World Liberty Financial fees may go to WLFI buybacks and burns

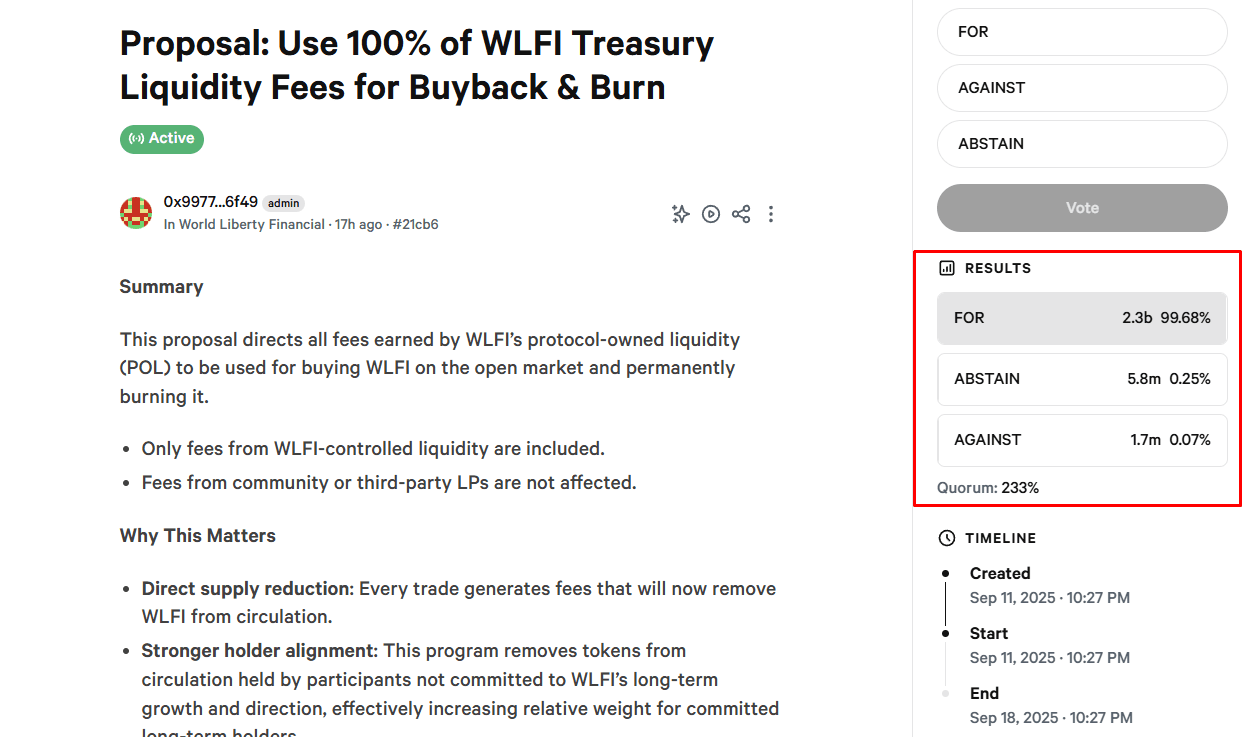

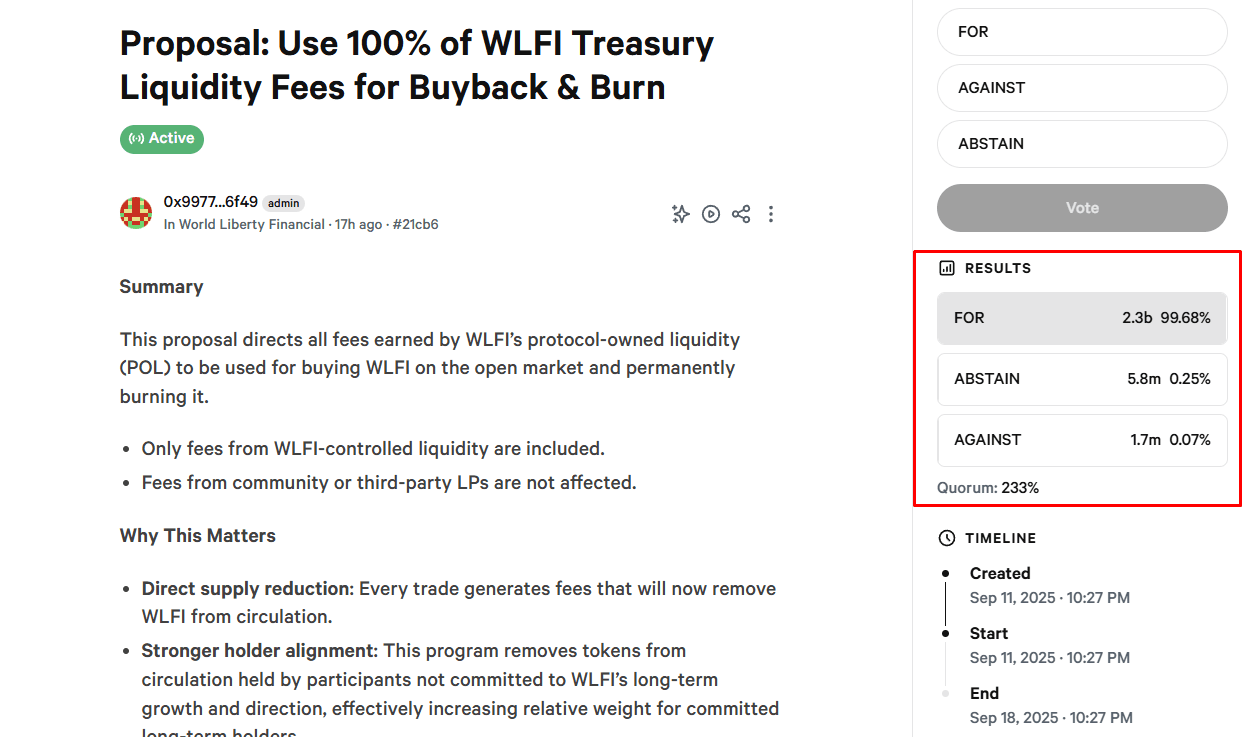

The World Liberty Financial (WLFI) community is considering a proposal to direct all protocol liquidity fees toward buying back and burning its own tokens.

Under the plan, WLFI would collect fees from protocol-owned liquidity pools on Ethereum, BNB Chain and Solana, then use them to purchase WLFI on the open market and send the tokens to a burn address. This would continuously reduce the circulating supply.

The initiative received near-unanimous approval: governance portal data shows 99.6% voted in favor, 0.09% against, and 0.34% abstained.

WLFI is a DeFi platform publicly backed by members of Donald Trump’s family. It markets itself as a bridge between traditional finance and on-chain markets, offering the USD1 stablecoin and treasury operations.

The project burned 47 million WLFI on Sept. 2, permanently removing them from supply after the token lost nearly 40% from its peak. It also fits into a broader trend: over the past three months, protocols like Hyperliquid, Pump.fun and Raydium have spent about $400M on token buybacks and supply reductions.

If fully approved, WLFI intends to expand the program to other protocol revenue streams, creating a long-term mechanism to support the token’s price.

The initiative received near-unanimous approval: governance portal data shows 99.6% voted in favor, 0.09% against, and 0.34% abstained.

World Liberty Financial voting results. Source: worldlibertyfinancial.com

The project notes that the program would strengthen long-term holder interest and create a direct link between protocol usage and the amount burned: the more trading activity, the more WLFI is destroyed. All buyback and burn operations will be recorded on-chain and published for the community.

WLFI is a DeFi platform publicly backed by members of Donald Trump’s family. It markets itself as a bridge between traditional finance and on-chain markets, offering the USD1 stablecoin and treasury operations.

The project burned 47 million WLFI on Sept. 2, permanently removing them from supply after the token lost nearly 40% from its peak. It also fits into a broader trend: over the past three months, protocols like Hyperliquid, Pump.fun and Raydium have spent about $400M on token buybacks and supply reductions.

If fully approved, WLFI intends to expand the program to other protocol revenue streams, creating a long-term mechanism to support the token’s price.