US stock market diverges as dollar weakens

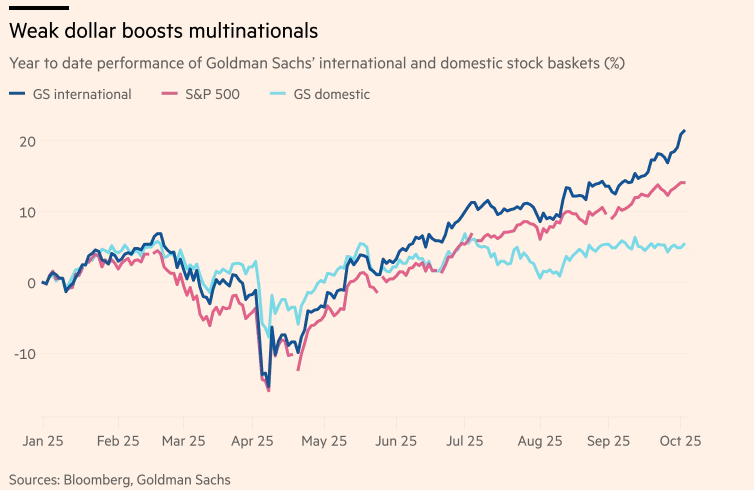

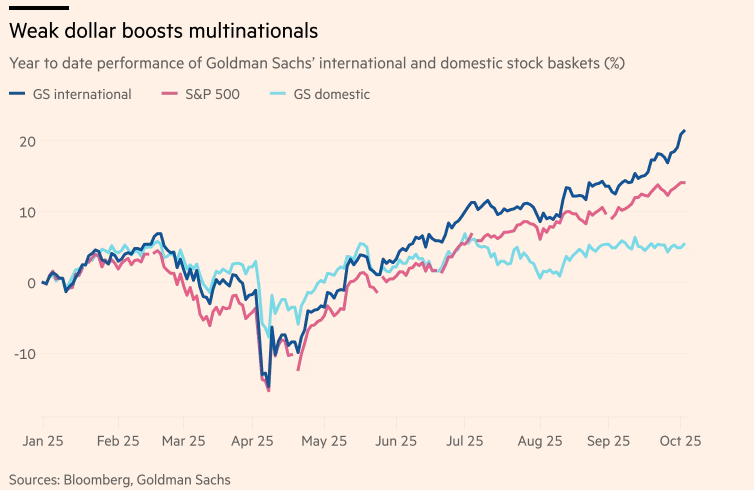

The index of companies with overseas revenue jumped 21%, while domestically focused firms gained just 5% - the widest gap since 2009.

The US stock market split sharply in 2025. The dollar’s nearly 10% decline supported multinational corporations but hit companies reliant on domestic demand.

Goldman Sachs’s index of 50 firms with the largest share of foreign sales rose 21%, outperforming the S&P 500. Among the top gainers were Meta, Philip Morris, and Applied Materials.

The weak dollar boosted Goldman Sachs’s international stocks, which outperformed the S&P 500 and GS domestic index. Source: ft.com

By contrast, the index of companies with high domestic exposure gained only 5%. Firms like T-Mobile US and Target saw little benefit from the weaker dollar and instead faced higher costs from pricier imports.

Analysts noted this divergence was the largest since 2009. Exporters benefit as US goods become cheaper abroad, while domestic businesses struggle with rising input costs.

The situation was compounded by the US government shutdown that began on October 1, which added uncertainty to consumer spending and business activity. Economists warn that prolonged political gridlock could further pressure companies focused on the domestic economy and widen the gap with multinational peers.

Microsoft estimated the weaker dollar will boost its revenues by 2 percentage points in 2026. Analysts at UBS and Citi believe the currency’s decline could continue to support global players, though domestic sectors remain under pressure.

Recommended