Cryptocurrency going up today – here is why

The crypto market is gaining momentum after weeks of volatility, with Bitcoin, Ethereum, and Solana posting solid gains on November 6, 2025. Here’s why crypto is going up today - and what’s fueling the latest rebound.

Key points:

- The total crypto market cap surged by $83 billion, hitting $3.41 trillion.

- Institutional and macro news, including Franklin Templeton’s tokenized fund, boosted sentiment.

- Altcoins like TRUMP and SOL led the rally amid recovering open interest and investor rotation.

The total crypto market capitalization climbed by $83 billion in the past 24 hours, reaching $3.49 trillion. Bitcoin (BTC) rose 1.4% to $104,000, Ethereum (ETH) gained 1.7% to $3,450, and Solana (SOL) advanced 1.1% to $162. The rally comes after several weeks of downward pressure that pushed Bitcoin to a five-month low near $99,000.

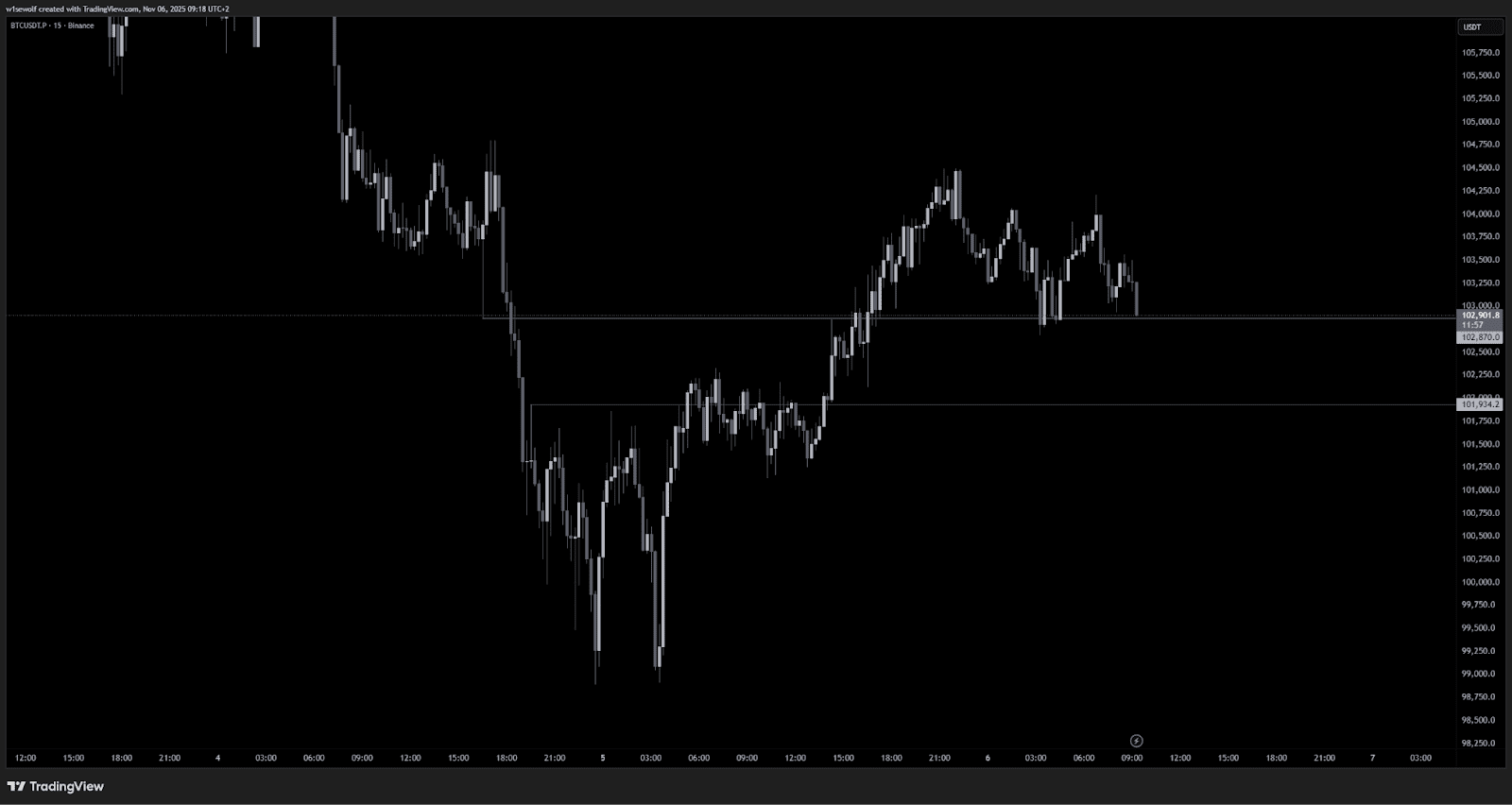

Bitcoin price is up on Nov 6. Source: tradingview.com

This rebound has traders asking one question - why is cryptocurrency going up today? In this article, we break down the key factors driving the current recovery: improving macro conditions, rising open interest, and strong institutional developments that have re-energized market sentiment.

U.S. tariff developments ease inflation concerns

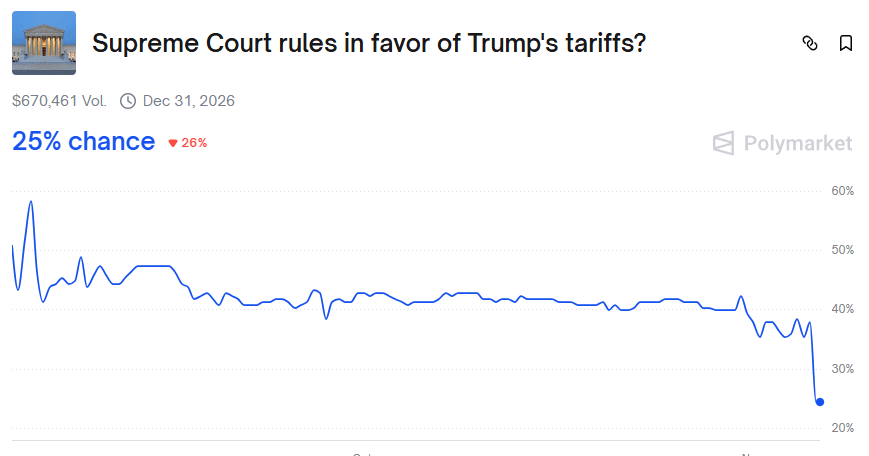

Optimism over the U.S. Supreme Court hearing on President Trump’s reciprocal tariffs is fueling the current rebound. A Polymarket poll shows the odds of Trump winning the case have fallen from 43% to 25%, raising hopes of reduced tariff-driven inflation.

Polymarket bet “Supreme Court rules in favor of Trump's tariffs”. Source: polymarket.com

