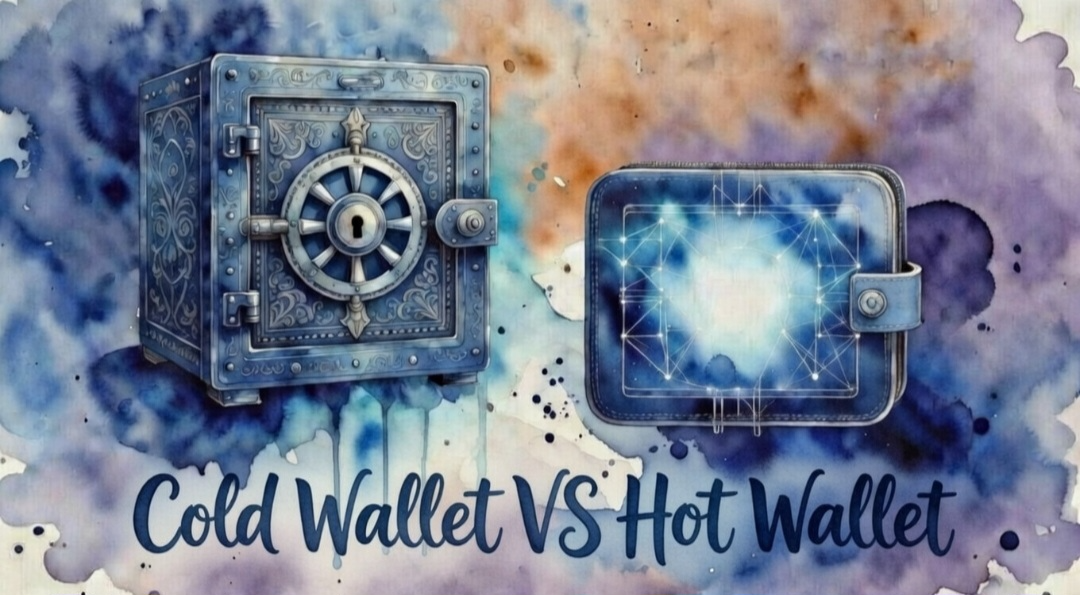

Cold wallet vs hot wallet: key differences explained

Newcomers entering the crypto market often hear the terms “hot wallet” and “cold wallet,” but do not fully understand the fundamental difference between them. This choice directly affects the safety of your funds, the convenience of daily transactions, and your level of control over private keys. Understanding how these storage formats differ is essential for operating safely and confidently in the crypto ecosystem.

On this page

Understanding hot wallets for everyday transactions

To understand what is a hot wallet, start with the core principle: it is a cryptocurrency wallet that remains connected to the internet. That constant online access makes it a convenient tool for daily activity – transfers, trading, paying for services, and interacting with DeFi protocols.

Hot wallets come in several formats: mobile apps, browser extensions, desktop software, or built-in exchange wallets on centralized platforms. Their primary advantage is speed. Users can instantly send transactions, connect to a dApp, or swap tokens without delay.

One of the most popular examples of a hot wallet is MetaMask. It supports multiple blockchains (including Ethereum and other EVM-compatible networks), thousands of tokens, and is widely used to interact with DeFi protocols and NFT platforms. A detailed breakdown of its features, fees, and potential risks is available in our dedicated article MetaMask wallet review.

However, constant internet connectivity is also the main source of risk. Because private keys or seed phrases are stored in an online environment (or in an environment connected to the internet), hot wallets are more vulnerable to phishing, malware, and device compromise.

If a trader actively moves funds between exchanges and DeFi platforms every day, a hot wallet allows instant execution. But if the device (for example, a smartphone or computer where the wallet is installed) becomes infected with malware, an attacker may gain access to the keys and drain the funds.

Common attack scenarios against hot wallets:

- Phishing and fake websites. Attackers create websites or browser extensions that closely resemble legitimate wallet interfaces. A user may enter their seed phrase or approve a transaction without noticing a fake domain or a modified recipient address. As a result, funds are sent directly to the attacker.

- SIM-swap attacks. A criminal gains control of the victim’s phone number through a mobile carrier. This allows them to intercept SMS-based two-factor authentication codes. If an exchange or wallet relies on phone-based verification, the attacker may reset access and initiate withdrawals.

- Malicious software and browser extensions. Some malware can replace a copied wallet address in the clipboard or even modify the recipient address within the wallet interface. If the user fails to verify the final characters of the address before confirming, the transaction may be redirected to a fraudulent wallet.

