Crypto going down – reasons why

The crypto market is losing ground again on November 5, 2025, with Bitcoin slipping below $100K and traders wondering why is all crypto down today. Here’s what’s behind the latest wave of selling and what it means for the market.

Key points:

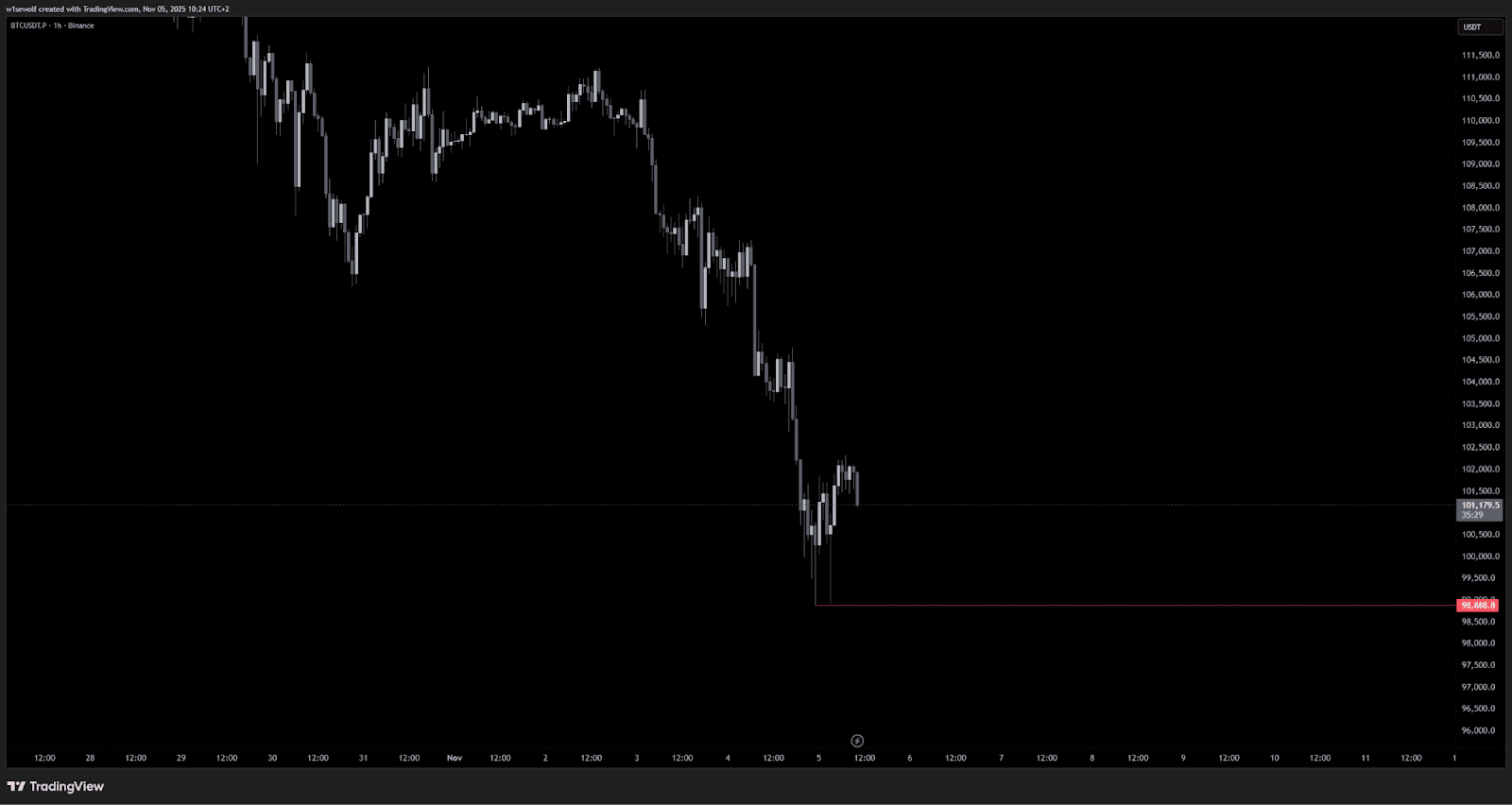

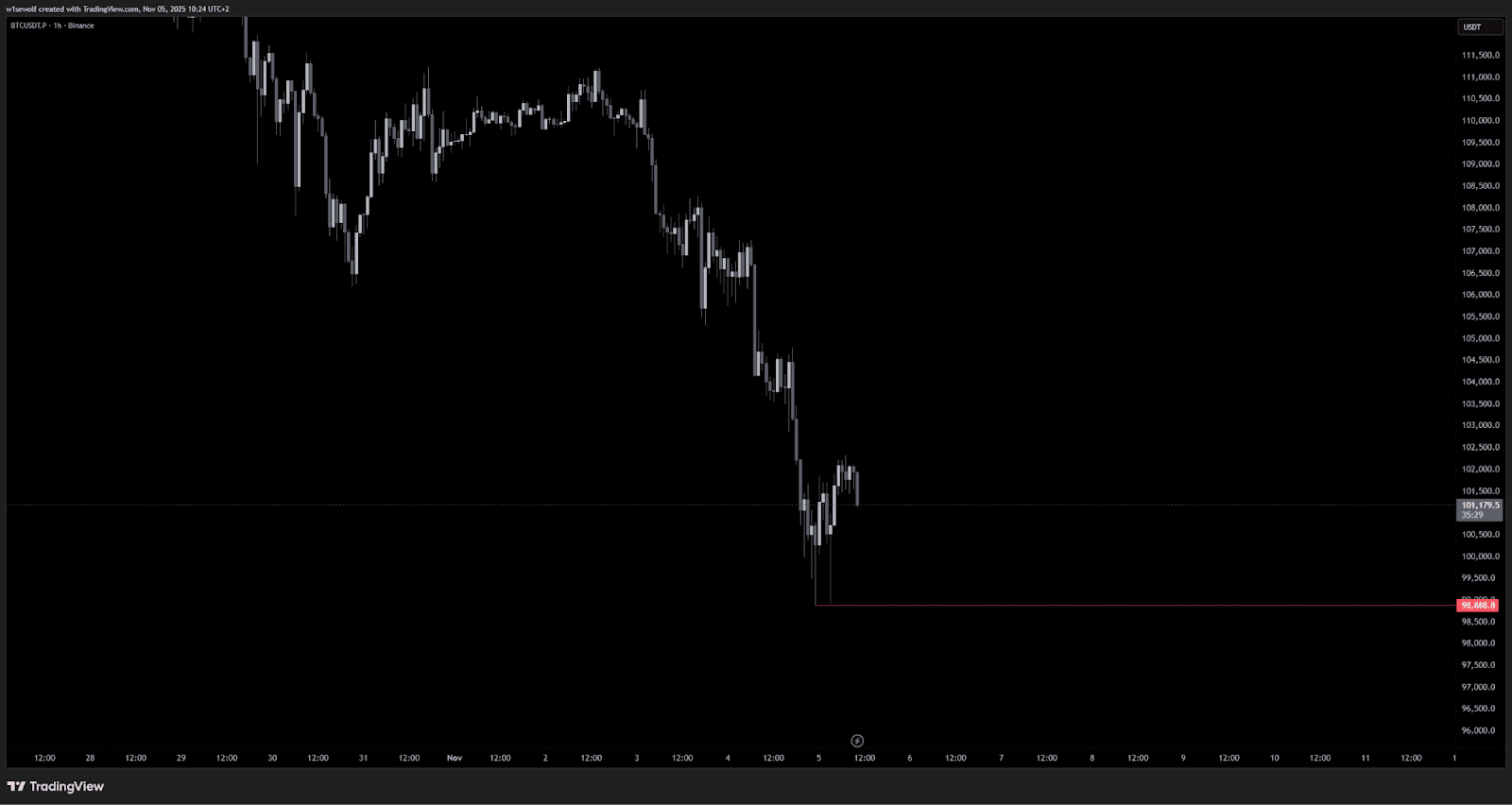

The crypto market is sharply lower today, with total capitalization falling to $3.35 trillion - a loss of more than $150 billion in 24 hours, leaving traders asking why is the crypto market down today. Bitcoin (BTC) briefly dropped below $100,000, touching $98,944 before stabilizing near $101,000, while Ethereum (ETH) slipped 4.8% to $3,690.

