Weekly inflows push Bitcoin ETFs higher as IBIT dominates

Bitcoin spot ETFs attracted $441 million in net inflows last week, with BlackRock’s IBIT dominating the market, while Grayscale’s GBTC continued to see outflows.

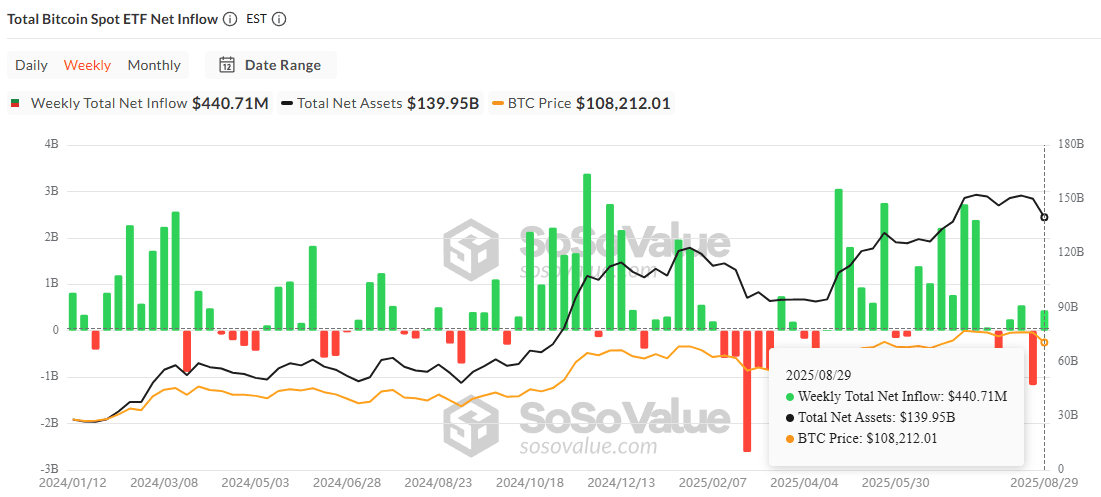

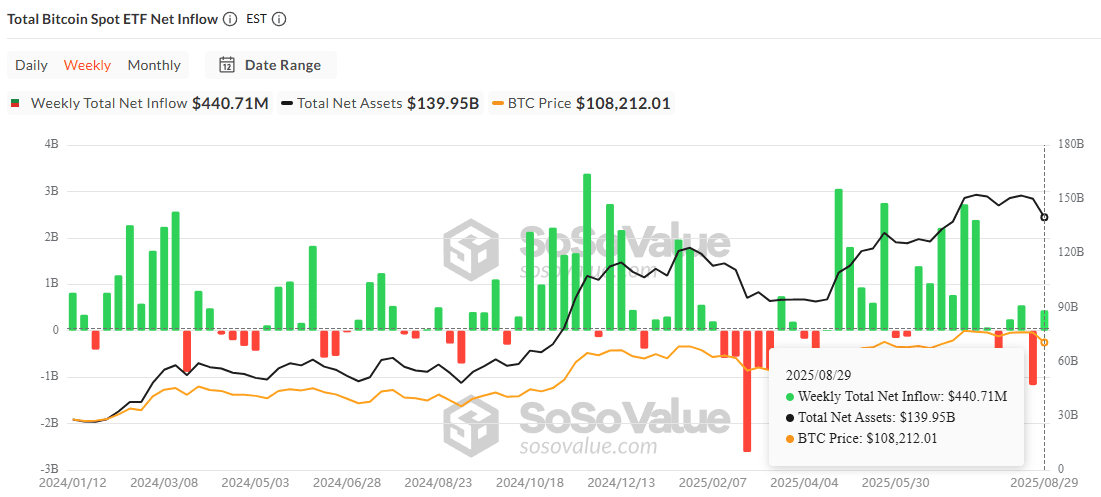

According to data from SoSoValue, U.S. Bitcoin spot ETFs recorded a combined $441 million in net inflows for the week ending August 29.

The largest inflow came from BlackRock’s iShares Bitcoin Trust (IBIT), which absorbed $248 million over the week. This pushed IBIT’s cumulative net inflow to $58.31 billion, cementing its position as the leading Bitcoin spot ETF.

Bitcoin spot ETFs saw $440.7M in weekly net inflows, with total net assets at $139.95B as BTC traded above $108K. Source: sosovalue.com

The second-largest gainer was ARK Invest and 21Shares’ ARKB, which brought in $78.59 million, lifting its historical net inflows to $2.09 billion.

Meanwhile, Grayscale’s Bitcoin Trust (GBTC) remained under pressure, posting $15.3 million in weekly net outflows. GBTC’s historical net outflows now stand at $23.94 billion, underscoring continued investor rotation into lower-fee products.

As of August 29, the total net assets of U.S. Bitcoin spot ETFs reached $139.95 billion, representing about 6.52% of Bitcoin’s total market cap. Cumulative historical net inflows across all funds now amount to $54.24 billion.

Recommended