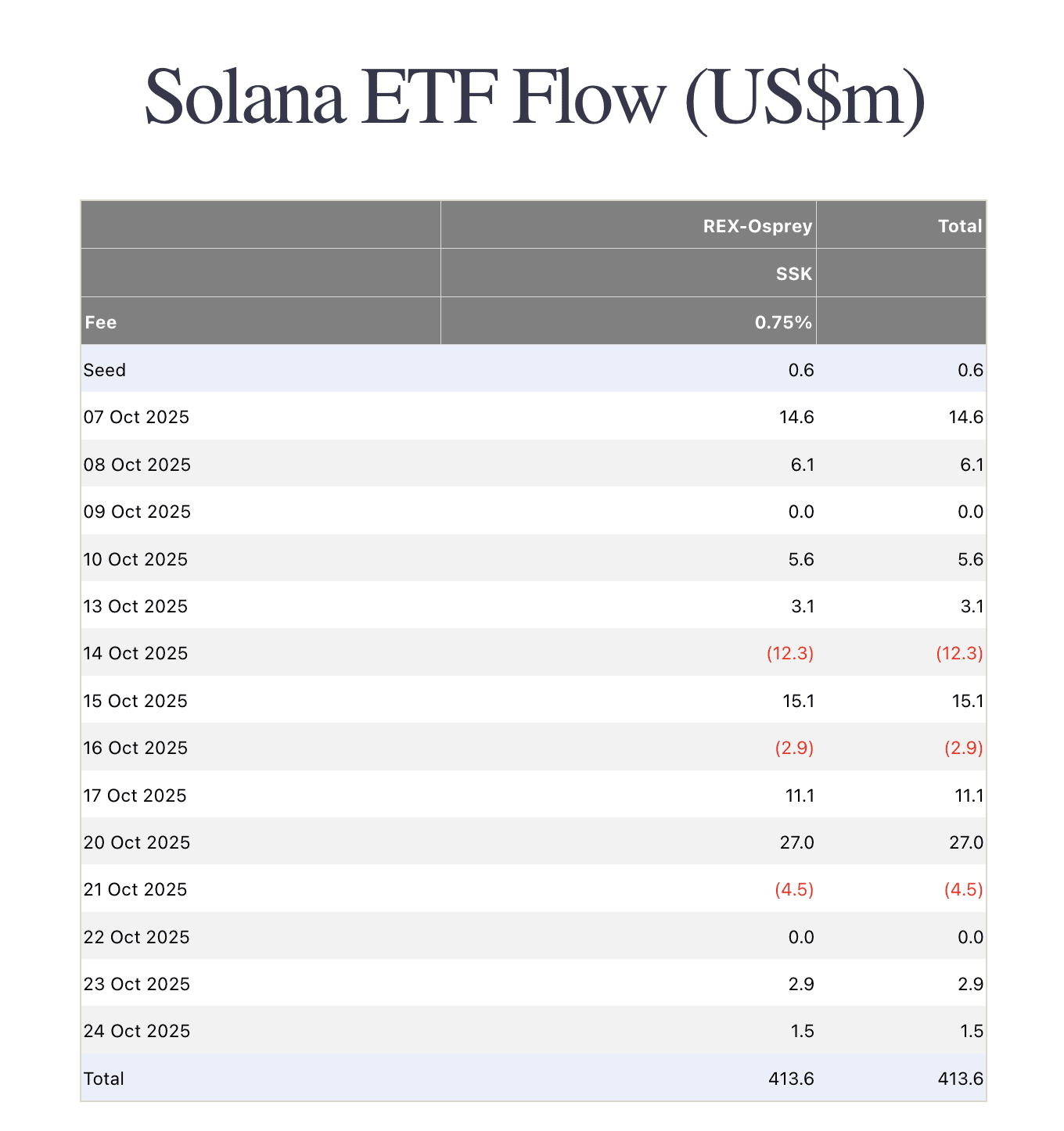

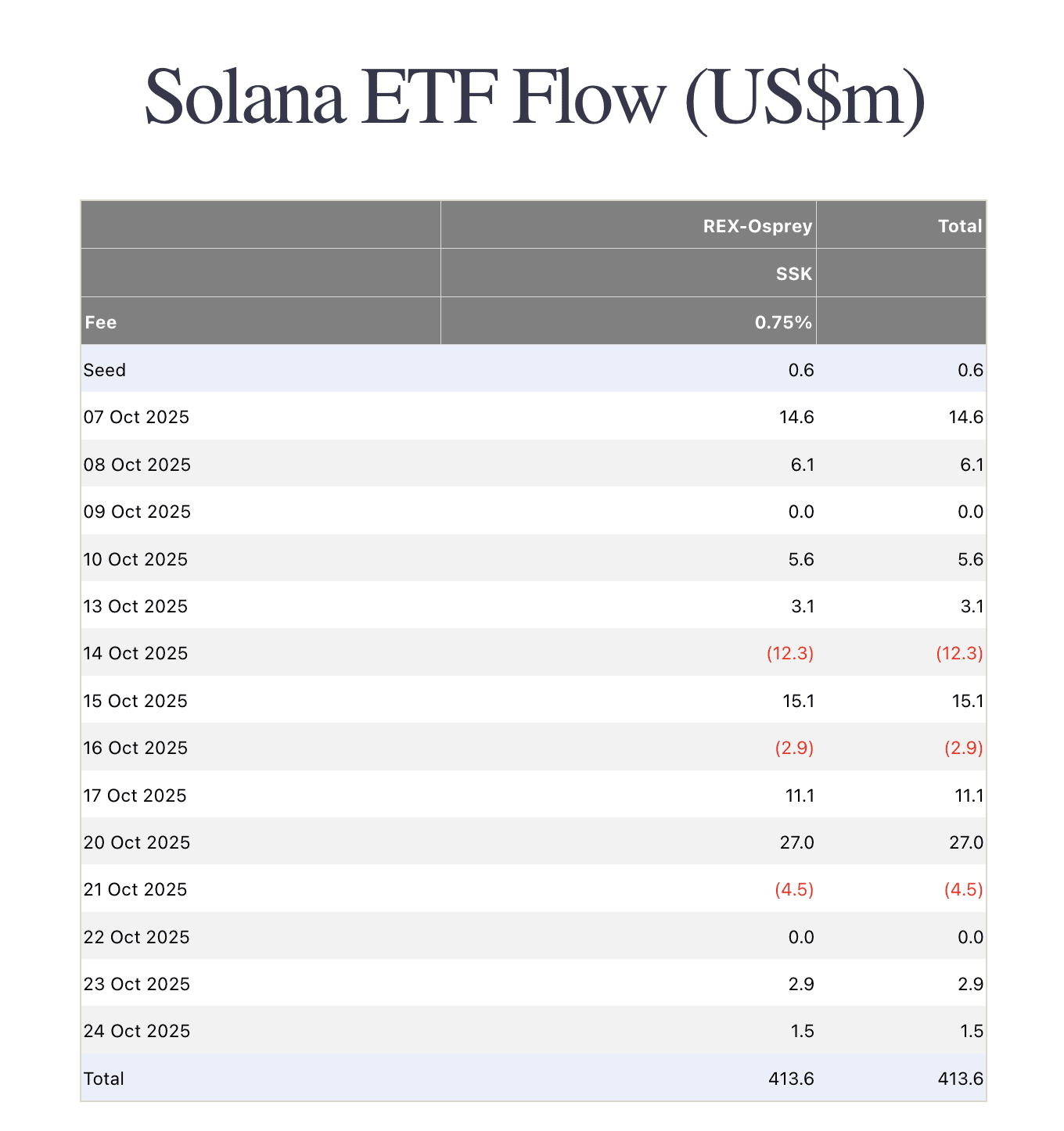

Solana ETF net inflows hit $26.9M during October 20–24

The only active U.S. product - REX-Osprey (SSK) - finished the week in the green with a positive five-session result.

REX‑Osprey is the first U.S. exchange‑traded fund to combine spot exposure to SOL with on‑protocol staking rewards, distributing those rewards to ETF shareholders. The fund avoids futures‑based structures and targets 1‑for‑1 price exposure to SOL before fees. Issuers are REX Advisers and Osprey Funds, and SSK is listed on the Cboe BZX Exchange, Inc.

In the first days after the July 2, 2025 launch, the fund attracted assets quickly and became an indicator of institutional interest in Solana.

For October 20–24, the combined result across spot SOL ETFs came to $26.9M in net inflows. Daily flows were as follows:

- Mon, 20 Oct: +$27.0M

- Tue, 21 Oct: −$4.5M

- Wed, 22 Oct: $0.0M

- Thu, 23 Oct: +$2.9M

- Fri, 24 Oct: +$1.5M

Weekly SOL‑ETF flows by day. Source: Farside

This outcome is largely linked to Solana’s role as core infrastructure for large‑scale tokenization (RWA) and on‑chain yield use cases. In 2025, several major asset managers signalled plans to shift parts of their solutions to Solana, while ETP flow reports showed persistent inflows into SOL products even during sell‑offs in Bitcoin and Ethereum.

Due to the prolonged U.S. government shutdown, several filings for SOL ETFs are still awaiting SEC approval, including 21Shares Solana Trust (Cboe BZX), VanEck Solana ETF (ticker VSOL, Cboe BZX), Bitwise Solana Staking ETF (NYSE), Canary Capital Solana ETF (ticker SOLC, Cboe BZX).

Recommended