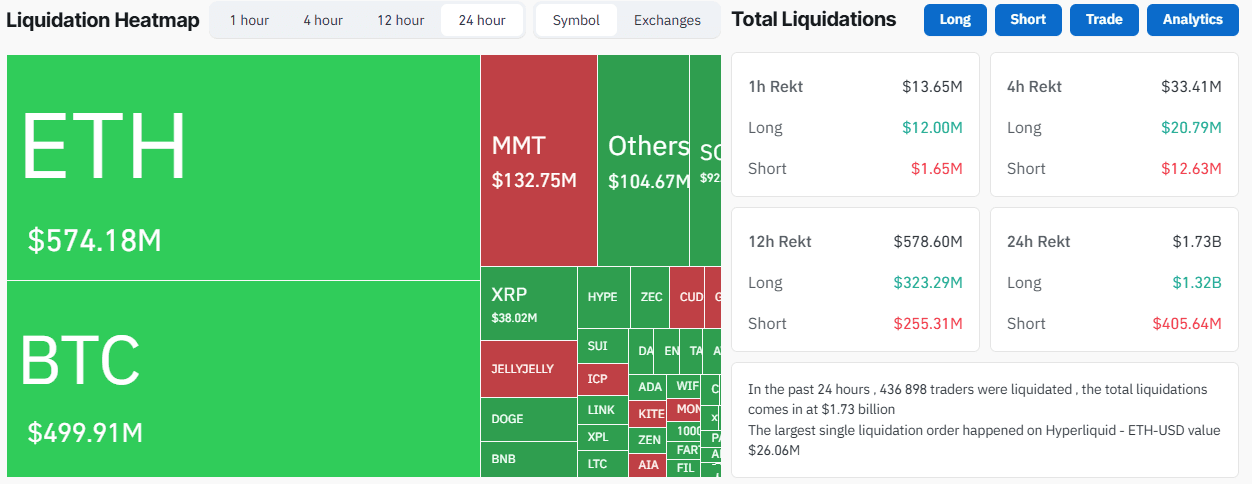

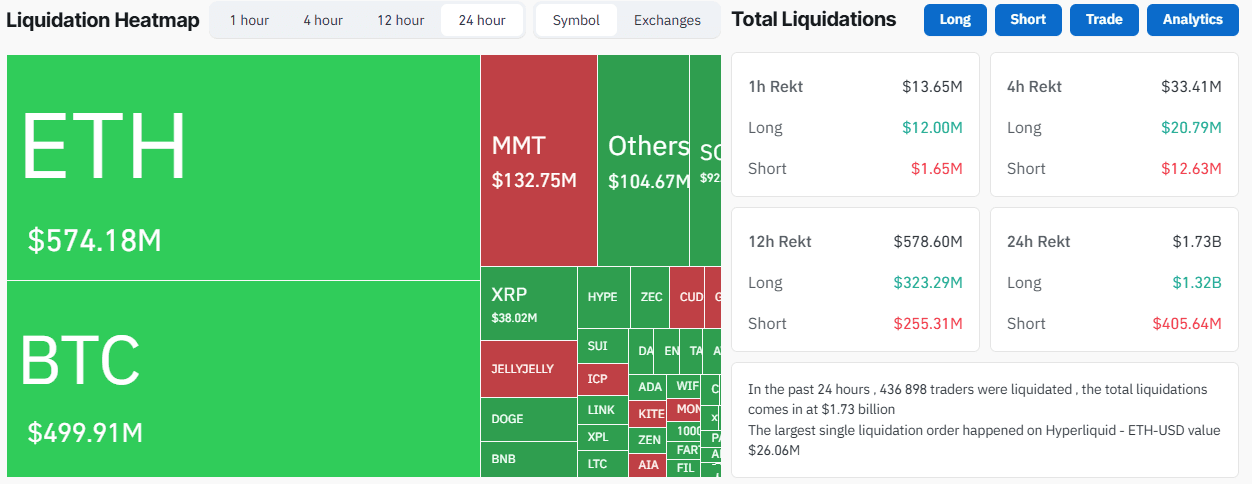

- Over $1,3 billion in leveraged positions liquidated as Bitcoin dropped below $100K.

- Global tech correction and bank warnings hit risk assets.

- U.S. government shutdown drains liquidity, extending market stress.

The crypto market is sharply lower today, with total capitalization falling to $3.35 trillion - a loss of more than $150 billion in 24 hours, leaving traders asking why is the crypto market down today. Bitcoin (BTC) briefly dropped below $100,000, touching $98,944 before stabilizing near $101,000, while Ethereum (ETH) slipped 4.8% to $3,690.

Bitcoin price dropped below $100,000. Source: tradingview.com

The sell-off reflects a broader wave of risk aversion in global markets. U.S. equities entered correction territory after Goldman Sachs and Morgan Stanley warned of possible 10–15% pullbacks driven by overvalued tech stocks. The resulting liquidity squeeze has spilled into digital assets, where heavy leverage amplified the decline.

This report examines the main drivers of Bitcoin’s and the wider crypto market’s latest downturn: macro uncertainty, leverage unwinds, and tightening liquidity.

Global liquidity strain and Wall Street correction

The first wave of pressure came from traditional markets. After weeks of record highs, U.S. indices corrected sharply as institutional warnings intensified. Mike Burry’s Scion Asset Management revealed a $1.1 billion short position against major AI-related stocks, including Nvidia (NVDA) and Palantir (PLTR), deepening investor anxiety across tech and crypto sectors and fueling the question of why is all crypto down today.

