ASTER is going up as Binance spot news stirs volatility

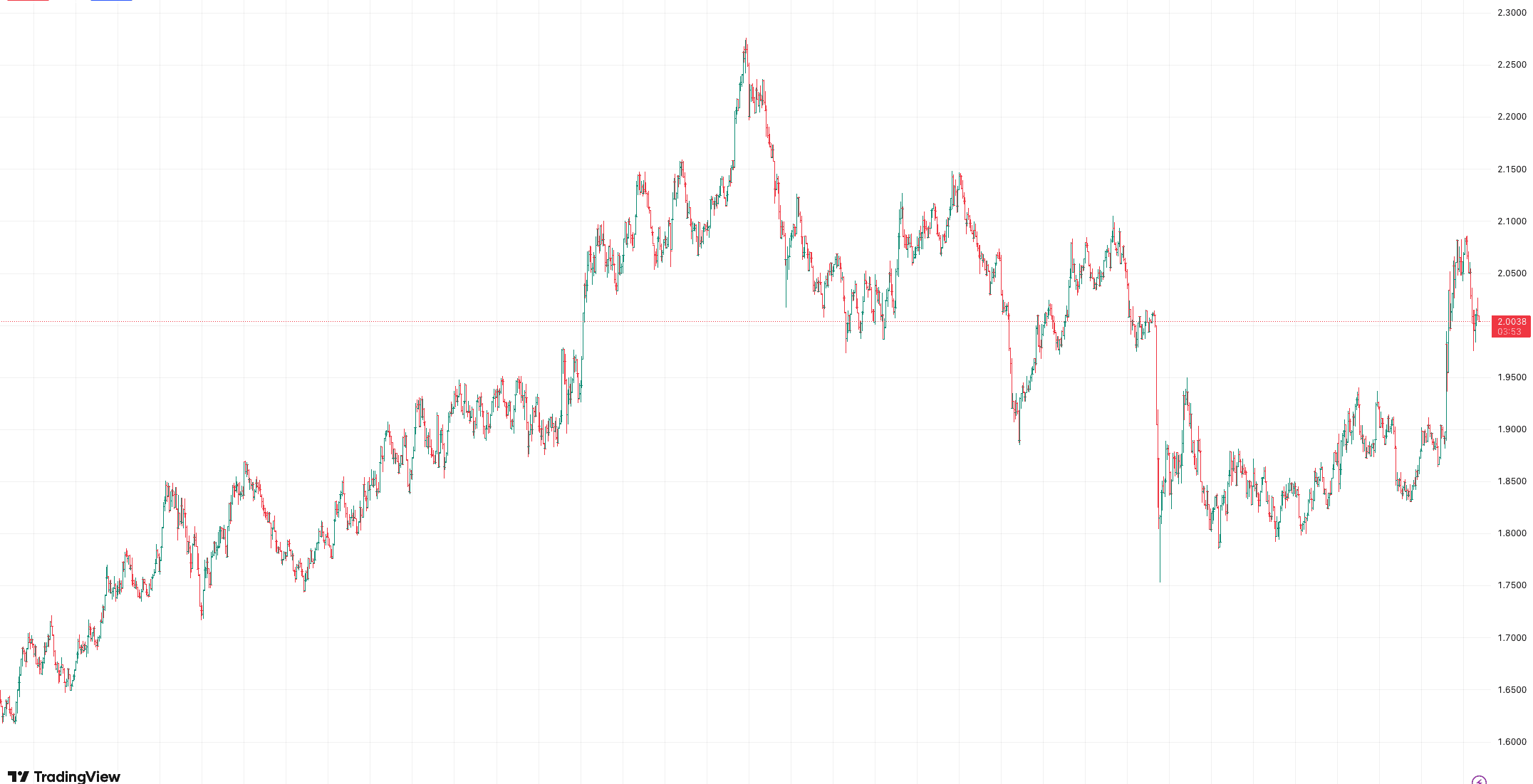

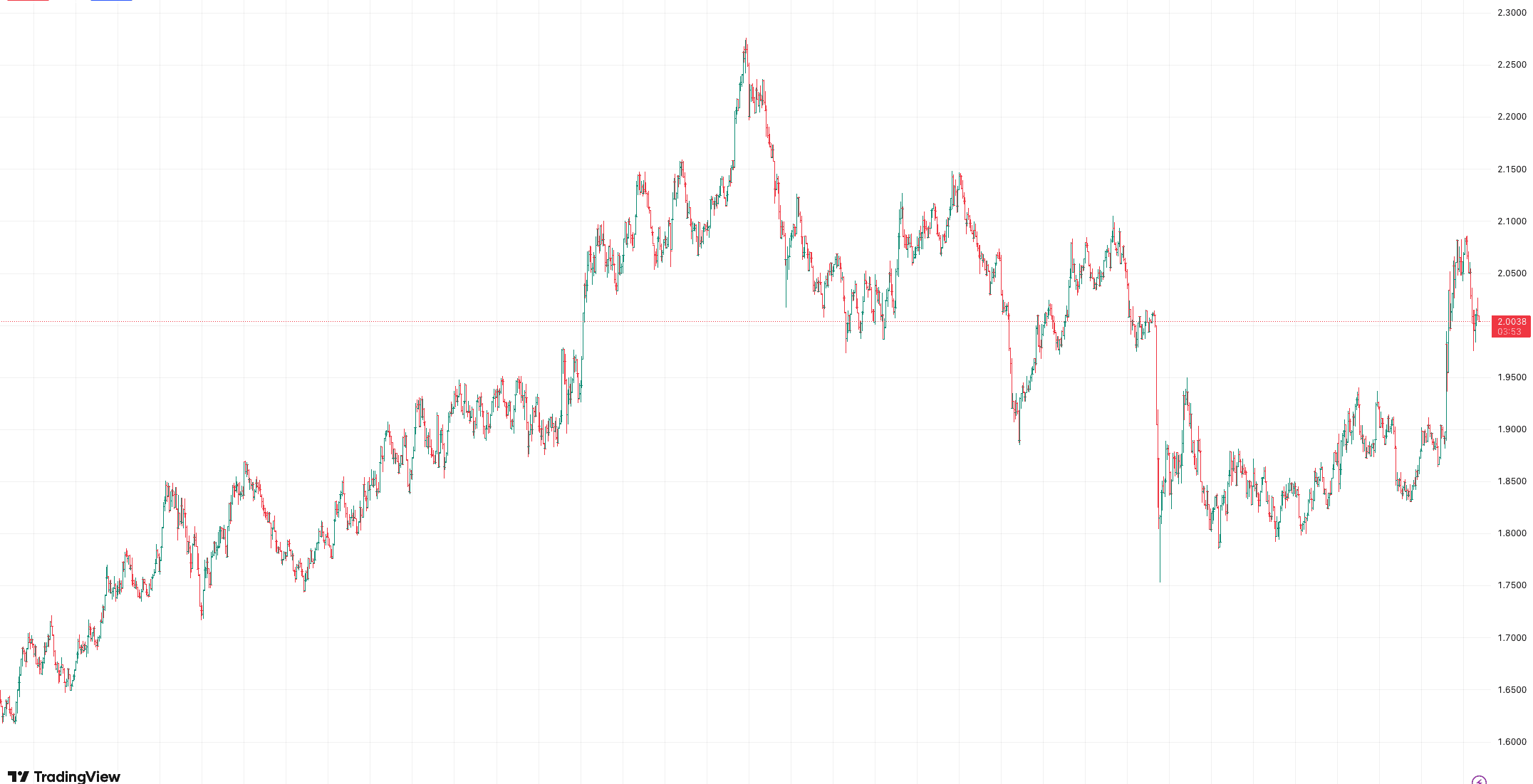

ASTER has increased by about 11% in the past 24 hours after Binance announced it would list the token for spot trading.

ASTER trades around $2.04, with a market cap of over $3 trillion, according to CoinMarketCap. The token has recovered after touching $1.8 and remains highly volatile as of the afternoon UTC.

Below, we’ll discuss why is ASTER going up today and what factors impact its price.

Key points

- Binance’s spot listing announcement increased market volatility around ASTER.

- ASTER is recovering after DeFiLlama removed its perpetual volume data.

- Upcoming airdrops and token unlocks suggest near-term volatility.

24-hour ASTER price performance. Source: TradingView

ASTER rises after Binance’s spot listing announcement

Binance is adding Aster (ASTER) on Oct 6, 2025. Spot trading for ASTER/USDT, ASTER/USDC, and ASTER/TRY starts at 12:00 UTC, with deposits opening at 09:00 UTC. Withdrawals begin Oct 7 at 12:00 UTC. ASTER currently sits in Binance Alpha. The shift from Alpha to Spot also brings in traders who only engage with fully listed assets, explaining why is ASTER going up today.

Aster rebounds after DefiLlama delists DEX perp data

On October 5, Web3 analytics platform DefiLlama delisted Aster DEX perpetuals after its pseudonymous founder, 0xngmi, highlighted an unusual correlation between Aster’s perp volumes and Binance’s. The resemblance raised concerns about potential wash trading or synthetic flow.

Since its September 17 launch, Aster has delivered strong performance, at times topping DEX leaderboards and outpacing Hyperliquid. After the delisting-driven wobble, momentum flipped when Binance confirmed a main-market listing with deposits and spot pairs opening on October 6. The announcement widened access, drew fresh liquidity, and prompted short covering, which is why traders are now asking why is ASTER going up. Earlier mentions by Binance co-founder Changpeng Zhao (CZ) lifted ASTER’s price, and the upcoming spot market has reinforced the recovery.

Token unlocks and airdrop pressure

ASTER’s tokenomics include scheduled releases for airdrops and incentive pools. As claim windows approach, newly unlocked tokens increase circulating supply, which can amplify volatility and heighten concerns among traders assessing order-book depth and liquidity. This context also helps explain intraday swings even as headlines around the Binance spot listing answered why did ASTER go up earlier in the session.

Stage 3 began on October 6 at 00:00 UTC and runs until November 9, 2025, allowing participants to earn platform rewards under the updated rules. Stage 2 airdrop eligibility opens on October 10, with token claims starting October 14. The clustering of these dates typically lifts activity and can sustain wider intraday ranges as recipients rebalance or hedge positions.

Recommended