For these reasons, hot wallets are typically used to store only a limited amount of crypto funds needed for active operations rather than long-term holding.

Understanding cold wallets for long-term asset storage

To understand whats a cold wallet, focus on the core difference: private keys stored offline, with no constant internet connection. This significantly reduces the risk of remote hacking.

Cold wallets are most commonly implemented as hardware devices (hardware wallets) or even as paper backups containing a written seed phrase. Hardware wallets sign transactions internally, ensuring the private key never leaves the device.

The primary function of a cold wallet is long-term storage. Investors who plan to hold Bitcoin or other cryptocurrencies for years typically choose this format.

An investor buys BTC at $30,000 and plans to hold it for at least three years. Instead of leaving the funds on an exchange or in a mobile app, they transfer the coins to a hardware wallet and store it securely. The seed phrase should be written down manually on paper or engraved on a metal backup and stored separately from the hardware wallet. It should never be photographed, saved in cloud storage, or sent by email. Anyone with access to the seed phrase has full control over the funds. Even if the investor’s computer is compromised, the private key remains protected offline.

Cold wallets are designed for a buy-and-hold strategy, where security takes priority over transaction speed.

One of the most well-known and respected solutions in this category is Trezor. This hardware wallet is widely regarded as one of the most secure options on the market and has not experienced confirmed remote compromises of the device itself. You can read more about its security architecture, models, and real-world usage in our article Trezor wallet: how secure is your crypto?

Hot vs cold wallet: quick comparison overview

When choosing between hot wallet vs cold wallet, it is important to weigh the strengths and weaknesses of each.

Advantages of a cold wallet:

- Maximum isolation of private keys from the online environment.

- Transaction signing occurs inside the device without exposing the private key.

- Strong protection for long-term storage of large balances.

Disadvantages of a cold wallet:

- Requires physical access to the hardware wallet for each transaction.

- Slower transaction process compared to online solutions.

- Risk of losing access if the device or seed phrase is lost.

Advantages of a hot wallet:

- Instant access to funds and fast transaction execution.

- Seamless integration with exchanges, DeFi protocols, and NFT platforms.

- In some cases, the ability to recover access through account verification, email, phone number, or two-factor authentication (depending on the wallet type).

Disadvantages of a hot wallet:

- Keys are stored in an environment connected to the internet.

- Higher exposure to phishing and malware attacks.

- Broader attack surface compared to offline storage.

Active traders, DeFi users, and NFT collectors benefit from hot wallet speed. Long-term holders prioritize cold wallet security.

Market volatility tests the security-speed tradeoff. When prices drop sharply and you need to exit a position, hot wallet funds move in seconds. Cold storage adds steps: connect the hardware device, unlock it, sign the transaction, wait for confirmations. Depending on network congestion, getting funds from a hardware wallet to an exchange can take 20 minutes to over an hour. The market doesn’t wait.

Hot wallet vs cold wallet: a trade-off between speed and security.

Advanced option: multisignature wallets for enhanced security

Multisignature wallets offer an advanced option beyond traditional hot and cold storage. This mechanism requires multiple private keys to authorize a transaction instead of just one.

For example, a “2-of-3” setup means three independent keys are created, and any two of them must approve a transaction before funds can be moved. A single compromised key alone is not enough to execute a transfer.

In practice, a multisig wallet is created by linking several keys to a single address. When a transaction is initiated, it must be signed sequentially by the required number of participants. Only after the necessary signatures are collected is the transaction broadcast to the network. This significantly reduces the risk of compromise, since an attacker would need access to multiple devices or accounts.

Multisignature setups are widely used by investment funds, DAOs, and companies where capital management is shared among multiple parties. For individual investors, multisig can provide an additional layer of protection for large holdings, especially when keys are stored on separate devices or in different physical locations.

Picking the right wallet strategy for your portfolio

Choosing between cold wallet vs hot wallet depends on your strategy and portfolio structure.

- If you actively trade, participate in yield farming, or frequently transfer funds, keeping part of your capital in a hot wallet provides flexibility and rapid market response.

- If you are building a long-term portfolio and do not plan daily transactions, it makes sense to store the majority of your assets in a cold wallet.

Many investors use a hybrid approach. For example, 10–20% of a portfolio may remain in a hot wallet for active use, while 80–90% is secured in a cold wallet for protection. This structure balances liquidity with security.

Capital size also matters: the larger the investment, the more critical private key protection becomes.

The difference between hot and cold wallet solutions comes down to priorities: convenience and speed versus maximum security. The optimal strategy is not choosing one over the other, but assigning each wallet a clear role based on your goals.

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.