These events triggered a broad risk-off shift. Nasdaq-100 futures fell more than 1.3% as capital moved out of speculative assets. With liquidity tightening, crypto traders began unwinding leveraged positions, sparking widespread margin calls. According to CryptoQuant, U.S. liquidity flows were already weakened by the prolonged government shutdown, further reducing the market’s capacity to absorb volatility.

Leveraged liquidations deepen the drop

Data from Coinglass shows more than $1.3 billion in long positions were liquidated within 24 hours - a clear sign of crypto going down as traders rushed to cut exposure. Funding rates across perpetual futures turned negative, reflecting a broad shift to defensive positioning.

Liquidation heatmap chart. Source: coinglass.com

Despite record adoption and strong institutional inflows earlier this year, markets had grown top-heavy - vulnerable to sharp reversals once buying momentum faded.

As volatility surged, the Fear & Greed Index fell to 21 (extreme fear), underscoring fragile sentiment. Bitcoin now hovers just above the key $100,000 psychological level; a close below it could trigger a deeper decline toward $94,000–$96,000.

Government shutdown and regulatory overhang

The ongoing U.S. government shutdown continues to disrupt capital flows and delay key financial approvals. According to CryptoQuant, the resulting liquidity disruptions have prolonged risk aversion among institutional investors.

At the same time, Canada’s new stablecoin rules and renewed scrutiny of crypto ETFs have added further policy uncertainty. Although BlackRock’s iShares Bitcoin ETF (IBIT) expanded to Australia this week, the broader market reaction remained muted amid macro headwinds. Traders are staying cautious until fiscal clarity and liquidity return.

Recommended