Lower inflation expectations, in turn, increase the likelihood of Federal Reserve rate cuts - a key driver for risk assets such as crypto.

Markets typically perform better during easing cycles, as lower interest rates boost liquidity and risk appetite. With traders anticipating softer monetary conditions, why crypto is up becomes clear: the macro narrative has shifted toward renewed optimism after months of tightening.

Institutional adoption and tokenization news boost confidence

Renewed institutional activity is another factor explaining why is crypto going up. Franklin Templeton has launched Hong Kong’s first Luxembourg-registered tokenized money market fund under the HKMA’s “Fintech 2030” initiative. The fund marks a major step for tokenized finance, signaling broader acceptance of blockchain technology among global asset managers.

Meanwhile, Citadel and Fortress Capital have taken a stake in Ripple Labs, valuing the company at $40 billion. Chainlink has also partnered with S&P Global to power the upcoming S&P Digital Markets 50 Index, further linking crypto infrastructure with traditional finance.

Rebound in open interest and memecoin rotation

The rally coincides with a sharp rebound in derivatives activity. CoinGlass data shows futures open interest rising 2.13% to $143 billion, the strongest increase since last month’s $20 billion liquidation event.

At the same time, investors are rotating into high-volatility assets such as memecoins and niche altcoins. OFFICIAL TRUMP (TRUMP) jumped 18% in a single day, while Iggy Azalea’s MOTHER token climbed 25% following the launch of a transparency-focused platform on Solana. The shift highlights renewed appetite for risk and helps explain why crypto is up, even as Bitcoin continues to consolidate below the $105,000 resistance.

Recommended