Why is Bitcoin falling today - key price triggers and analysis

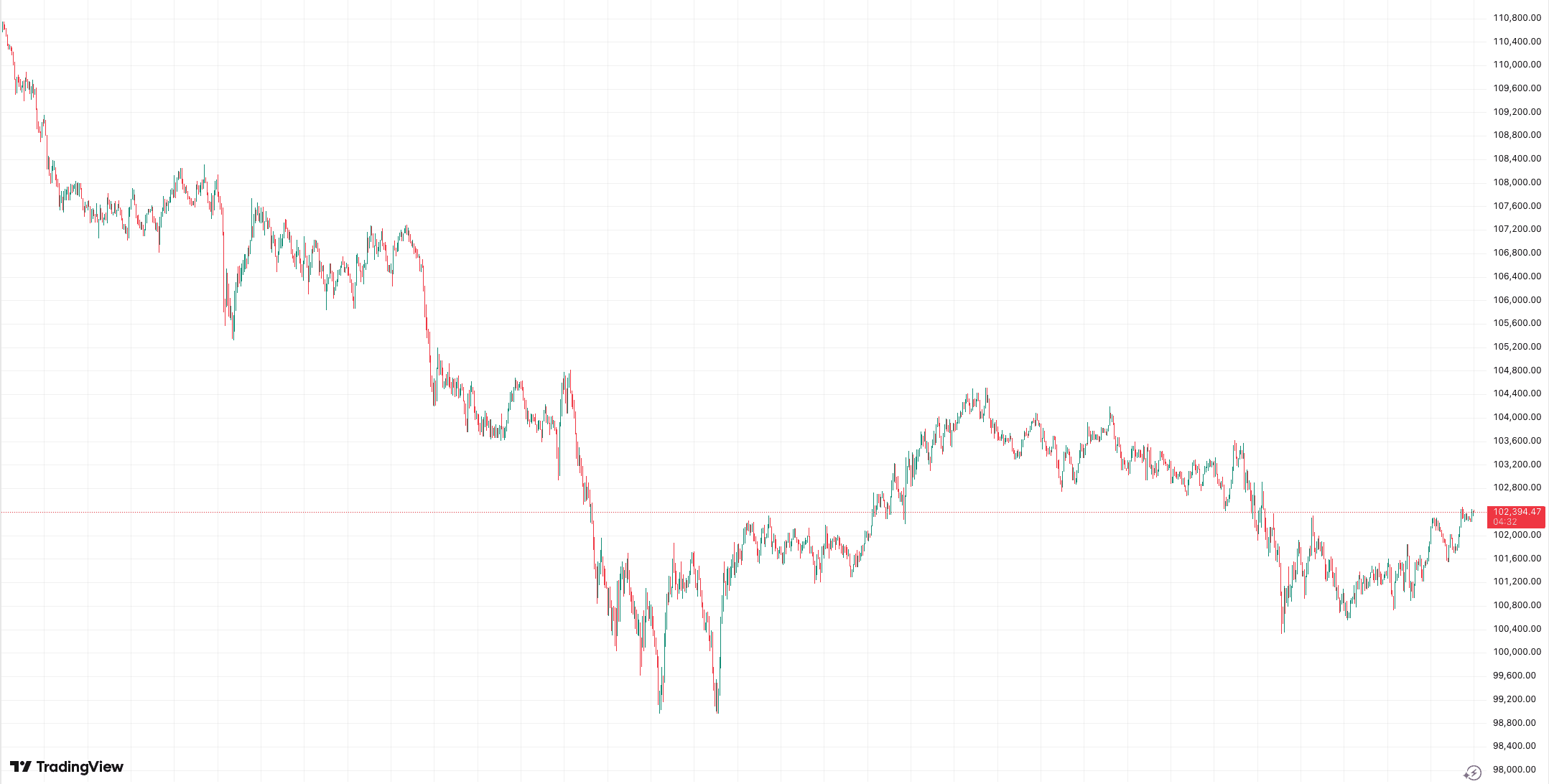

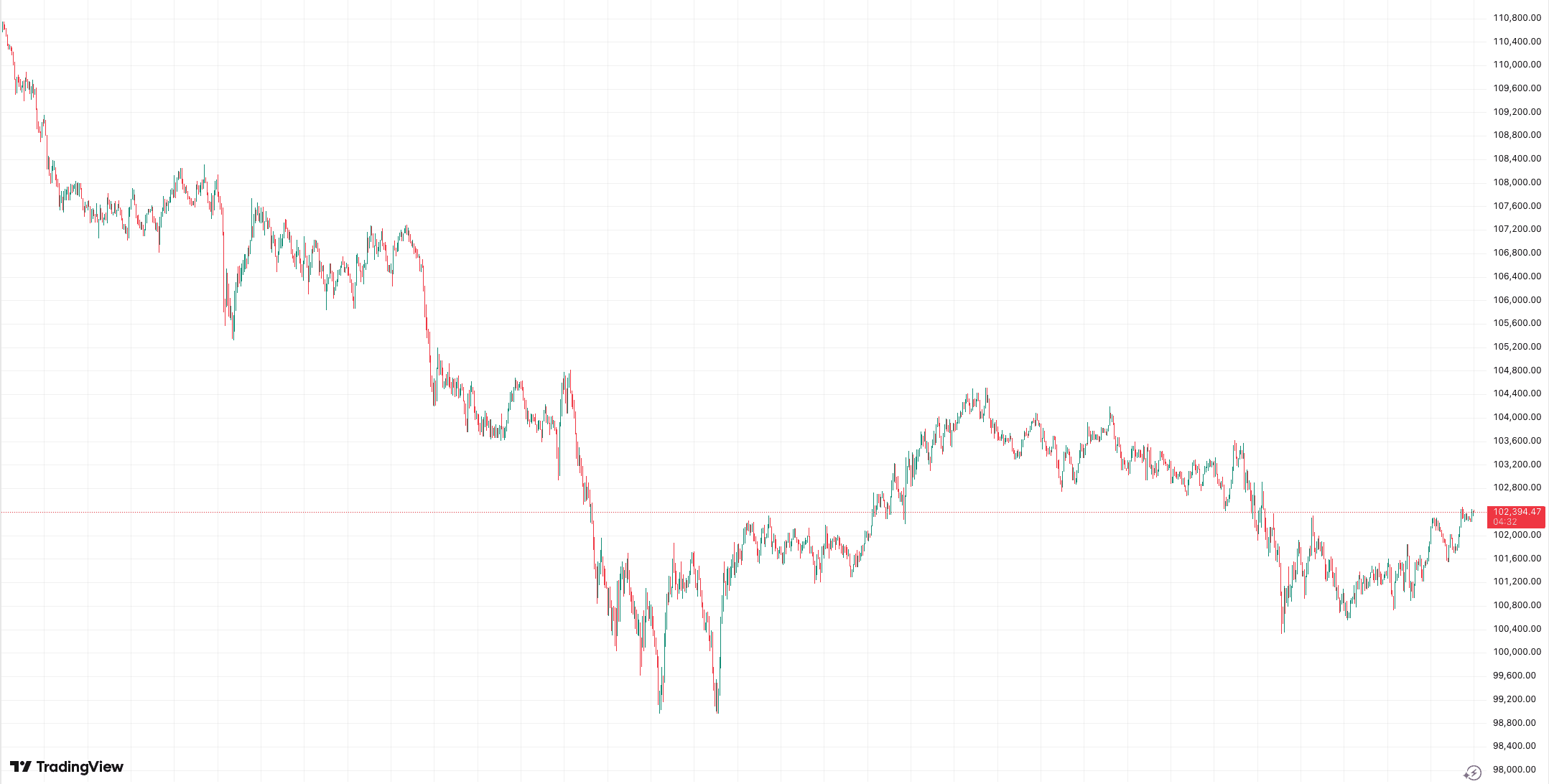

In the past 24 hours, Bitcoin has fallen by 1% and is currently trading below $103,000. Over the last 7 days, it’s down 7%, and over the past 30 days, 16%.

Bitcoin dipped in response to the extended U.S. government shutdown, lack of official economic data, market uncertainty, and large liquidations.

Below is a breakdown of the reasons why is Bitcoin dropping today.

Key points

- Economic distress and missing key data shake Bitcoin’s price

- Over $236 million in Bitcoin positions were liquidated

- Uncertainty around the U.S. Federal Reserve rate cuts

Below is a breakdown of the reasons why is Bitcoin dropping today.

Bitcoin price performance from November 3 to November 7, 2025. Source: TradingView

Data blackout fuels volatility amid U.S. shutdown

The U.S. government shutdown, now lasting over a month, has weakened investor confidence and limited economic data releases, triggering market-wide risk aversion. With official data on hold, private U.S. reports such as ADP and Challenger are shaping market sentiment. Challenger’s report shows that U.S. companies announced 153,074 job cuts in October, the highest for any October since 2003. According to the ADP Employment Report, private-sector employment in the U.S. added 42,000 jobs, driven by large companies. Overall, the three-month average of job losses fell to -29,333, the highest since the 2020 pandemic. Macroeconomic uncertainty impacts global liquidity, explaining why did Bitcoin crash.

Over $236 million in Bitcoin positions were liquidated

CoinGlass data shows that over $236 million in Bitcoin positions were liquidated, $183 million of which were long. The largest single liquidation order happened on Hyperliquid - BTC-USD value $15.31M. These liquidations add selling pressure to the market, amplifying volatility and driving prices lower. Combined with broader economic uncertainty and limited U.S. data, this helps explain why is Bitcoin falling today, as traders react to both forced liquidations and cautious sentiment.

Markets on edge amid Fed rate-cut uncertainty

In an October meeting, the Fed cut rates by 25 bps but revealed a rare split vote and warned that the next move isn’t assured. Chair Jerome Powell said there are differing views about a December cut, so the bar for more easing is unclear. Jobs signals are noisy: private payrolls beat forecasts this week, yet layoff trackers show a jump in announced job cuts. With an ongoing federal data delay crimping some official releases, investors are flying a bit blind. Markets also worry that long-term yields may stay high even if the Fed trims short-term rates - because of sticky inflation, pockets of strong growth, and heavy Treasury supply. That keeps financial conditions tight, providing another reason why did Bitcoin drop today.

Recommended