#oil

22 articles found

Latest

Trump tariffs to lift oil and gas costs in 2026

U.S. tariffs now cover a wide set of equipment and materials the industry relies on – from specialized steel and copper to rigs, valves and compressors. Deloitte estimates duties could lift material and service costs by ~4% to as much as 40%, depending on the item and supply routes.

U.S. tariffs now cover a wide set of equipment and materials the industry relies on – from specialized steel and copper to rigs, valves and compressors. Deloitte estimates duties could lift material and service costs by ~4% to as much as 40%, depending on the item and supply routes. OPEC+ repeats 137,000 bpd increase despite surplus concerns

OPEC+ will increase crude oil output by 137,000 barrels per day in November, the alliance announced Sunday. The figure matches October's addition and marks the second month of production increases after the group began unwinding earlier cuts.

OPEC+ will increase crude oil output by 137,000 barrels per day in November, the alliance announced Sunday. The figure matches October's addition and marks the second month of production increases after the group began unwinding earlier cuts. Why China is stockpiling oil at record levels - opinion

China has purchased more than 150 million barrels of crude oil this year, roughly $10 billion worth beyond its immediate consumption needs. The buying spree sets a new record and has prompted debate over Beijing’s motives. Bloomberg highlights the logic behind this.

China has purchased more than 150 million barrels of crude oil this year, roughly $10 billion worth beyond its immediate consumption needs. The buying spree sets a new record and has prompted debate over Beijing’s motives. Bloomberg highlights the logic behind this. US sanctions Iranians moving oil revenues through crypto

The US Treasury Department, through OFAC, imposed new sanctions on two Iranian nationals and over a dozen companies in Hong Kong and the UAE linked to oil sales and the use of cryptocurrency to funnel funds for Iran’s Islamic Revolutionary Guard Corps–Quds Force (IRGC-QF) and Ministry of Defense (MODAFL).

The US Treasury Department, through OFAC, imposed new sanctions on two Iranian nationals and over a dozen companies in Hong Kong and the UAE linked to oil sales and the use of cryptocurrency to funnel funds for Iran’s Islamic Revolutionary Guard Corps–Quds Force (IRGC-QF) and Ministry of Defense (MODAFL). Oil rises after OPEC group opts for smaller November hike

Crude prices rose about 1.5% after OPEC+ approved only a limited production rise for November. Brent pushed back above $65 a barrel and WTI neared $62 as traders unwound bets on a larger hike. The group kept the monthly adjustment at 137,000 bpd – the same as in October – easing fears of a supply flood.

Crude prices rose about 1.5% after OPEC+ approved only a limited production rise for November. Brent pushed back above $65 a barrel and WTI neared $62 as traders unwound bets on a larger hike. The group kept the monthly adjustment at 137,000 bpd – the same as in October – easing fears of a supply flood. AI Drones: The Forefront of Modern Warfare

Russia's economy is steadily moving towards a military emphasis: by 2024, Putin intends to dedicate 6% of the GDP to defense industry needs. Despite Western sanctions, the exportation of energy resources—such as crude oil, oil processing products, and natural gas—remains the major financial backbone for Russia's budget.

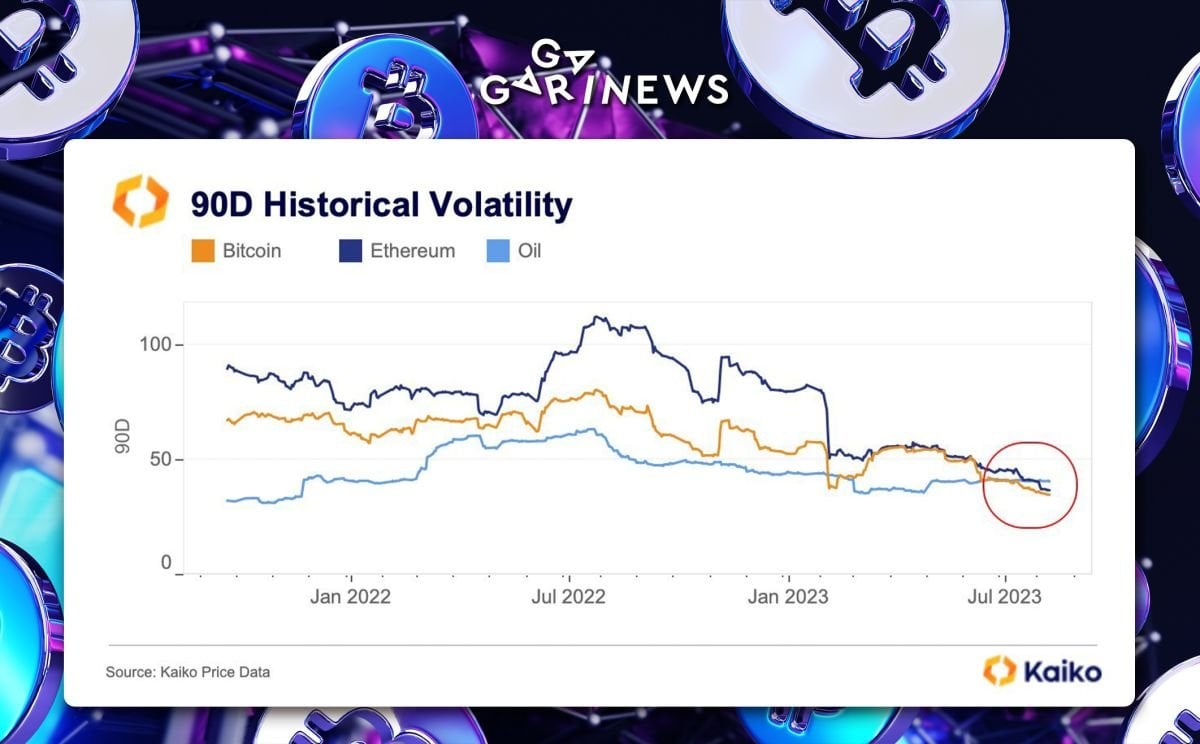

Russia's economy is steadily moving towards a military emphasis: by 2024, Putin intends to dedicate 6% of the GDP to defense industry needs. Despite Western sanctions, the exportation of energy resources—such as crude oil, oil processing products, and natural gas—remains the major financial backbone for Russia's budget.  According to Kaiko, BTC and ETH have recorded their lowest 90-day price volatility compared to oil in many years, a mark last reached in 2016.

Right now, Bitcoin's volatility sits at 35%, Ethereum's at 37%, while oil's is higher at 41%.

Experience tells us that after such periods of quiet , a significant move often follows. Judging by Bitcoin's recent dynamics, it appears such a shift might be kicking off.

According to Kaiko, BTC and ETH have recorded their lowest 90-day price volatility compared to oil in many years, a mark last reached in 2016.

Right now, Bitcoin's volatility sits at 35%, Ethereum's at 37%, while oil's is higher at 41%.

Experience tells us that after such periods of quiet , a significant move often follows. Judging by Bitcoin's recent dynamics, it appears such a shift might be kicking off.